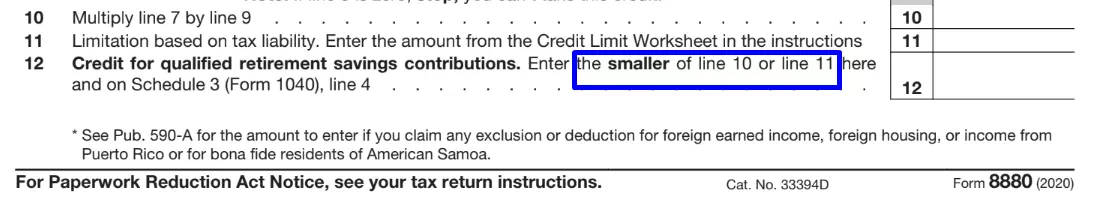

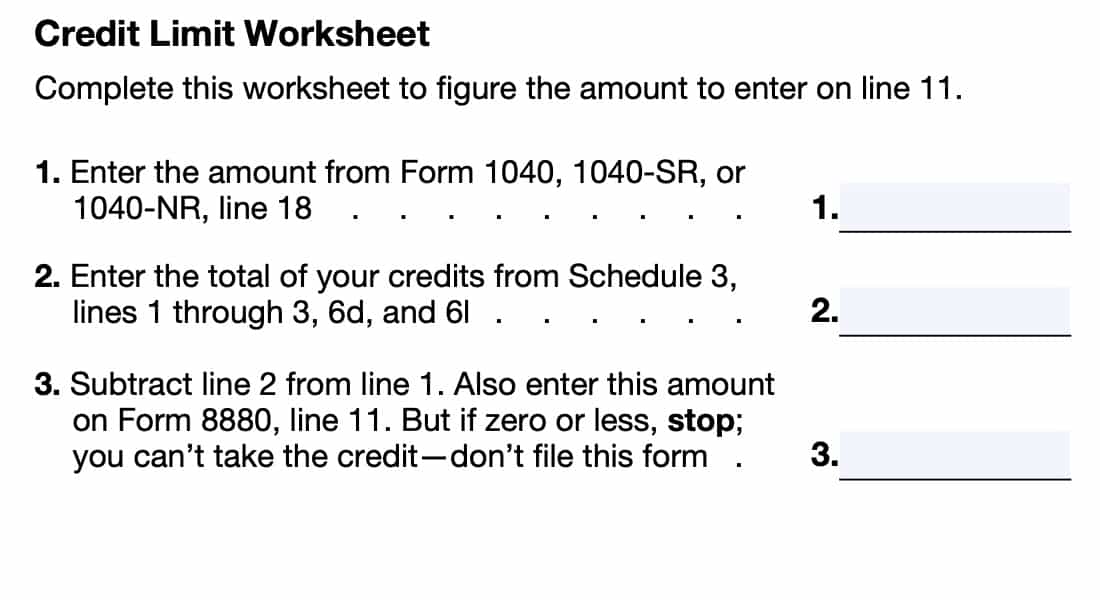

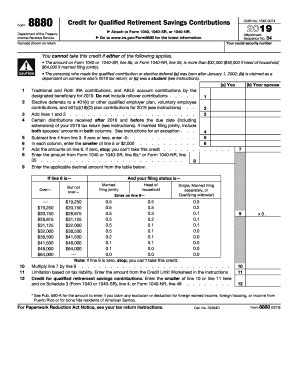

Credit Limit Worksheet 8880 Lines 9 through 12 then provide detailed instructions for calculating your credit based on your income There is a separate Credit Limit Worksheet in the form

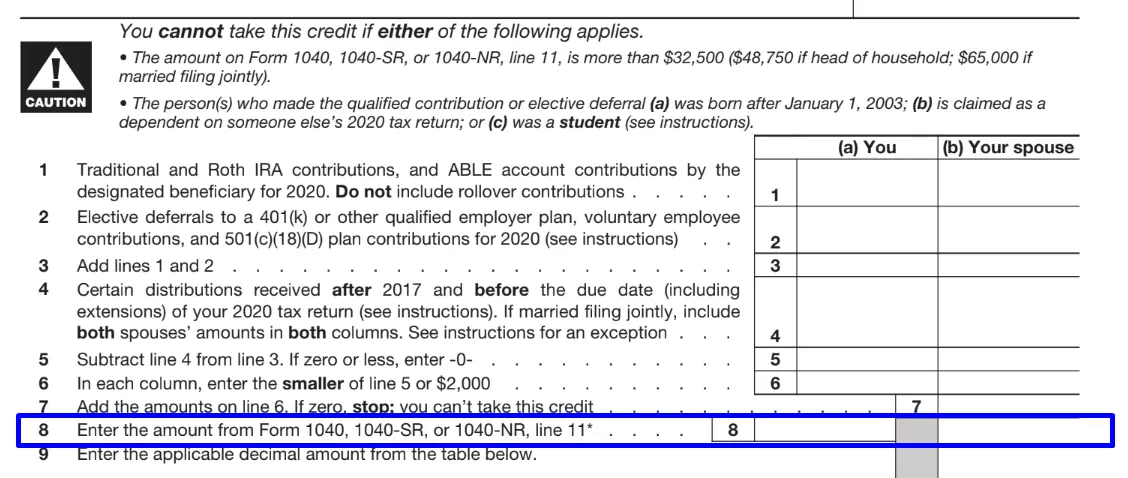

What are the income limits for the Saver s Credit Single married filing separately and qualifying surviving spouse up to 32 500 Head of The credit is equal to 50 20 or 10 of your retirement plan contributions The amount is dependent on your Adjusted Gross Income The maximum credit amount

Credit Limit Worksheet 8880

Credit Limit Worksheet 8880

Credit Limit Worksheet 8880

https://www.signnow.com/preview/100/9/100009198.png

Enter the amount from the Credit Limit Worksheet in the instructions 11 12 Credit for qualified retirement savings contributions Enter the smaller of line

Templates are pre-designed documents or files that can be used for various purposes. They can save effort and time by providing a ready-made format and layout for developing different sort of material. Templates can be utilized for personal or expert tasks, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Credit Limit Worksheet 8880

IRS Form 8880 ≡ Fill Out Printable PDF Forms Online

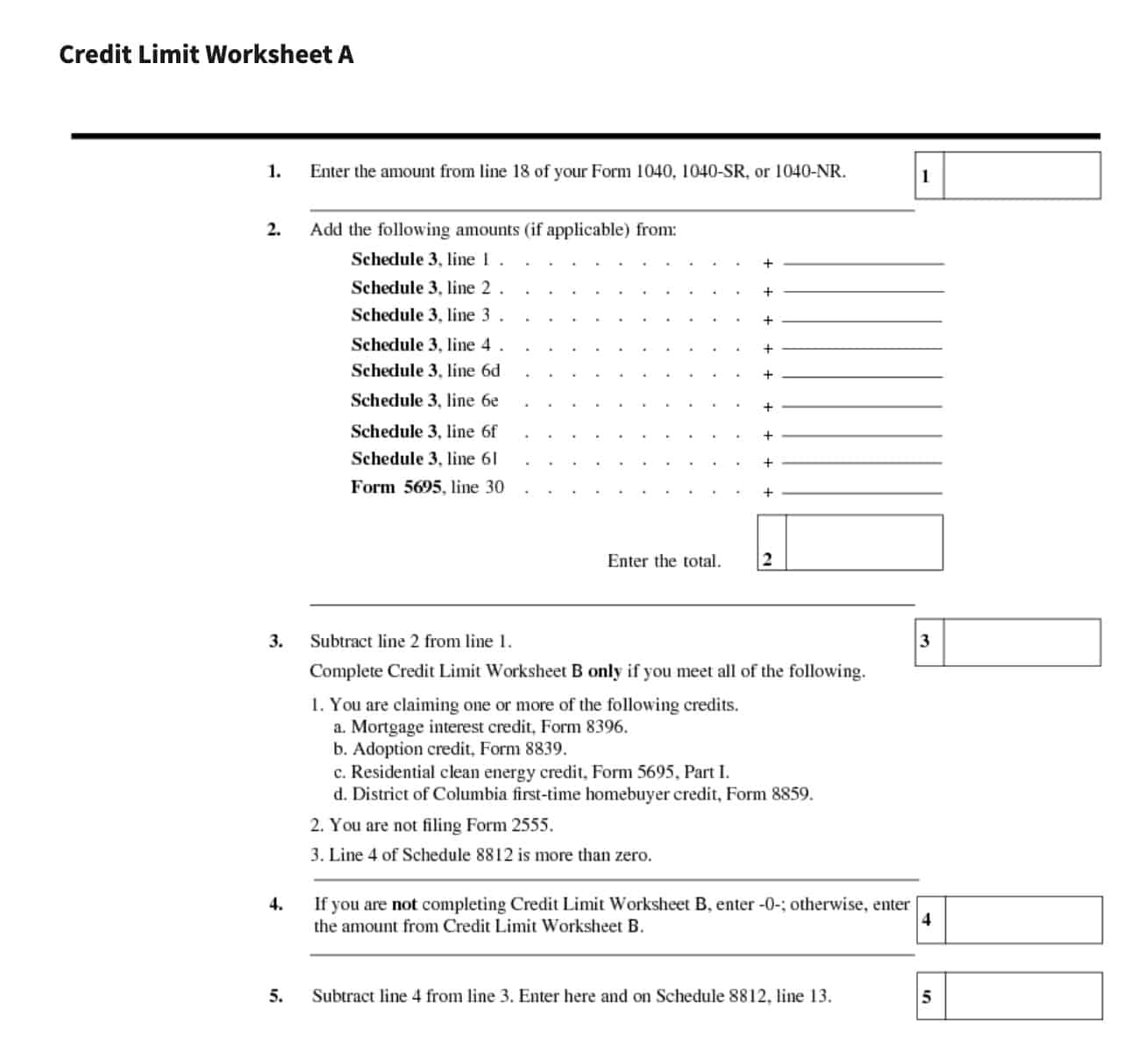

Schedule 8812 Instructions - Credits for Qualifying Dependents

IRS Form 8880 - Credit for Qualified Retirement Savings Contributions - Form 8880 Department of the Treasury Internal Revenue Service Credit for | Course Hero

:max_bytes(150000):strip_icc()/2022Form8880-8fe5fa4359674a21bcfd5a8fa5c692b4.jpg)

IRS Form 8880: Who Qualifies for the Retirement Saver's Credit

Child Credit - Fill Out and Sign Printable PDF Template | signNow

Schedule 8812 Instructions - Credits for Qualifying Dependents

https://www.irs.gov/forms-pubs/about-form-8880

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit Current Revision

https://www.esmarttax.com/tax-forms/federal-form-8880-instructions/

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit TIP This credit can be claimed

https://www.investopedia.com/irs-form-8880-credit-for-qualified-retirement-savings-contributions-5114767

Form 8880 Credit ABLE account contributions 1 000 The maximum credit you may qualify for if you re a single filer The maximum credit is 2 000 if you re

https://www.reginfo.gov/public/do/DownloadDocument?objectID=85804501

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit This credit can be claimed in

https://turbotax.intuit.com/tax-tips/investments-and-taxes/what-is-the-irs-form-8880/L0mePsZju

Your Form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim The size of your tax

The Credit Limit Worksheet of Form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to Once you ve calculated your credit amount on Form 8880 input it on the Retirement savings contributions credit line on Schedule 3 Part I

lines of Form 8880 Line 1 You and your spouse s Line 11 Use this Credit Limit Worksheet to figure the amount to enter on line 11