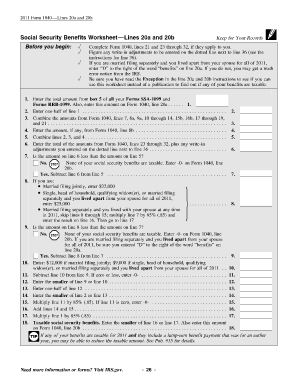

1040 Social Security Worksheet 2021 Amount of social security benefits from Federal Form 1040 or 1040 SR line MODIFICATION FOR TAXABLE SOCIAL SECURITY INCOME WORKSHEET STEP 1 Eligibility

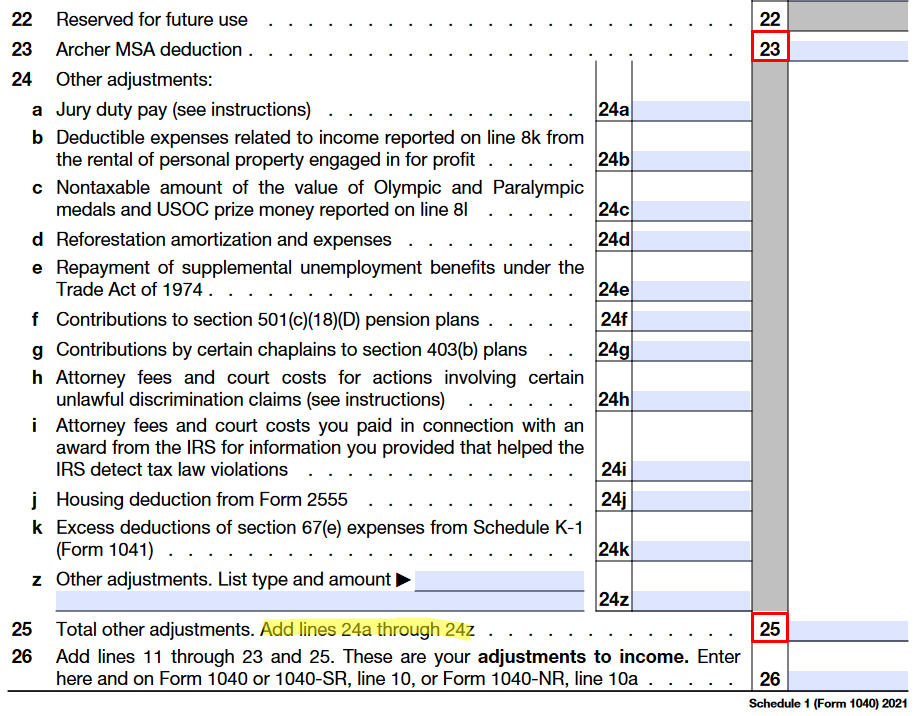

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040 SR line 16 No Complete the rest

1040 Social Security Worksheet 2021

1040 Social Security Worksheet 2021

1040 Social Security Worksheet 2021

https://www.pdffiller.com/preview/6/963/6963800.png

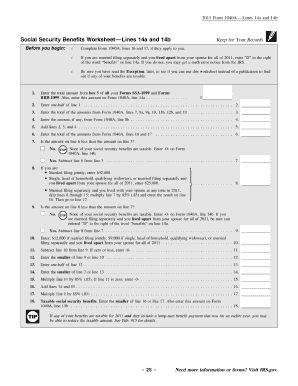

Instead include the amount from Schedule B Form 1040 or 1040 SR line 2 1 Enter the total amount from box 5 of ALL your Forms SSA 1099 and Forms RRB 1099

Templates are pre-designed files or files that can be utilized for various purposes. They can save effort and time by offering a ready-made format and design for creating different kinds of material. Templates can be used for personal or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

1040 Social Security Worksheet 2021

Irs Form 703 - Fill Out and Sign Printable PDF Template | signNow

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

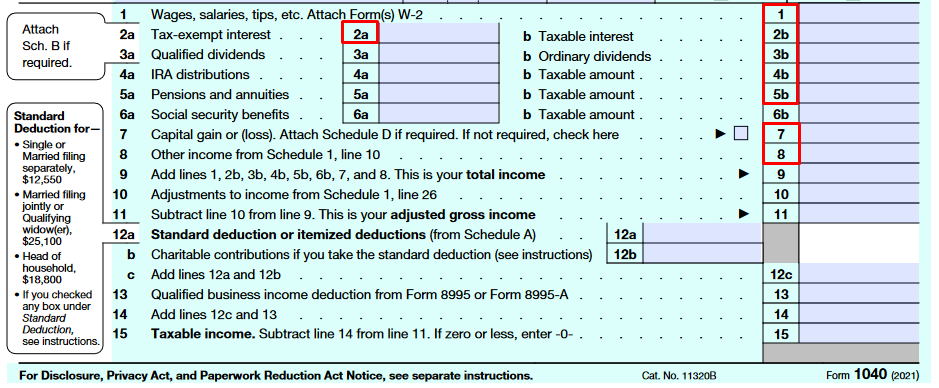

1040 (2022) | Internal Revenue Service

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

2021-2023 Form IRS Publication 915Fill Online, Printable, Fillable, Blank - pdfFiller

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

https://apps.irs.gov/app/vita/content/globalmedia/social_security_benefits_worksheet_1040i.pdf

Social Security Benefits Worksheet Lines 5a and 5b Keep for Your Records Also enter this amount on Form 1040 line 5a 1 2 Multiply line 1 by

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The worksheet provided can be used to determine the exact amount Social Security worksheet for Form 1040 Social Security worksheet for Form 1040A The file

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

This worksheet is based on the worksheet in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits Note that any link in the

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-01/social-security-worksheet_b_0.pdf

2021 Modification Worksheet Taxable Social Security Income Worksheet Enter Taxable amount of social security from Federal Form 1040 or 1040 SR line 6b

https://tax.iowa.gov/expanded-instructions/reportable-social-security-benefits-2021

SOCIAL SECURITY WORKSHEET 9 Subtract line 8 from line 7 9 10 Enter one of the following amounts based on the federal filing status used on form 1040

8 Amount of social security benefits from Federal Form 1040 or 1040 SR line 6a Webstead of 500 Their income used to determine if Social In 1984 less than 10 percent of beneficiaries paid federal income tax on their benefits A Social Security Administration SSA microsimulation model

income meaning on your Form 1040 will be the lesser of either However the IRS helps taxpayers by offering software and a worksheet to