1031 Exchange Worksheet Excel This tax worksheet examines the disposal of an asset and the acquisition of a replacement like kind asset while postponing or deferring the gain from the

A 1031 Exchange is a strategy where CRE investors can defer both capital gains tax and depreciation recapture tax upon the sale of a property 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out can be valuable inspiration for people who seek an image according specific categories you

1031 Exchange Worksheet Excel

1031 Exchange Worksheet Excel

1031 Exchange Worksheet Excel

https://www.pdffiller.com/preview/1/283/1283667.png

Edit sign and share 1031 exchange worksheet 2019 online No need to install software just go to DocHub and sign up instantly and for free

Templates are pre-designed files or files that can be utilized for different functions. They can save time and effort by offering a ready-made format and layout for developing different sort of material. Templates can be used for individual or expert projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

1031 Exchange Worksheet Excel

TAXPAK™ GuideBook 2018 Reporting Your 1031 Exchange

1031 Like Kind Exchange Calculator - Excel Worksheet

TAXPAK™ GuideBook 2017 Reporting Your 1031 Exchange

Depreciation: Like-Kind exchange examples

Like kind exchange worksheet: Fill out & sign online | DocHub

TAXPAK™ GuideBook 2017 Reporting Your 1031 Exchange

https://www.expert1031.com/sites/default/files/worksheets2017.pdf

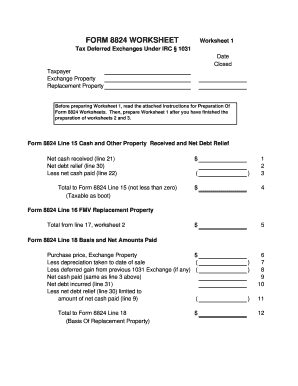

Download fresh worksheets from 1031TaxPak Page 3 WorkSheet 2 Calculation of Exchange Expenses HUD 1 Line A Exchange expenses from sale of Old

http://static.fmgsuite.com/media/documents/19cce23c-2bd4-4159-855b-a33f698992de.pdf

LIKE KIND EXCHANGE WORKSHEET A Realized Gain 1 FMV of all property received 2 Total cash received 3 Liabilities transferred 4 Total additions

https://www.efirstbank1031.com/2accountantsInfo/10form8824.htm

We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824 and herein enclose a copy We hope

https://www.realized1031.com/1031-exchange-calculator

Download the free like kind exchange worksheet This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property

https://www.uslegalforms.com/form-library/87804-1031-exchange-worksheet-2019-2020

Complete 1031 Exchange Worksheet 2019 2020 2023 online with US Legal Forms Easily fill out PDF blank edit and sign them Save or instantly send your

In no way should the completion of this worksheet be construed as tax advice or used in place of competent tax advice 1031 Exchange Calculator 45 180 Day The cash down payment was 370 000 and exchange expenses were 5 000 Page 4 The Worksheet is broken down into four steps as follows STEP 1 IT IS

Additionally we have developed a Microsoft Excel spreadsheet to help you with the preparation of IRS Form 8824 Like Kind Exchanges If you would like a copy