941 Worksheet 1 For 1st Quarter 2021 The IRS has released an updated version of Form 941 for the 2nd through 4th quarters of 2020 the 1st quarter 2021 the 2nd through 4th quarters of 2021 and the 1st quarter of 2022 and later Below is a summary of the new fields on the form and how Accounting CS populates those fields

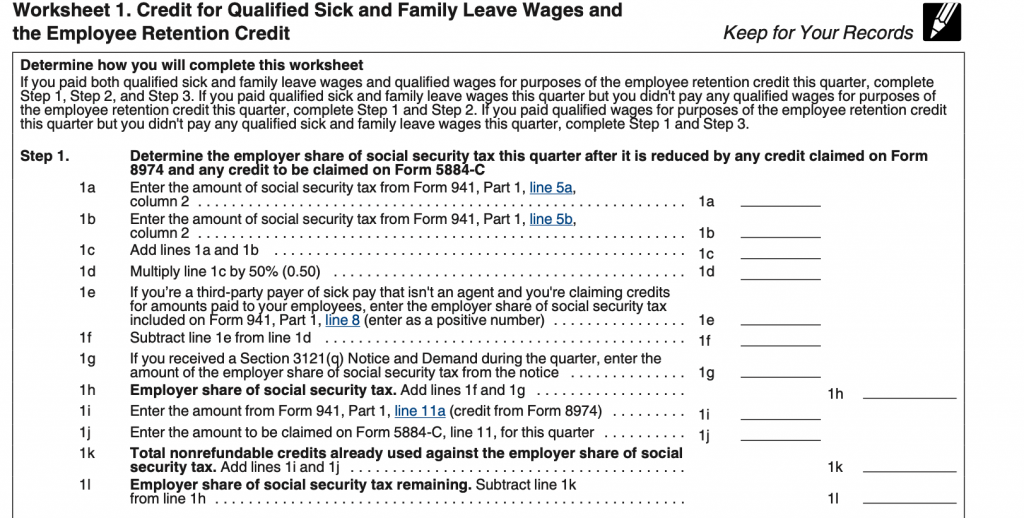

You must use this worksheet if you claimed the employee retention credit for wages paid after March 12 2020 and before July 1 2021 on your original Form 941 and you correct any amounts used to figure the employee retention credit for wages paid after March 12 2020 and before July 1 2021 Oct 8 2021 0183 32 The credits for the first quarter of 2021 were calculated on Worksheet 1 Employee Retention Credit Extended and Amended The American Rescue Plan Act also added a new employee retention credit ERC for qualified wages paid during the last six months of 2021

941 Worksheet 1 For 1st Quarter 2021

941 Worksheet 1 For 1st Quarter 2021

941 Worksheet 1 For 1st Quarter 2021

https://www.withholdingform.com/wp-content/uploads/2022/08/federal-form-941-2021-941-form-2021-printable-1.jpg

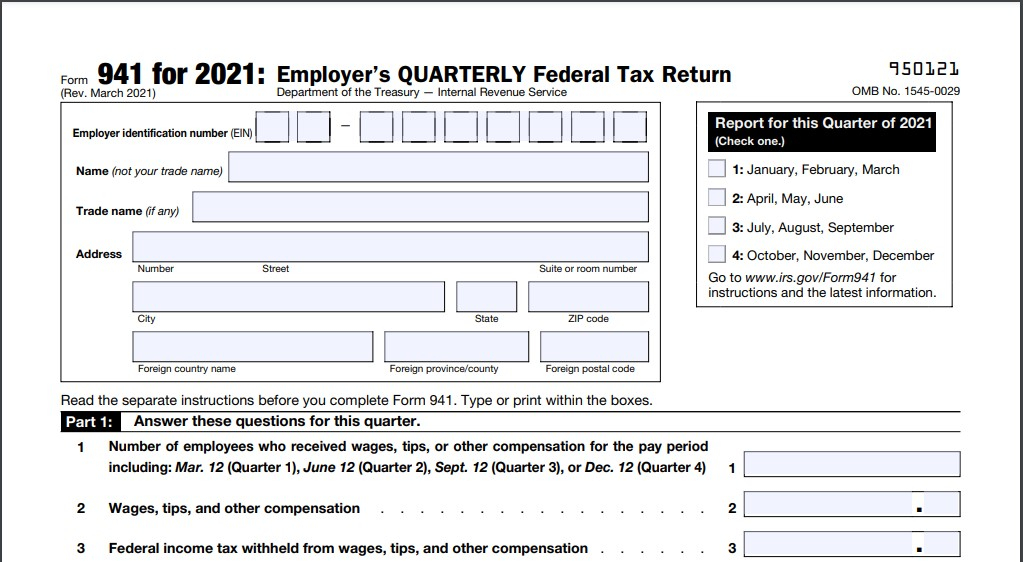

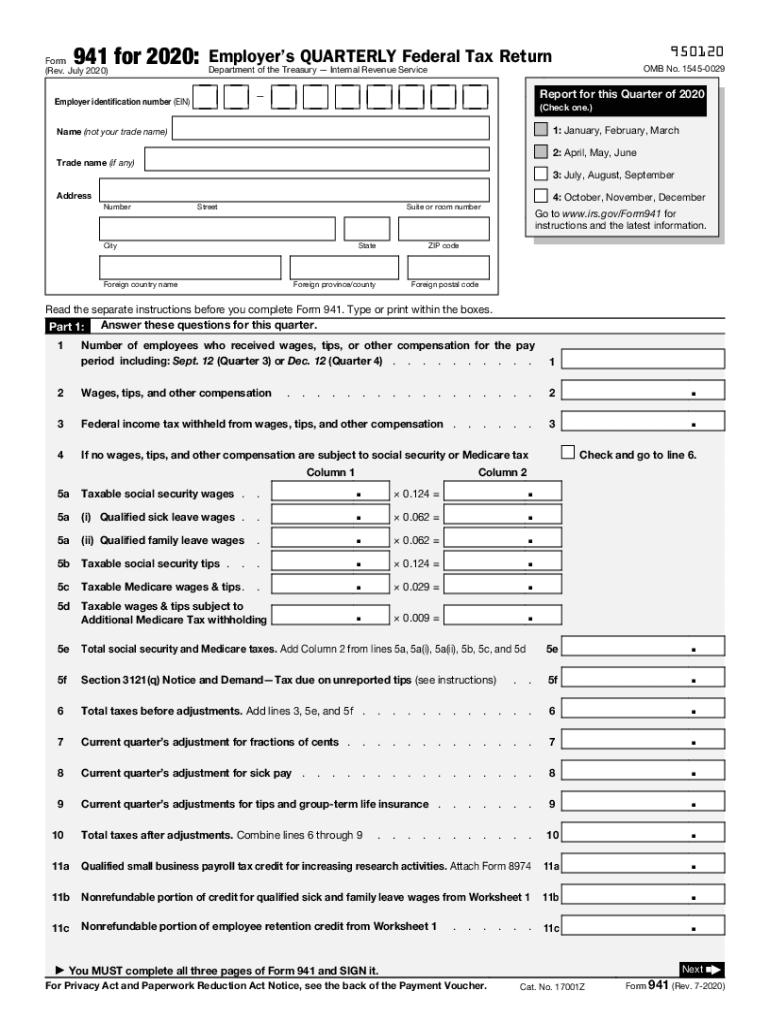

Mar 29 2021 0183 32 Employers IRS Changes Payroll Tax Form 941 for Q1 2021 In 2020 to combat the economic effects on small businesses caused by the COVID 19 pandemic new legislation executive actions drastically changed the format of Form 941 expanding it from two to three pages and adding 58 new data fields

Templates are pre-designed documents or files that can be utilized for various purposes. They can save time and effort by providing a ready-made format and layout for producing various kinds of material. Templates can be utilized for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

941 Worksheet 1 For 1st Quarter 2021

941 Worksheet 1 Example

941X Worksheet 1 Excel Printable Word Searches

Free Printable 941 Form For2019 Printable Forms Free Online

Step by Step How To Guide To Filing Your 941 X ERTC Baron Payroll

Generate Fillable Form Inpdf Printable Forms Free Online

Changes In Form 941 For 1st Quarter 2021 TaxBandits YouTube

https://www.payroll.org/docs/default-source/2021

Report for this Quarter of 2021 Check one 1 January February March 2 April May June 3 July August September 4 October November December Go to www irs gov Form941 for instructions and the latest information Read the separate instructions before you complete Form 941 Type or print within the boxes

.jpg?w=186)

https://www.irs.gov/forms-pubs/about-form-941

Information about Form 941 Employer s Quarterly Federal Tax Return including recent updates related forms and instructions on how to file Form 941 is used by employers who withhold income taxes from wages or who must pay social security or Medicare tax

https://news.bloombergtax.com/payroll/form-941-tax

Mar 11 2021 0183 32 The worksheet for calculating coronavirus related employment tax credits was updated in the finalized instructions for the 2021 Form 941 Employer s Quarterly Federal Tax Return released March 9 by the Internal Revenue Service Worksheet 1 is used to calculate the amounts of the credits for qualified sick and family leave wages and

https://www.irs.gov/pub/irs-prior/i941x--2021.pdf

Worksheet 1 Adjusted Credit for Qualified Sick and Family Leave Wages for Leave Taken Before April 1 2021 Worksheet 2 Adjusted Employee Retention Credit for Wages Paid After March 12 2020 and Before July 1 2021 Worksheet 3 Adjusted Credit for Qualified Sick and Family Leave Wages for Leave Taken After March 31 2021 Worksheet 4

https://medium.com/modern-payroll/a-complete-guide

Apr 13 2021 0183 32 What are the changes to Form 941 worksheet 1 for 2021 As per the recent changes in Form 941 instructions Worksheet 1 has also been updated Below are the changes to Worksheet 1

1 January February March 2 April May June Read the separate instructions before completing this form Use this form to correct errors you made on Form 941 or 941 SS Use a separate Form 941 X for each quarter that needs correction Type or print within the boxes You MUST complete all five pages Mar 17 2023 0183 32 1 What are the new changes in Form 941 Worksheets for 2023 The IRS has updated the first step of Worksheet 1 and reintroduced Worksheet 2 These changes are based on Form 8974 changes for the first quarter of 2023 Worksheet 1 Step 1 Line 1i Enter the amount from Form 941 Part 1 line 11a credit from Form 8974 Worksheet

Jun 3 2020 0183 32 The IRS has also issued the final Form 941 instructions that include new Worksheet 1 for figuring the tax credits for the CARES Act employee retention credit and or the FFCRA paid leave credits It is necessary to complete Worksheet 1 before preparing the Form 941 Worksheet 1 is retained in the employer s records and is not filed with