2022 Qualified Dividends And Capital Gains Worksheet Line 16 Easily complete a printable IRS Instruction 1040 Line 44 Form 2015 online Get ready for this year s Tax Season quickly and safely with pdfFiller

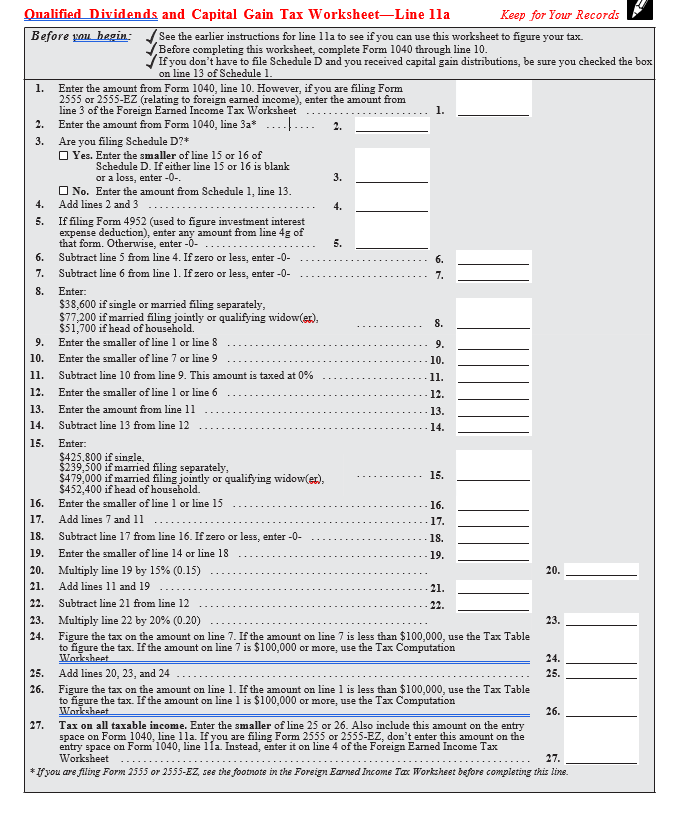

Instead you will need to use the Capital Gains Worksheet to figure your tax 1040 Instructions Line 16 Qualified Dividends and Capital Gains Worksheet Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 Don t complete lines 21 and 22 below No Complete

2022 Qualified Dividends And Capital Gains Worksheet Line 16

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/c465f676-3fbb-4148-9468-8268d83ab82c.default.PNG

If the organization the qualified dividends and capital gain tax worksheet line 16 is going to be brought to allows you to do it via internet implement safe

Pre-crafted templates offer a time-saving option for producing a diverse series of documents and files. These pre-designed formats and designs can be made use of for various individual and professional tasks, including resumes, invitations, flyers, newsletters, reports, presentations, and more, streamlining the material creation procedure.

2022 Qualified Dividends And Capital Gains Worksheet Line 16

Qualified Dividends And Capital Gain Tax Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

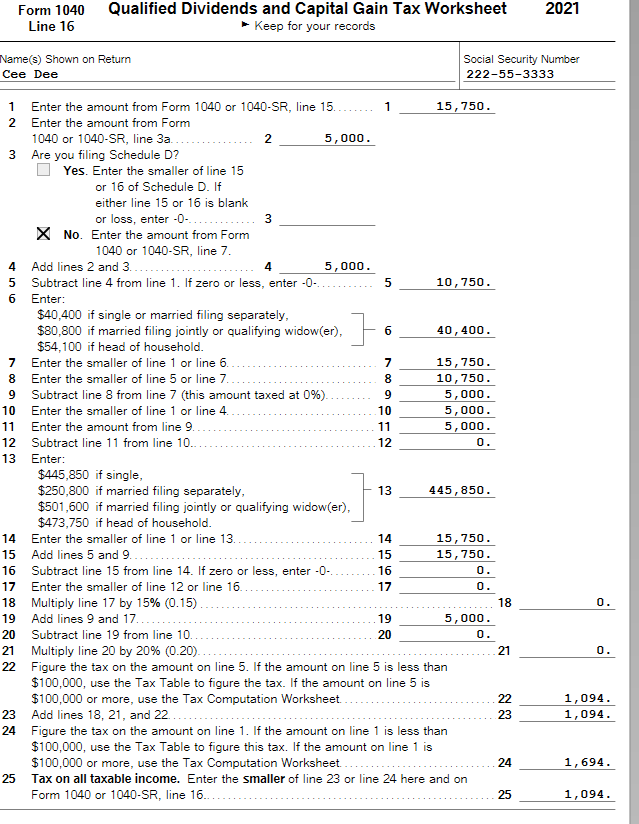

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

ACC 330 Final Project Two Qualified Dividends and Capital Gains - Qualified Dividends and Capital - Studocu

ACC 330 Qualified Dividends and Capital Gain Tax Worksheet.pdf - 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line | Course Hero

Completed Qualified Dividends and Capital Gain Worksheet.pdf - 2017 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for | Course Hero

Create a Function in C++ for Calculating the Tax Due | Chegg.com

https://media.hrblock.com/media/KnowledgeDevelopment/ITC/2023Forms/2022_Qualified_Dividends_and_Capital_Gains_Tax_Worksheet_line_16_fillable.pdf

Enter the amount from Form 1040 or 1040 SR line 15 However if you are filing 1 Form 2555 relating to foreign earned income enter the amount from

https://www.irs.gov/pub/irs-dft/i1040sd--dft.pdf

Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 or in the instructions for Form 1040

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

Qualified Dividends and Capital Gains Worksheet 2022 easily fill out and sign forms download blank or editable online

https://support.cch.com/kb/solution.aspx/000059538

You do not have to file Schedule D and you reported capital gain distributions on Form 1040 line 7 You are filing Schedule D and Schedule D lines 15 and 16

https://www.drakesoftware.com/sharedassets/education/practice/solution2.pdf

Are lines 15 and 16 both gains Yes Go to line 18 No Skip lines 18 through Qualified Dividends and Capital Gain Tax Worksheet Line 16 Form 1040 2022

3 2018 Form 1040 Line 11a Qualified Dividends and Capital Gain Tax Worksheet Line 11a If either line 15 or 16 is blank or a loss enter 0 No Enter the 16 turbotax accuracy 00 3025276 Qualified Dividends and Capital Gain Tax Worksheet Line 16 1040 2022 Internal Revenue Service IRS SCHEDULE D Capital

2022 Internal Revenue Service Qualified Dividends and Capital Gains Tax Worksheet or Schedule Qualified Dividends and Capital Gain Tax Worksheet Line 16