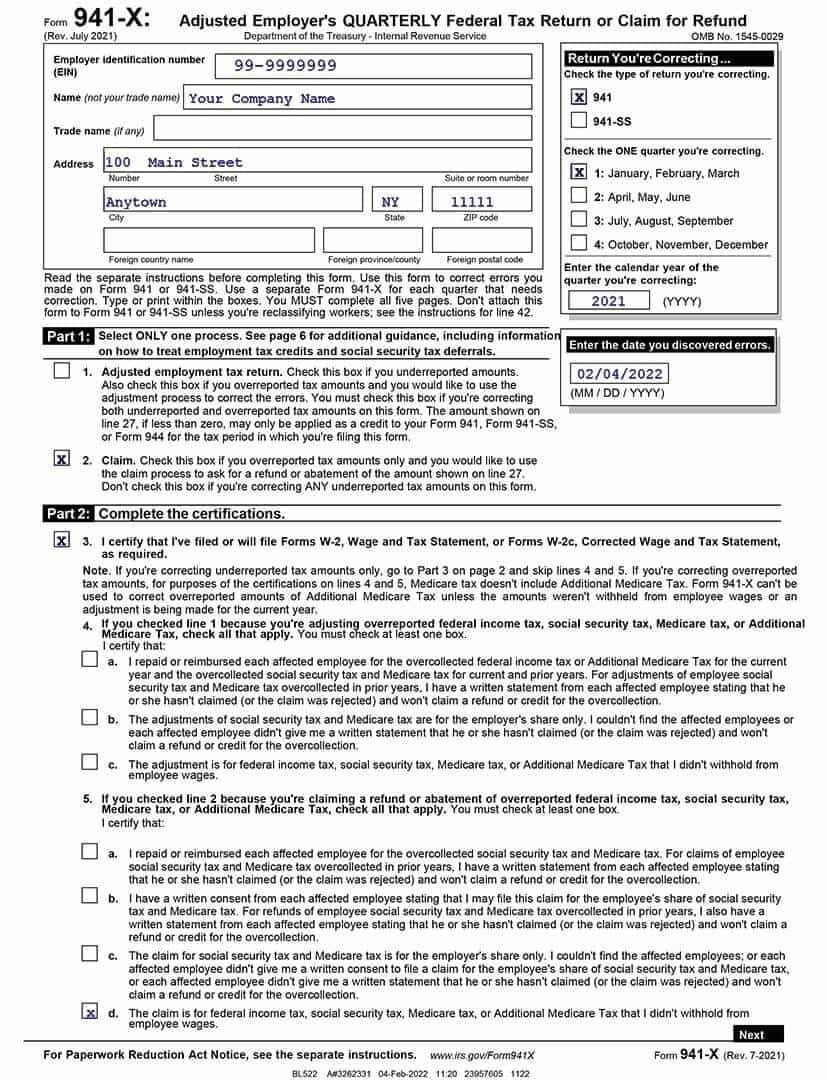

941 X Worksheet For Erc 2020 Download Form 941 X from the Internal Revenue Service website Complete the company name and corresponding information on each page including your Employee

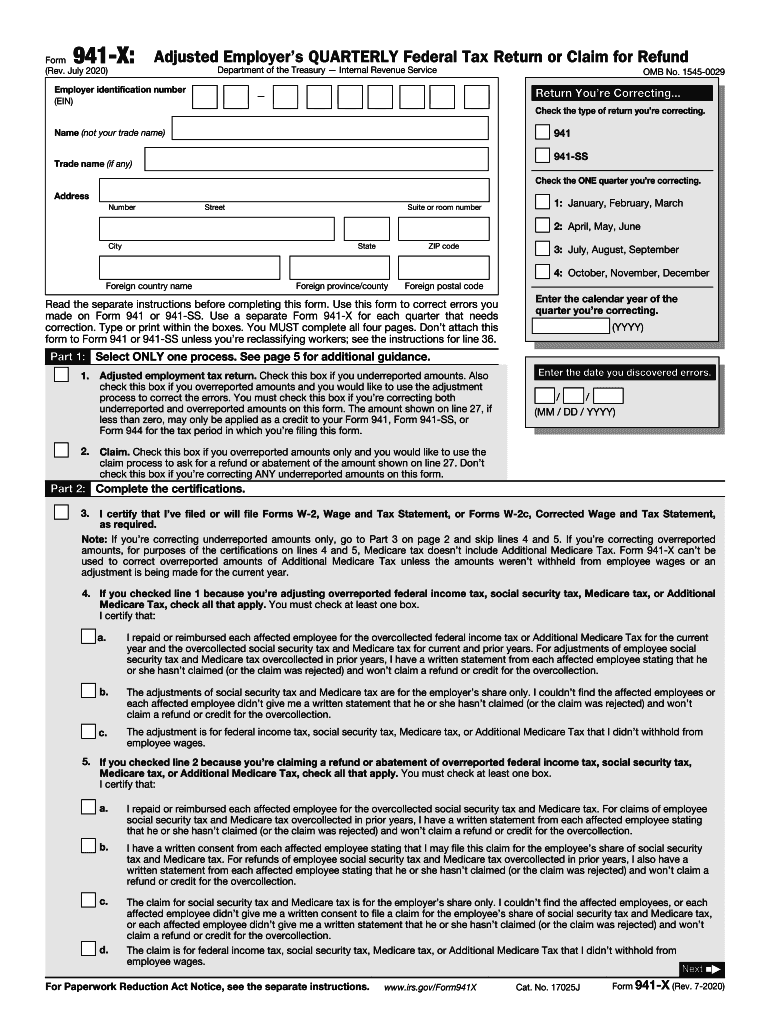

However since the ERC credits started so late in the first quarter began March 13 2020 the IRS required all business to include the first You will use Worksheet 2 to make changes to the refundable portion of the employee tax credit that apply to qualified wages paid after March 12 2020 and

941 X Worksheet For Erc 2020

941 X Worksheet For Erc 2020

941 X Worksheet For Erc 2020

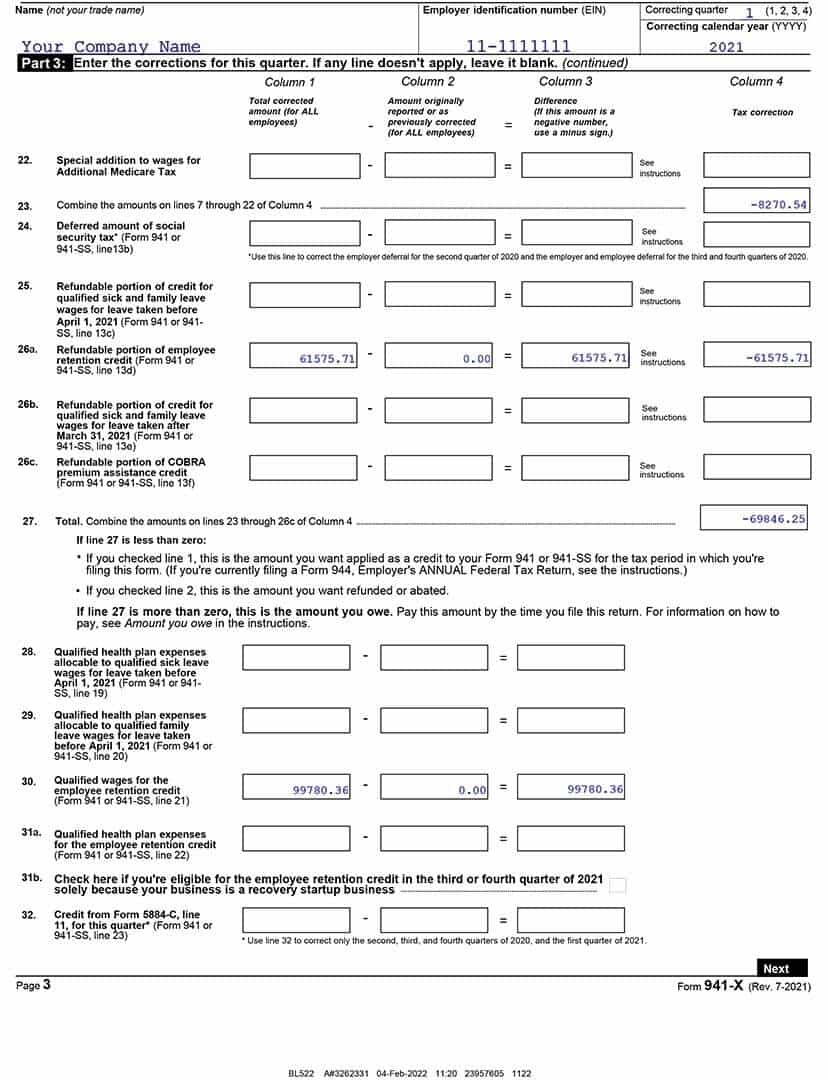

https://5638311.fs1.hubspotusercontent-na1.net/hub/5638311/hubfs/941-X-Page3.jpg?quality=low&width=827&name=941-X-Page3.jpg

Don t file Form 941 X for the first quarter of 2020 to claim the employee Enter the refundable portion of the employee retention credit from Worksheet 1 Step

Templates are pre-designed documents or files that can be used for various purposes. They can conserve effort and time by providing a ready-made format and layout for creating different kinds of content. Templates can be used for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

941 X Worksheet For Erc 2020

Updated Form 941 Worksheet 1, 2, 3 and 5 for 2023 | Revised 941

Step-by-Step How to Guide to Filing Your 941-X ERTC | Baron Payroll

941x: Fill out & sign online | DocHub

Don't Forget Worksheet 1 When You File Your Form 941 this Quarter! | Blog - TaxBandits

941x Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Employee Retention Tax Credit on 941

https://www.irs.gov/pub/irs-pdf/i941x.pdf

COVID related Tax Relief Act of 2020 was enacted on December 27 2020 therefore Worksheet 1 in those Instructions for Form 941 didn t

https://www.kbkg.com/employee-retention-tax-credits/a-guide-to-filing-form-941-x-for-employee-retention-credits

How Do You File Form 941 X Fill out the Return You re Correcting box and select 941 Check the quarter being corrected and the year to

https://www.meadenmoore.com/blog/atc/how-to-claim-the-employee-retention-tax-credit-using-form-941-x

A Worksheet 1 included in the instructions to Form 941 is used to calculate the Nonrefundable Portion and Refundable Portion of the ERC b

https://www.disasterloanadvisors.com/how-to-fill-out-941-x-for-employee-retention-credit/

Employers that missed out on the ERC in the first two quarters of 2021 can still file a Form 941 X worksheet for ERC to take advantage of it

https://erctoday.com/ertc-irs-form-941/

If you need to see a 941 X ERC example of a properly filled out worksheet or need help with filling any of your 941 forms out reach out and we

941 X Worksheet 12 36 Can 941 X Be Filed Online 13 20 What Is A 941 X Used ERC ERC Tax Credit 2020 26 000 PER EMPLOYEE Combined ERTC SEMINAR BY Employee

Form 941 X Adjusted Employer s Quarterly Federal Tax Return or Claim for Refund may be your key to getting all the Covid relief your