1031 Exchange Basis Worksheet The allowed exchange expenses are summarized and listed on Line 3 of the Worksheet The amount on line 25 is your basis in the like kind property you received

The cost basis in the property being relinquished with improvements is 150 000 and 45 000 has been taken in depreciation over a ten year period 2 Adjusted basis of like kind property you gave up net amounts paid to other party plus any exchange expenses not used on line 15 See instructions

1031 Exchange Basis Worksheet

1031 Exchange Basis Worksheet

1031 Exchange Basis Worksheet

https://www.pdffiller.com/preview/1/283/1283667.png

The amount on line 25 is your basis in the like kind property you received in the exchange worksheet to figure ordinary income under the

Templates are pre-designed files or files that can be used for different functions. They can save effort and time by supplying a ready-made format and design for creating various type of material. Templates can be used for individual or expert tasks, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

1031 Exchange Basis Worksheet

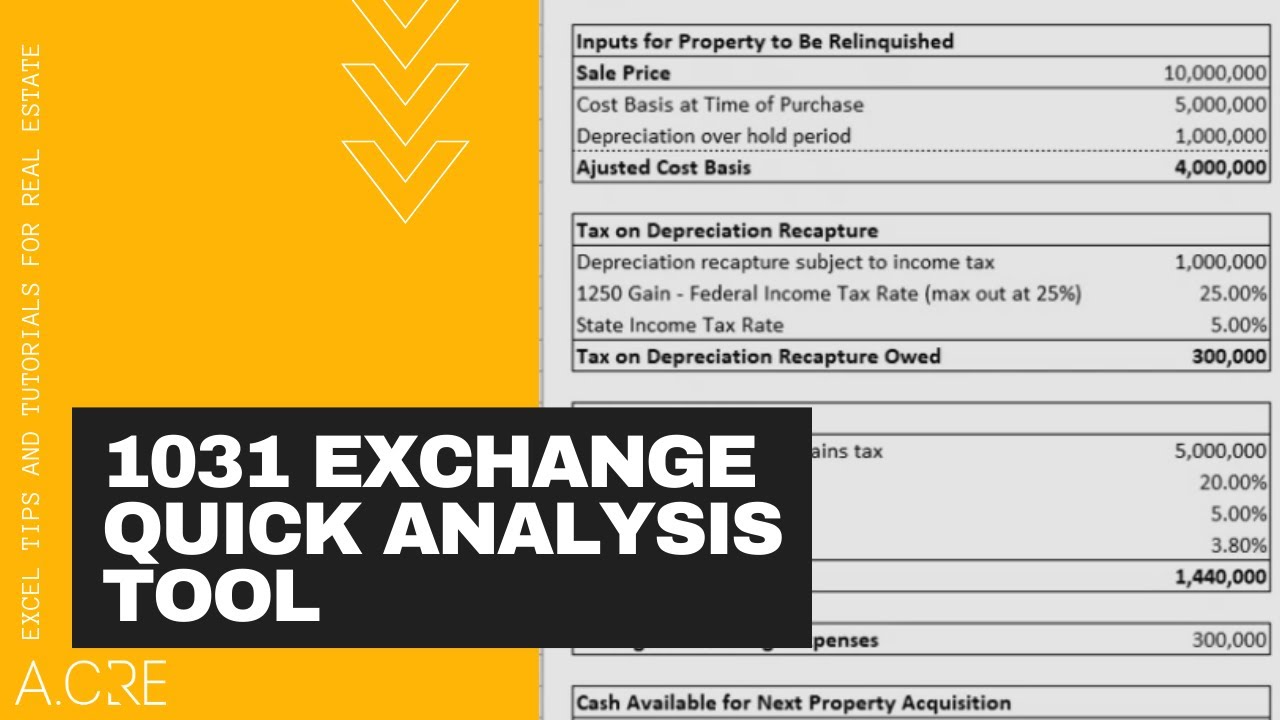

1031 Exchange - Overview and Analysis Tool (Updated Apr 2022) - Adventures in CRE

TAXPAK™ GuideBook 2018 Reporting Your 1031 Exchange

Realty Exchange Corporation Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824

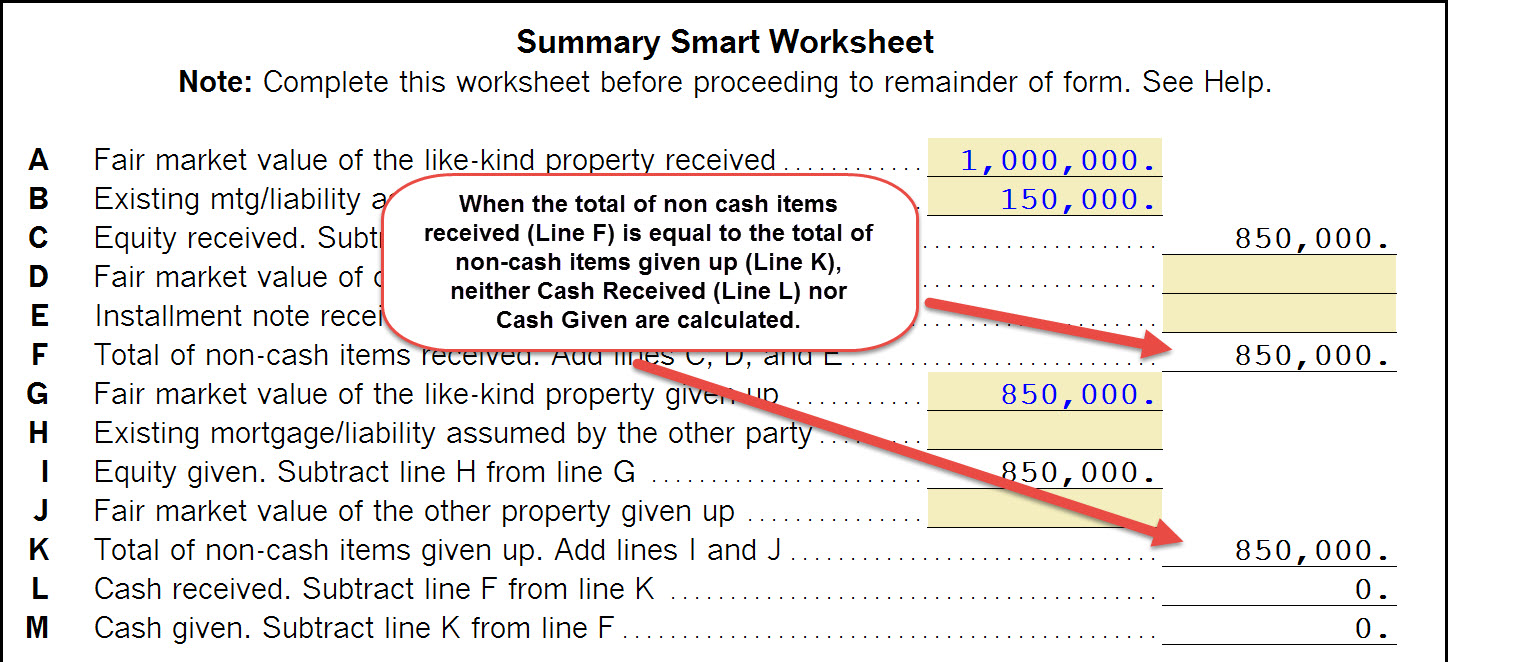

Completing a like-kind exchange in the 1040 return

Solved In the following 1031 exchanges, calculate the | Chegg.com

TAXPAK™ Buying-DOWN! GuideBook 2020 Reporting Your 1031 Exchange

http://static.fmgsuite.com/media/documents/19cce23c-2bd4-4159-855b-a33f698992de.pdf

LIKE KIND EXCHANGE WORKSHEET A Realized Gain 1 FMV of all property received 2 Total cash Basis of like kind property received line 8 minus line 9

https://www.firsttuesday.us/Course/Downloads/355.pdf

Any upward adjustment in the depreciable basis in the replacement property over the remaining depreciable exchange basis from the property sold due to a trade

https://www.efirstbank1031.com/documents/Form8824Worksheet.xls

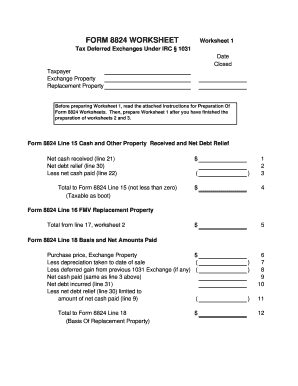

We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges Form 8824 Line 18 Basis and Net

https://www.expert1031.com/sites/default/files/worksheets2017.pdf

WorkSheet 8 Calculation of Basis of New Property for Form 8824 Line 18 A Basis in your Old Property from WorkSheet 1 Line F B Total

https://www.uslegalforms.com/form-library/87804-1031-exchange-worksheet-2019-2020

How to fill out and sign 1031 exchange basis worksheet online Get your online template and fill it in using progressive features Enjoy smart fillable

We ll be happy to help you with calculating your 1031 Exchange please give us a call 215 489 3800 ADJUSTED TAX BASIS OF RELINQUISHED PROPERTY plus less Related Content 1031 exchange calculation worksheet Rate free like kind exchange worksheet excel form Keywords relevant to 1031 exchange basis worksheet

Determine Adjusted Basis Over the course of several years the adjusted basis of the property owned by Ron and Maggie could resemble the following Purchase