Clergy Tax Deductions Worksheet This publication covers the following topics about the collection of social security and Medi care taxes from members of the clergy reli gious workers and

Below are forms and worksheets to help you keep track of your expenses Clergy Expense Worksheet xls Clergy Expense Works Compute your estimated tax for 2022 using the Form 1040 ES worksheet They can deduct half Page 22 18 Clergy Tax Return Preparation Guide for 2021 Returns

Clergy Tax Deductions Worksheet

Clergy Tax Deductions Worksheet

x-raw-image:///a4aec0c40c159d1e4b55c0da265eaf6ce8f8451b5e0d4d9b02b18b2b1de6c66d

Compute your estimated tax for 2023 using the Form 1040 ES worksheet Tax computation Line 12 Form 1040 Itemized deductions or standard deduction

Templates are pre-designed files or files that can be utilized for numerous purposes. They can save effort and time by supplying a ready-made format and design for producing different kinds of material. Templates can be utilized for individual or expert projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Clergy Tax Deductions Worksheet

Tax Organizers and Prep Tools

Tax deductions worksheet

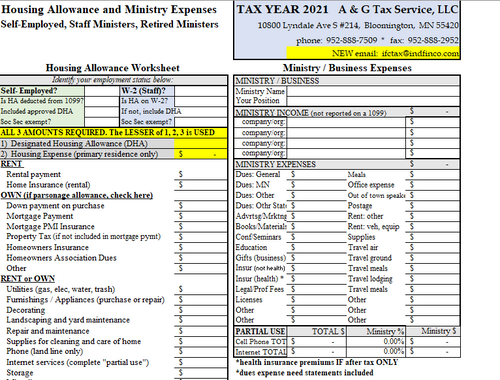

Housing Allowance Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Clergy Worksheet

Untitled

Clergy housing allowance form: Fill out & sign online | DocHub

https://schulzcpas.com/wp-content/uploads/Minister-Worksheets.pdf

THE ABOVE QUESTIONS WILL HAVE TO BE ANSWERED IN ORDER TO PROVIDE THE IRS WITH A COMPLETE RETURN IRS REQUIREMENT FOR CLAIMING AN EXPENSE DEDUCTION FOR AUTOS

https://iksynod.org/wp-content/uploads/2021/08/housingallowanceworksheet.pdf

NOTE This worksheet is provided for educational purposes only You should discuss your specific situation with your professional advisors including the

https://musselmantax.com/wp-content/uploads/2017/02/Clergy-Expense-Worksheet.pdf

Deductible mileage includes Musical instruments office equipment office furniture professional library etc Item Purchased Date Purchased Cost

https://www.clergyfinancial.com/resources/worksheets/

View our collection of clergy tax and church payroll resources including worksheets for charitable donations expense reporting mileage logs and more

https://cs.thomsonreuters.com/ua/ut/cs_us_en/utwapp/kb/1040-us-irs-publication-517-clergy-worksheets.htm

IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns

CLERGY worksheet Computation of Expense Allocable to Tax free Ministerial Income Ministers who own their homes and itemize their deductions can deduct Employee Business Expenses The biggest change that will affect ministers is the removal of Form 2106 Meaning you can no longer deduct un reimbursed business

In today digital age eBooks have become a staple for both leisure and learning The convenience of accessing Clergy Tax Deductions Worksheet and various