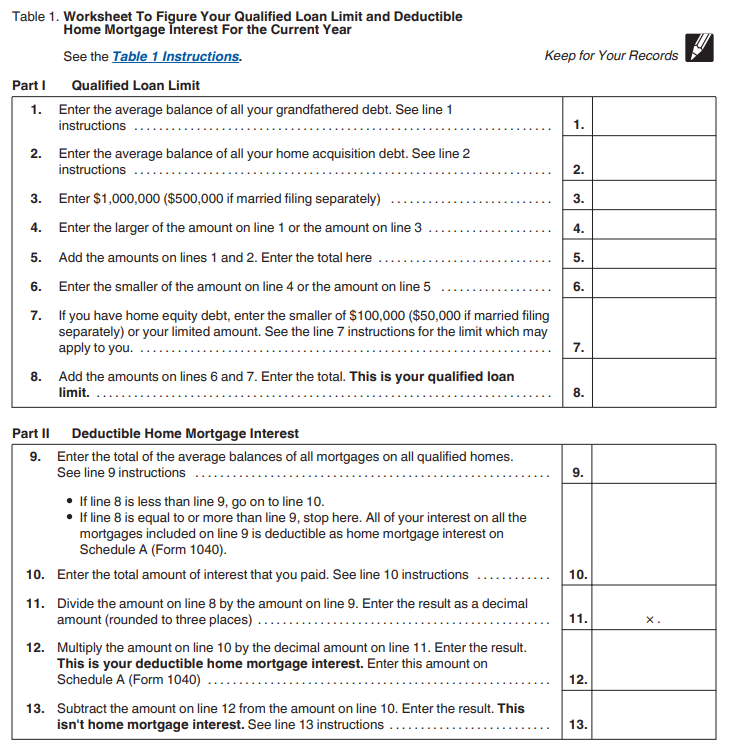

Deductible Home Mortgage Interest Worksheet Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1 Enter the average is deductible as home mortgage interest on Schedule A Form 1040

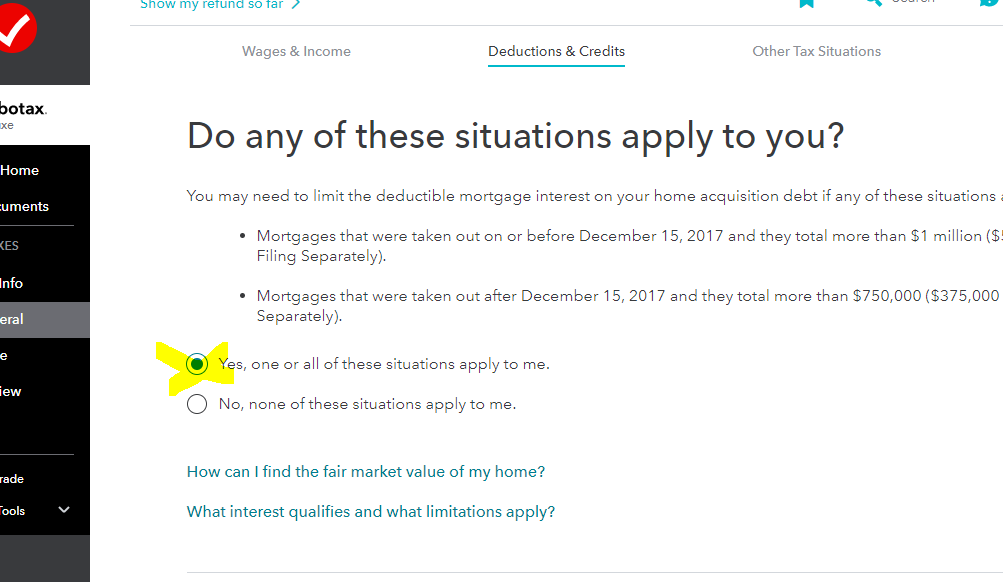

You will need to complete this IRS Qualified Loan Limit Worksheet before reporting the mortgage interest deduction in the 1098 program entry What if I own more You can only deduct interest on the first 375 000 of your mortgage if you bought your home after December 15 2017 Per IRS Publication 587 Business Use of

Deductible Home Mortgage Interest Worksheet

Deductible Home Mortgage Interest Worksheet

Deductible Home Mortgage Interest Worksheet

https://www.irs.gov/pub/xml_bc/10426g05.gif

deductible home mortgage interest Table 5 IRS Worksheet to Figure Home Mortgage Interest Part I Qualified loan limit Number 1 Computation action

Templates are pre-designed files or files that can be used for different purposes. They can save time and effort by providing a ready-made format and design for producing various kinds of material. Templates can be utilized for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Deductible Home Mortgage Interest Worksheet

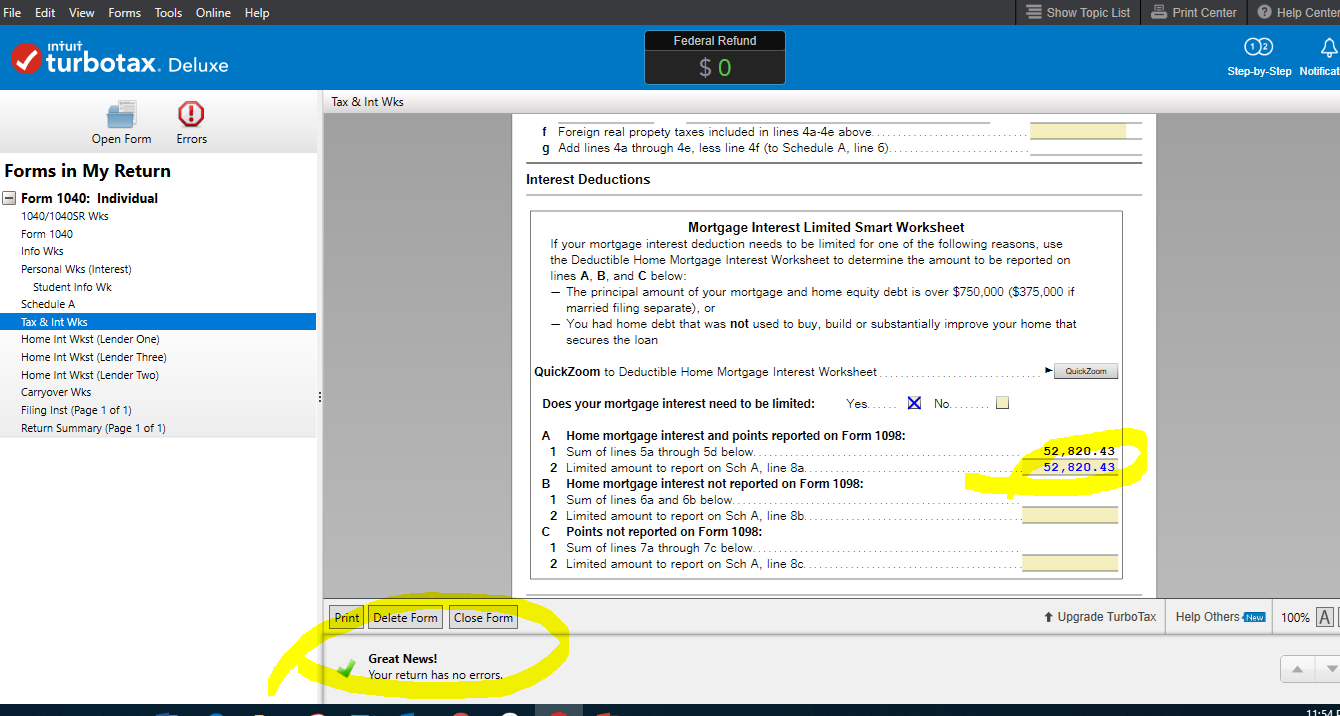

I don't believe my mortgage interest deduction is calculating correctly. My calculation is significantly different than that of TT. Any advice?

Deductible Home Mortgage Interest Worksheet - Page 4

Edit 'Deductible Home Mortgage Interest Worksheet' for CA 540 return

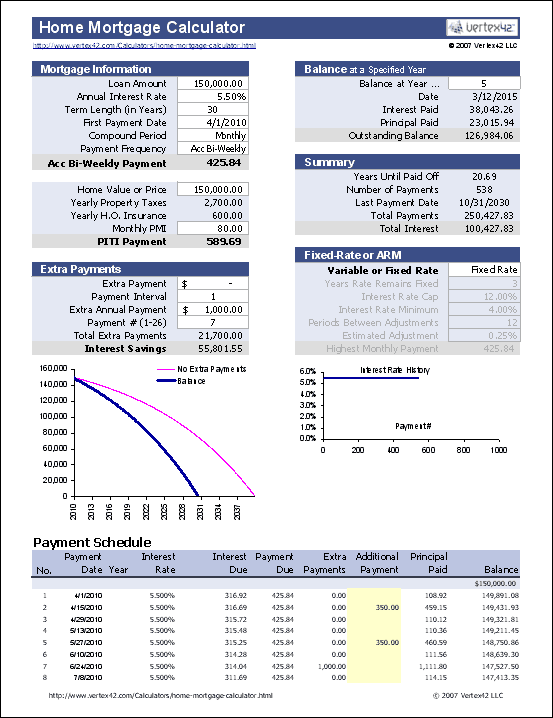

Free Home Mortgage Calculator for Excel

Deductible Home Mortgage Interest Worksheet - Page 4

Publication 936 (2022), Home Mortgage Interest Deduction | Internal Revenue Service

https://www.irs.gov/publications/p936

Part II explains how your deduction for home mortgage interest may be limited It contains Table 1 which is a worksheet you can use to figure the limit on your

https://proconnect.intuit.com/support/en-us/help-article/form-1098/understanding-deductible-home-mortgage-interest/L18S60lyN_US_en_US

The Deductible Home Mortgage Interest Worksheet is designed to help you calculate your deductible home mortgage interest if that debt is

https://cotaxaide.org/tools/Mortgage%20Interest%20Worksheet.html

Instructions Complete a worksheet tab for all home secured mortgages to determine the amount of interest paid that is deductible on

https://cs.thomsonreuters.com/ua/toolbox/cs_us_en/Calculator_screen_overviews/cshw_deductible_home_mortgage_interest_screen.htm

This tax worksheet computes the taxpayer s qualified mortgage loan limit and the deductible home mortgage interest Example

https://answerconnect.cch.com/topic/2044c93a7cb1100082b190b11c18cbab012/mortgage-interest-deduction

Worksheet Qualified Loan Limit and Deductible Home Mortgage Interest News October 2 2023 News PwC Insights IRS Notice provides additional interim CAMT

Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest For the Current Year and the accompanying instructions on page 12 will As of 1 1 2018 equity debt no longer produces deductible interest Only debt to buy build or substantially improve your home will generate deductible interest

Enter your income from line 2 of the Standard Deduction Worksheet for Home mortgage interest On home purchases up to 1 000 000 On home