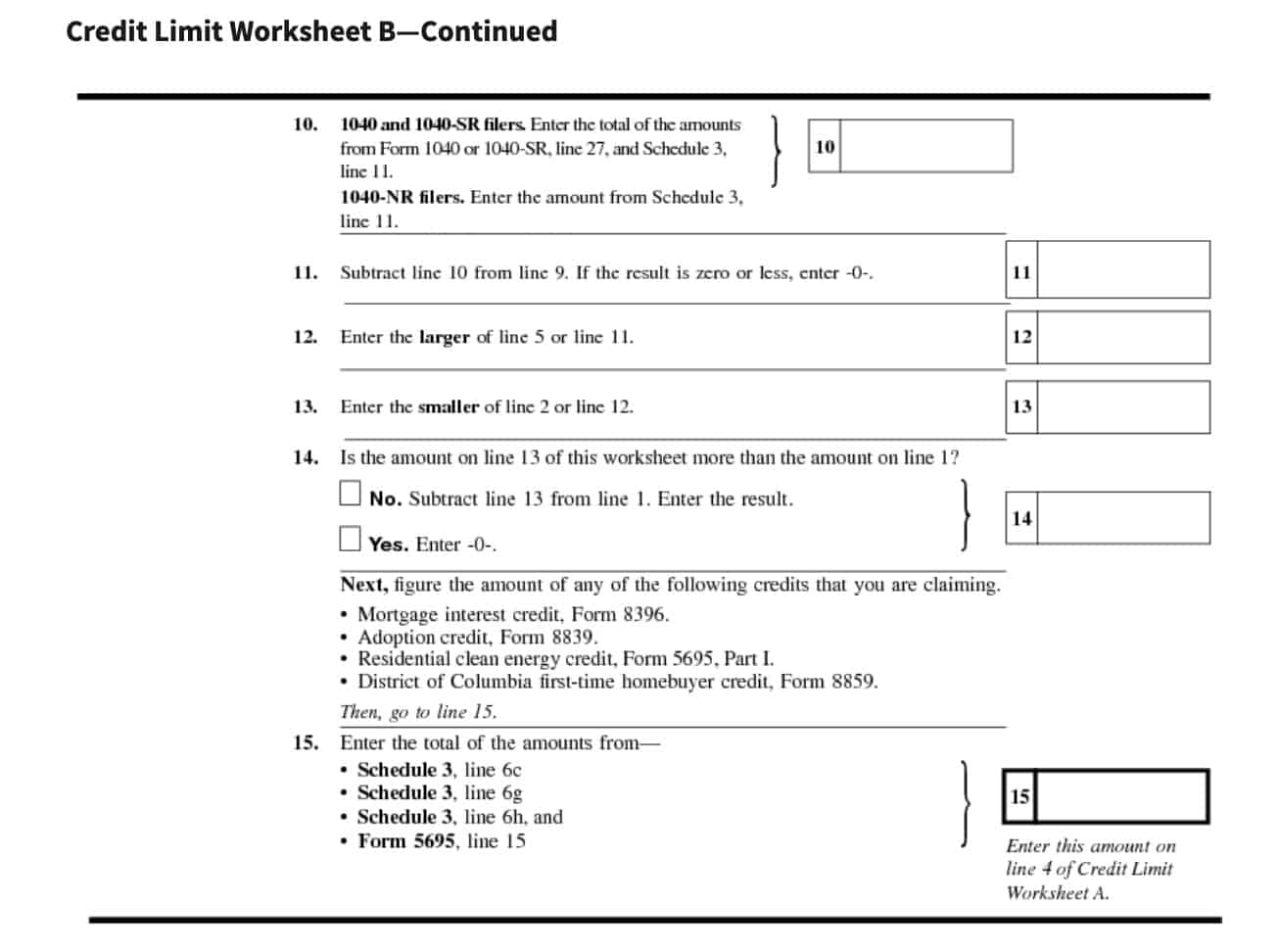

Credit Limit Worksheet For Form 8863 The 8863 Credit Limit Worksheet is a document that helps you calculate the maximum credit limit for each of your business locations What is a schedule A for

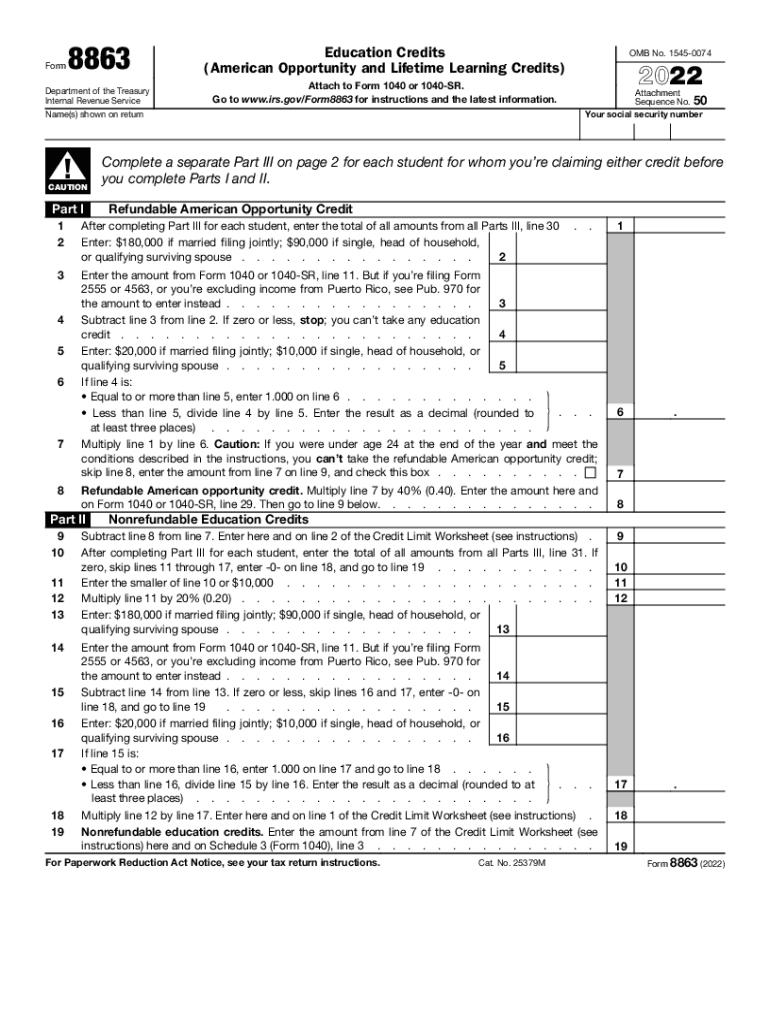

The maximum credit you can claim per year is 2 000 based on 10 000 in qualifying expenses Phase out for higher income taxpayers Like many The Credit Limit Worksheet of Form 8863 includes information about the taxpayer s income education expenses and other factors that affect the tax credit

Credit Limit Worksheet For Form 8863

Credit Limit Worksheet For Form 8863

Credit Limit Worksheet For Form 8863

https://formspal.com/pdf-forms/other/8863-credit-limit-worksheet/8863-credit-limit-worksheet-preview.webp

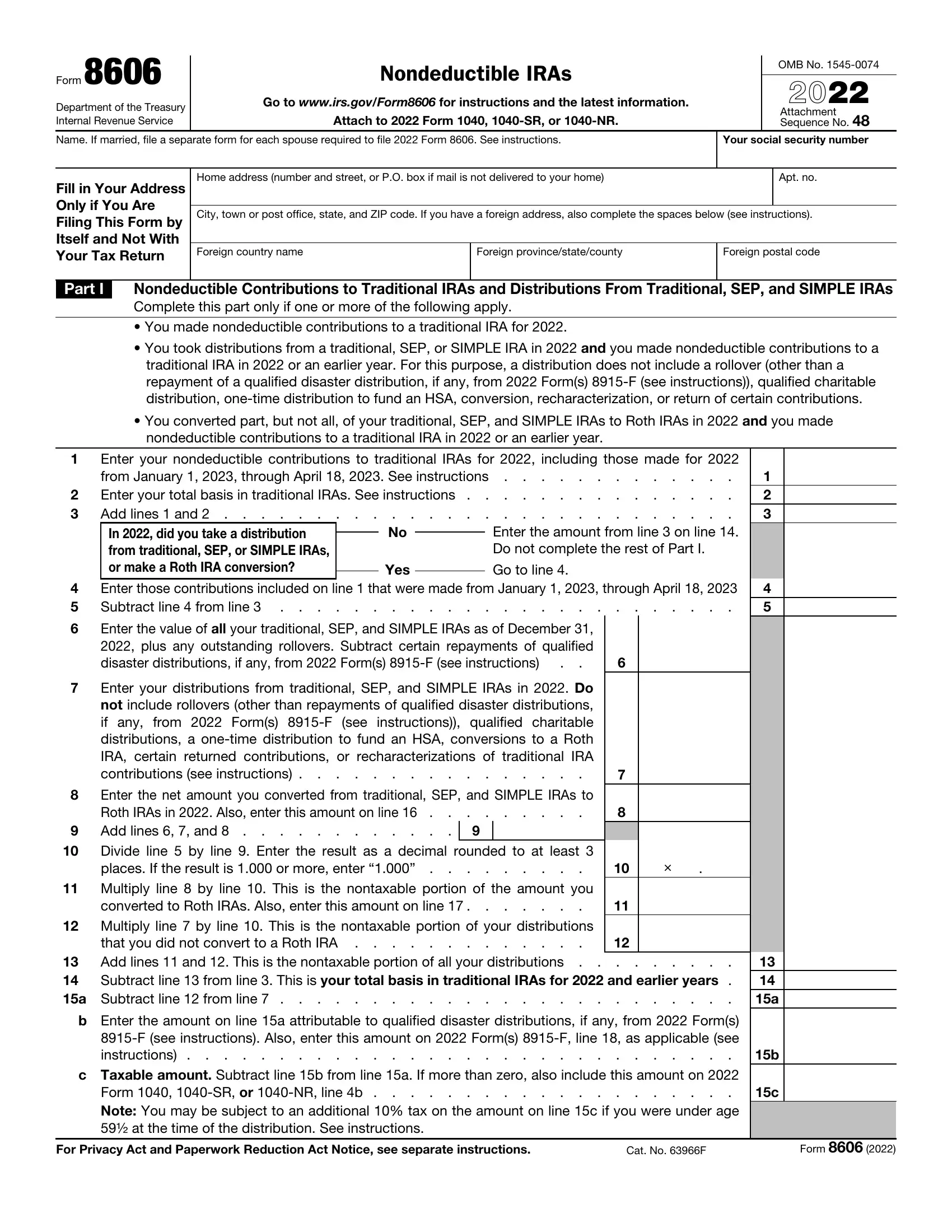

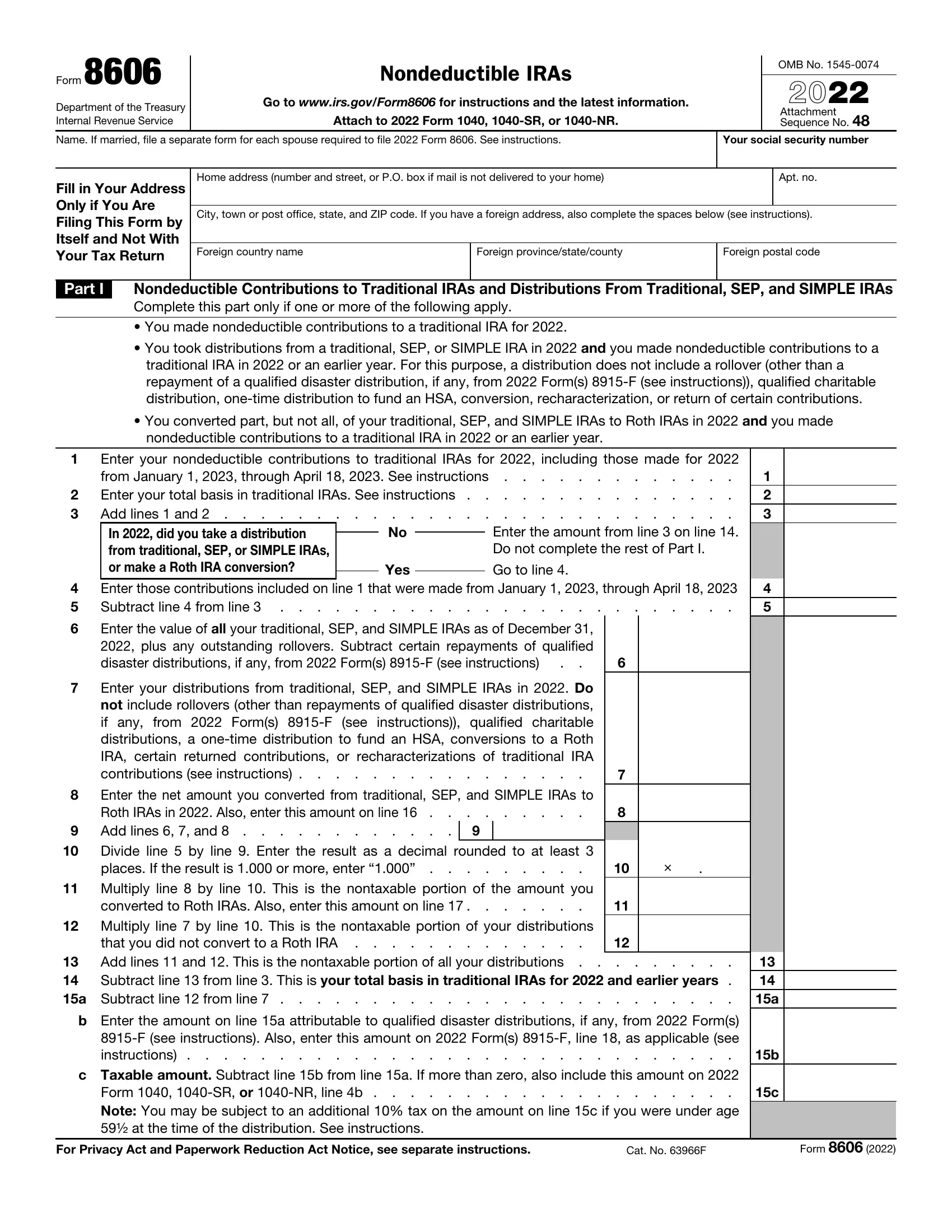

Form 8863 Credit Limit Worksheet is a tool used to calculate education credits You can use this form to get a tax credit for qualifying postsecondary education

Pre-crafted templates use a time-saving option for creating a varied series of files and files. These pre-designed formats and designs can be used for different individual and professional jobs, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the content production procedure.

Credit Limit Worksheet For Form 8863

Learn How to Fill the Form 8863 Education Credits - YouTube

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

2022 Form IRS 8863Fill Online, Printable, Fillable, Blank - pdfFiller

Anthony (27) and Nicole (26) are married and filing a | Chegg.com

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

Schedule 8812 Instructions - Credits for Qualifying Dependents

https://formspal.com/pdf-forms/other/8863-credit-limit-worksheet/

The Credit Limit Worksheet of Form 8863 includes information about the taxpayer s income education expenses and other factors that affect the tax credit

https://8863-credit-limit-worksheet.pdffiller.com/

The Credit Limit Worksheet of Form 8863 is an important tool for taxpayers who are claiming education related tax credits as it helps them determine the

https://www.irs.gov/pub/irs-pdf/f8863.pdf

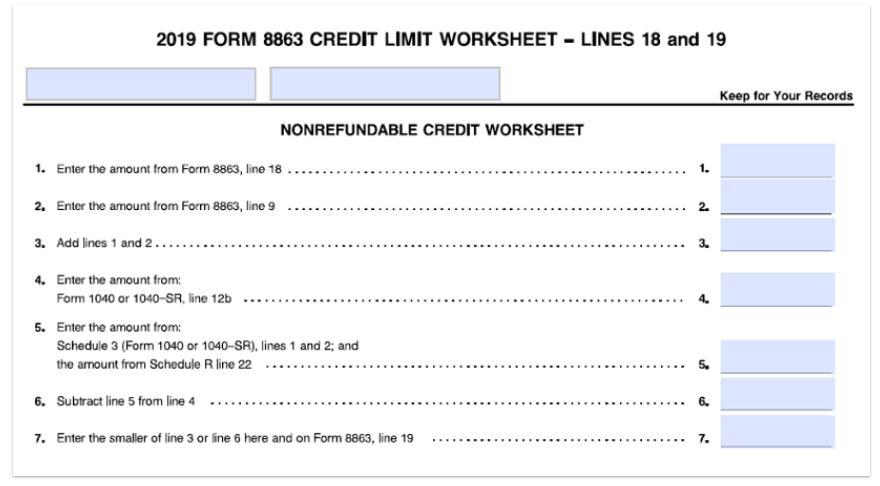

19 Nonrefundable education credits Enter the amount from line 7 of the Credit Limit Worksheet see instructions here and on Schedule 3 Form 1040 line 3

https://formspal.com/pdf-forms/other/8863-credit-limit-worksheet/8863-credit-limit-worksheet.pdf

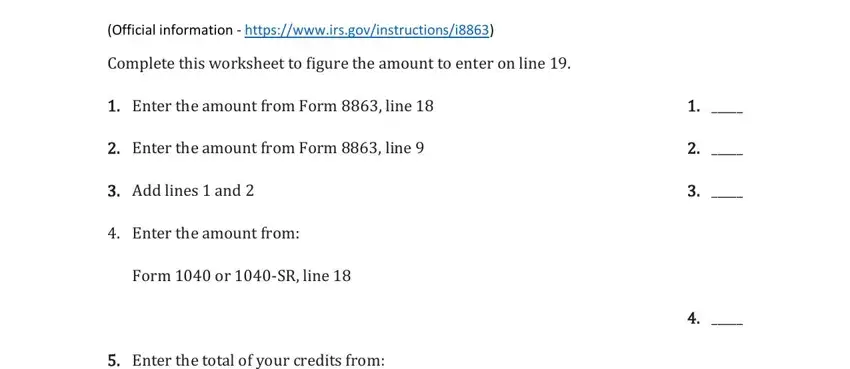

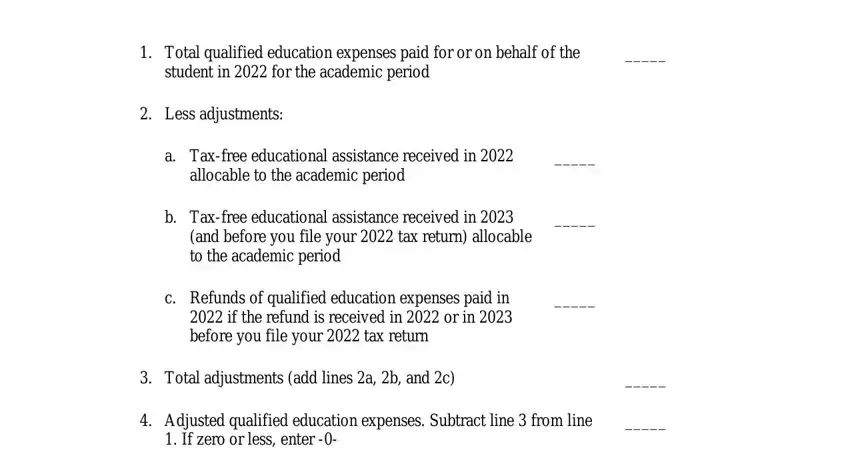

Complete this worksheet to figure the amount to enter on line 19 1 Enter the amount from Form 8863 line 18 2 Enter the amount from Form 8863 line 9 3

https://www.signnow.com/fill-and-sign-pdf-form/26902-credit-limit-worksheet-form

Credit Limit Worksheet Get your fillable template and complete it online using the instructions provided Create professional documents with signNow

Use Form 8863 to figure and claim your education credits which are based on adjusted Form 8863 Credit Limit Worksheet pdf FORM 8863 CREDIT 4 5 Enter the total of your credit from Schedule 3 Form 1040 lines 1 2 6d and 6l5 6

If you re a student hoping to take advantage of one of the IRS education tax credits you ll have to file Form 8863 with your tax return and there are a few