Business Use Of Home Worksheet To generate Form 8829 complete the following Click Government on the Navigation Panel Click Worksheets Click Expenses for Business Use of Home

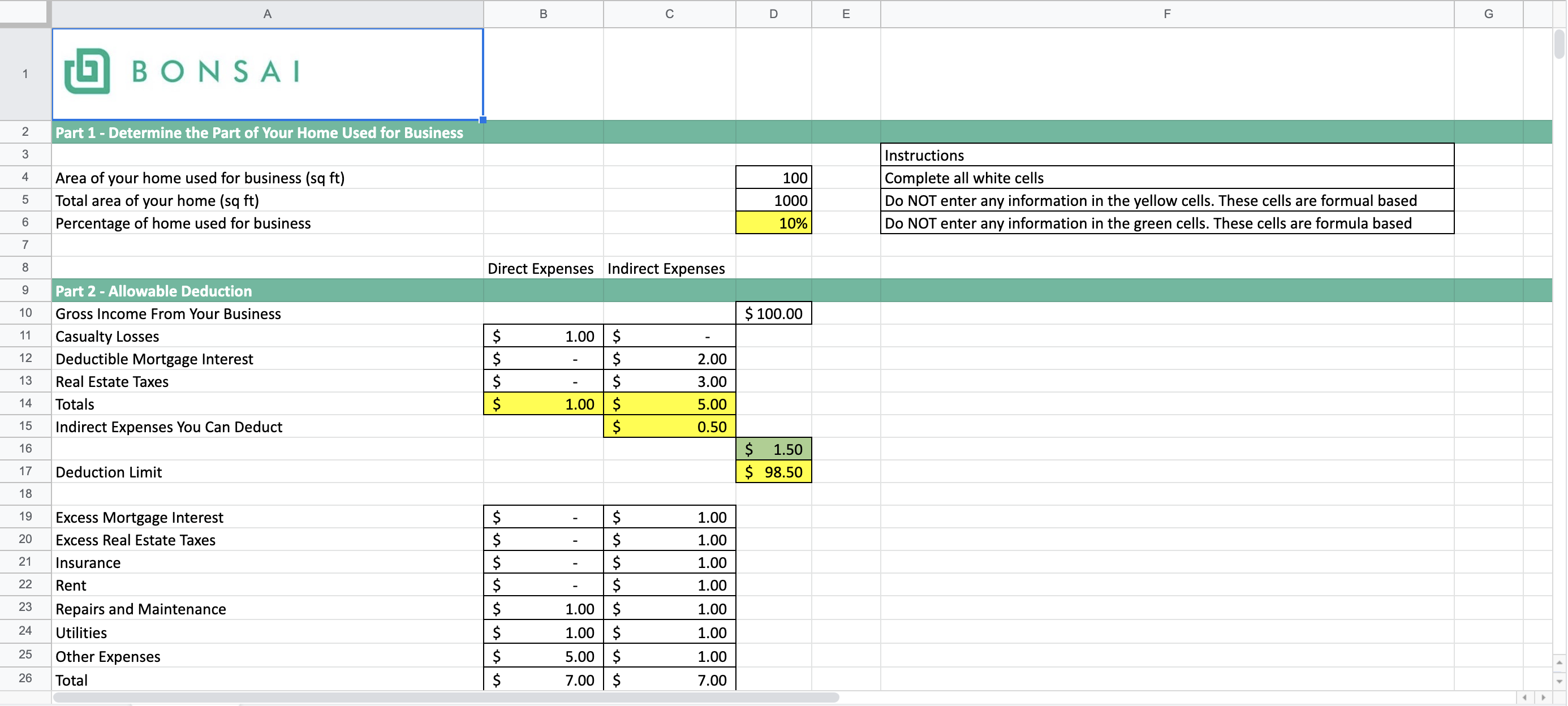

Form 8829 Business Use of Home Worksheet Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 or 1040 SR and Overview Welcome to the workshop on business use of your home In this program we will provide information from calculating and claiming the deduction for

Business Use Of Home Worksheet

![The Best Home Office Deduction Worksheet for Excel [Free Template] the-best-home-office-deduction-worksheet-for-excel-free-template](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png) Business Use Of Home Worksheet

Business Use Of Home Worksheet

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png

use for business and how much your annual home office business expenses are use this worksheet as it would be a duplicative effort At the

Pre-crafted templates provide a time-saving option for creating a diverse series of files and files. These pre-designed formats and designs can be made use of for different individual and professional jobs, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, enhancing the content development procedure.

Business Use Of Home Worksheet

8829 - Simplified Method (ScheduleC, ScheduleF)

FREE Home Office Deduction Worksheet (Excel) For Taxes

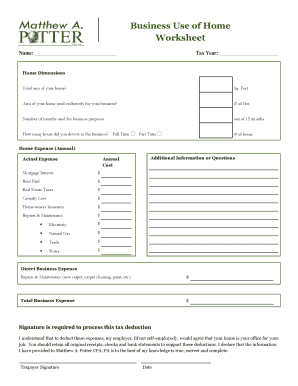

Anchor Tax Service - Home use worksheet

Home Office Tax Deduction: What to Know | Fast Capital 360®

![The Best Home Office Deduction Worksheet for Excel [Free Template] the-best-home-office-deduction-worksheet-for-excel-free-template](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b2e1a76f03a1d5ed1068_home-office-expenses-worksheet-entering-expenses.png)

The Best Home Office Deduction Worksheet for Excel [Free Template]

Untitled

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png?w=186)

https://www.irs.gov/taxtopics/tc509

Regular Method You compute the business use of home deduction by dividing expenses of operating the home between personal and business use You may deduct

http://www.lbtaxservices.com/Forms/Business%20Use%20of%20Home%20Worksheet.pdf

Business Use of Home Worksheet 1 Can you deduct business use of the home expenses for a home office Please review the attached flowchart to determine 2

https://www.keepertax.com/posts/home-office-deduction-excel-spreadsheet

These direct expenses have a business use percentage of 100 so they re 100 tax deductible This worksheet can handle these deductions for you more on that

https://sharedeconomycpa.com/wp-content/uploads/2020/01/home-office-deduction-worksheet.pdf

Use this worksheet if you file Schedule F Form 1040 or you are a partner and you are using actual expenses to figure your deduction for business use of the

https://etsmetairie.com/files/Home-Office-Deduction-Worksheet.pdf

Home Office Deduction Worksheet To deduct expenses for the business use of your home It must be your principal place of business for your trade or business

Multiply the business percentage you figured out in Step 1 by the applicable whole home expenses If you used the space as your home office for only part of the The biggest roadblock to qualifying for these deductions is that you must use a portion of your home exclusively and regularly for your business

Instructions for the Worksheet If you are an employee a partner or you file Schedule F Form 1040 use the preceding worksheet to figure your deduction