Credit Limit Worksheet A Use Plan 8812 Form 1040 to determine the Child Tax Credit CTC Other Dependents Credit episode and Other Child Tax Credit ACTC

Schedule 8812 credit limit worksheet a https apps irs gov app picklist list formsInstructions html value 8812 criteria formNumber WebHow to edit credit Enter the amount from your federal instructions for Schedule 8812 Credit Limit Worksheet instructions for Schedule 8812 Credit Limit Worksheet B line 15

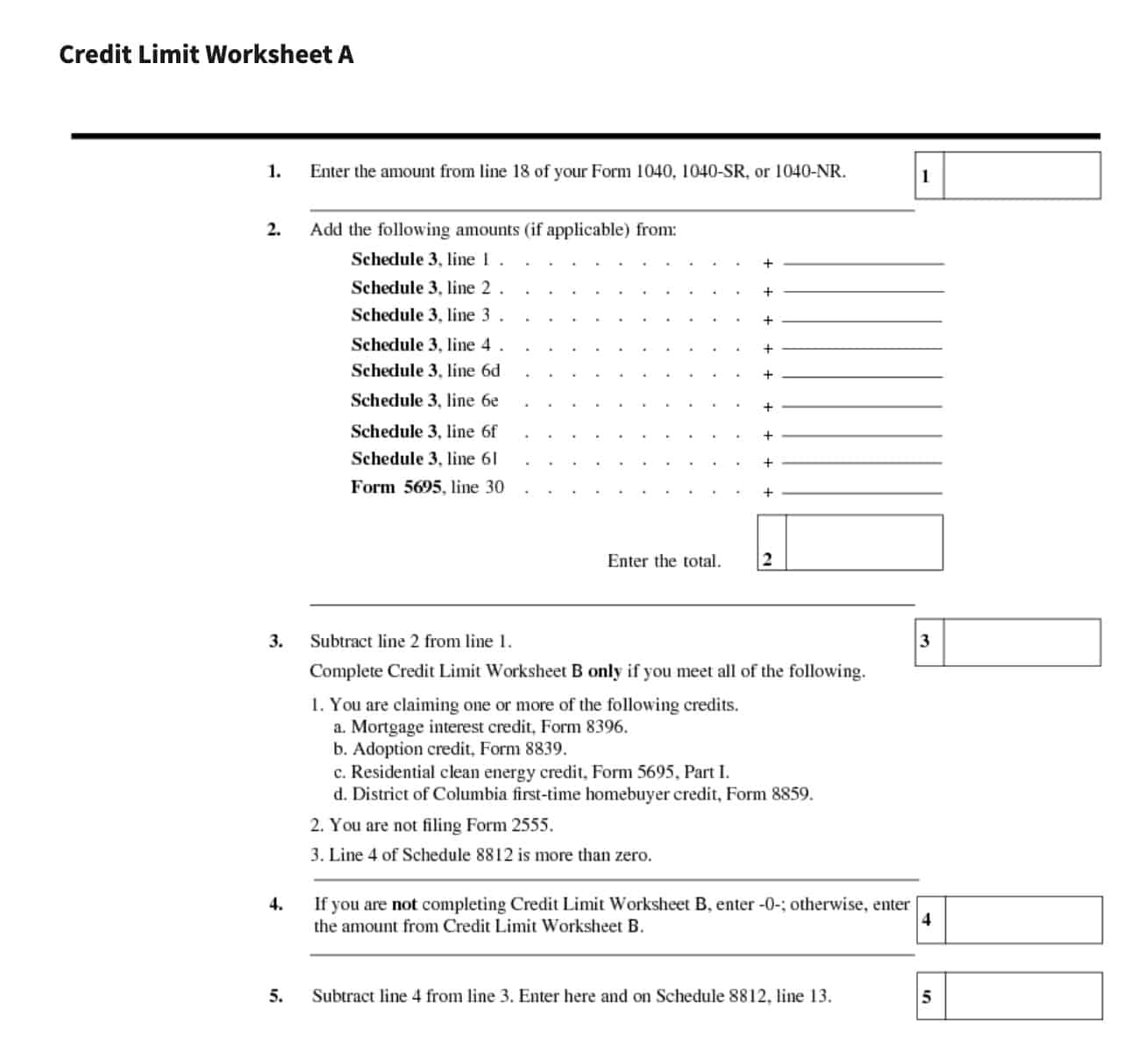

Credit Limit Worksheet A

Credit Limit Worksheet A

Credit Limit Worksheet A

https://www.pdffiller.com/preview/100/9/100009198/large.png

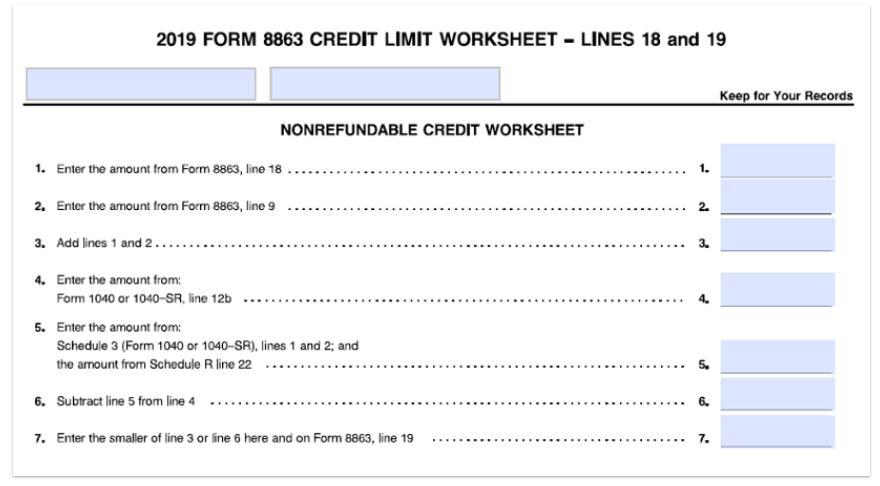

The 8863 Credit Limit Worksheet is a document that helps you calculate the maximum credit limit for each of your business locations What is a schedule A for

Pre-crafted templates offer a time-saving solution for developing a varied range of documents and files. These pre-designed formats and layouts can be made use of for different personal and professional jobs, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the material creation process.

Credit Limit Worksheet A

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

About Schedule 8812 (Form 1040), Credits for Qualifying Children and : Fill out & sign online | DocHub

Schedule 8812 Instructions - Credits for Qualifying Dependents

Credit Limit Worksheet A Walkthrough (Schedule 8812) - YouTube

Downloadable worksheets: Fill out & sign online | DocHub

Anthony (27) and Nicole (26) are married and filing a | Chegg.com

https://www.irs.gov/pub/irs-pdf/i1040s8.pdf

Complete Credit Limit Worksheet B only if you meet all of the following 1 You are claiming one or more of the following credits a Mortgage

https://www.youtube.com/watch?v=ZcDTEYW08mI

Taxpayers looking to claim a tax credit for a qualifying child or dependent might need to

https://8863-credit-limit-worksheet.pdffiller.com/

A Credit Limit Worksheet is a document used to record the total amount of credit that can be extended to a customer This worksheet will list the customer s

https://ttlc.intuit.com/community/taxes/discussion/credit-limit-worksheet/00/2638466

Finally found the Credit Limit Worksheet A It is located in the Instructions pamplet for Form 8812 page 4

https://www.hrblock.com/tax-center/filing/credits/child-tax-credit/

The maximum refundable portion of the credit is limited to 1 500 per qualifying child

Caution If you checked a box on line 13 do not complete Part I C 15a Enter the amount from the Credit Limit Worksheet A In Credit Limit Worksheet A start by entering the amount from Line 18 of your Form 1040 1040 SR or 1040 NR This represents your total tax

The Credit Limit Worksheet of Form 8863 is an important tool for taxpayers who are claiming education related tax credits as it helps them determine the