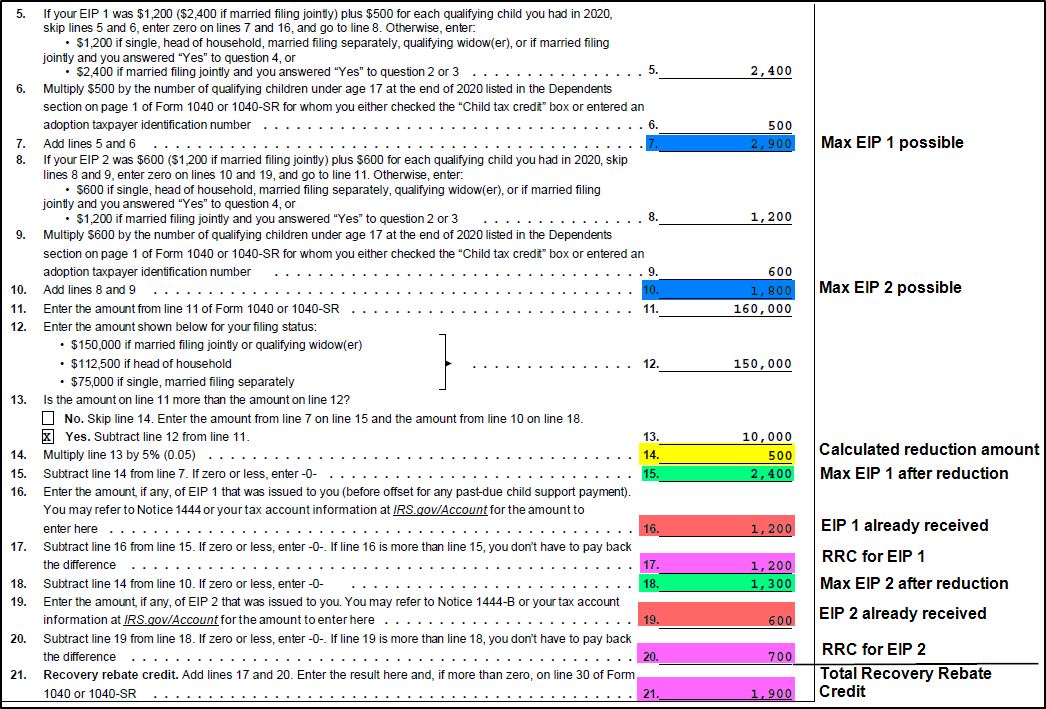

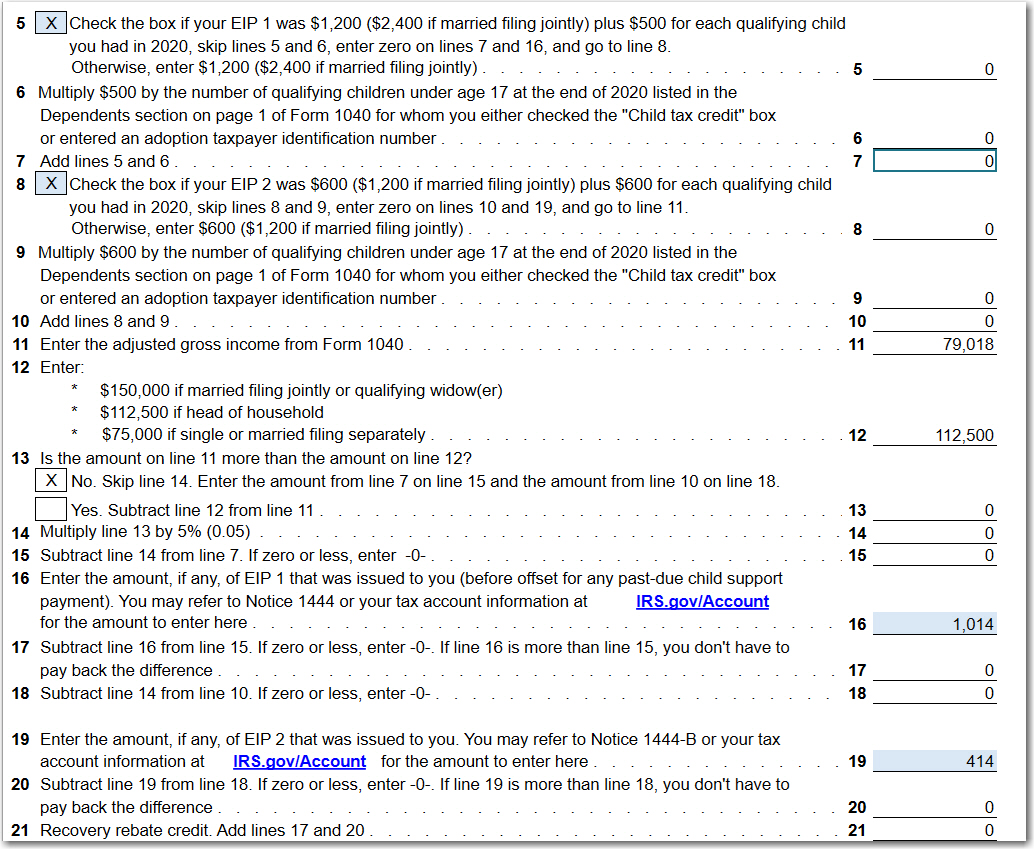

2020 Recovery Rebate Credit Worksheet The maximum 2020 Additional Recovery Rebate credit is 600 for each eligible individual and each qualifying child Each maximum credit amount is reduced but

Recovery Rebate Credit and must file a 2020 tax return to claim the credit even if you don t normally file The Recovery Rebate Credit Worksheets Rec Rebate Recovery Rebate Credit Worksheet Note XXXX calculated amounts based on 2020 tax return information EIP1

2020 Recovery Rebate Credit Worksheet

2020 Recovery Rebate Credit Worksheet

https://support.taxslayer.com/hc/article_attachments/4415858470797

See IRS gov rrc or the Recovery Rebate Credit Worksheet available in the 2020 Form 1040 and Form 1040 SR instructions for more information Q B2

Templates are pre-designed files or files that can be utilized for various purposes. They can conserve time and effort by supplying a ready-made format and layout for developing various sort of content. Templates can be utilized for personal or expert projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

2020 Recovery Rebate Credit Worksheet

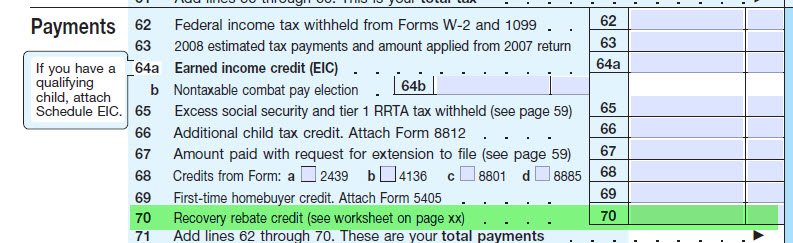

1040 - Recovery Rebate Credit (Drake20)

IT'S NOT TOO LATE: Claim a 'Recovery Rebate Credit' to get your stimulus checks | cbs19.tv

What Happens If I Make a Mistake when Claiming My Remaining Child Tax Credit (CTC) or Stimulus Check (Recovery Rebate Credit) in Your 2021 Tax Return Filed in 2022 | $aving to Invest

How to claim the stimulus money on your tax return | wfmynews2.com

Here's what to do if you haven't received a previous stimulus check | American Samoa | Samoa News

Recovery Rebate Credit Worksheet | Tax Guru - Ker$tetter Letter

https://www.irs.gov/newsroom/recovery-rebate-credit

Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how

https://www.finance.gov.mp/division-forms/revenue-taxation/2020/2020-recovery-rebate-credit-wksht.pdf

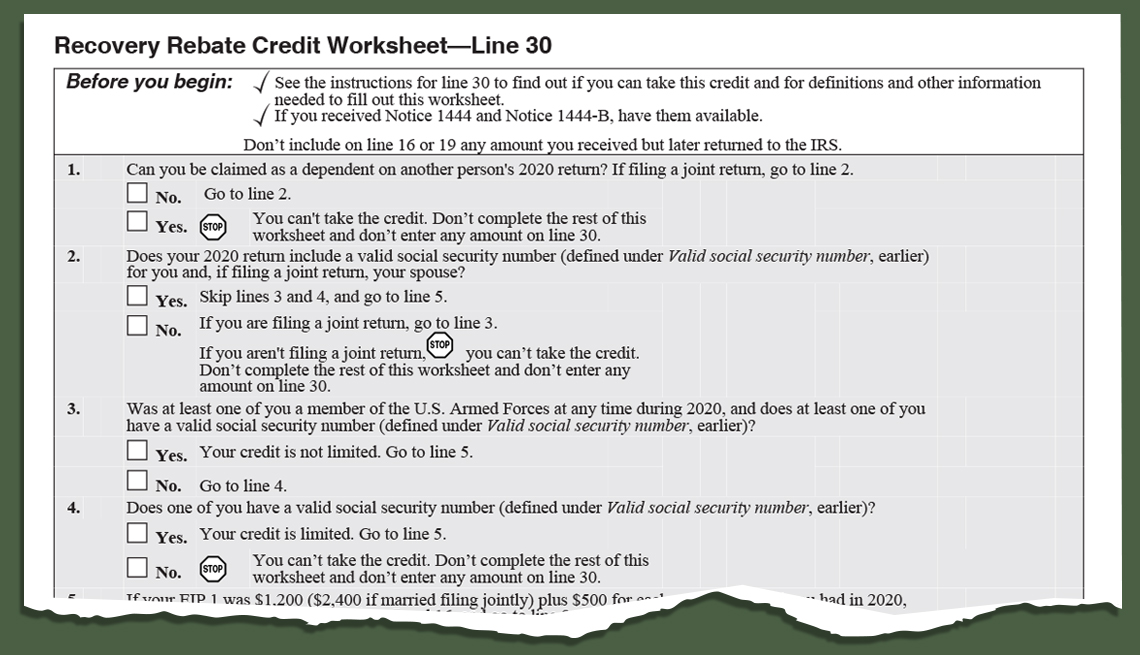

2020 NMI Recovery Rebate Credit Worksheet Line 30 Attach this worksheet to your 2020 1040CM See the 2020 IRS 1040 and 1040 SR instructions for line 30 to

https://support.taxslayer.com/hc/en-us/articles/360059853171--Recovery-Rebate-Credit-Worksheet-Explained

As the IRS indicated they are reconciling refunds with stimulus payments and the Recovery Rebate Credit claimed on your return If you

https://www.taxact.com/support/25636/2020/recovery-rebate-credit

The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments issued in 2020 You will

https://turbotax.intuit.com/tax-tips/tax-relief/what-is-the-recovery-rebate-credit-and-am-i-eligible/L3pAVU4it

The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out

If you need to return to the the Recovery Rebate Credit Worksheet from the Main Menu of the tax return Form 1040 select Payments Estimates In this video I discuss how to fill out the Recovery Rebate Credit worksheet The Recovery

On line 30 2 Does the 2020 return include a valid Social Security Number for the taxpayer and if ling a joint return the taxpayer