Cost Basis For Rental Property Apr 4 2024 0183 32 Learn how to calculate the cost basis for a rental property with this easy to use calculator Simply input your purchase price improvements expenses and accumulated

Learn the difference between basis and adjusted basis of a rental property and how to calculate them with various expenses Find out how adjusted basis affects your taxable gain or loss and how a 1031 exchange can help you defer taxes To calculate rental value depreciation you must first determine the total cost basis of the rental property This is the total investment in the rental property as it relates to taxes

Cost Basis For Rental Property

Cost Basis For Rental Property

Cost Basis For Rental Property

https://wp-assets.stessa.com/wp-content/uploads/2021/10/15111724/coins-around-small-house.jpg

May 28 2024 0183 32 Put simply the cost basis in real estate is the original value that a buyer pays for their property This includes but is not limited to the price paid for the property any closing costs paid by the buyer and the cost of improvements

Pre-crafted templates provide a time-saving option for producing a varied variety of files and files. These pre-designed formats and designs can be used for numerous individual and expert projects, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the material creation procedure.

Cost Basis For Rental Property

Start Here Understand Cost Basis Cost Basis Implications

Calculating Cost Basis On Rental Property Sale RamandhaAde

Real Estate Solution For Rental Property Management In UAE NetSuite

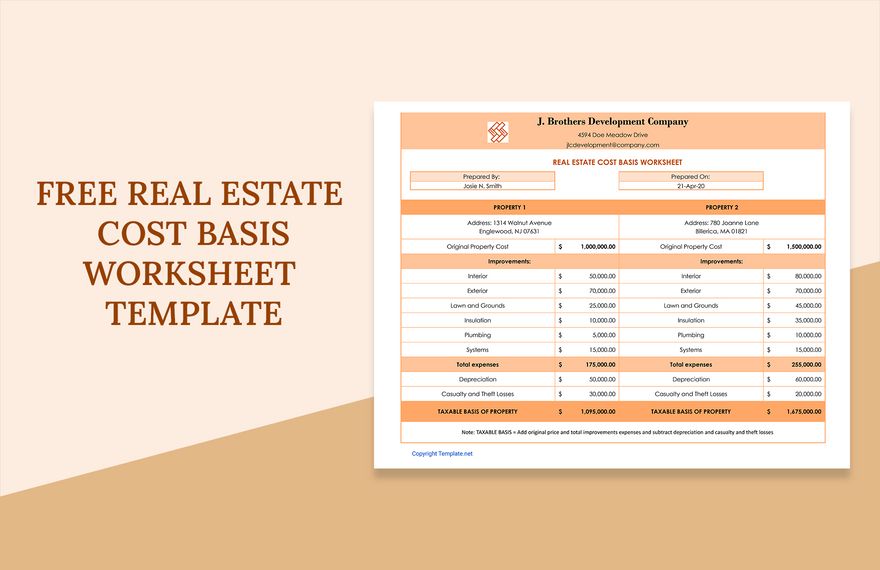

Free Real Estate Cost Basis Worksheet Template Google Docs Google

What Is An Adjusted Cost Basis S Ehrlich

Calculate Cost Basis For Inherited Property

https://www.realized1031.com/blog/how …

Apr 18 2024 0183 32 Learn how to determine the cost basis of a rental property which is the cost of acquiring it plus certain expenses The cost basis affects your taxable income and depreciation and can be deferred with a 1031 exchange

https://smartasset.com/taxes/how-to-calcula…

The cost basis is the original purchase price of real estate but it changes based on certain changes to the property Here is how it is calculated

https://certifiedcalculator.com/how-to-calculate

Apr 4 2024 0183 32 To calculate the cost basis of a rental property you can use the following formula Cost Basis Purchase Price Depreciation Improvement Costs Where Purchase Price

https://www.stessa.com/blog/cost-basis-for-rental-property

Learn how to calculate the original adjusted and depreciation cost basis of a rental property and why they matter for taxes See how to apply cost basis to capital gain

https://www.landlordstudio.com/blog/cost-b…

Feb 8 2024 0183 32 In this article we take a closer look at what adjusted cost basis is how you can calculate the adjusted basis in real estate and the role that rental property cost basis plays in capital gains tax and depreciation recapture

Apr 4 2024 0183 32 To calculate the cost basis of your rental property follow these steps Gather Information Collect the necessary information including the purchase price cost of Aug 11 2023 0183 32 A overview on how to calculate adjusted cost basis for a rental property Learn how initial acquisition costs capital improvements depreciation and other expenses impact

Oct 3 2022 0183 32 When you sell a rental property your capital gain or loss is determined by subtracting your cost basis from your selling price For this reason understanding how to