2019 Tax Computation Worksheet Table of contents Important Dates Do I Have to File What s New and Other Important Information for 2019 Which Form Should I Use Instructions

The standard deduction for single filers will increase by 200 and by 400 for married couples filing jointly Table 2 The personal exemption Tax Tables 2019 Edition 1 TAXABLE INCOME BASE AMOUNT OF TAX PLUS MARGINAL TAX RATE OF THE AMOUNT OVER OVER NOT OVER

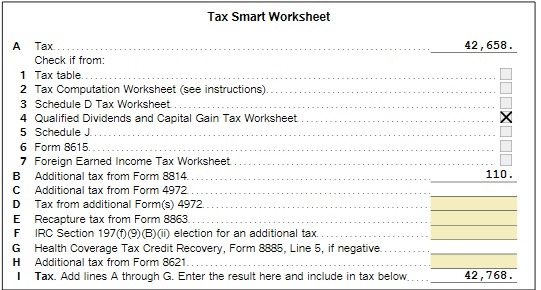

2019 Tax Computation Worksheet

2019 Tax Computation Worksheet

2019 Tax Computation Worksheet

https://www.pdffiller.com/preview/430/912/430912746.png

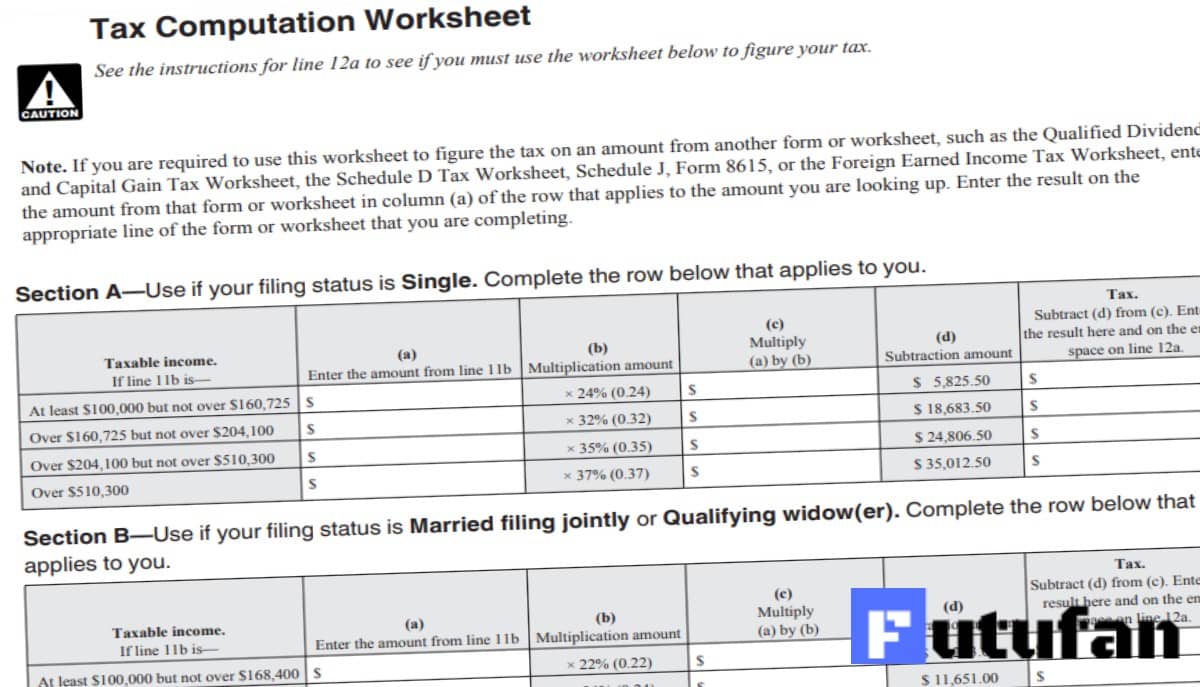

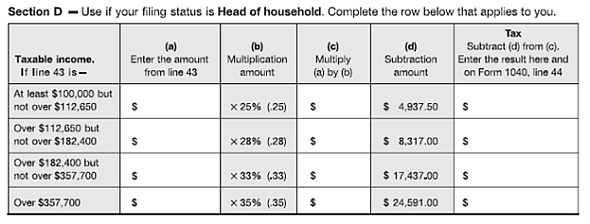

2019 tax computation worksheet line 12a WebComplete the rest of that worksheet through line 6 line 10 if you use the Schedule D Tax Worksheet

Templates are pre-designed files or files that can be utilized for various functions. They can conserve effort and time by providing a ready-made format and design for producing different kinds of content. Templates can be utilized for personal or expert jobs, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

2019 Tax Computation Worksheet

Tax Computation Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Fill - Free fillable 2019 Tax Computation Worksheet—Line 12a PDF form

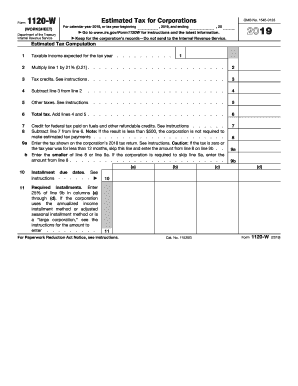

2019 1120 Form - Fill Out and Sign Printable PDF Template | signNow

Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill and Sign Printable Template Online

Tax Computation Worksheet 2023 - 2024

COMPTROLLER

https://www.cchcpelink.com/w/wp-content/uploads/2020/03/2019-Tax-Computation-Worksheet.pdf

2019 Tax Computation Worksheet Line 12a CAUTION See the instructions for and Capital Gain Tax Worksheet the Schedule D Tax Worksheet Schedule J Form

https://www.irs.gov/pub/irs-prior/i1040tt--2019.pdf

See the instructions for line 12a to see if you must use the Tax Table below to figure your tax At Least But Less Than Single Married

https://www.cchcpelink.com/w/wp-content/uploads/2020/03/2019-Tax-Tables.pdf

Brown are filing a joint return Their taxable income on Form 1040 line 11b is 25 300 First they find the 25 300 25 350 taxable income line Next

https://portal.ct.gov/-/media/DOC/Pdf/Coronavirus-3-20/IRS-Form-1040-2019.pdf

Form 1040 Department of the Treasury Internal Revenue Service 99 U S Individual Income Tax Return 2019 OMB No 1545 0074 IRS Use Only Do not write or

https://www.freetaxusa.com/download-forms-2019

All calculations are guaranteed 100 accurate and you ll get a copy of your tax return to download print or save as a PDF file We believe in high value and

GENERAL INFORMATION Tax Code Section 26 04 c requires an officer or employee designated by the governing body to calculate the effective tax rate and rollback Complete 2019 Tax Computation Worksheet online with US Legal Forms Easily fill out PDF blank edit and sign them Save or instantly send your ready

Reported as income on your 2019 federal Form 1040 or 1040 SR Schedule 1 Use the Use Tax UT Worksheet or Use Tax UT Table to determine your use tax