Earnings And Profits Calculation Worksheet Accumulated earnings and profits E P are net profits a company has available after paying dividends This figure is calculated as E P at the beginning of the

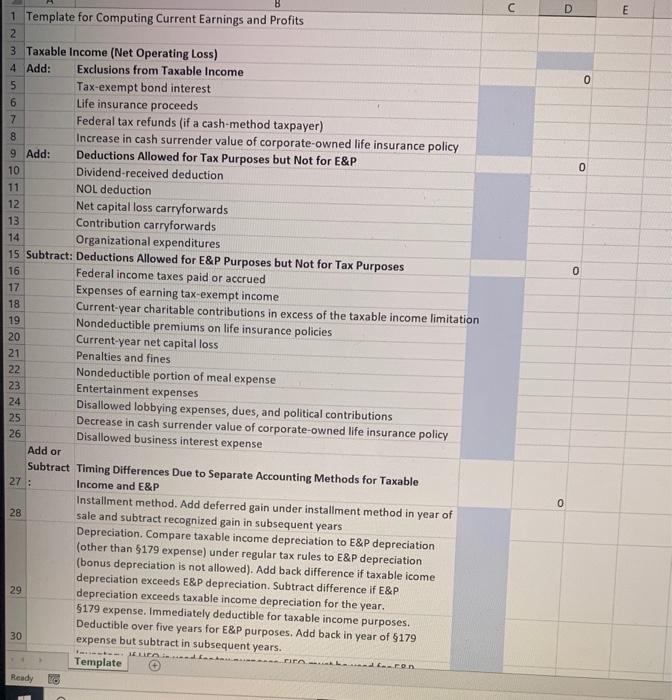

Forms Earnings Profits Computation Worksheet Taxable Income or Loss Add Tax exempt income Depreciation for income tax Earnings and Profits Portfolio 762 discusses the principles and rules associated with earnings and profits E P and analyzes the tax effects on E P of

Earnings And Profits Calculation Worksheet

Earnings And Profits Calculation Worksheet

Earnings And Profits Calculation Worksheet

https://www.thetaxadviser.com/content/dam/tta/issues/2013/oct/kaiser-1.png

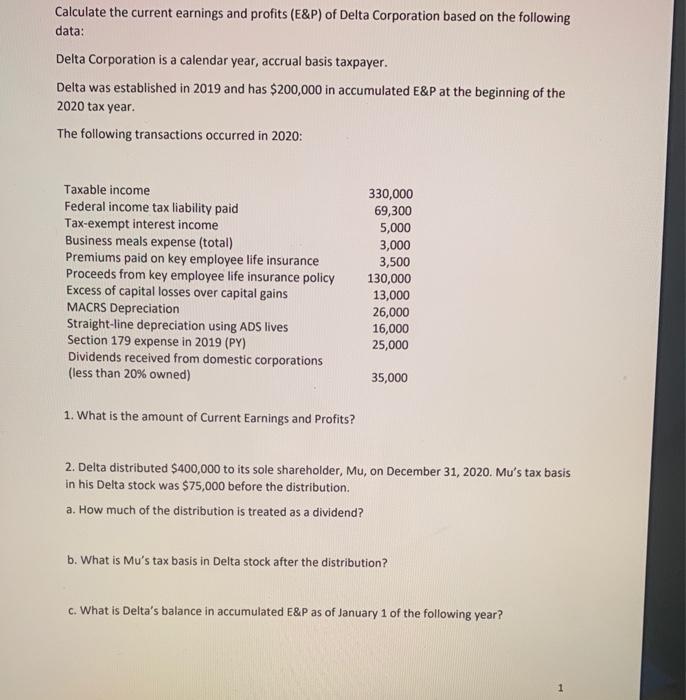

Calculation of a corporation s earnings and profits is a key element in determining the tax character of corporate distributions A distribution of property

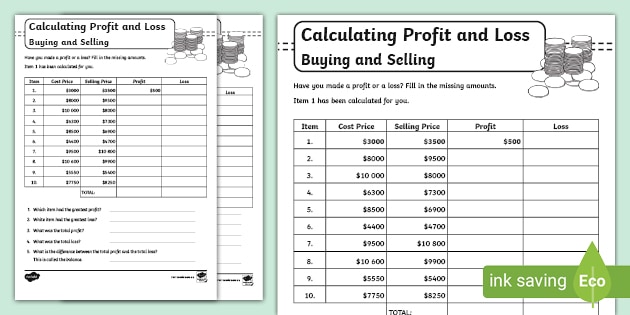

Pre-crafted templates use a time-saving option for developing a diverse series of files and files. These pre-designed formats and layouts can be used for different personal and expert tasks, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the content production process.

Earnings And Profits Calculation Worksheet

Earnings and profits computation practice guide

Solved Calculate the current earnings and profits (E&P) of | Chegg.com

Demystifying IRC Section 965 Math - The CPA Journal

Demystifying IRC Section 965 Math - The CPA Journal

Using a spreadsheet to calculate how to divide profits - YouTube

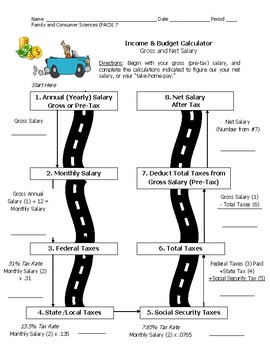

Taxes: Gross & Net Income Budget Calculation Worksheet by Elena Teixeira

https://egrove.olemiss.edu/cgi/viewcontent.cgi?article=1063&context=aicpa_assoc

Worksheets for computing E P are included in this practice aid beginning on page 13 E Ordering Sourcing of Distributions In determining the source of a

https://www.leoberwick.com/leo-berwicks-math-lesson-of-the-day-calculating-earnings-and-profits/

Ever wondered what earnings and profits are And how to properly calculate them Here s Leo Berwick s lesson on how to calculate earnings and profits

https://www.thetaxadviser.com/issues/2013/oct/kaiser-oct2013.html

In general a corporation s current year E P is calculated by making adjustments to its taxable income for the year for items that are treated

https://www.irs.gov/pub/irs-access/f5452_accessible.pdf

Worksheet for Figuring Current Year Earnings and Profits Date Incorporated Method of Accounting Retained Earnings Shown in Books Debit Credit Earnings

https://www.ftb.ca.gov/tax-pros/procedures/waters-edge-manual/chapter-7.pdf

Accumulated E P represents the sum of each year s current E P reduced by distributions 1 Calculation of E P Current E P begins with taxable income Revenue

Calculating Earnings Profits slide 2 of 4 Calculation generally begins with taxable income plus or minus certain adjustments cont d Subtract certain A corporation s E P is neither its accumulated taxable income nor its retained earnings for financial accounting purposes Rather E P is an

E P and accumulated E P The calculation of E P begins with taxable income and