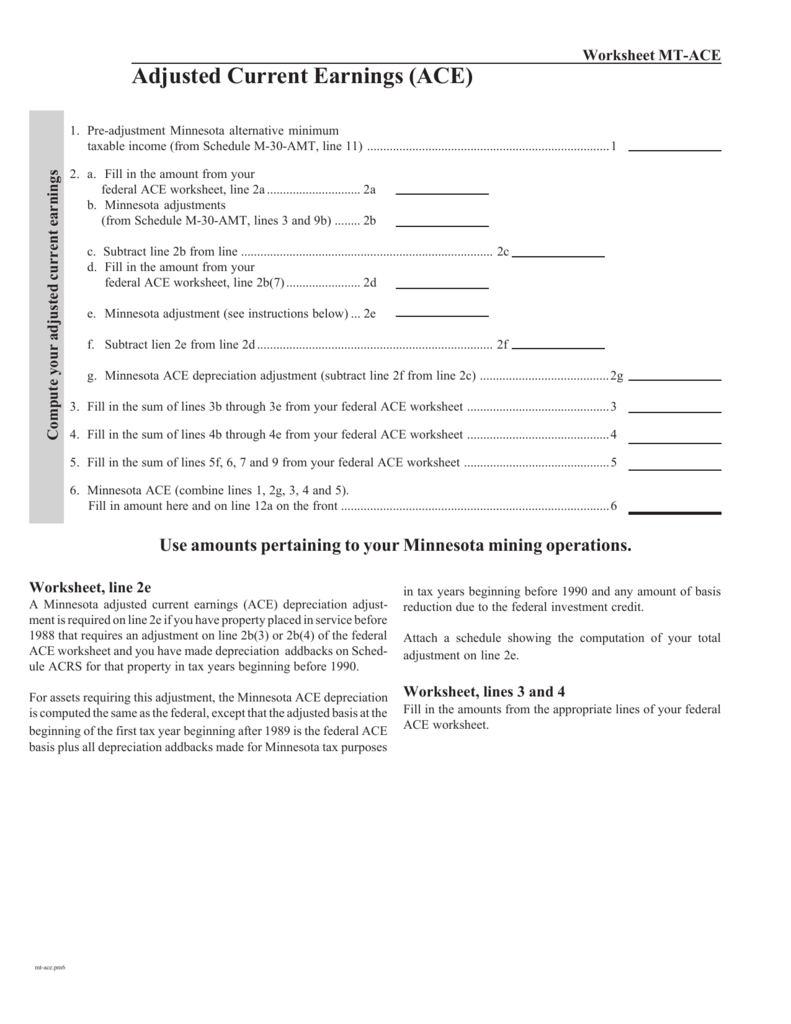

Adjusted Current Earnings Worksheet Worksheet line 2e A Minnesota adjusted current earnings ACE depreciation adjust ment is required on line 2e if you have property placed in service

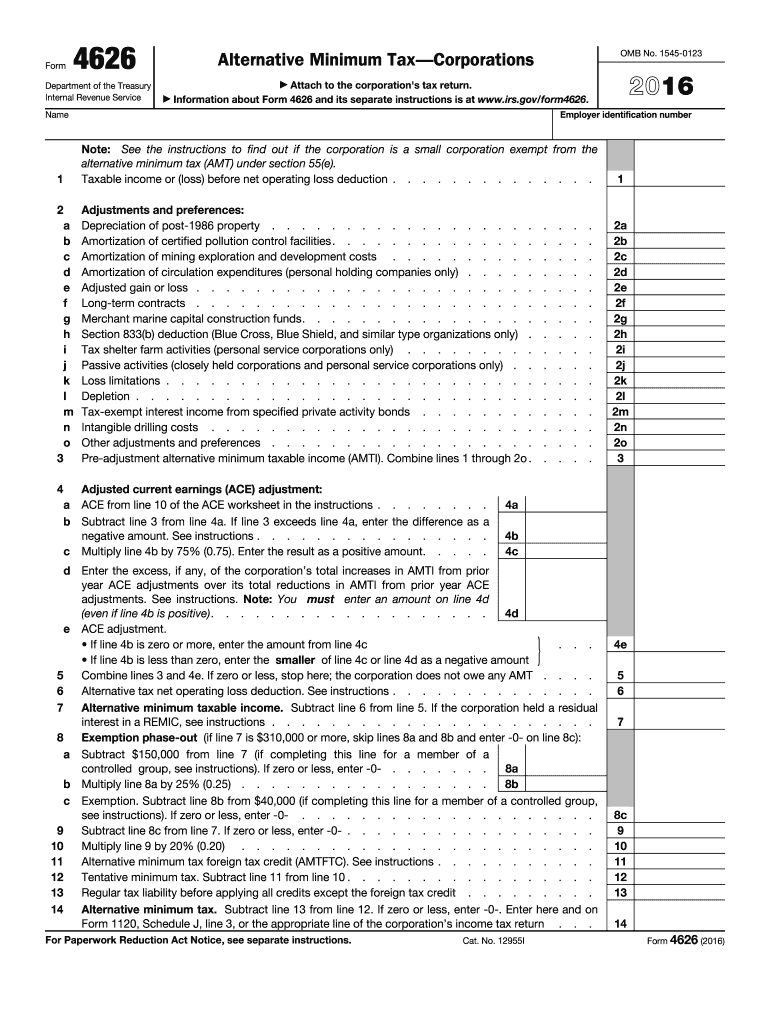

4 Adjusted current earnings ACE adjustment a ACE from line 10 of the ACE worksheet in the instructions ACE adjustments See instructions Note You must Abstract The adjusted current earnings ACE adjustment may have been simplified by the Revenue Reconciliation Act of 1989 RRA 89 but

Adjusted Current Earnings Worksheet

Adjusted Current Earnings Worksheet

Adjusted Current Earnings Worksheet

https://s3.studylib.net/store/data/008270311_1-f4e1cac8775c2f35d59c082ec3c86392.png

AMT is managed and modified with entries on the worksheet Schedule K Income Deduction Overrides Go to Income Deductions Schedule K Income Deductions

Templates are pre-designed files or files that can be utilized for various purposes. They can save effort and time by supplying a ready-made format and design for producing various kinds of material. Templates can be utilized for personal or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Adjusted Current Earnings Worksheet

Fillable Online Iowa Adjusted Current Earnings (ACE) Worksheet, 43013 Fax Email Print - pdfFiller

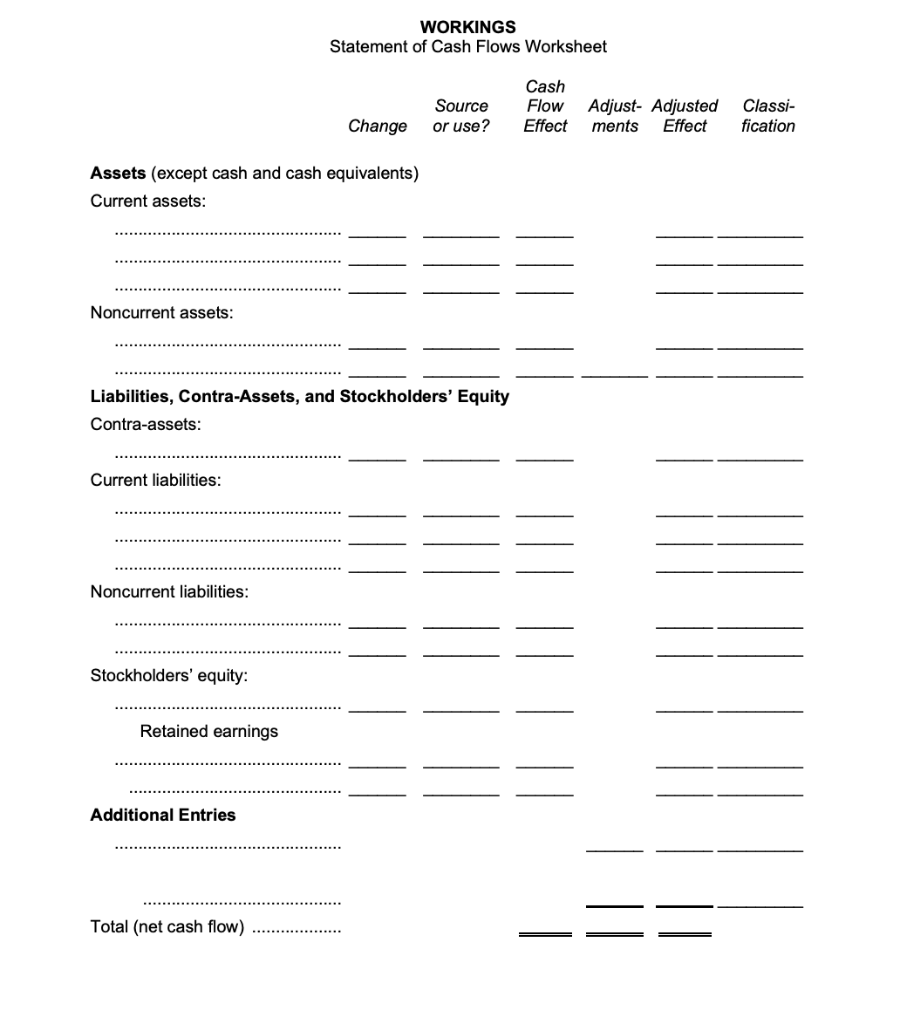

Solved WORKINGS Statement of Cash Flows Worksheet Source or | Chegg.com

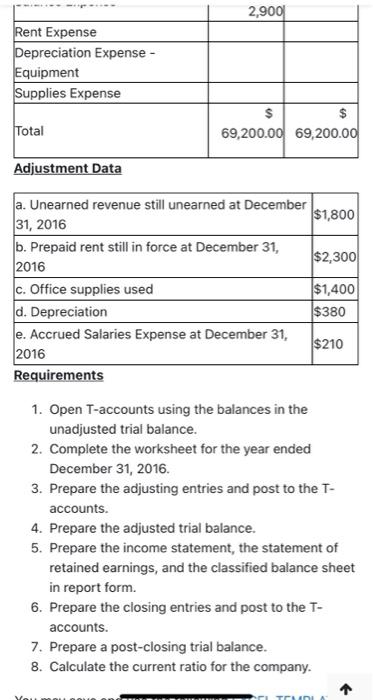

Solved Adjustment Data Requirements 1. Open T-accounts using | Chegg.com

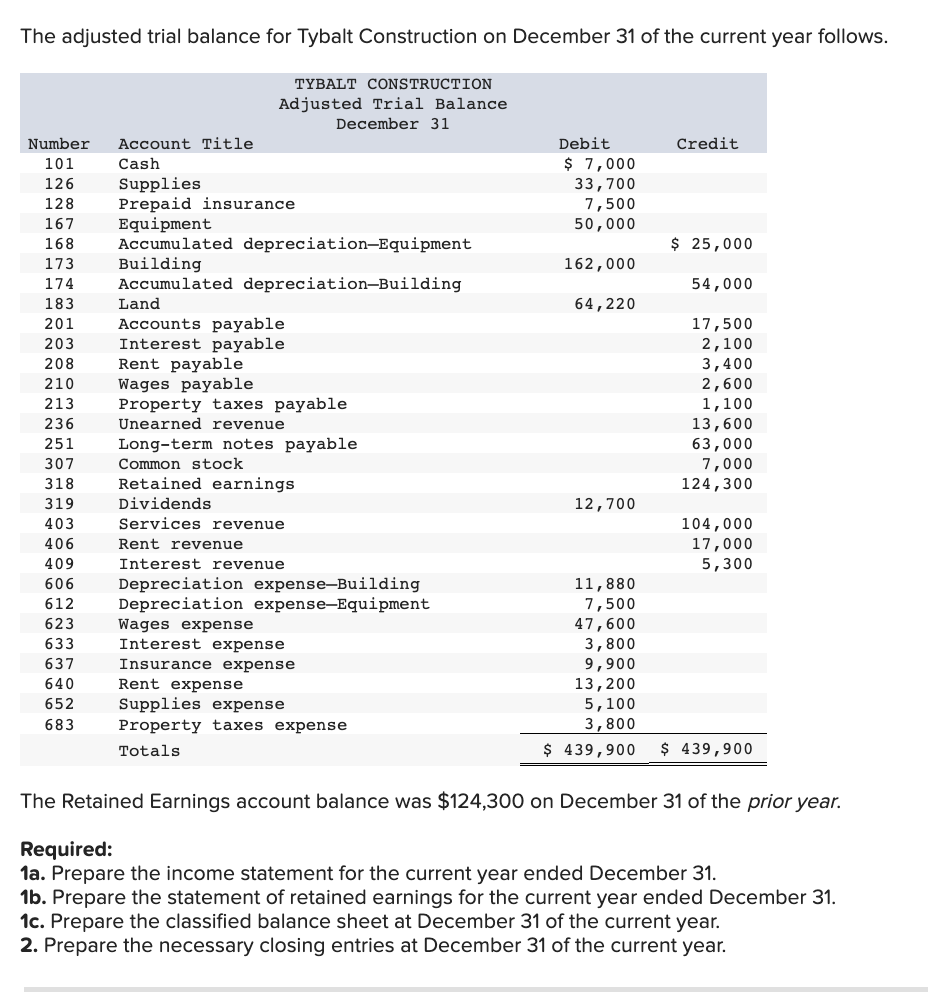

Solved The adjusted trial balance for Tybalt Construction on | Chegg.com

Our Greatest Hits | The ACE depreciation adjustment - coping with "simplification" (adjusted current earnings) - The CPA Journal

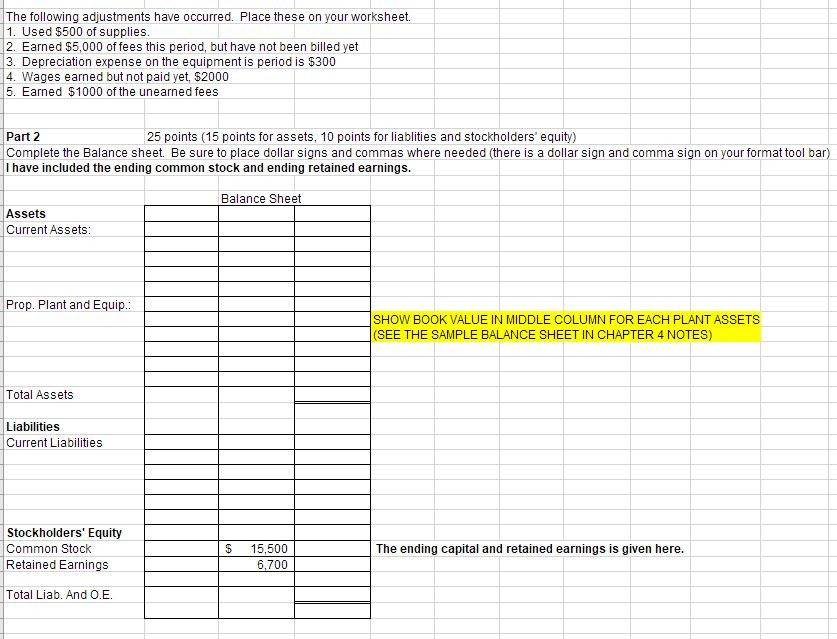

Solved Part 1 25 points (10 points for adjustments, 5 points | Chegg.com

https://tax.iowa.gov/sites/default/files/2019-12/2019IAAce%2843013%29.pdf

Deductions that are not allowed in figuring ACE include Page 5 2019 Iowa Adjusted Current Earnings ACE Worksheet Instructions page 2 43

https://tax.iowa.gov/forms/iowa-adjusted-current-earnings-worksheet-43-013

Iowa Adjusted Current Earnings Worksheet 43 013 Breadcrumb Home Forms Form 2018IAAce 43013 pdf Tax Type Corporation Income Tax Franchise Income Tax

https://www.law.cornell.edu/cfr/text/26/1.56(g)-1

Any excess of pre adjustment alternative minimum taxable income over adjusted current earnings that is not allowed as a negative adjustment for the taxable year

https://download.cchaxcess.com/taxprodhelp/2017P/Worksheet/Content/Hlp800.htm

Federal Adjusted Current Earnings ACE depreciation is computed from entries made on this worksheet The Force Calculation option is also available for

https://www.ftb.ca.gov/forms/2021/2021-100-p-instructions.html

The ACE is the pre adjustment AMTI from line 4a with additional adjustments To compute the California ACE use the ACE worksheet included in these instructions

The Service explained that ACE generally includes all income items that are taken into account in determining current earnings and profits E P Current Year Federal Depreciation 179 Deducted Federal Basis For Depreciation NJ Section 179 Deduction NJ Basis Prior Year New Jersey Depreciation NJ

Adjusted Current Earnings ACE Worksheet See ACE Worksheet Instructions Pre adjustment AMTI Enter the amount from line 3 of Form 4626 2 ACE depreciation