Capital Loss Carryover Worksheet How to file your taxes with TurboTax In this video I cover the basics of Capital Loss carryovers

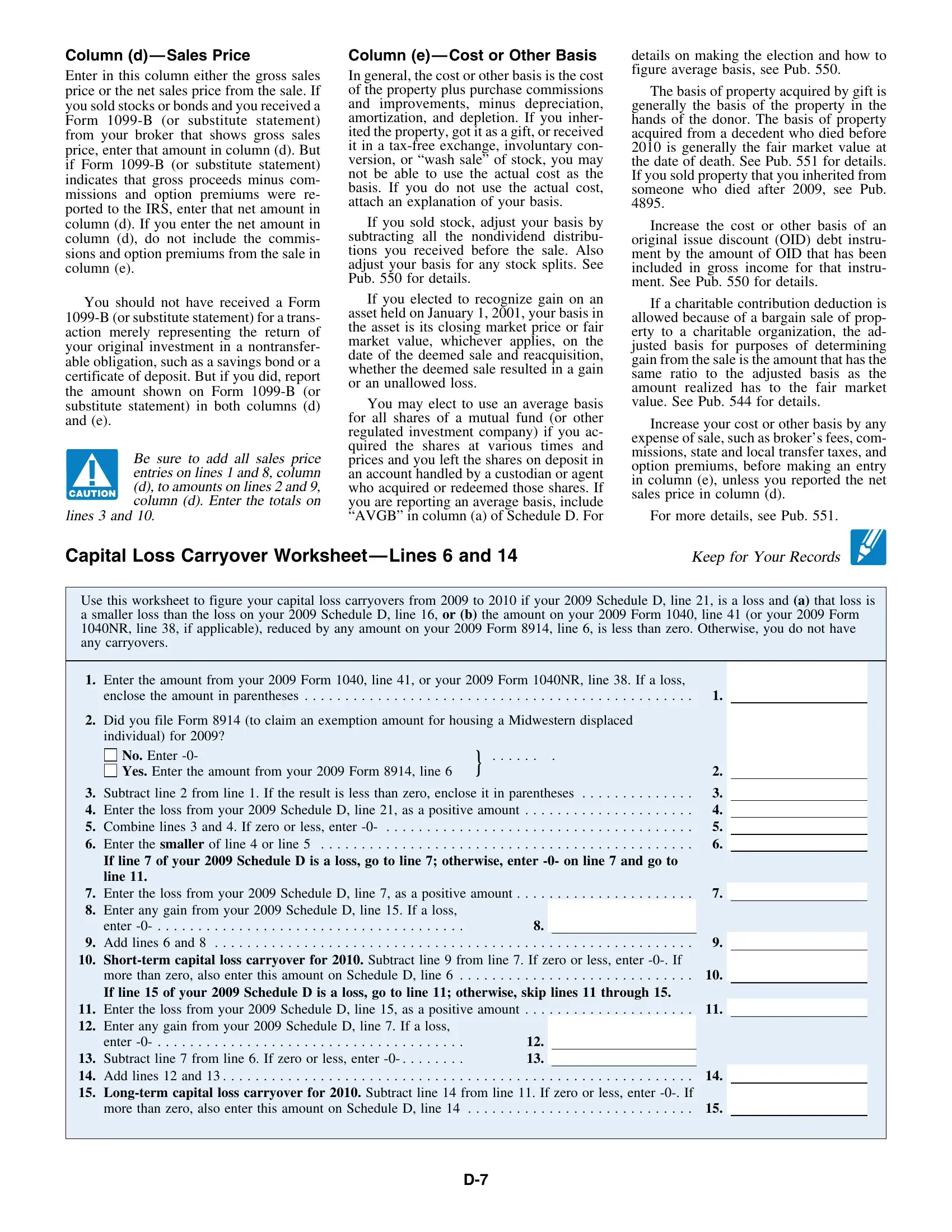

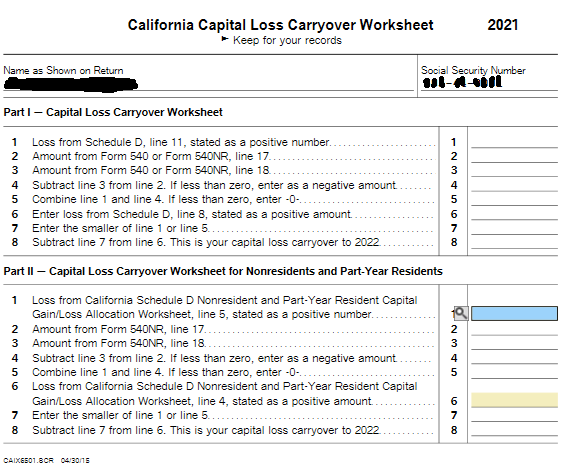

The Capital Loss Carryover Worksheet is used to determine the amount of capital loss that can be carried over from one tax year to the next It helps taxpayers In View mode the page labeled Wks Loss Capital Loss Carryover Worksheet shows the calculation for what portion of the loss is available to be carried forward

Capital Loss Carryover Worksheet

Capital Loss Carryover Worksheet

Capital Loss Carryover Worksheet

https://kb.drakesoftware.com/Site/Uploads/Images/11406%20image%201.0.jpg

Capital Loss Carryover Worksheet Keep for Your Records Use this worksheet to figure the estate s or trust s capital loss carryovers from

Templates are pre-designed files or files that can be used for various purposes. They can conserve effort and time by providing a ready-made format and layout for producing various type of content. Templates can be used for individual or expert projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Capital Loss Carryover Worksheet

Capital Loss Carryover - Trying to Understand it - Bogleheads.org

Capital Loss Carryover Worksheet PDF Form - FormsPal

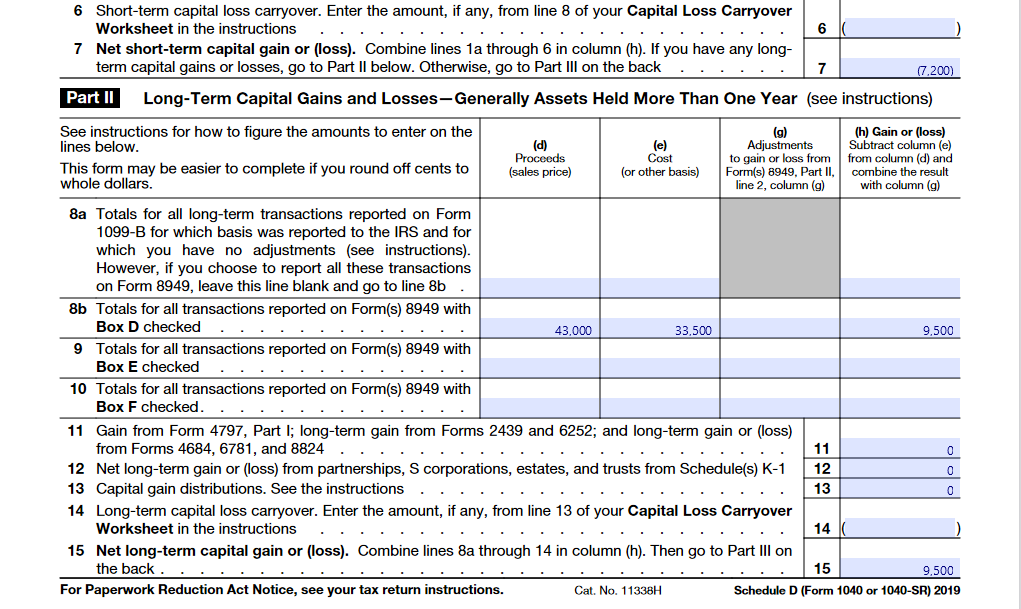

6 6 Short-term capital loss carryover. Enter the | Chegg.com

How to Minimize Portfolio Taxes

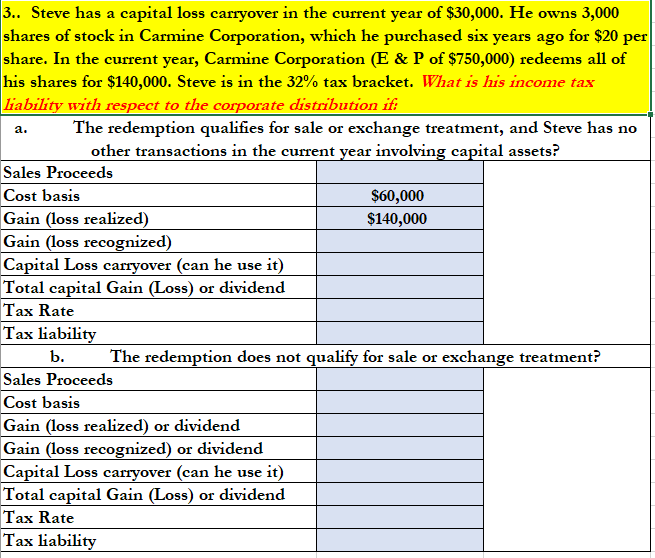

Solved 3.. Steve has a capital loss carryover in the current | Chegg.com

Capital Loss Carryover on Your Taxes - YouTube

https://apps.irs.gov/app/vita/content/globalmedia/capital_loss_carryover_worksheet.pdf

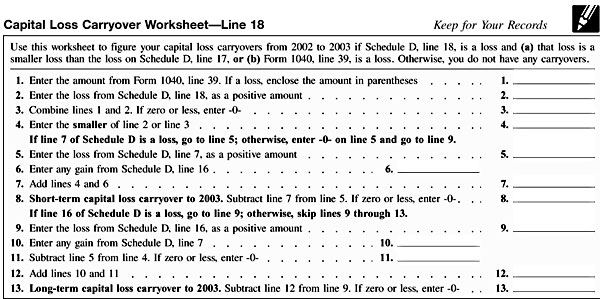

Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than

https://www.cchwebsites.com/content/taxguide/tools/caploss_m.php

The worksheet provided below is designed to help you compute your carryovers and retain them in your records as short term or long term so that you don t

https://www.taxact.com/support/1024/2022/capital-gains-and-losses-capital-loss-carryover

You may deduct capital losses up to the amount of your capital gains plus 3 000 1 500 if married filing separately If part of the loss is still unused

https://www.investopedia.com/terms/c/capital-loss-carryover.asp

This worksheet typically helps you calculate and document the amount of capital loss that you can carry over from one tax year to the next It

https://www.revenue.state.mn.us/sites/default/files/2011-11/other_supporting_content_CLCarryover.pdf

If you show a capital loss on line 13 of Form 1040 use the worksheet below to compute the amount that needs to be added back in household income See the

Capital Loss Carryover Worksheet in the 2020 and the 2021 instructions for Schedule D Form 1040 Capital Gains and Losses corrected Capital Loss Carryover Worksheet Lines 6 and 14 Keep for Your Records Use this worksheet to figure your capital loss carryovers from 2005 to 2006 if your

Capital Loss Carryover Worksheet Example Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor