Do Qualified Dividends Count As Unearned Income Oct 28 2024 0183 32 The tax rate on qualified dividends is 15 for most taxpayers It s zero for single taxpayers with incomes under 47 025 as of 2024 and 20 for single taxpayers with incomes over 518 901

They re taxable as ordinary income unless they re qualified dividends Qualified dividends are dividends taxed at the lower rates that apply to net long term capital gains Qualified dividends must meet be Given for a stock you owned for 60 days out of a 121 day period Since 2003 certain dividends known as qualified dividends have been subject to the same tax rates as long term capital gains which are lower than rates for ordinary income

Do Qualified Dividends Count As Unearned Income

Do Qualified Dividends Count As Unearned Income

Do Qualified Dividends Count As Unearned Income

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/04/05175309/Dividends-Payable-Journal-Entry-–-Debit-Credit.jpg

Oct 20 2020 0183 32 Usually you ll pay taxes on unearned income at your personal marginal tax rate however in certain cases for example capital gains and qualified dividends your unearned income will be taxed at a lower rate Some unearned income gets taxed at a much lower rate

Pre-crafted templates use a time-saving option for producing a diverse series of documents and files. These pre-designed formats and designs can be made use of for numerous personal and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, improving the content development process.

Do Qualified Dividends Count As Unearned Income

Solved Taxpayers Whose Only Unearned Income Consists Of Chegg

/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

8 Best Dividend Stocks For Brokerage Account Schedule D

Do Dividends Count As Income For Mortgage Applications

/dotdash_final_How_the_Dividend_Yield_and_Dividend_Payout_Ratio_Differ_Dec_2020-01-f835700d354f452c9ef1c94750ee4962.jpg)

How To Calculate Net Dividend Haiper

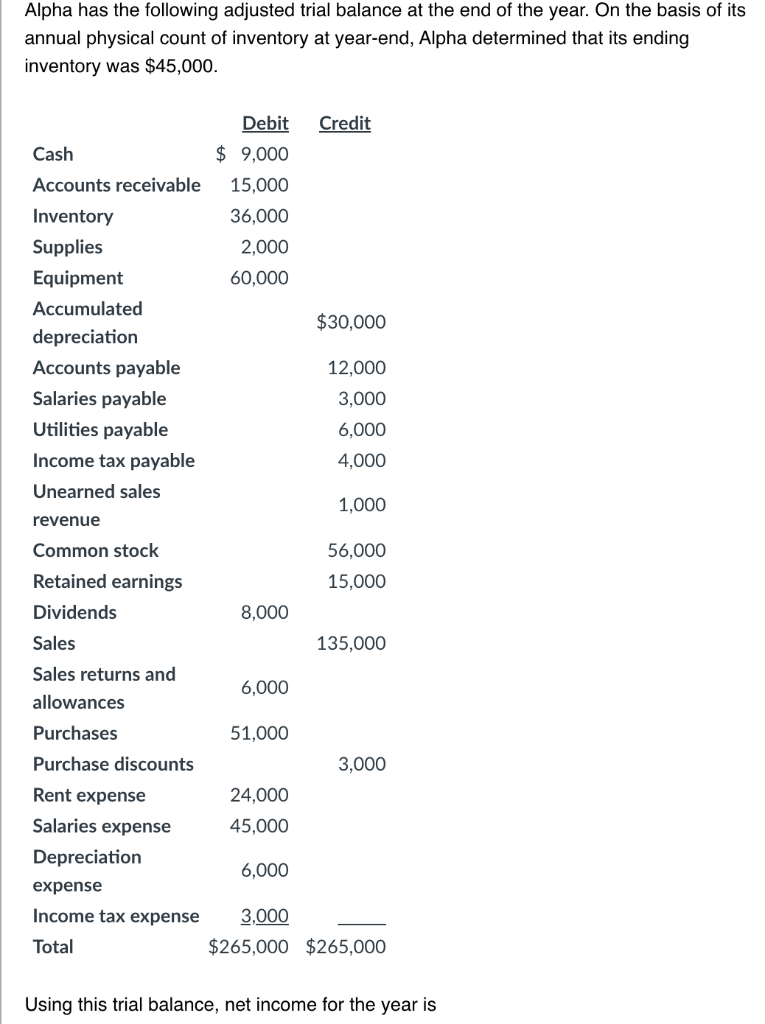

Solved Alpha Has The Following Adjusted Trial Balance At The Chegg

What Is An Exempt Interest Dividend InfoComm

https://www.investopedia.com/terms/u/unearnedincome.asp

Nov 14 2023 0183 32 Taxation of dividends is based on whether the dividend is ordinary or qualified Ordinary dividends the more common form of dividends that investors receive from a company are taxed at

https://www.investopedia.com/terms/q/qualifieddividend.asp

Nov 25 2024 0183 32 Qualified dividends must meet special requirements issued by the IRS The maximum tax rate for qualified dividends is 20 for tax year 2024 depending on your taxable income with a few

https://www.whitecoatinvestor.com/qualified

Dec 20 2023 0183 32 Dividends are generally taxed at your ordinary income tax rates However some dividends are special They are qualified with the IRS for a special lower tax rate The qualified dividend tax brackets are 0 15 and 20 much lower than the ordinary income tax rates ranging from 10 37

https://kahnlitwin.com/blogs/tax-blog/how-do-i

Mar 13 2023 0183 32 The most significant difference between the two is that ordinary dividends are taxed at ordinary income rates while qualified dividends receive more favorable tax treatment by being taxed at lower capital gains rates

https://www.fool.com/terms/d/dividend-income

Nov 7 2024 0183 32 Nonqualified or ordinary dividends do not meet those requirements to qualify for a lower tax rate As a result the IRS taxes them based on the recipient s ordinary income

Nov 29 2024 0183 32 Qualified dividends are ordinary dividends from domestic corporations and certain foreign corporations that qualify for the lower long term capital gains tax rates rather than ordinary Sep 21 2020 0183 32 It s zero for single taxpayers with incomes under 40 000 and 20 for single taxpayers with incomes over 441 451 However ordinary dividends or nonqualified dividends are taxed at your normal marginal tax rate

For 2024 your qualified dividends may be taxed at 0 if your taxable income falls below 47 025 Single or Married Filing Separately 63 000 Head of Household or 94 050 Married Filing Jointly or Qualifying Surviving Spouse Above those