Car And Truck Expenses Worksheet Car And Truck Expenses Employees use ORG17 Employee Business Expenses ORG18 VEHICLE QUESTIONS Vehicle 1 Vehicle 2 Vehicle 3 33 Is another vehicle

Car and Truck Expenses Drake Software Advance Child Tax Credit How to Write Off 2020 BUSINESS USE OF A PERSONAL VEHICLE WORKSHEET If you will be deducting ANY EXPENSES of operating an automobile or light truck in connection with YOUR

Car And Truck Expenses Worksheet

Car And Truck Expenses Worksheet

Car And Truck Expenses Worksheet

https://formspal.com/pdf-forms/other/truck-driver-expenses-worksheet/truck-driver-expenses-worksheet-preview.webp

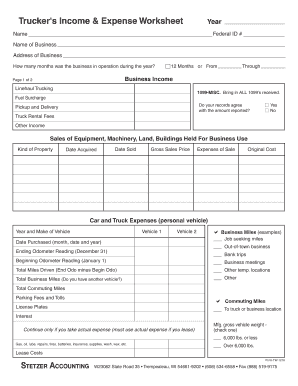

Car and truck expenses for business purposes are deductible expenses All business mileage and expenses should be documented with exact current records

Pre-crafted templates use a time-saving solution for developing a varied variety of documents and files. These pre-designed formats and layouts can be utilized for different individual and professional jobs, including resumes, invites, flyers, newsletters, reports, presentations, and more, improving the material production process.

Car And Truck Expenses Worksheet

Trucking Expenses Spreadsheet: 7 Templates and Tools

Car Truck Expenses Worksheet Schedule C | List template, Book template, Planner template

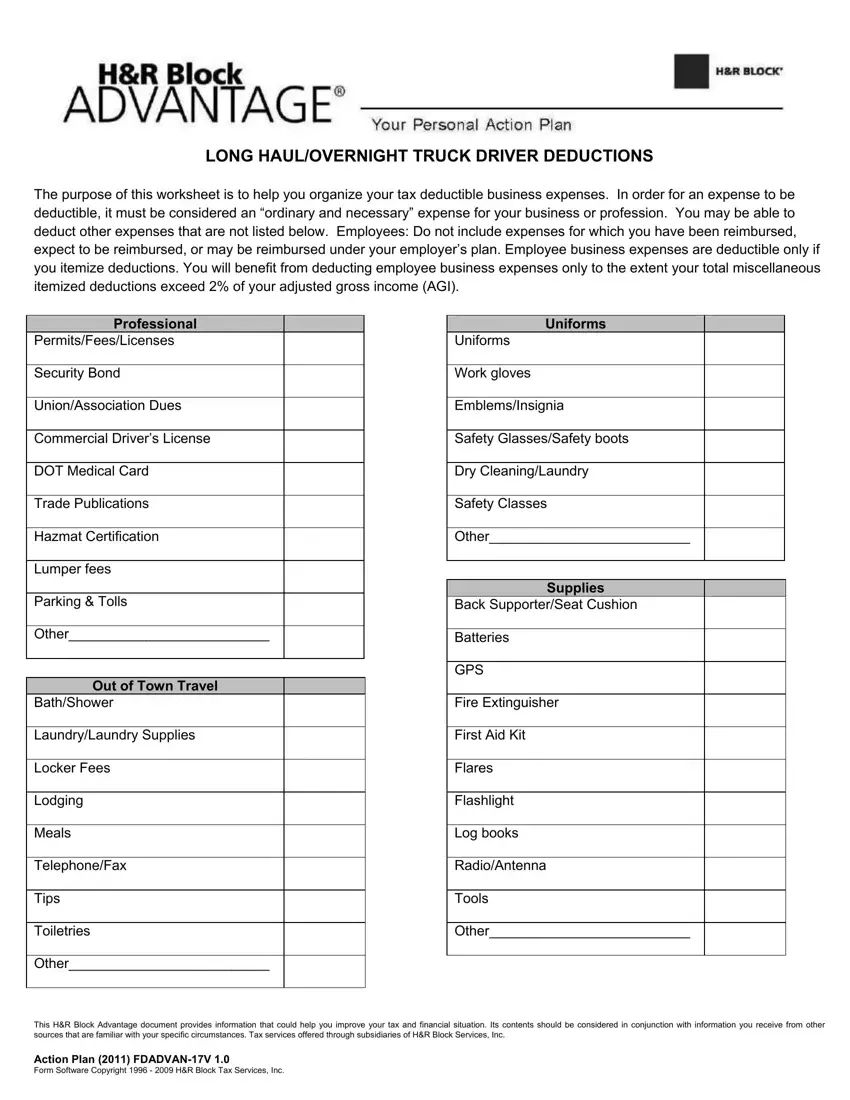

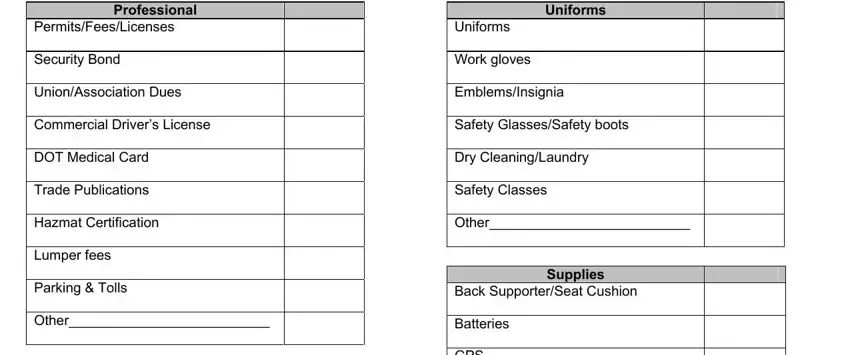

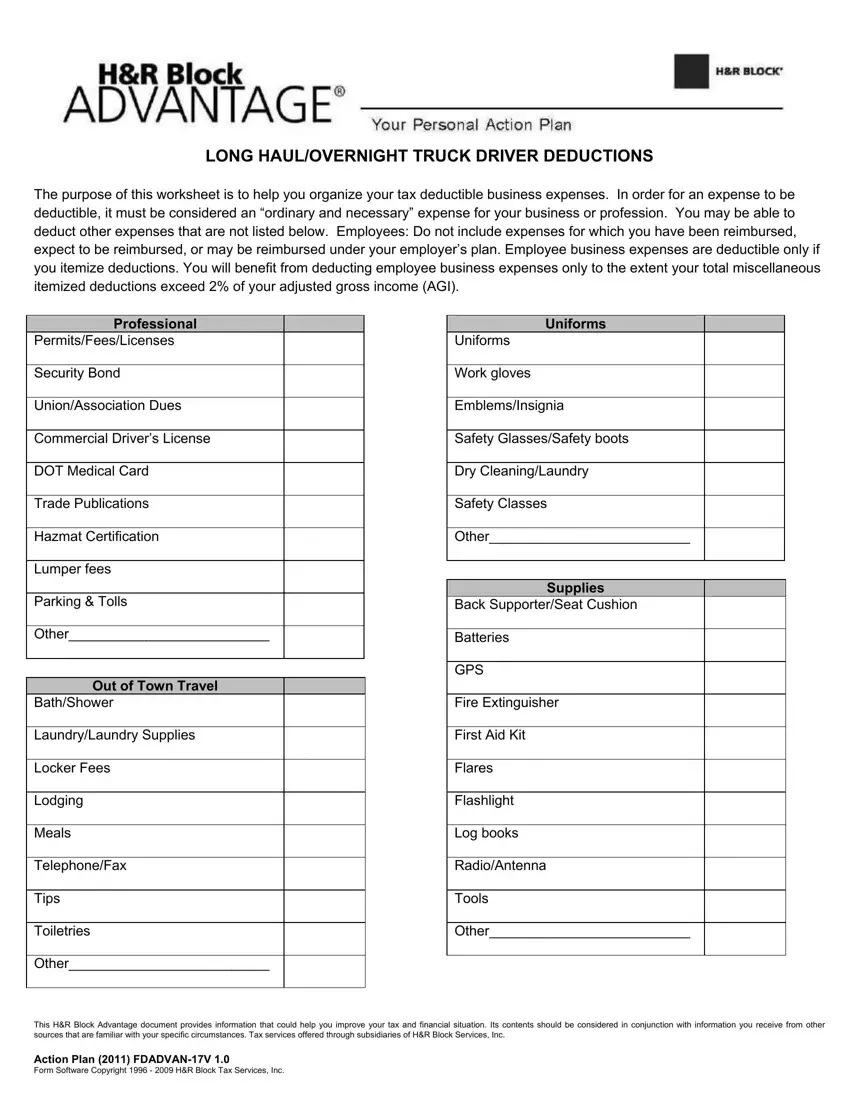

Truck Driver Expenses Worksheet PDF Form - FormsPal

Back To Trucking Expenses SpreadsheetRelated posts of "Trucking Expenses Spreadsheet"Budget Track… | Spreadsheet template, Excel spreadsheets templates, Spreadsheet

![Independent Contractor Expenses Spreadsheet [Free Template] independent-contractor-expenses-spreadsheet-free-template](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

Independent Contractor Expenses Spreadsheet [Free Template]

TurboTax Car and Truck Expense Bug: How-To Fix Editing Problem/Issue in Schedule C Worksheet Mac/PC - YouTube

https://www.irs.gov/pub/irs-news/fs-06-26.pdf

Ordinarily expenses related to use of a car van pickup or panel truck for business can be deducted as transportation expenses Use of larger vehicles such

https://ttlc.intuit.com/community/tax-credits-deductions/discussion/car-truck-expenses-worksheet/00/2822814

Car Truck Expenses Worksheet 1 Choose Tax Tools option on the left menu bar in the federal section of TurboTax 2 Choose Tools 3 Under

https://pdvcpa.com/wp-content/uploads/2022/02/2021-TAX-YEAR-CAR-and-TRUCK-EXPENSE-WORKSHEET.pdf

2021 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET Vehicle Information Vehicle 1 Vehicle 2 Vehicle 3 Complete for all vehicles 1 Make model of vehicle

https://pdvcpa.com/2022-tax-year-car-and-truck-expense-worksheet/

2022 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET by PDVoytovich Jan 12 2023 0 comments 2022 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET

https://content.enactmi.com/documents/training/course/2015%20Farmer%20%20F%20Form%20Car%20and%20Truck%20Expenses%20Worksheet.pdf

1 Make and model of vehicle Example Ford Taurus 2 Date placed in service Example 06 15 2015 3 Type of vehicle 4 a Ending mileage reading

Vehicle Expense Worksheet Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns There are You can use this number as a business expense if you use the actual car expenses method Of the many figures you ll be tracking vehicle depreciation can be the

AUTO EXPENSE WORKSHEET FILL OUT FOR BOTH MILEAGE ACTUAL EXPENSE METHODS VEHICLE 1 VEHICLE 2 Year and Make of Vehicle Date Purchased Leased Is the