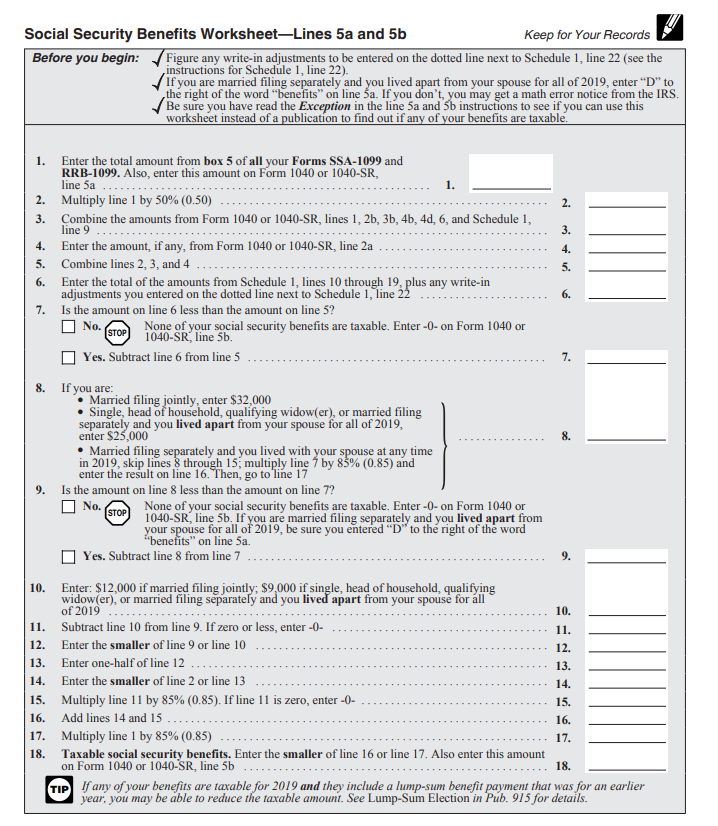

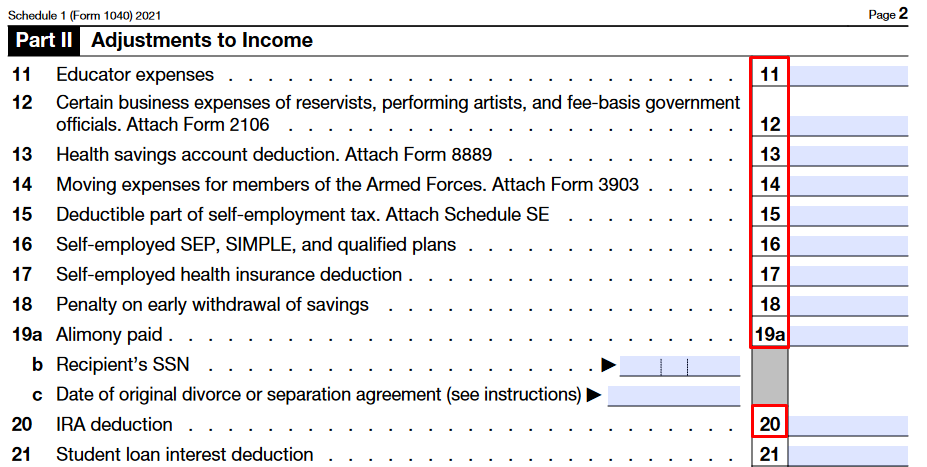

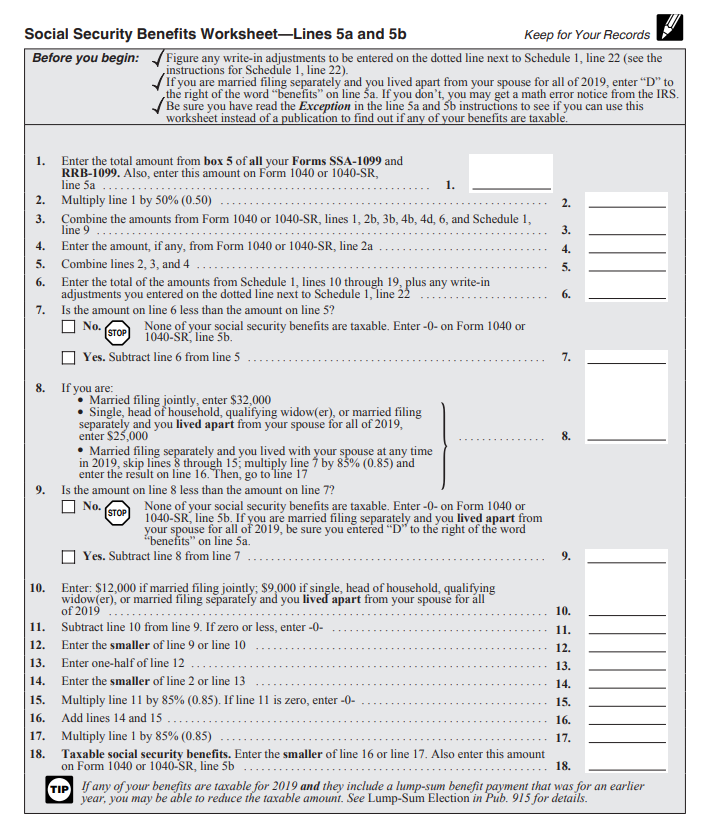

2021 Social Security Worksheet The reportable Social Security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040 SOCIAL SECURITY WORKSHEET 1 Enter the

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed 2021 Modification Worksheet Taxable Social Security Income Worksheet Enter MODIFICATION FOR TAXABLE SOCIAL SECURITY INCOME WORKSHEET STEP 1 Eligibility

2021 Social Security Worksheet

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1609791972896-THBK30R3E77U3F9SENTO/Social+Security+Income+Calculations.PNG

Information for people who work Information for people who receive Social Security benefits SSA gov over Update WebIRS the Social Security

Templates are pre-designed files or files that can be used for various functions. They can save effort and time by offering a ready-made format and layout for creating different kinds of content. Templates can be utilized for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

2021 Social Security Worksheet

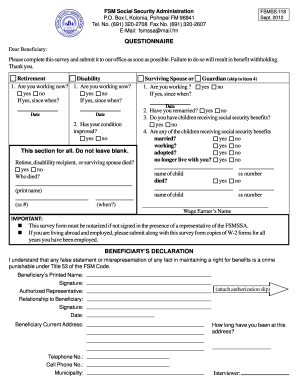

15 Printable social security benefits application form Templates - Fillable Samples in PDF, Word to Download | pdfFiller

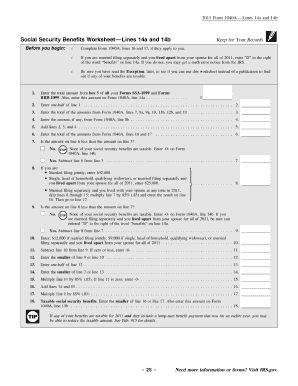

Social Security Benefits Worksheet 2022 Pdf - Fill Out and Sign Printable PDF Template | signNow

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

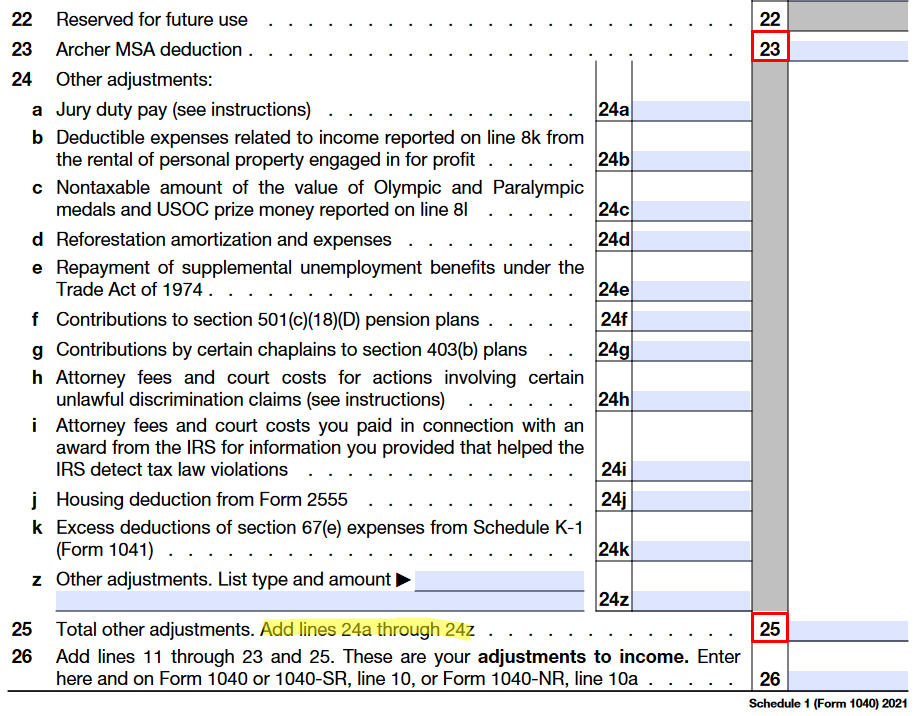

1040 (2022) | Internal Revenue Service

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

https://www.irs.gov/publications/p915

In March 2022 the SSA notified you that you should have received only 2 500 in benefits in 2021 worksheet 1 Enter the total amount from

https://www.ssa.gov/news/press/factsheets/colafacts2021.pdf

2021 SOCIAL SECURITY CHANGES Cost of Living Adjustment COLA Based on the Other important 2021 Social Security information is as follows Tax Rate

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount Social Security

https://www.ssa.gov/benefits/retirement/planner/taxes.html

This Social Security planner page explains when you may have to pay income taxes on your Social Security benefits

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

This worksheet is based on the worksheet in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits Note that any link in the

2 Enter the amount reported on your 2021 federal Social Security Benefits Worksheet Line 9 If filing status is MARRIED FILING SEPARATELY follow Using the 2022 SSI monthly benefit you can compute the monthly benefit received in 2021 6 Social Security benefits received in FFY22 cannot be calculated

2021 Social Security and Equivalent Jan 13 2022 Your benefits aren t taxable for 2021 because your income as figured in Worksheet A isn t more