Are There Closing Costs With An Fha Streamline Refinance Most lenders charge between 2 and 5 of the loan amount in closing costs for an FHA Streamline refinance These costs typically include These fees reduce the value of refinancing

May 20 2022 0183 32 An FHA streamline refinance will have closing costs However some lenders let you close your loan with no out of pocket costs in exchange for a higher interest rate Aug 14 2024 0183 32 There are costs involved with an FHA Streamline Refinance but they may be less due to the reduced requirements For example you do not

Are There Closing Costs With An Fha Streamline Refinance

Are There Closing Costs With An Fha Streamline Refinance

Are There Closing Costs With An Fha Streamline Refinance

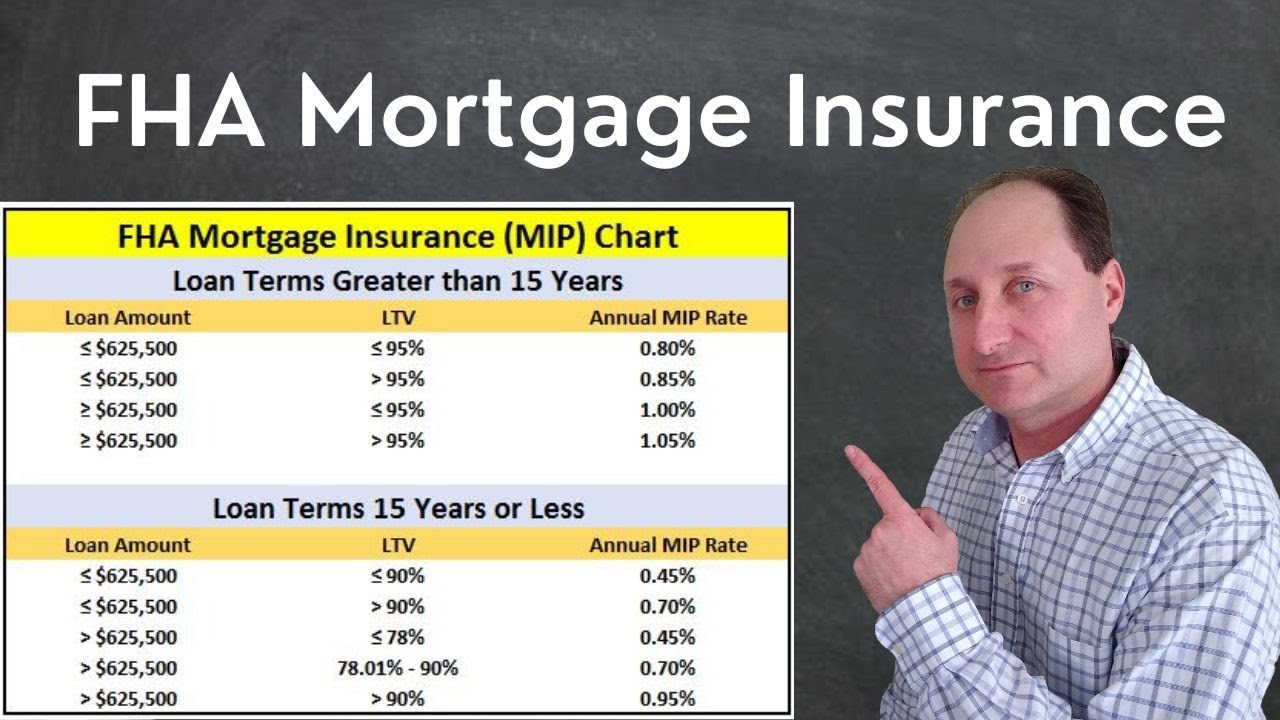

https://i.ytimg.com/vi/7e1TO8Oth6E/maxresdefault.jpg

Oct 5 2021 0183 32 The estimated closing costs for an FHA streamline refinance vary from 2 5 of the loan amount If your loan amount is 150 000 your estimated closing costs could be between

Pre-crafted templates provide a time-saving solution for creating a diverse variety of files and files. These pre-designed formats and designs can be utilized for numerous individual and expert projects, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, improving the material creation procedure.

Are There Closing Costs With An Fha Streamline Refinance

What Are The Actual Closing Costs On An FHA Insured Reverse Mortgage

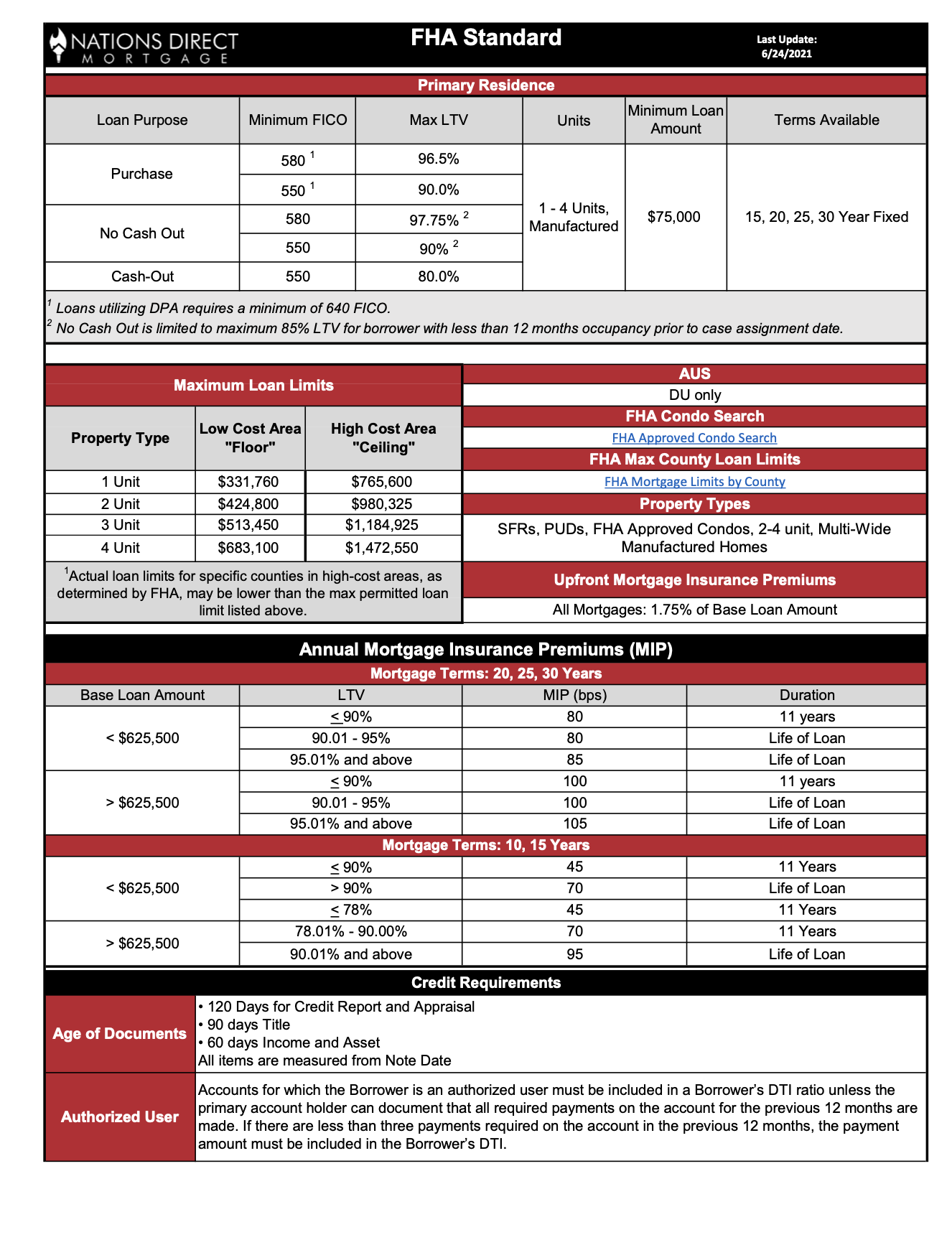

FHA Nations Direct Mortgage

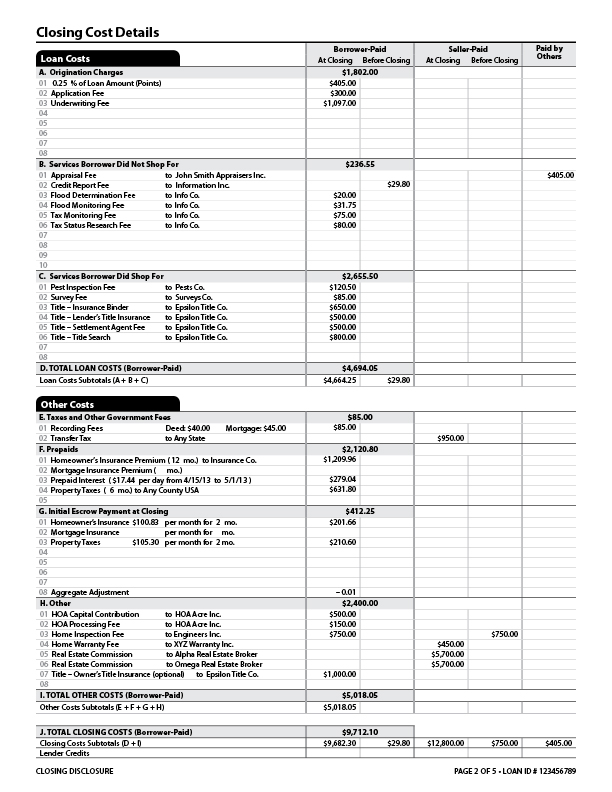

Closing Disclosure Home Closing 101

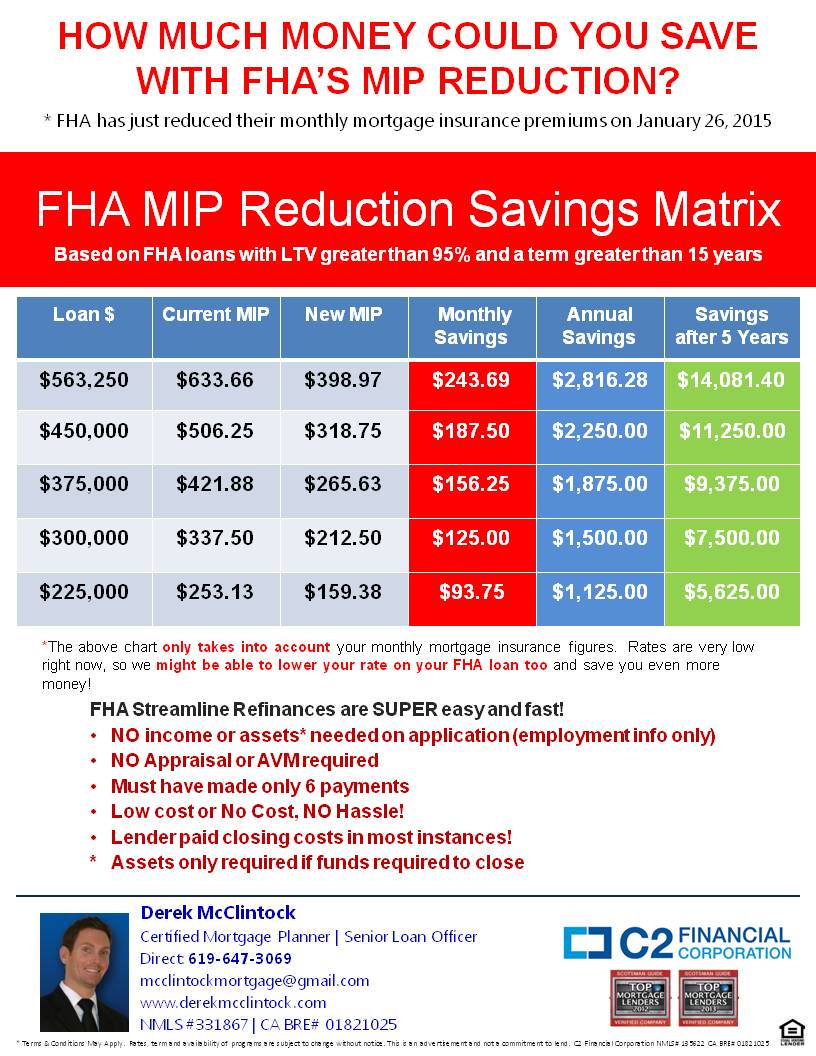

FHA STREAMLINE REFINANCE

Tangible Net Benefit Worksheet

The Benefit Of An FHA Streamline Refinance AmeriHome

https://www.localmortgage.com › post › understanding

What Are FHA Streamline Closing Costs Closing costs are the fees and expenses paid when finalizing your refinance loan With the FHA Streamline Refinance these usually range from

https://fhalenders.com › fha-streamline-refinance

Aug 27 2019 0183 32 FHA streamline refinance closing costs will average anywhere from 2 3 of the loan amount With the exception of the net FHA mortgage

https://www.fha.com › fha_article

Jul 31 2019 0183 32 You can only roll the closing costs into your new FHA Streamline loan if there s enough equity in the property to cover the additional amount

https://www.mortgageresearch.com › articles › fha-streamline-refinance

Feb 7 2024 0183 32 Overall you can expect FHA streamline refinance closing costs to run 3 to 5 of your loan balance However they may be lower if you qualify for an FHA upfront mortgage

https://fastercapital.com › content › Navigating-the

When considering an FHA Streamline Refinance it s important to keep in mind the closing costs associated with the process While these costs are typically lower compared to a traditional

FHA Streamline refinances do have closing costs While some other programs can roll closing costs into the loan whereby you d pay them a little at a time each month the FHA program Are there closing costs with an FHA streamline refinance Generally you can expect to pay between 1 000 and 5 000 in FHA streamline closing costs though this amount may be

Dec 24 2019 0183 32 With an FHA streamline refinance you cannot roll the closing costs into the loan If you do not have the additional money for closing costs you can negotiate with the lender to