8829 Simplified Method Jan 23 2023 0183 32 IRS Form 8829 is the form used to deduct expenses for your home business space The IRS determines the eligibility of an allowable home business space using two criterion quot regular quot use of the space for business purposes and quot exclusivity quot the space is used solely for business purposes

May 18 2022 0183 32 The simplified method discussed in more detail below doesn t require you to file Form 8829 and instead goes directly on Schedule C the sole proprietor profit or loss tax form The other Form 8829 also called the Expense for Business Use of Your Home is the IRS form you use to calculate and deduct your home office expenses 1099 contractors and other self employed individuals process the IRS home office form along with their annual tax return unless you re using the simplified method

8829 Simplified Method

8829 Simplified Method

8829 Simplified Method

https://www.pdffiller.com/preview/621/821/621821290/big.png

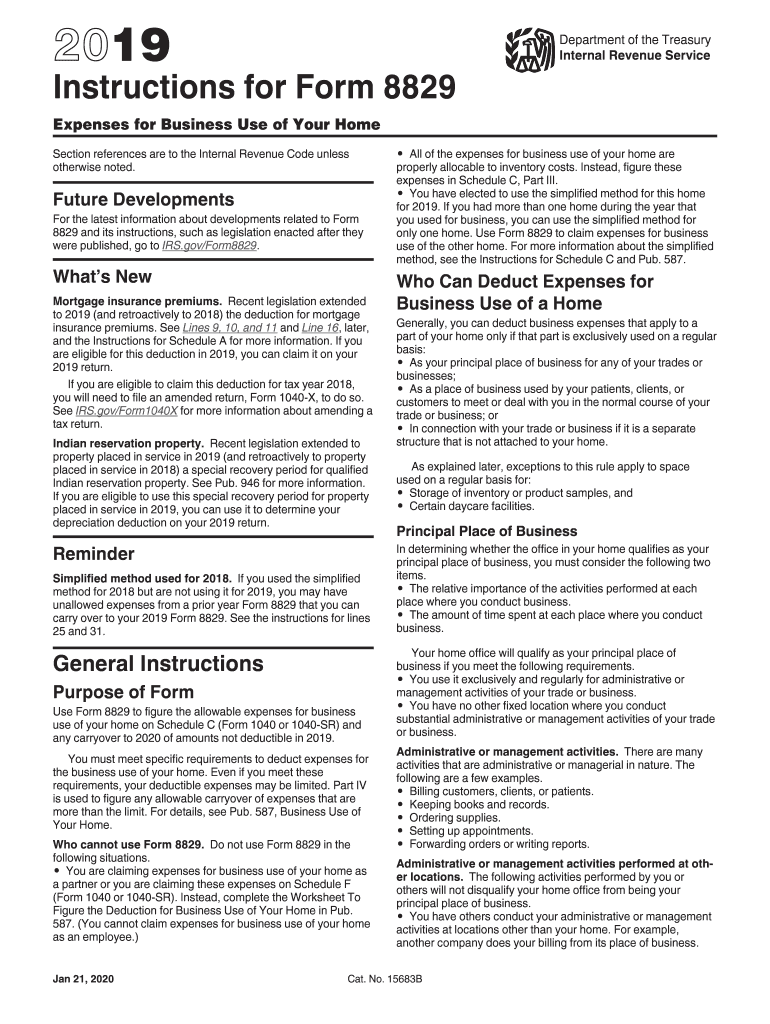

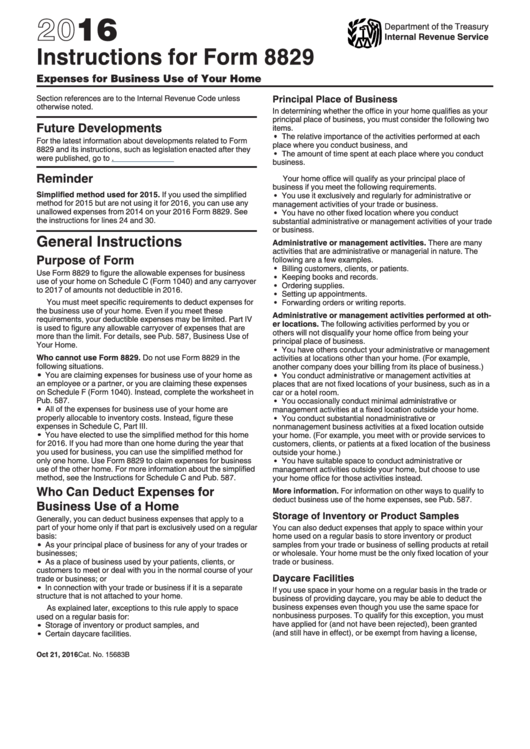

Simplified method used for 2022 If you used the simplified method for 2022 but are not using it for 2023 you may have unallowed expenses from a prior year Form 8829 that you can carry over to your 2023 Form 8829 See the instructions for lines 25 and 31 General Instructions Purpose of Form

Pre-crafted templates use a time-saving service for producing a diverse range of files and files. These pre-designed formats and layouts can be made use of for various personal and professional projects, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the content creation process.

8829 Simplified Method

Simplified Method Worksheet Schedule C

Solved Trying To Fix Incorrect Entry Form 8829

Worksheet Form 8829 Worksheet Worksheet Fun Worksheet Study Site

25 Off Neat Method Coupons January 2024

Scientific Method Digital Worksheet Storyboard

Form 8829 2023 Printable Forms Free Online

https://www.irs.gov/businesses/small-businesses

Jul 27 2023 0183 32 Beginning in tax year 2013 returns filed in 2014 taxpayers may use a simplified option when figuring the deduction for business use of their home Note This simplified option does not change the criteria for who may claim a home office deduction

https://accountants.intuit.com/support/en-us/help

Mar 23 2023 0183 32 Follow these steps to select the simplified method Go to Screen 29 Business Use of Home 8829 Enter a 2 in the field 1 use actual expenses default 2 elect to use simplified method About the simplified method The simplified method allows a standard deduction of 5 per square foot of home used for business with a maximum of

https://www.drakesoftware.com/Site/Browse/12513/

When the taxpayer elects to use the simplified method Form 8829 is not produced the calculated amount will flow to the applicable schedule instead The calculation is shown on the Simplified Method Worksheet Form 8829 Simplified in view mode Schedule C line 30 Schedule F line 32 Form 2106 line 4

https://www.nerdwallet.com/article/small-business/

May 14 2020 0183 32 There are two ways to claim the deduction using the simplified method and reporting it directly on your Schedule C or by filing IRS Form 8829 to calculate your total deduction This guide

https://www.thebalancemoney.com/simplified-home

Sep 19 2022 0183 32 If you want to use the simplified method your deduction is 5 x 150 sq ft 750 If you want to use the regular method you ll need to do more calculations and use Form 8829 How the Regular Home Office Deduction Calculation Works

Jul 17 2023 0183 32 by Intuit 38 Updated July 17 2023 Electing the Simplified Method for Form 8829 To elect the simplified method for the Form 8829 Open the Form 8829 Go to Part I the Simple Method Smar How do I Use the Simplified Method for Business Use of Home Form 8829 When calculating the business use of home by simplified method you will multiply the total home office space up to 300 square feet by the rate per square foot 5 for the current tax year Does My Home Office Qualify W 2 employees do not qualify for this deduction

The simplified method described in more detail below eliminates the need to submit home office deduction form 8829 and instead takes you directly to Schedule C which is the sole proprietor s income tax form Another option is the actual costing method required on home office deduction form 8829