2022 Auto Expense Worksheet Auto Expense Worksheet Please Fill Out As Completely As Possible use your prior return as a guide IF YOU HAVE INCOMPLETE RECORDS YOU MAY ELECT TO CLAIM

Please provide us with the following information so we can determine which method is more beneficial For tax year 2022 the standard mileage rate changed When a vehicle is used for business the taxpayer may qualify to deduct either mileage or actual expenses including depreciation if applicable for a car or

2022 Auto Expense Worksheet

2022 Auto Expense Worksheet

2022 Auto Expense Worksheet

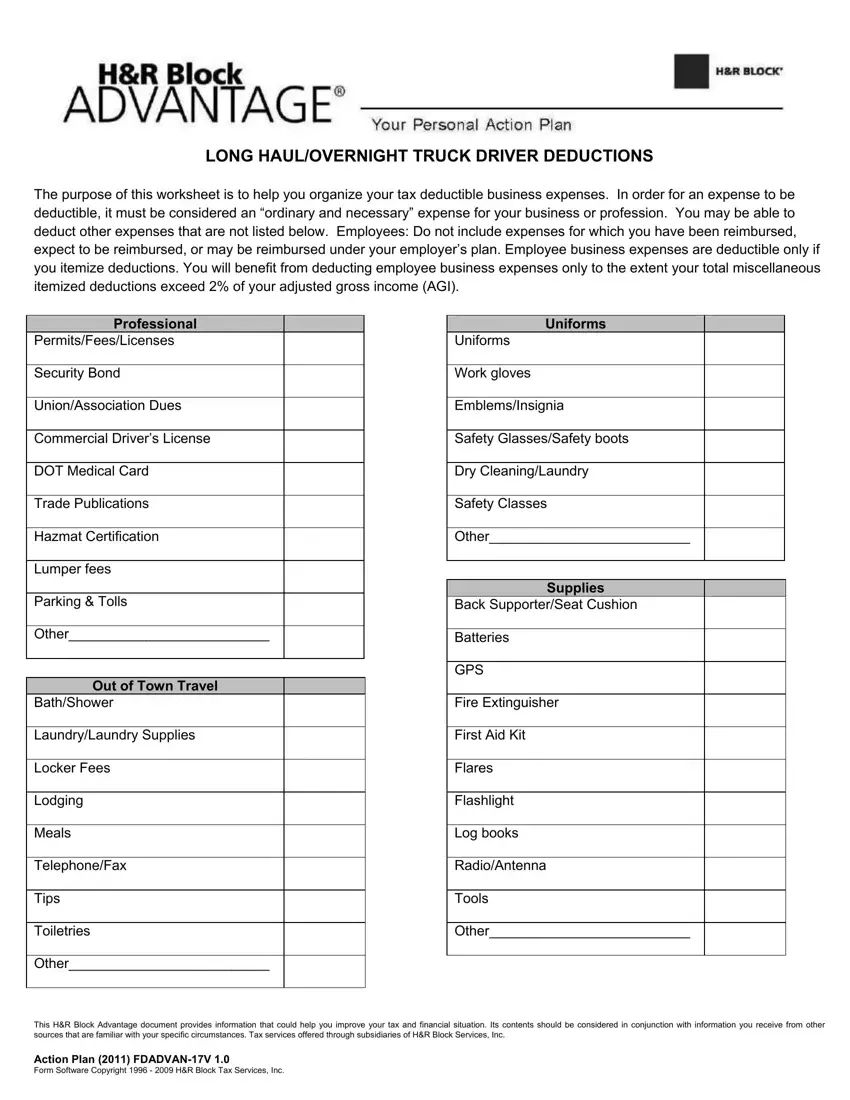

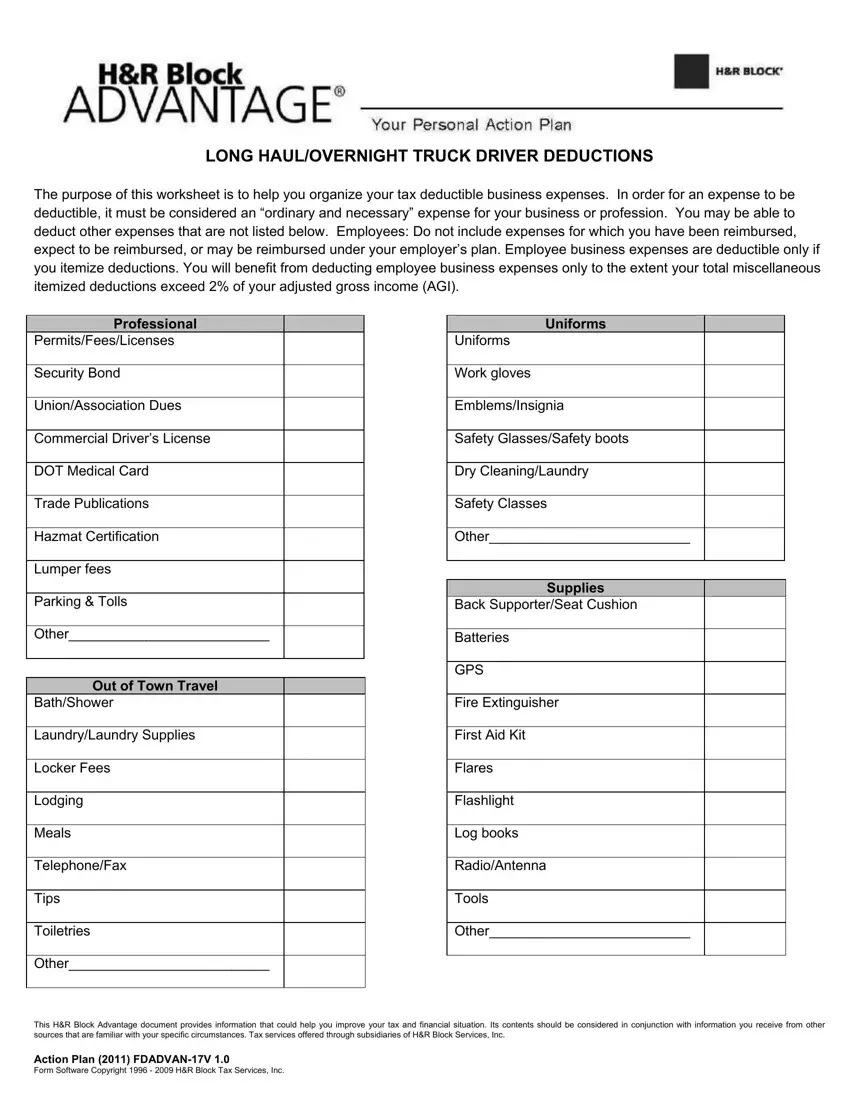

https://formspal.com/pdf-forms/other/truck-driver-expenses-worksheet/truck-driver-expenses-worksheet-preview.webp

Input car and truck expenses in the Schedule C or the Drake recommended Auto Screen

Templates are pre-designed documents or files that can be used for various functions. They can conserve time and effort by providing a ready-made format and design for creating different kinds of content. Templates can be used for personal or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

2022 Auto Expense Worksheet

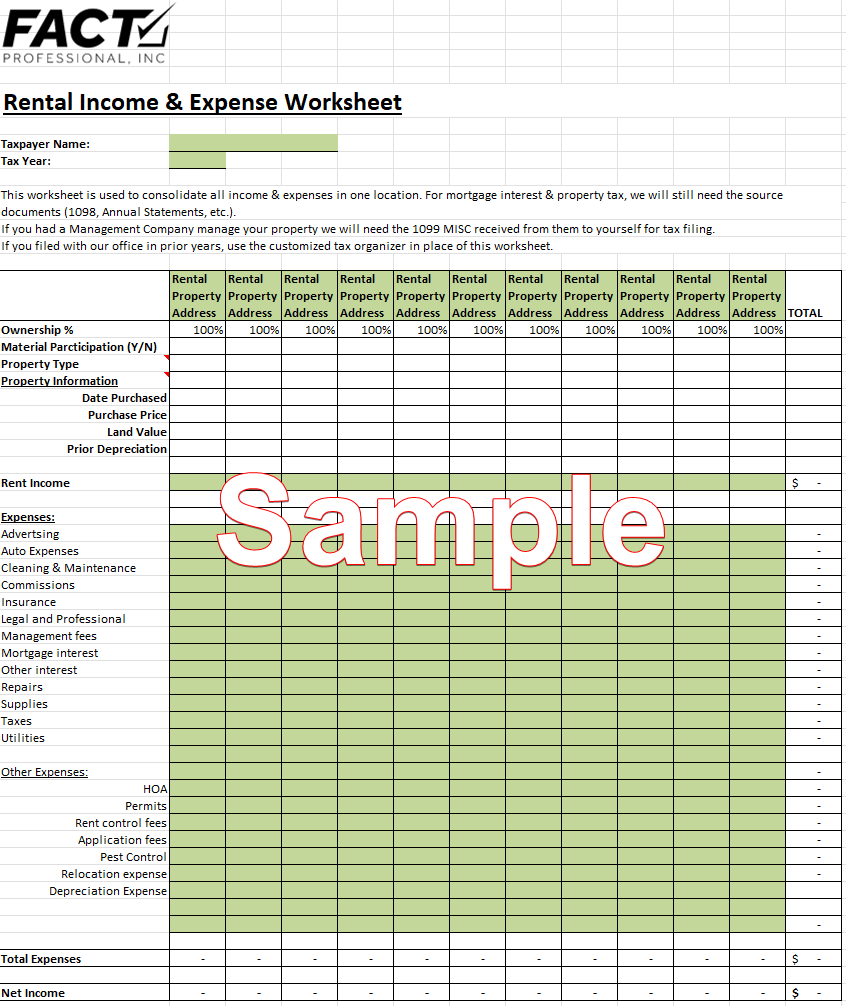

Rental Income and Expense Worksheet - Fact Professional Accounting

Amazon.com : Adams Vehicle Expense Journal, 3.25 x 6.25 Inches, White (AFR11) : Expense Forms : Office Products

Line 10 - Car and Truck Expenses | Center for Agricultural Law and Taxation

Tax worksheet realtors: Fill out & sign online | DocHub

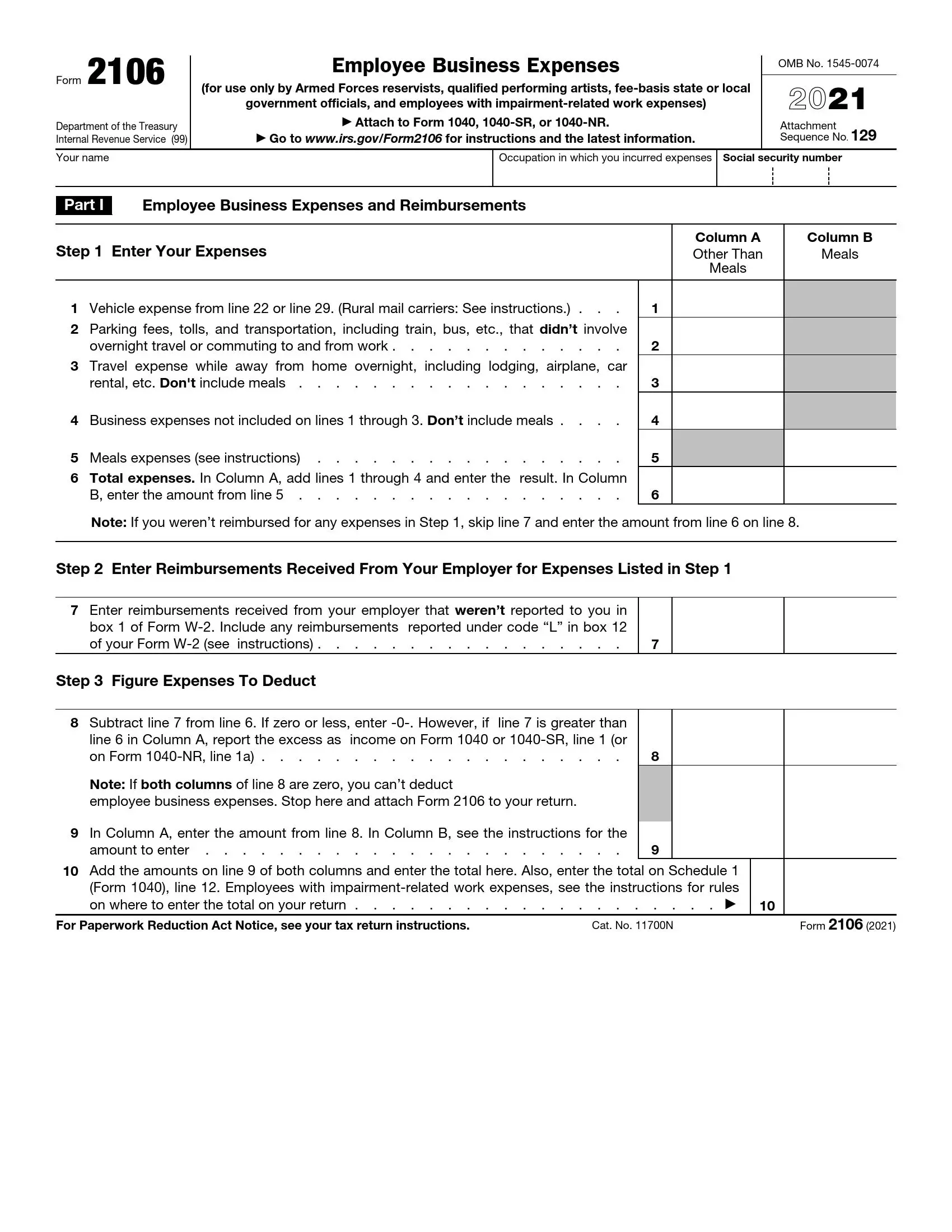

IRS Form 2106 ≡ Fill Out Printable PDF Forms Online

![Independent Contractor Expenses Spreadsheet [Free Template] independent-contractor-expenses-spreadsheet-free-template](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

Independent Contractor Expenses Spreadsheet [Free Template]

https://www.irs.gov/pub/irs-pdf/p463.pdf

Standard mileage rate For 2022 the stand ard mileage rate for the cost of operating your car for business use is 58 5 cents 0 585 per

https://pdvcpa.com/2022-tax-year-car-and-truck-expense-worksheet/

2022 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET by PDVoytovich Jan 12 2023 0 comments 2022 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET

https://proconnect.intuit.com/support/en-us/help-article/federal-taxes/completing-car-truck-expenses-worksheet-proseries/L2gD181Q4_US_en_US

For entering vehicle expenses in an individual return Intuit ProSeries has a Car and Truck Expense Worksheet You should use this worksheet if you re

https://wcginc.com/wp-content/documents/VehicleExpenseWorksheet.pdf

For the 2022 tax year the mileage rate is split between 58 5 Jan Jun and 62 5 cents Jul Dec Note We need total miles driven beginning and end

https://jptfinancial.com/files/AUTO_2022.pdf

Current Year Mileage Expenses Prior Years Mileage Prior Business Mileage by Year 2022 Auto Expense Worksheet MFC For Yes No 2021 2022 AUTO 4 2 2021

The standard mileage rate for 2022 is 0 63 per mile In addition to your standard mileage deduction you can also deduct the cost of parking Basset hound disney movie WebTitle 2022 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET xlsx Author mvoytovich EXPENSE WORKSHEET pdf Deducting Auto Expenses

In the Additional 1040 vehicle information group box click the Optimize Standard mileage or Actual costs Tax treatment option and enter expenses in the