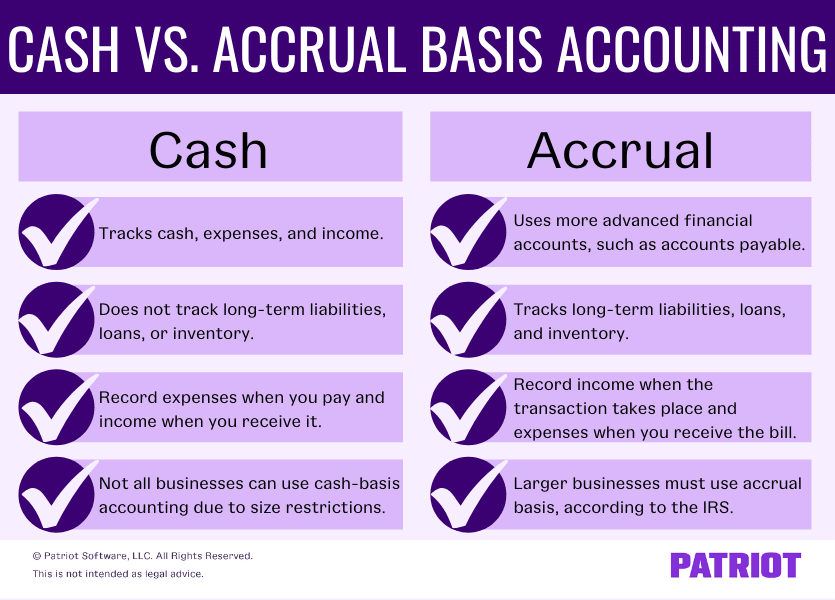

Change From Accrual To Cash Basis Cash basis is a way to work out your income and expenses for your Self Assessment tax return if you re a sole trader or partner Why use cash basis If you run a small business cash basis

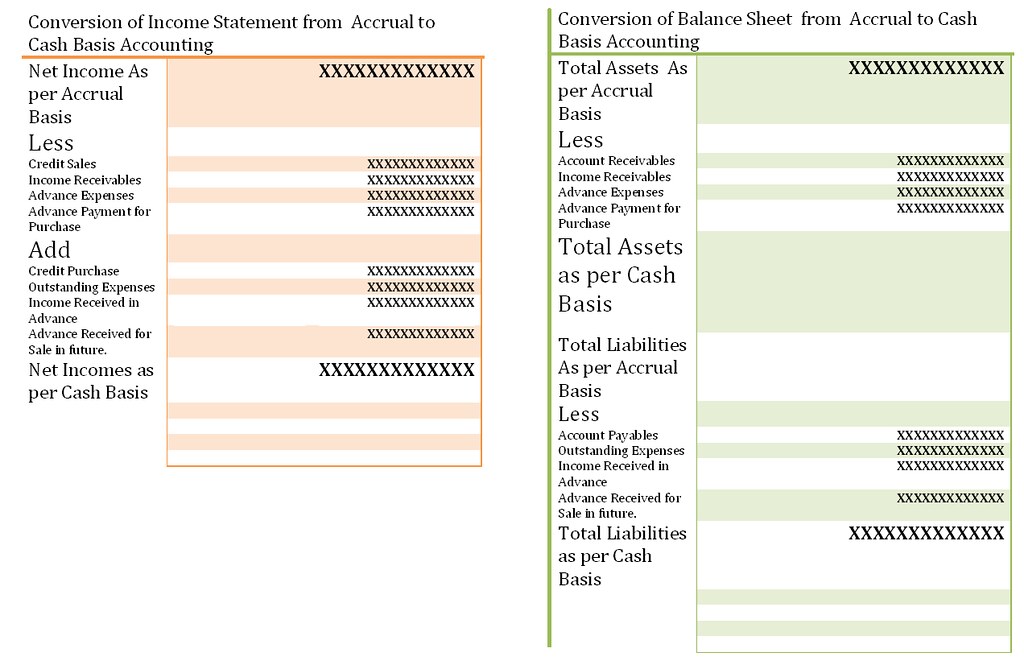

Dec 3 2019 0183 32 Other Useful Accrual to Cash Conversion Formulas The following formulas represent the conversion of accrual to the cash basis income statement The terminology used in the formulas is shown below BB Beginning balance EB Ending balance AR Accounts receivable AP Accounts payable MI Merchandise inventory PE Prepaid Mar 1 2018 0183 32 Understanding Accrual to Cash Conversions Examples First Year The above balance sheet is on the accrual method of accounting you can tell because there are accounts receivable and accounts payable To convert this balance sheet to the cash basis method of accounting you would reverse the accounts receivable and accounts payable

Change From Accrual To Cash Basis

Change From Accrual To Cash Basis

Change From Accrual To Cash Basis

https://i0.wp.com/thedailycpa.com/wp-content/uploads/2018/03/Screen-Shot-2018-03-01-at-7.02.15-AM.png?resize=646%2C658&ssl=1

Nov 5 2019 0183 32 Typically a change from the accrual to cash method of accounting is beneficial if a taxpayer has more accounts receivables and prepaid expenses compared to accounts payable and accrued expenses The largest favorable impact is usually in the year of the method change

Templates are pre-designed files or files that can be used for numerous purposes. They can conserve time and effort by offering a ready-made format and design for producing different sort of content. Templates can be utilized for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Change From Accrual To Cash Basis

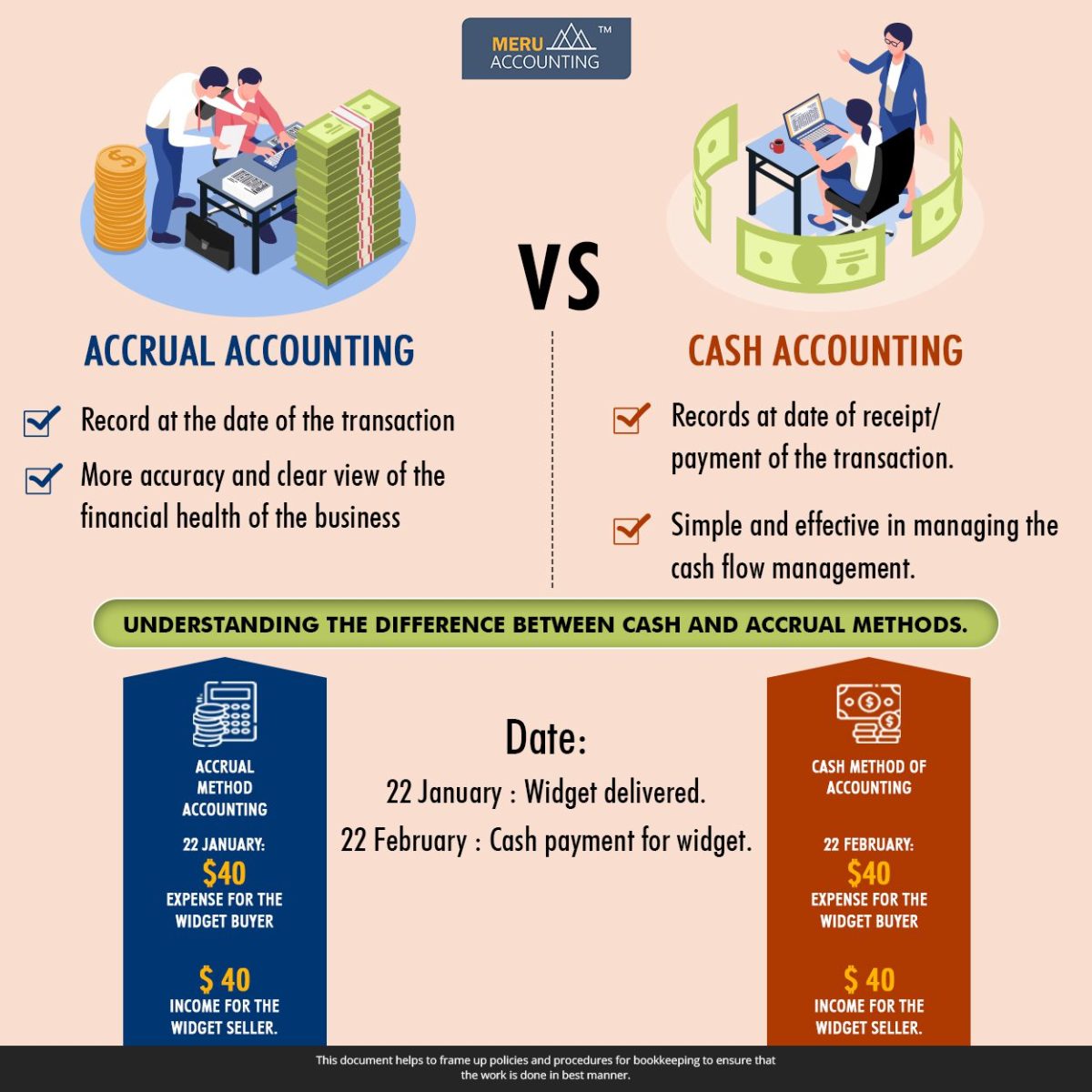

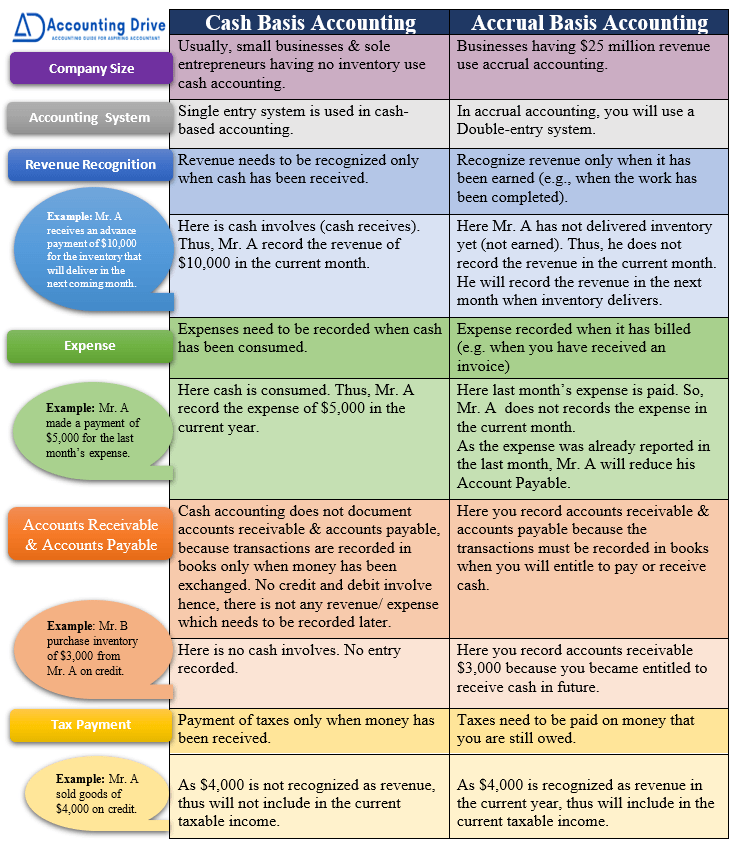

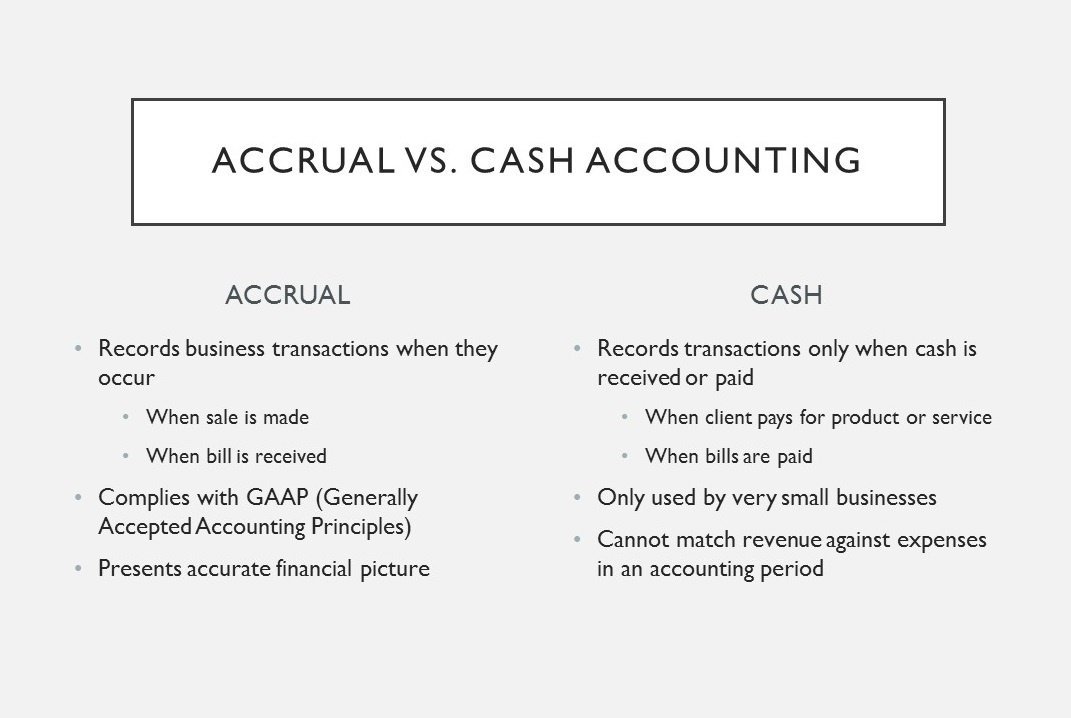

Accrual Accounting Vs Cash Basis Accounting What Is The Difference

What Is The Difference Between Cash And Accrual Accounting Meru

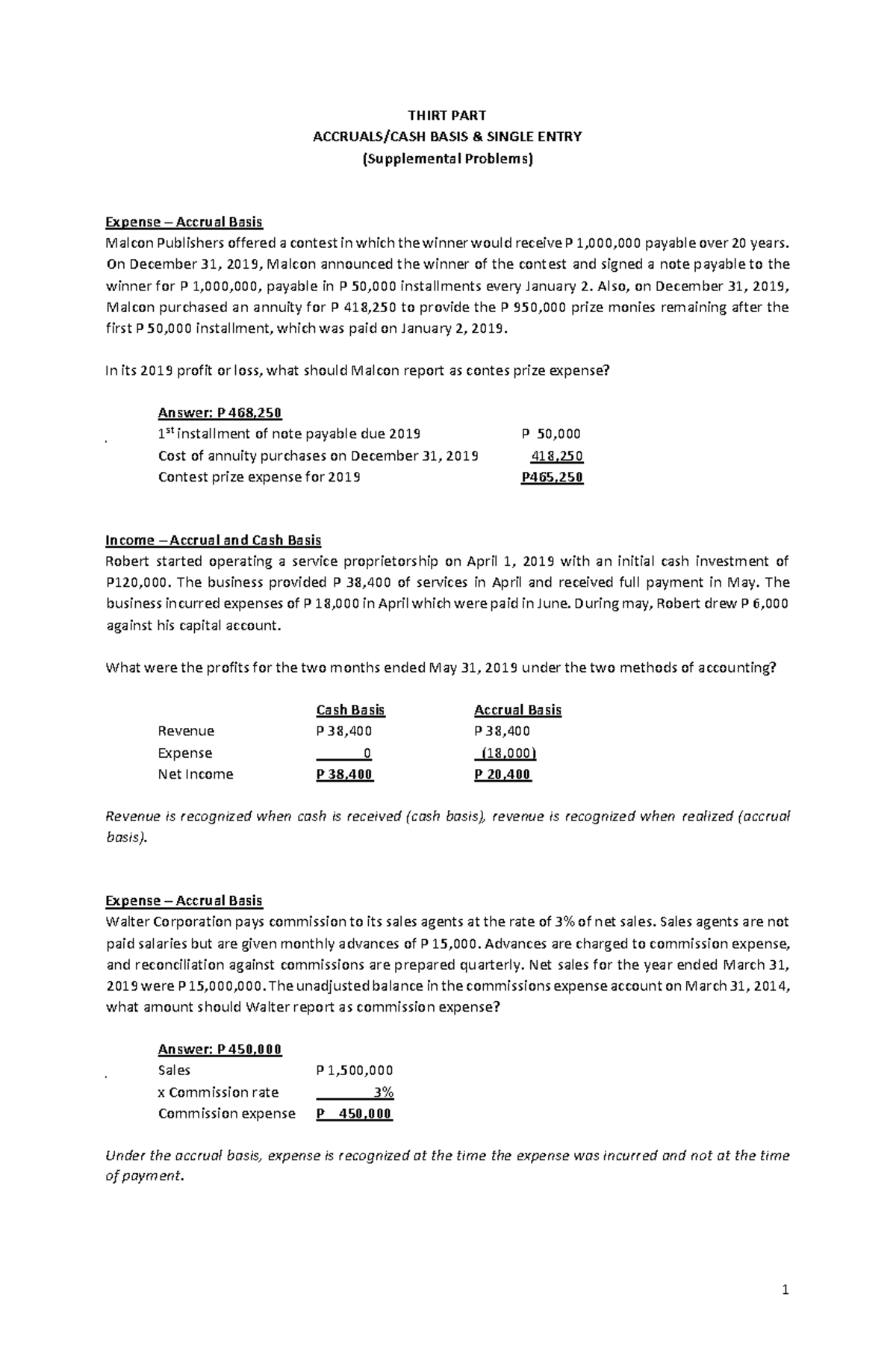

Sample Problems Accrual CASH Basis Single Entry PART 3 THIRT PART

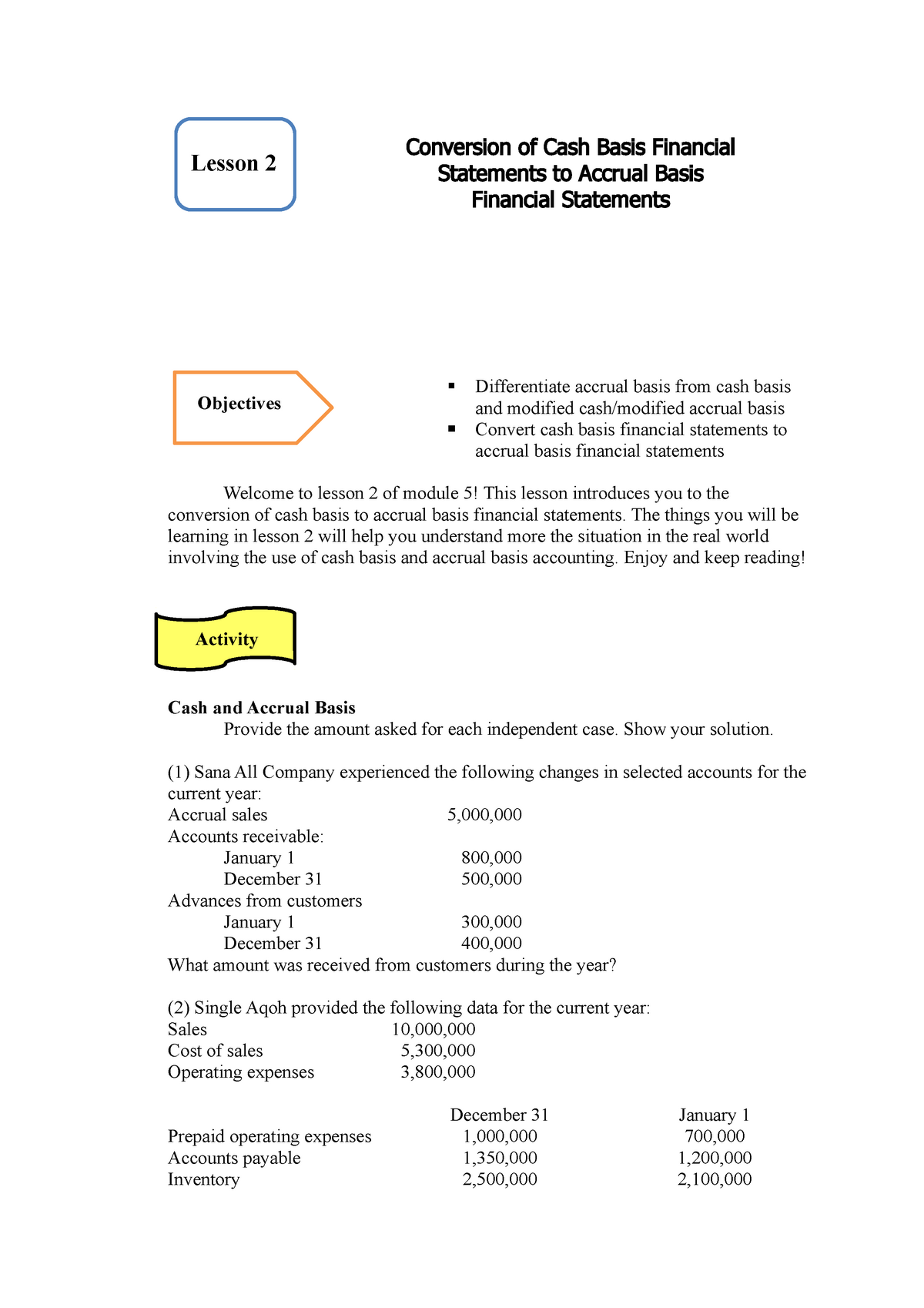

M5 Lesson 2 Accounting Conversion Of Cash Basis Financial

Cash Basis Accounting Vs Accrual Accounting Bench Accounting

Cash Accounting Versus Accrual Accounting Basic Hot Sex Picture

https://www.cfajournal.org/convert-from-accrual

To convert from the accrual basis of accounting to the cash basis of accounting the following steps need to be undertaken Adjusting for Accrued Expenses In order to adjust from accrual basis of accounting to cash basis of accounting accrued expenses need to be subtracted from the financial statements

https://www.thetaxadviser.com/issues/2022/may/new

May 1 2022 0183 32 Under revised Section 15 17 of Rev Proc 2022 14 the scope of a change from an overall accrual accounting method to the overall cash method is expanded to include changes from either an overall cash or overall accrual method to a method of using an accrual method for purchases and sales of inventories and the cash method for

https://taxnews.ey.com/news/2021-2307-irs-provides

A taxpayer may change from the cash method to an accrual method under Section 15 01 of Revenue Procedure 2019 43 This change applies to A taxpayer that must make the change under IRC Section 448 any other Code section or regulations or other guidance published in the Internal Revenue Bulletin

https://www.irs.gov/publications/p538

A change from the cash method to an accrual method or vice versa A change in the method or basis used to value inventory A change in the depreciation or amortization method except for certain permitted changes to the straight line method

https://www.double-entry-bookkeeping.com/bookkeeping-basics/accrual-

Jan 13 2020 0183 32 In general the following accrual to cash conversion formulas can be used to convert each revenue and expense income statement account from the accrual basis to the cash basis of accounting In each formula the terms used have the following meanings AR Accounts receivable AP Inventory accounts payable AE Accrued expenses

Sep 19 2022 0183 32 Changes in accounting methods that require approval from the IRS include switching from a cash basis method to an accrual basis method or vice versa You must also request an official OK from the IRS to make a change in the method or basis used to value your inventory The procedure provides four new automatic method changes for any tax year beginning after Dec 31 2017 Change from overall accrual to overall cash method Change to discontinue capitalizing costs under Sec 263A

Nov 22 2023 0183 32 The accruals basis is the default method of calculating profits and the cash basis is an opt in regime This measure changes this to set the cash basis as the default method of