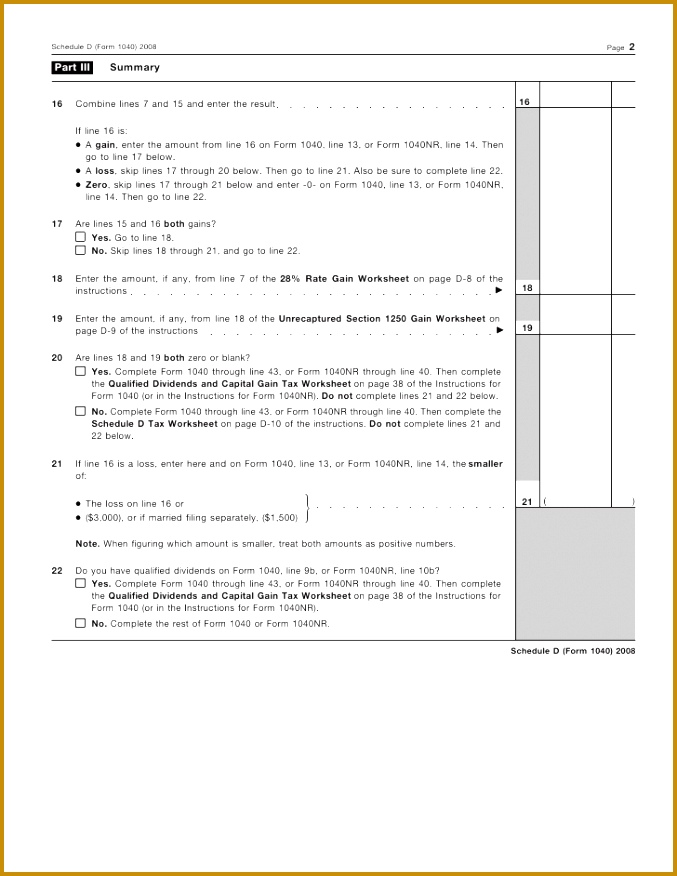

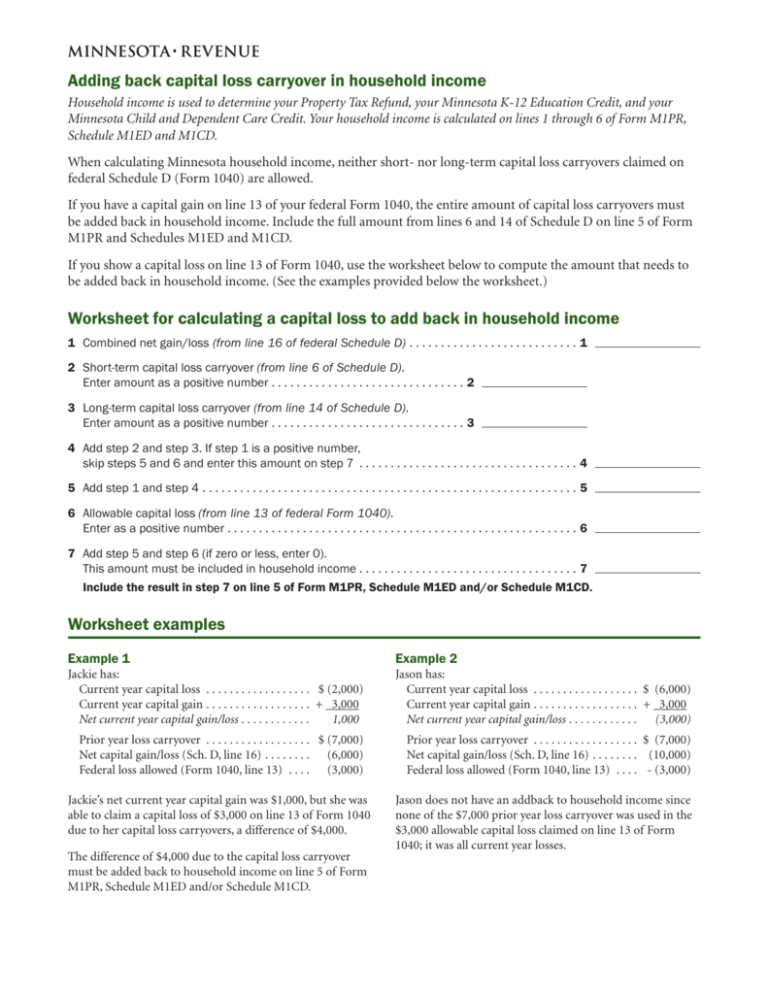

Capital Loss Carryover Example WEB You can carry over capital losses indefinitely Figure your allowable capital loss on Schedule D and enter it on Form 1040 Line 13 If you have an unused prior year loss you can subtract it from this year s net capital gains You can report and deduct from your income a loss up to 3 000 or 1 500 if married filing separately

WEB 3 days ago 0183 32 There are two types of tax loss carryforwards net operating loss NOL carryforwards and capital loss carryforwards Net operating loss carryforwards apply to businesses WEB Below you ll learn how to calculate the appropriate amount of capital loss carryovers Netting gains and losses You re allowed to use an unlimited amount of capital losses to offset any

Capital Loss Carryover Example

Capital Loss Carryover Example

Capital Loss Carryover Example

https://i.ytimg.com/vi/8miJEHT8xPA/maxresdefault.jpg

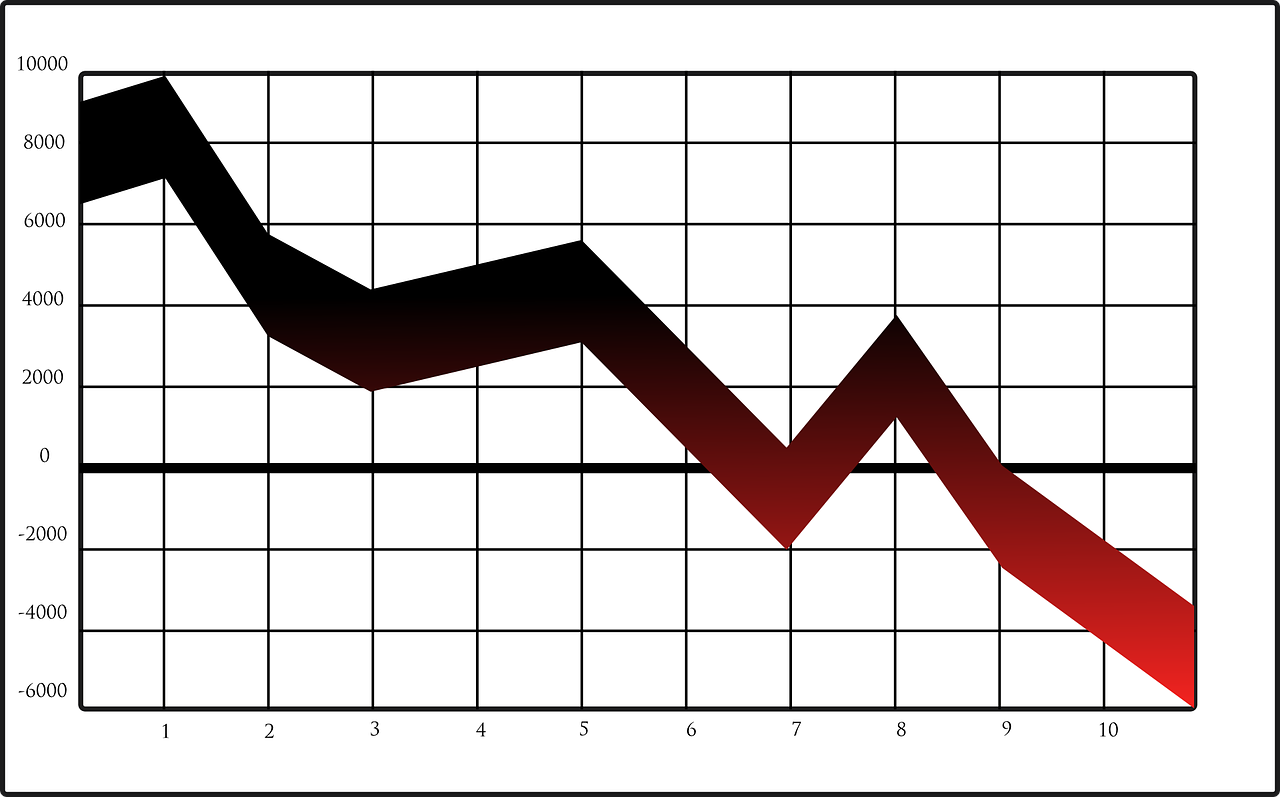

WEB Nov 2 2023 0183 32 Capital Loss Carryover is a tax provision that allows investors to carry forward their capital losses from one tax year to the next This provision is particularly beneficial when the capital losses exceed the capital gains for the year

Templates are pre-designed files or files that can be utilized for various functions. They can conserve effort and time by providing a ready-made format and layout for creating various sort of material. Templates can be used for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Capital Loss Carryover Example

TurboTax 2022 Form 1040 Capital Loss Carryovers On Schedule D YouTube

Capital Loss Carryover Definition Rules And Example Laksheya Writes

Capital Loss Carryover Finance Reference

Capital Loss Carryover Worksheet Slidesharedocs

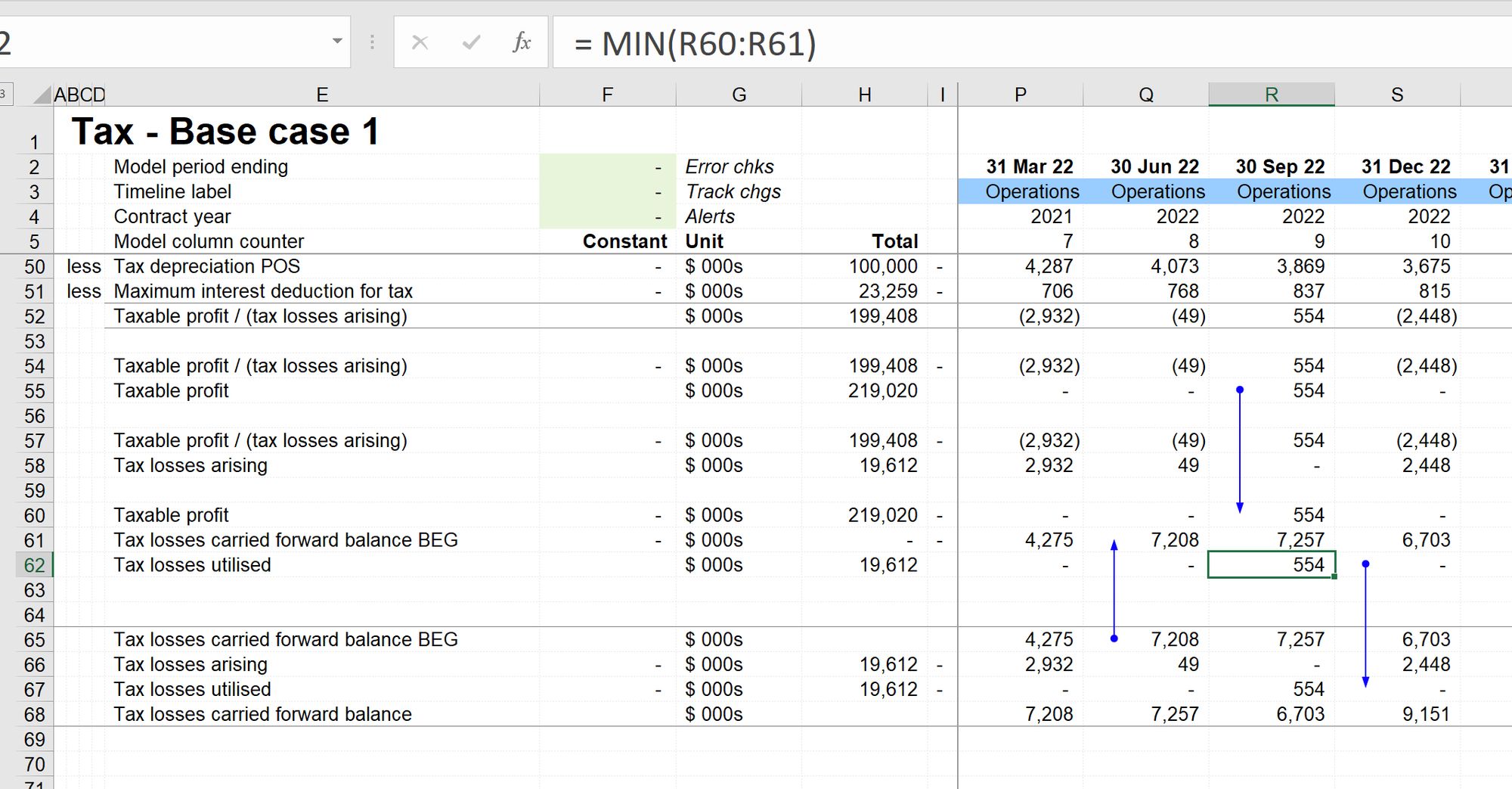

Modelling Tax Loss Carry Forward

5 Capital Loss Carryover Worksheet FabTemplatez

https://smartasset.com/investing/what-is-a-capital-loss-carryover

WEB May 23 2023 0183 32 The amount of capital losses that an investor can take into future tax years is called a capital loss carryover Here s how you can use it to offset taxes

https://www.financestrategists.com/tax/tax

WEB Jan 5 2024 0183 32 Capital loss carryover allows investors to apply net capital losses from one tax year to subsequent years offsetting potential capital gains or ordinary income in those years It serves as a financial tool to reduce potential tax obligations in the future

https://www.wallstreetmojo.com/capital-loss-carryover

WEB Jan 4 2024 0183 32 Capital loss carryover is a provision under the United States tax laws that helps individuals to off set their capital losses within a financial year against their capital gains The capital loss carryover rules have a specific limit for individuals applying for such a provision in their yearly tax filing

https://www.financestrategists.com/tax/tax

WEB Sep 8 2023 0183 32 A capital loss carryover occurs when your total capital losses in a year exceed the annual limit of 3 000 or 1 500 if you re married and filing separately The excess loss can be carried over to future tax years until it s completely deducted

https://www.supermoney.com/encyclopedia/capital-loss-carryover

WEB Apr 8 2024 0183 32 Claiming a capital loss carryover involves precise calculations and accurate record keeping Find out how to determine the carryover amount report it on your tax return and ensure compliance with IRS guidelines Explore the steps to realizing and claiming your capital loss carryovers effectively

[desc-11] [desc-12]

[desc-13]