941 X Worksheet 2 Fillable Form Worksheet 2 is used for qualified wages paid after March 12 2020 and before July 1 2021 The Nonrefundable Portion of the employee retention

Select Create Form 941x 2020 941 x instructions 941 x worksheet 2 941 x for Fillable Fields Create PDF Insert and Merge Add Page Numbers Rotate Worksheet 2 You must use this worksheet if you claimed the employee retention credit for qualified wages paid after March 12 2020 and before

941 X Worksheet 2 Fillable Form

941 X Worksheet 2 Fillable Form

941 X Worksheet 2 Fillable Form

https://www.taxbandits.com/Content/Images/worksheet2.png

Employers that missed out on the ERC in the first two quarters of 2021 can still file a Form 941 X worksheet for ERC to take advantage of it

Pre-crafted templates offer a time-saving solution for developing a diverse variety of documents and files. These pre-designed formats and layouts can be used for different individual and expert jobs, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, streamlining the content creation procedure.

941 X Worksheet 2 Fillable Form

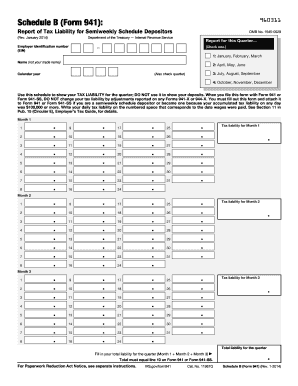

21 Printable Form 941 Templates - Fillable Samples in PDF, Word to Download | pdfFiller

941 x 2010 form: Fill out & sign online | DocHub

21 Printable Form 941 Templates - Fillable Samples in PDF, Word to Download | pdfFiller

2016 Form IRS 941Fill Online, Printable, Fillable, Blank - pdfFiller

Step-by-Step How to Guide to Filing Your 941-X ERTC | Baron Payroll

IRS Form 941 ≡ Fill Out Printable PDF Forms Online

https://www.irs.gov/instructions/i941x

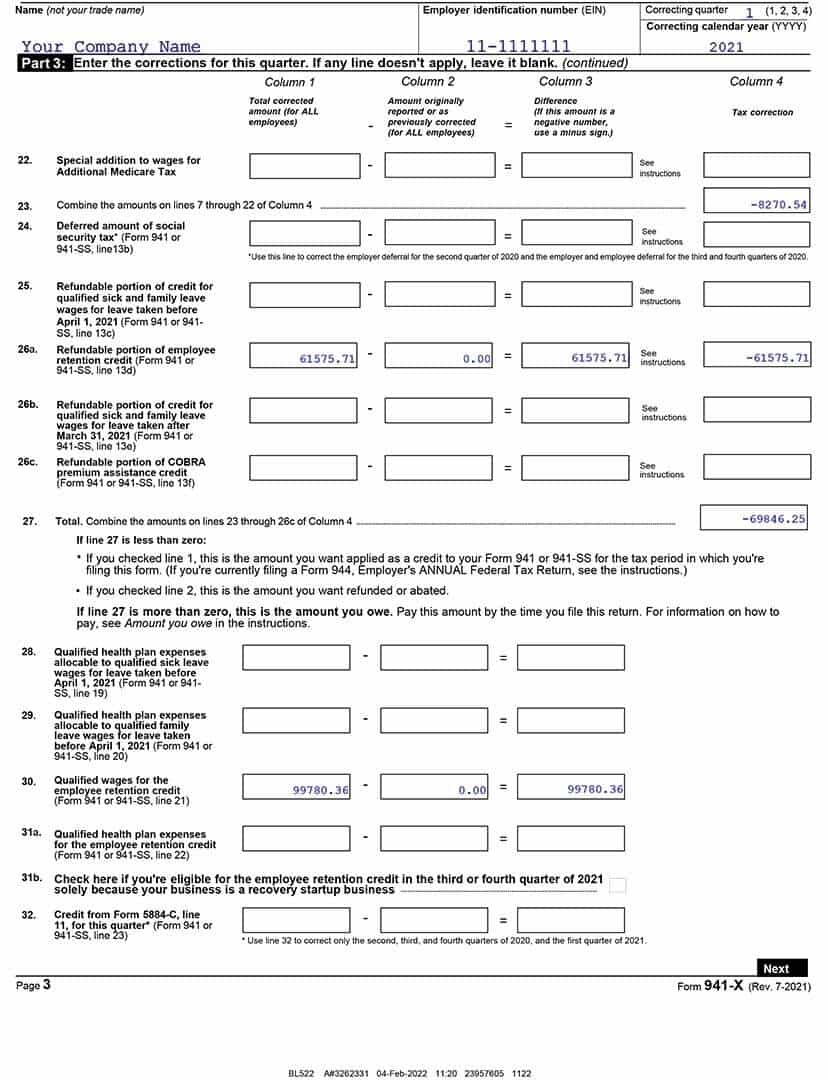

Form 941 X and complete Worksheet 2 to claim the correct amount of the credit For more information see Notice 2021 20 2021 11 I R B 922 available at

https://www.taxbandits.com/form-941/941-worksheet/

2 About Form 941 Worksheet 2 Worksheet 2 should be used by employers to calculate the Employee Retention Credit for the Second Quarter of 2021

https://www.pdffiller.com/en/catalog/form-941.htm

Fill Now Worksheet 2 941x 941x

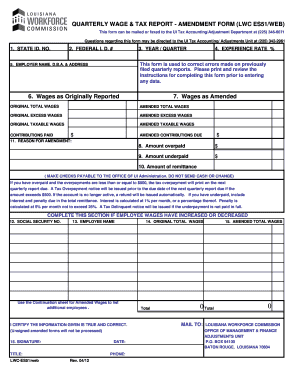

https://form-lwc-es51.pdffiller.com/

The Form 941 X worksheet is used specifically to calculate and report adjustments to employment tax returns for various reasons such as correcting wage amounts

https://silvertaxgroup.com/irs-employee-retention-credit/

Using Worksheet 2 to Update Form 941X Refundable Portion You will use Worksheet 2 to make changes to the refundable portion of the employee tax credit that

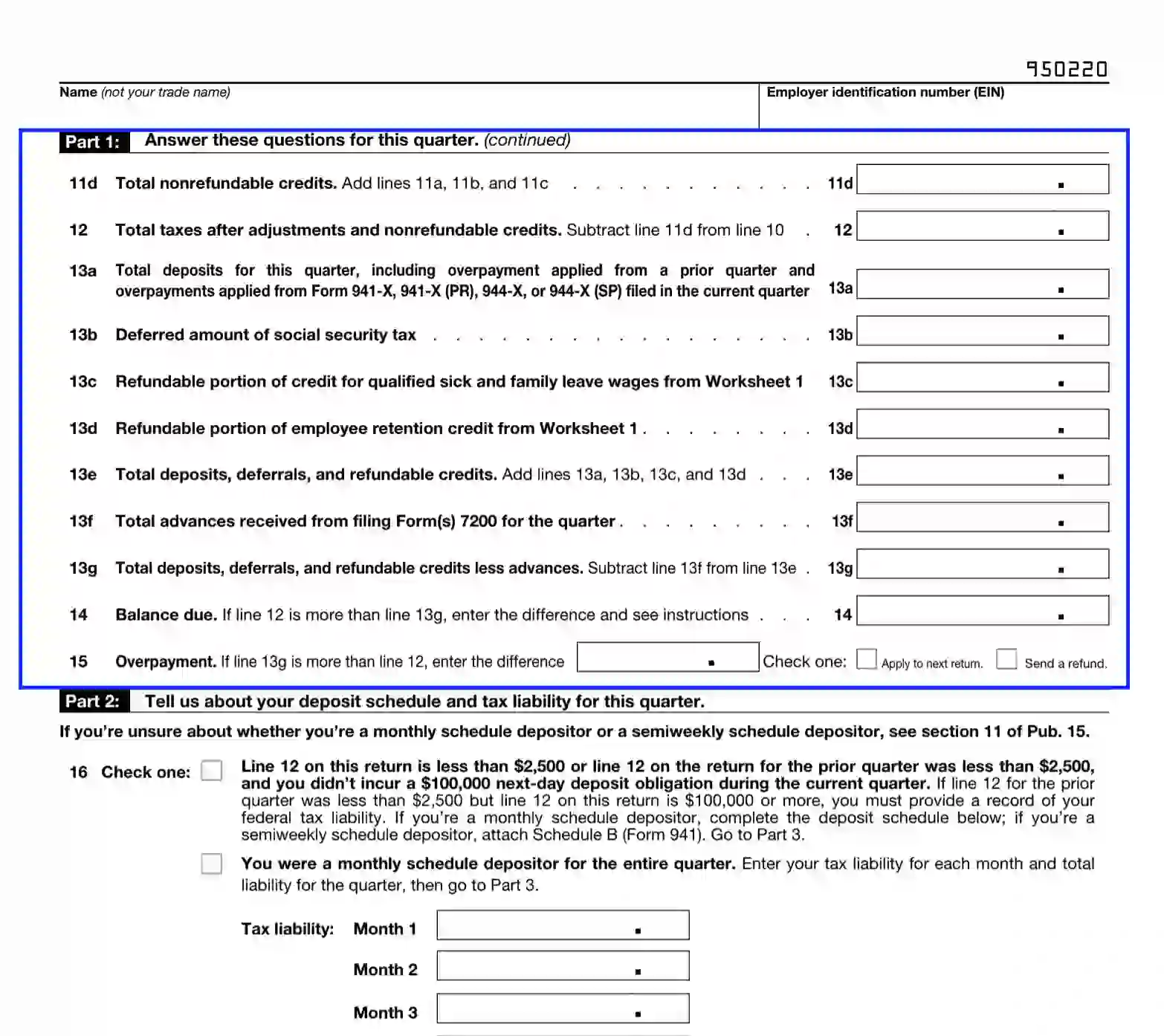

941 941 SS Quarter and year you are correcting Type of process adjusted employment tax return claim Certifications Filed or will file Forms W 2 or Forms Here is a downloadable Worksheets 1 to 5 for preparing or amending your 941 X forms to claim ERC Employee Retention Credit and FFCRA

IRS Forms 941 941 X and 5884 D Worksheet IRS About Form 941 Form 941 X Page 2 941 X Page2 Step 8 On Page 2 Part 3 Line 18a