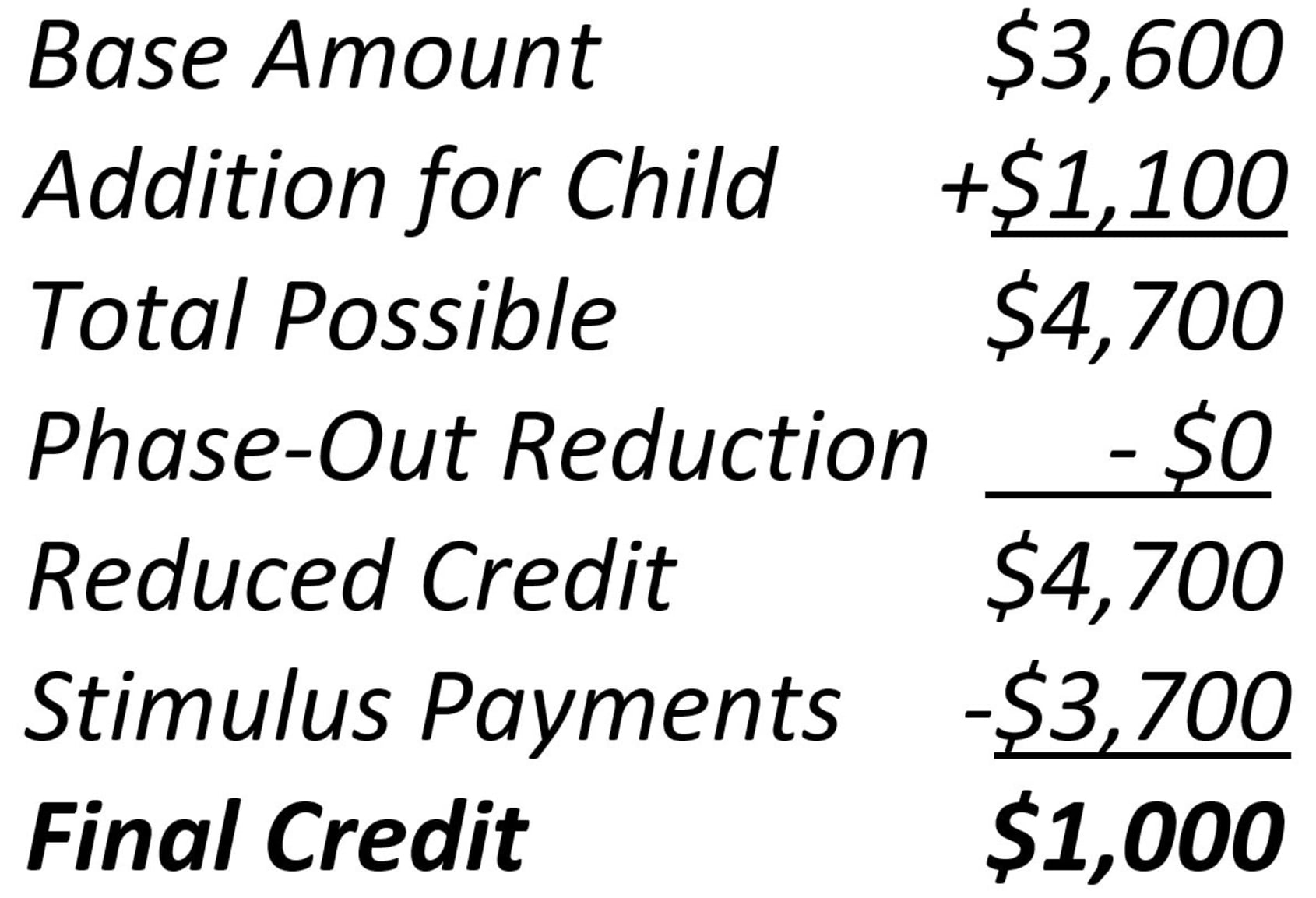

2021 Recovery Rebate Credit Form WEB Aug 17 2022 0183 32 The Recovery Rebate Credit was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and paid in advance to most eligible citizens in the form of an Economic Impact

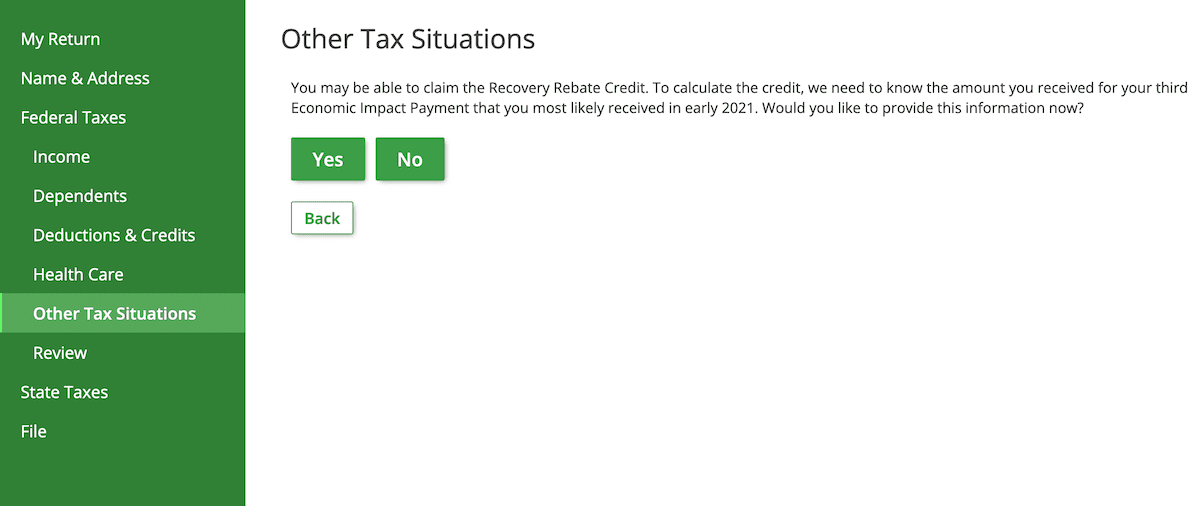

WEB Check out our FAQs about claiming the 2021 Recovery Rebate Credit below for general information on who is eligible for this important tax relief and how to claim the credit on your return this tax year WEB Apr 27 2023 0183 32 If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return

2021 Recovery Rebate Credit Form

2021 Recovery Rebate Credit Form

2021 Recovery Rebate Credit Form

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

WEB File a complete and accurate 2021 tax return to avoid refund delays The IRS urges taxpayers to file electroni cally and allow tax software to figure the 2021 Recovery Rebate Credit Individuals will need the amount of any third payments they received to accurately calculate their 2021 Recovery Rebate Credit Individuals can securely access

Templates are pre-designed files or files that can be utilized for numerous functions. They can conserve effort and time by providing a ready-made format and layout for developing various sort of content. Templates can be used for personal or expert projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

2021 Recovery Rebate Credit Form

Strategies To Maximize The 2021 Recovery Rebate Credit

How To Claim The 2021 Recovery Rebate Credit On Tax Return

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Recovery Rebate Form 1040 Printable Rebate Form

An Overview Of The Recovery Rebate Credit 2021 Initor Global

Recovery Rebate Credit 2021 Tax Return

https://www.irs.gov/newsroom/recovery-rebate-credit

WEB Feb 12 2024 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Impact payment and any plus up payments to claim the 2021 Recovery Rebate Credit

https://www.irs.gov/newsroom/2021-recovery-rebate

WEB Jan 13 2022 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account You can have your refund direct

https://www.taxpayeradvocate.irs.gov/covid-19-home/3rd-eip-and-2021-rrc

WEB 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040

https://apps.irs.gov/app/IPAR/resources/help/recovrebate.html

WEB Recovery Rebate Credit The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if You are eligible but were not issued an EIP 1 an EIP 2 or neither an EIP 1 or EIP 2 or

https://www.taxpayeradvocate.irs.gov//2021/04

WEB Apr 15 2021 0183 32 The American Rescue Plan Act of 2021 enacted March 11 2021 provides a 2021 Recovery Rebate Credit RRC which can be claimed on 2021 Individual Income Tax Returns

[desc-11] [desc-12]

[desc-13]