Dividends And Capital Gains Worksheet The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you Lines 1 7 are

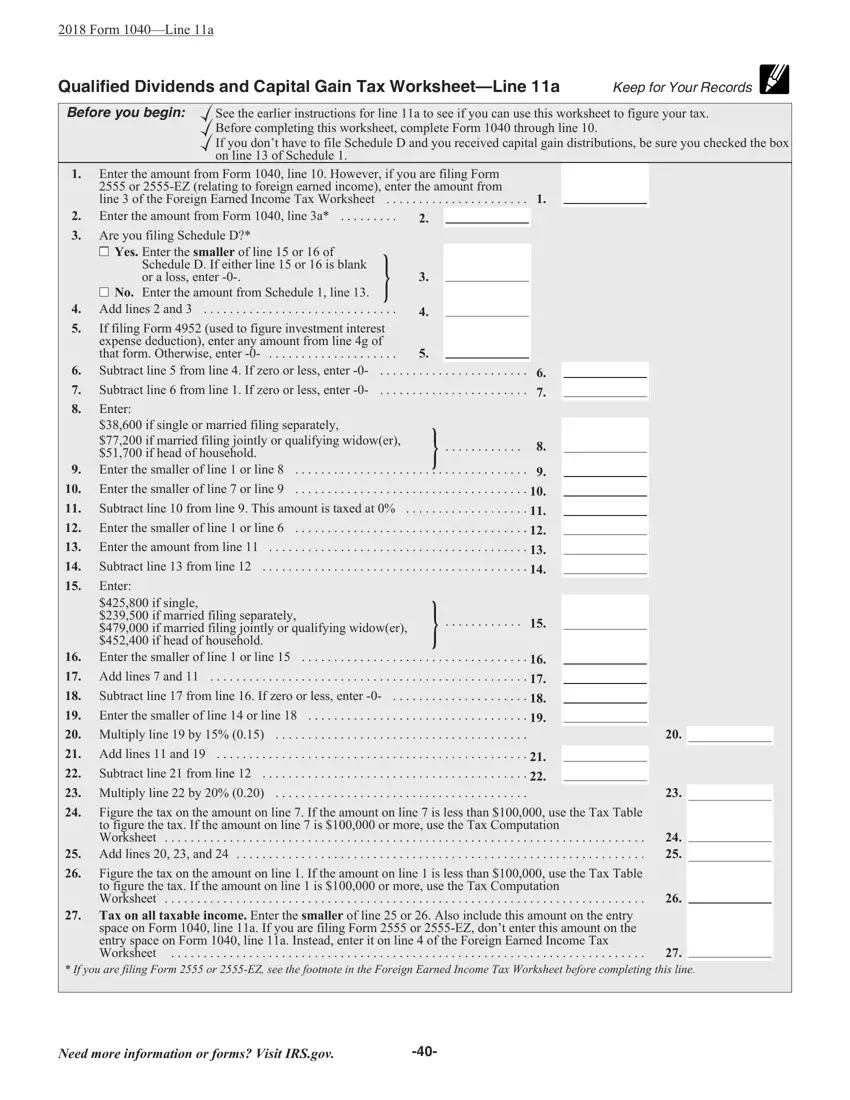

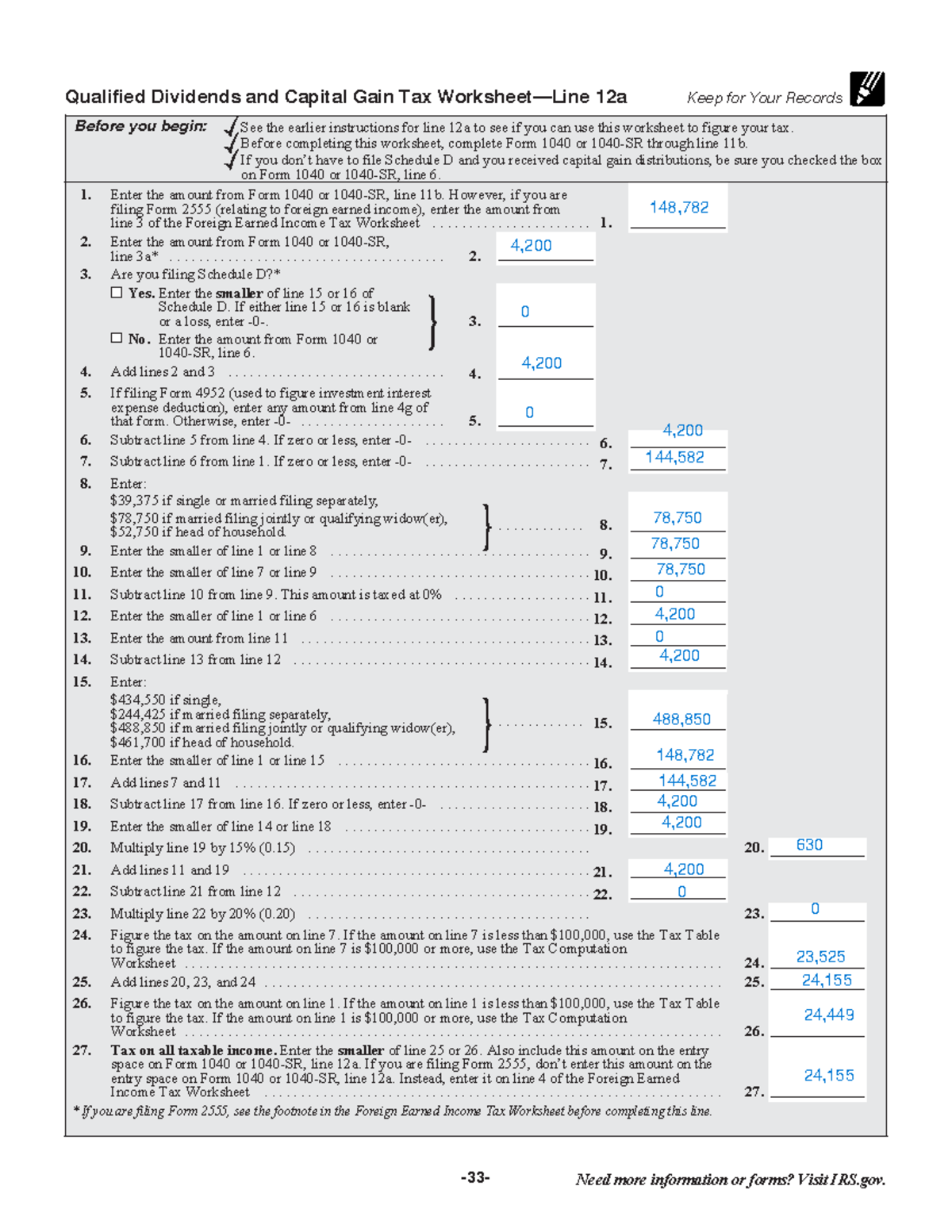

The tax rate computed on your Form 1040 must consider any tax favored items such as Before completing this worksheet complete Form 1040 or 1040 SR through line 11b If you don t have to file Schedule D and you received capital gain distributi

Dividends And Capital Gains Worksheet

Dividends And Capital Gains Worksheet

Dividends And Capital Gains Worksheet

https://www.pdffiller.com/preview/391/725/391725062/large.png

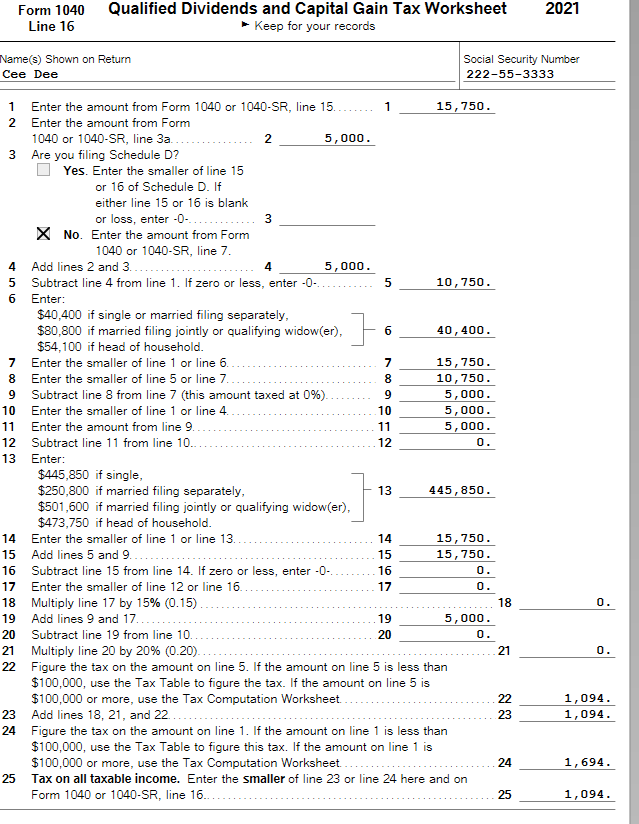

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 Don t complete lines 21 and 22 below No Complete

Pre-crafted templates use a time-saving solution for creating a varied series of files and files. These pre-designed formats and layouts can be used for numerous personal and professional tasks, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the material production process.

Dividends And Capital Gains Worksheet

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

Qualified Dividends Form - Fill Out and Sign Printable PDF Template | signNow

IN C++ Please Create a Function to Certify the | Chegg.com

SOLUTION: Qualified Dividends and Capital Gain Tax Worksheet - Studypool

ACC 330 Qualified Dividends and Capital Gain Tax Worksheet.pdf - 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line | Course Hero

Easy Calculator for 2022 Qualified Dividends and Capital Gain - Etsy

https://www.irs.gov/pub/irs-dft/i1040sd--dft.pdf

Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet 46 47 Tax on all taxable income including capital gains and qualified dividends

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://www.marottaonmoney.com/how-your-tax-is-calculated-qualified-dividends-and-capital-gains-worksheet/

Lines 1 5 of this worksheet calculate your total qualified income line 4 and your total ordinary income line 5 so they can be taxed at

https://www.drakeetc.com/modules/1057/13-deductions/images/wk_cgtax.pdf

Before completing this worksheet complete Form 1040 or 1040 SR through line 15 If you don t have to file Schedule D and you received capital gain

https://answerconnect.cch.com/document/mtg01e3a826b3b0d74b5d99dcd205fa86b8fa/mastertaxguide/2023-capital-gains-and-qualified-dividend-rates

2023 Capital Gains and Qualified Dividend Rates Taxable Income Threshold 0 Married Filing Jointly and Surviving Spouse 0 to 89 250 Head of Household

Qualified dividends and capital gain tax 12a keep for your records before you begin 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 The Qualified Dividends and Capital Gain Tax Worksheet also known as Form 1040 Line 44 is designed to calculate taxes on capital gains at a special rate

Fillable No Fillable fields 0 Avg time to fill out 15 sec Other names capital gains tax worksheet 2020