Business Tax Expenses Worksheet We provide a downloadable IRS business expense categories list to help you identify all your deductions

Tax Write Offs You May Qualify For Here s a shortlist of business related expenses self employed individuals can claim to lower their tax bills Client ID TAX YEAR ORDINARY SUPPLIES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses

Business Tax Expenses Worksheet

Business Tax Expenses Worksheet

Business Tax Expenses Worksheet

https://images.template.net/wp-content/uploads/2019/09/Small-Business-Expenses-Worksheet.jpg

This Business Income and Expense Template can help you stay organized for tax business income and expenses to make sure you get the best possible tax outcome

Templates are pre-designed files or files that can be used for various functions. They can conserve effort and time by supplying a ready-made format and design for creating various sort of content. Templates can be utilized for personal or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Business Tax Expenses Worksheet

Nurse Tax Deduction Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Tax worksheet realtors: Fill out & sign online | DocHub

12+ Business Expenses Worksheet in PDF | DOC

Home Business Worksheet Template | Business worksheet, Business tax deductions, Home business

Printable Tax Deduction Tracker Business Tax Log Purchase - Etsy

![Free Printable Business Expense Spreadsheet Template [Save Now] free-printable-business-expense-spreadsheet-template-save-now](https://www.typecalendar.com/wp-content/uploads/2023/08/Printable-Business-Expense-Spreadsheet.jpg?gid=783)

Free Printable Business Expense Spreadsheet Template [Save Now]

https://foxtaxservice.com/downloads/FoxTax-Worksheet-Business.pdf

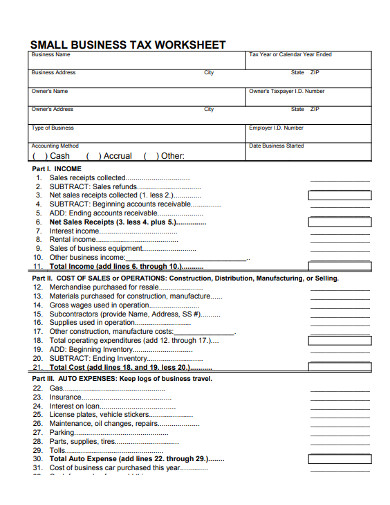

BUSINESS INCOME EXPENSE WORKSHEET FILL OUT ONE SHEET FOR EACH BUSINESS DO Auto Expenses See auto and in home office worksheet below Commissions and

https://diamondfinancial.com/wp-content/uploads/2016/01/Small-Business-Fillable-Worksheet.pdf

Small Business Self Employed 1099 Income Schedule C Worksheet Send last year s Schedule C or tax return if you operated the business previously and we

https://sharetheharvest.com/wp-content/uploads/2018/03/9-Schedule-C-Self-Employed-Single-LLC.pdf

Use a separate worksheet for each business owned operated Do not duplicate expenses Name type of business Owned Operated by Client Spouse Income

https://1ststepaccounting.com/wp-content/uploads/2017/02/Business-Income-and-Expense-worksheet.pdf

This worksheet was created to give you a manual method of tracking your business income and expenses monthly to assist with annual tax preparation Enter

![Independent Contractor Expenses Spreadsheet [Free Template] Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349af5f4a6db36bd21473a4_1099-excel-template.png?w=186)

https://www.neat.com/blog/small-business-tax-deductions-worksheet-part-1

55 small business tax deductions Business use of your car Home office Bonus depreciation License fees Salaries and benefits Work

Apr 26 2015 This Pin was discovered by Katie Pratt Discover and save your own Pins on Pinterest Oct 23 2020 Small Business Tax Spreadsheet Small Business Tax Spreadsheet In addition to the image above you can see a gallery of Spreadsheet

Qualified long term care services Worksheet 6 A Self Employed Health Insurance Deduction Worksheet A business cannot elect to deduct their total research