2022 Social Security Taxable Income Worksheet C Enter the weekly biweekly or semi monthly wage amounts in the Gross Wages column d

State of Rhode Island Division of Taxation 2022 Modification Worksheet Taxable Social Security Income Worksheet Enter your spouse s date of birth if The IRS will not have Social Security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late

2022 Social Security Taxable Income Worksheet

2022 Social Security Taxable Income Worksheet

2022 Social Security Taxable Income Worksheet

https://www.signnow.com/preview/6/963/6963800.png

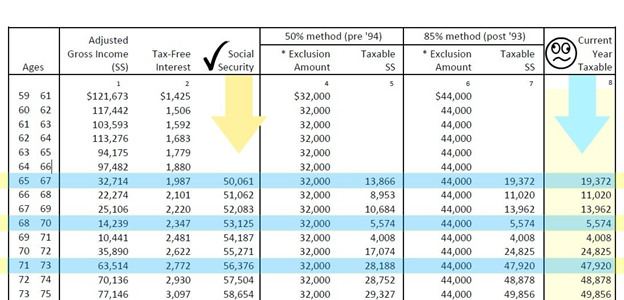

Note that not everyone pays taxes on benefits but clients who have other income in retirement beyond Social Security will likely pay taxes on their benefit If

Templates are pre-designed files or files that can be used for numerous functions. They can save effort and time by offering a ready-made format and layout for developing different type of material. Templates can be utilized for individual or expert jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

2022 Social Security Taxable Income Worksheet

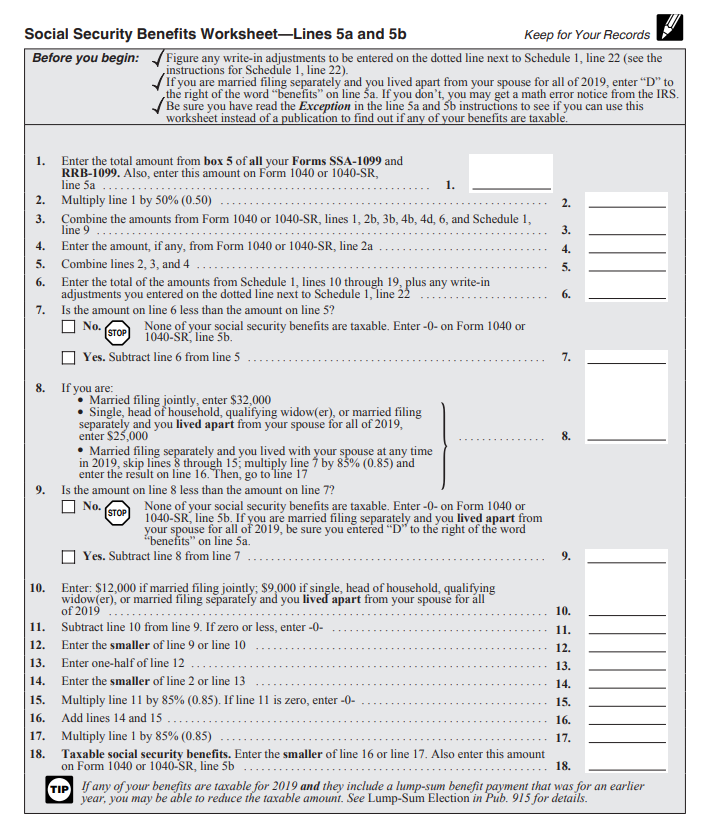

Fillable Social Security Benefits Worksheet - Fill and Sign Printable Template Online

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Calculating Taxable Social Security Benefits - Not as Easy as 0%, 50%, 85% | Moneytree Software

https://www.irs.gov/pub/irs-pdf/n703.pdf

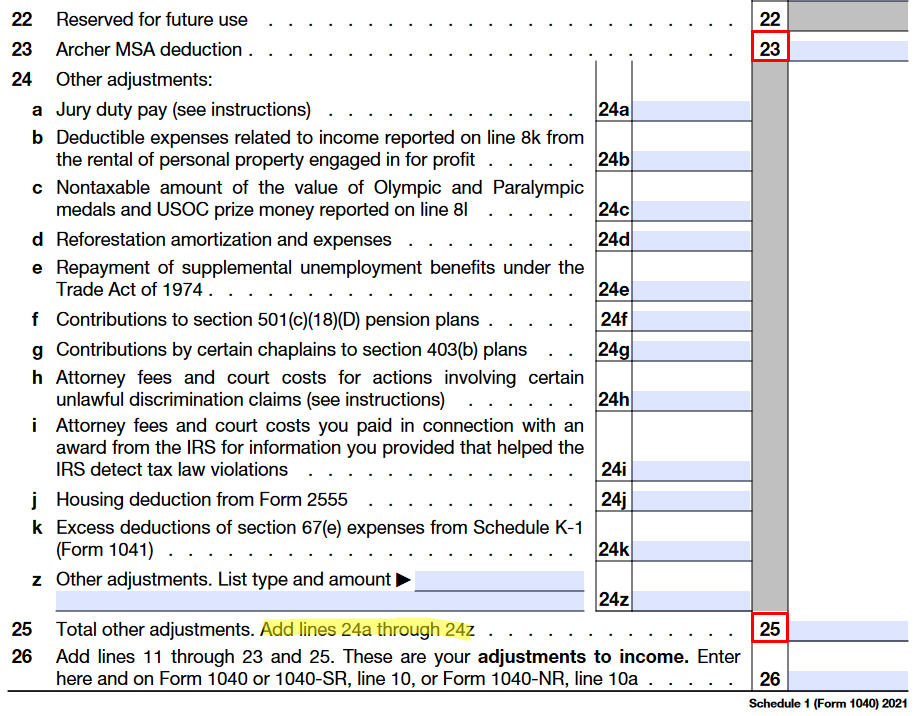

If your social security and or SSI supplemental security income benefits were your only source of income for 2022 you probably will not have to file a

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

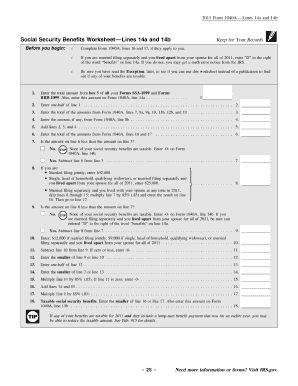

If your income is modest it is likely that none of your Social Security benefits are taxable As your gross income increases a higher percentage of your

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments More specifically if your total

https://pdfliner.com/social_security_benefits_worksheet_lines_20a_and_20b

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

https://www.ssa.gov/benefits/retirement/planner/taxes.html

Between 25 000 and 34 000 you may have to pay income tax on up to 50 percent of your benefits more than 34 000 up to 85 percent of your benefits may be

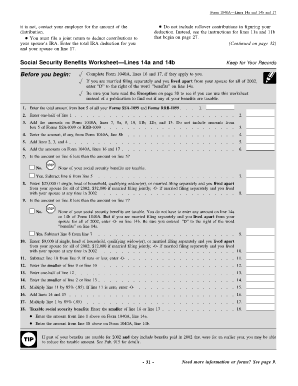

Social Security income is generally taxable at the federal level However the IRS helps taxpayers by offering software and a worksheet to income for purposes of computing the alternate tax on line 39 NOTE This also affects you if you are single and use the Tax Reduction Worksheet The

If your income is modest it is likely that none of your Social Security benefits are taxable As your gross income increases a higher percentage of your