2022 Simplified Method Worksheet How do I find the Simplified Method Worksheet It s from Publication 17 Topics TurboTax Deluxe Online posted April 15 2022 4 45 PM

If you re receiving a pension that was entirely paid for by your employer the entire amount of your payments will be taxed and you don t need this tool But The Simplified Method Worksheet in the TaxAct program shows the calculation of the taxable amount from entries made in the retirement income section You need

2022 Simplified Method Worksheet

2022 Simplified Method Worksheet

2022 Simplified Method Worksheet

https://formspal.com/pdf-forms/other/form-1040-simplified-method-worksheet/form-1040-simplified-method-worksheet-preview.webp

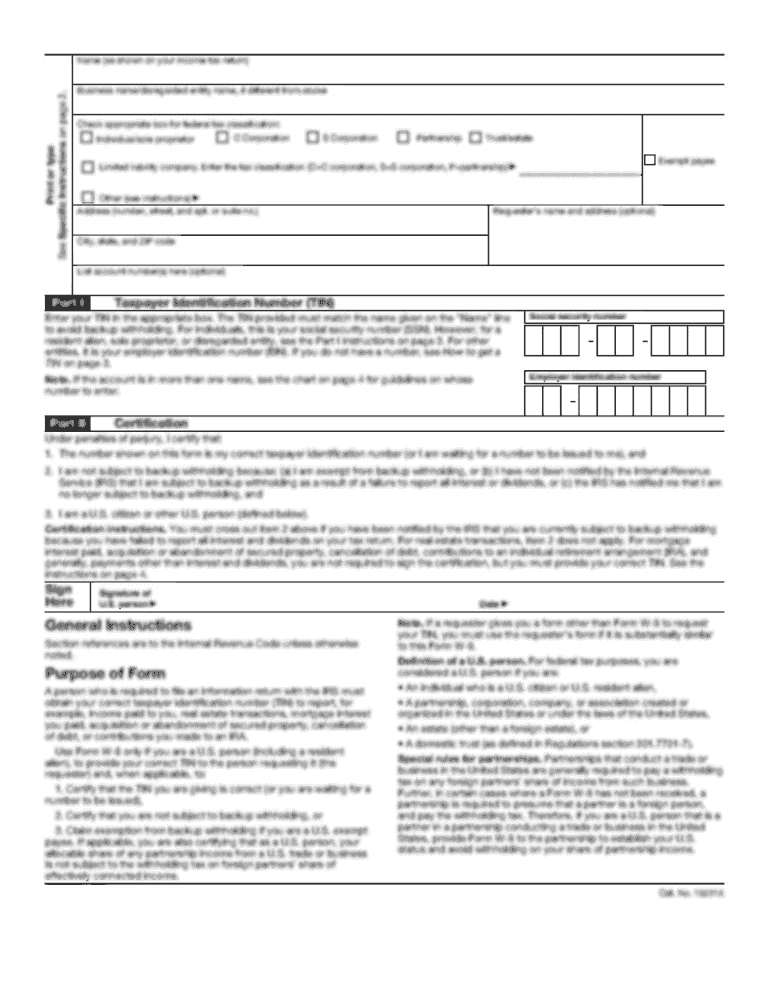

W 2 1099 Information Page 2022 Simplified W 2 Method Spreadsheet 2022 Simplified W 2 Method Specifications Easy Entry 2022 Simplified W 2

Pre-crafted templates provide a time-saving solution for developing a varied series of files and files. These pre-designed formats and designs can be utilized for different personal and professional projects, consisting of resumes, invites, leaflets, newsletters, reports, presentations, and more, streamlining the content production procedure.

2022 Simplified Method Worksheet

Simplified home office tax deduction pays off for some small businesses - Don't Mess With Taxes

8829 Simplified Method Worksheet - Fill Out and Sign Printable PDF Template | signNow

1040 Simplified Method Worksheet PDF Form - FormsPal

1040 (2022) | Internal Revenue Service

Home Office Tax Deduction: What to Know | Fast Capital 360®

Simplified method worksheet: Fill out & sign online | DocHub

https://www.irs.gov/media/166951

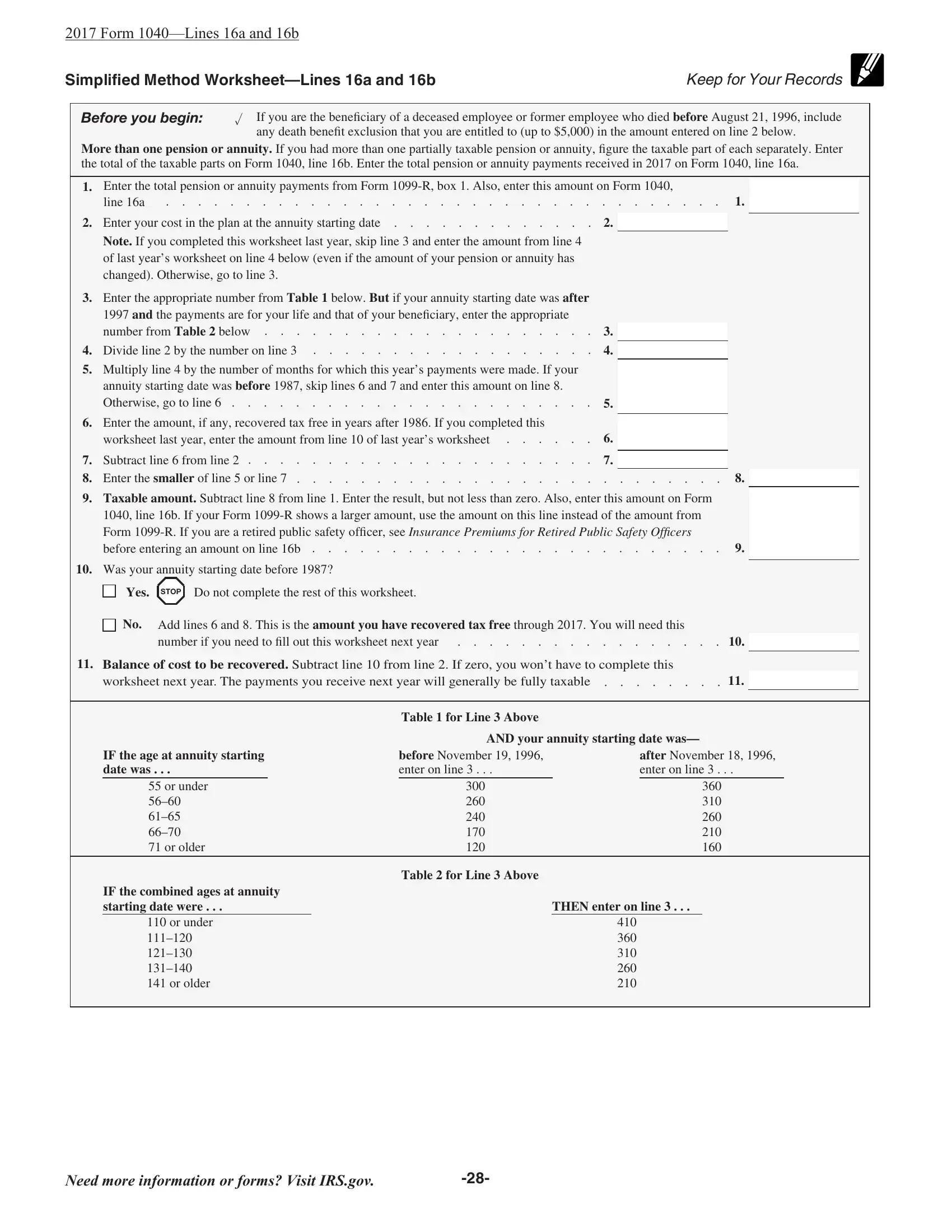

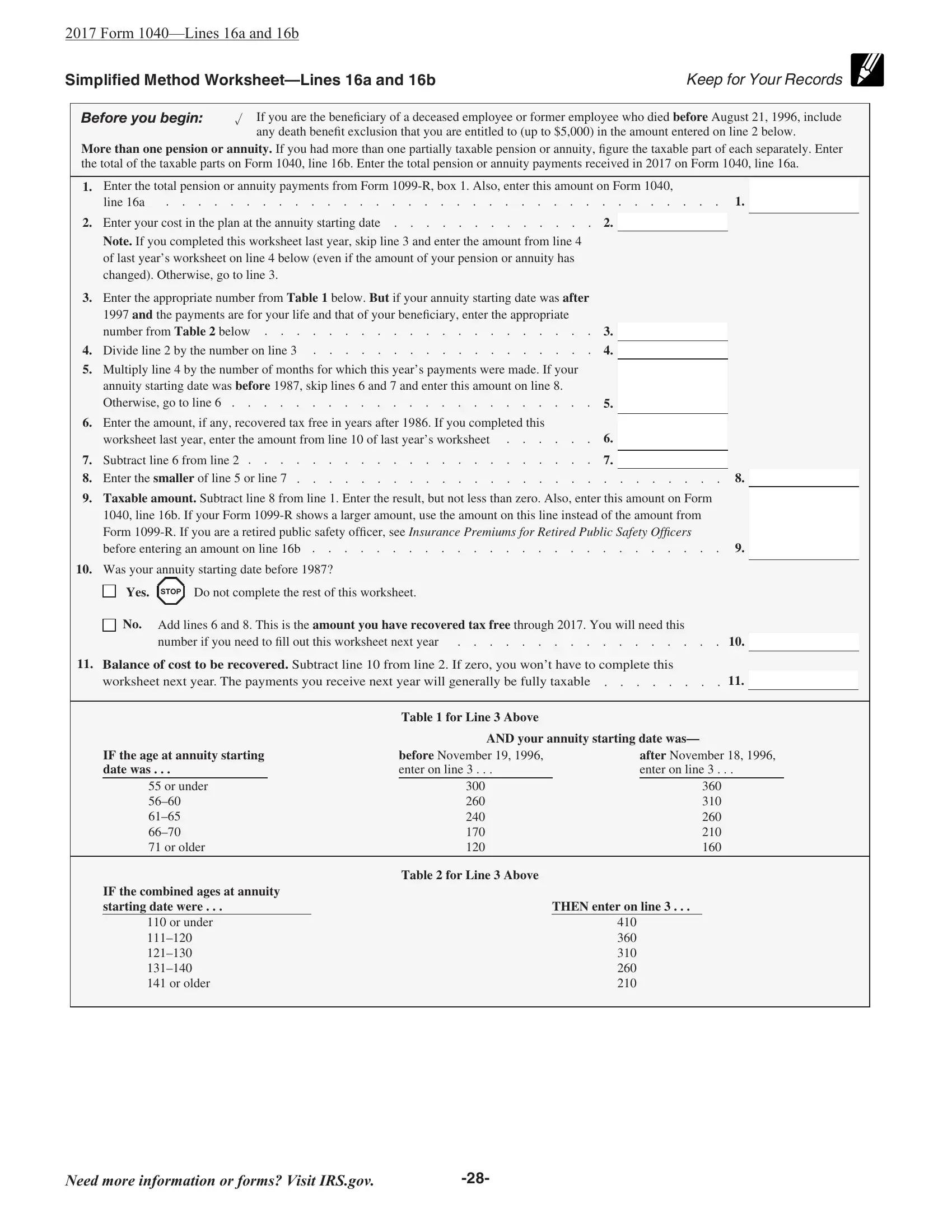

Summary This is the simplified method worksheet It is used to figure the taxable part of your pension or annuity using the simplified method Before you begin

https://www.irs.gov/instructions/i1040sc

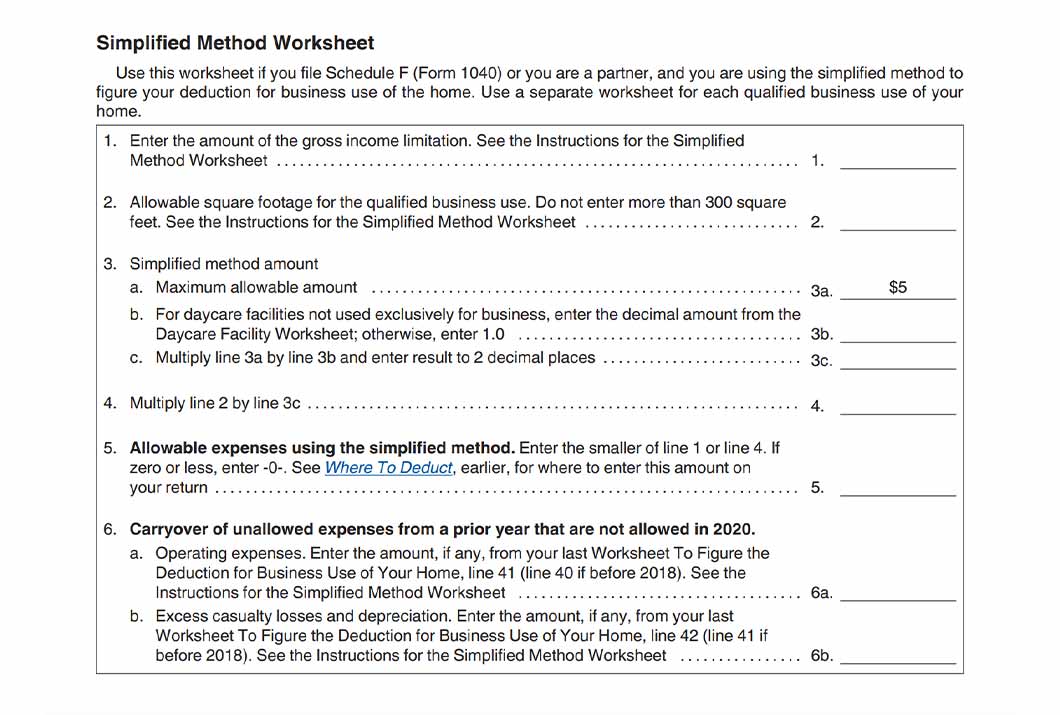

Electing to use the simplified method Simplified Method Worksheet Daycare Facility Worksheet for simplified method Business use of more

https://www.taxact.com/support/1369/2022/simplified-method-worksheet

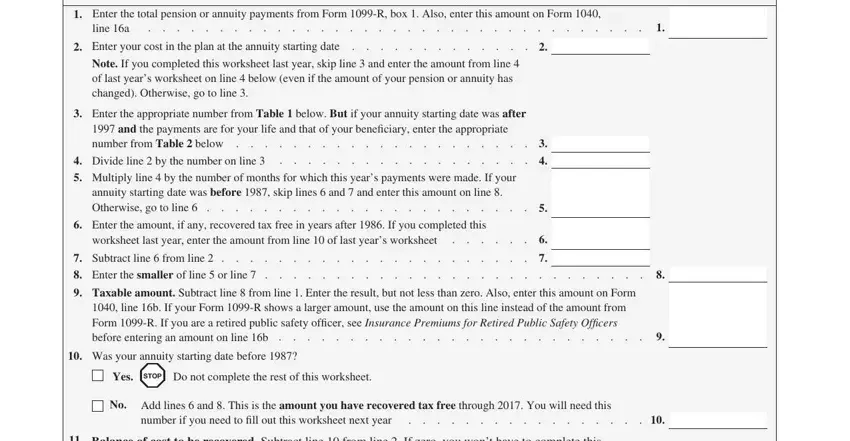

The Simplified Method Worksheet in the TaxAct program shows the calculation of the taxable amount from entries made in the retirement income section

https://support.taxslayer.com/hc/en-us/articles/360015701872-How-do-I-complete-the-Simplified-Method-Worksheet-1099-R-

If you must use the Simplified Method to figure the taxable amount in Box 2a of the 1099 R form use this guide to assist you with your entries

https://support.taxslayer.com/hc/en-us/articles/360016472752-Should-I-use-the-Simplified-Method-Worksheet-to-figure-my-1099-R-s-taxable-amount-

The Simplified Method Worksheet can be found in Form 1040 1040 SR Instructions if you prefer to do it by hand Are there restrictions on when the Simplified

A simplified method worksheet is a form used by employers to calculate the amount of federal income tax withholding from an employee s wages This method is The calculation is shown on the Simplified Method Worksheet Form 8829 Simplified in view mode Schedule C line 30 Schedule F line 32 Form 2106 line 4

Simplified Method Note If Form 1099 R does show a taxable amount the taxpayer may be able to report a lower taxable amount by using the