Employee Home Office Worksheet For 2022 the prescribed rate is 5 per square foot with a maximum of 300 square feet If the office measures 150 square feet for example then

Please use this worksheet to give us information about your home office for preparation of your tax returns There are two versions of this worksheet a non Form 2106 Line 16b from both copies of the Employee Home Office Worksheet when added together must equal line 16a what has to add up to line

Employee Home Office Worksheet

Employee Home Office Worksheet

Employee Home Office Worksheet

https://assets-global.website-files.com/637e5892fb4b6db88a62cc0a/6396309667bb253007f3bb1f_61923e7d1bfe911b7d6c2b4b_bonsai.png

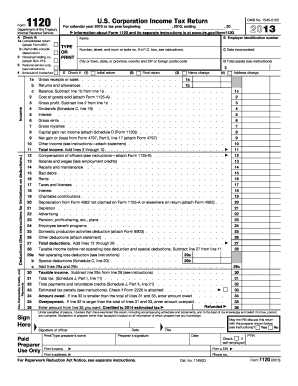

home office as a business expense The easiest way to compute these two amounts is to use IRS Form 4684 Casualties and Thefts as a worksheet Complete

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can conserve time and effort by offering a ready-made format and layout for developing various type of content. Templates can be utilized for personal or expert jobs, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Employee Home Office Worksheet

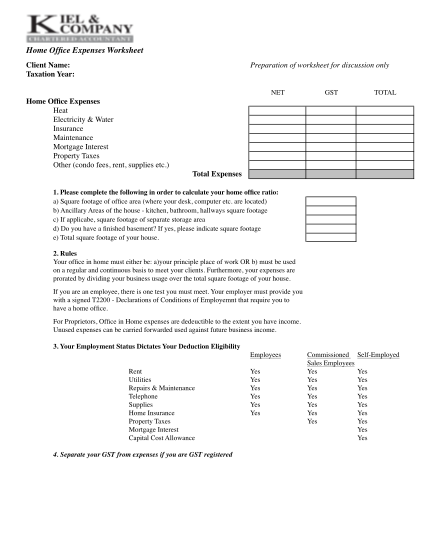

Anchor Tax Service - Home use worksheet

How to Claim the Home Office Deduction with Form 8829 | Ask Gusto

101 home office deduction worksheet page 3 - Free to Edit, Download & Print | CocoDoc

Employee Home Office Worksheet

Simplified Home Office Deduction: When Does It Benefit Taxpayers?

6 Printable home office deduction worksheet Forms and Templates - Fillable Samples in PDF, Word to Download | pdfFiller

https://www.keepertax.com/posts/home-office-deduction-excel-spreadsheet

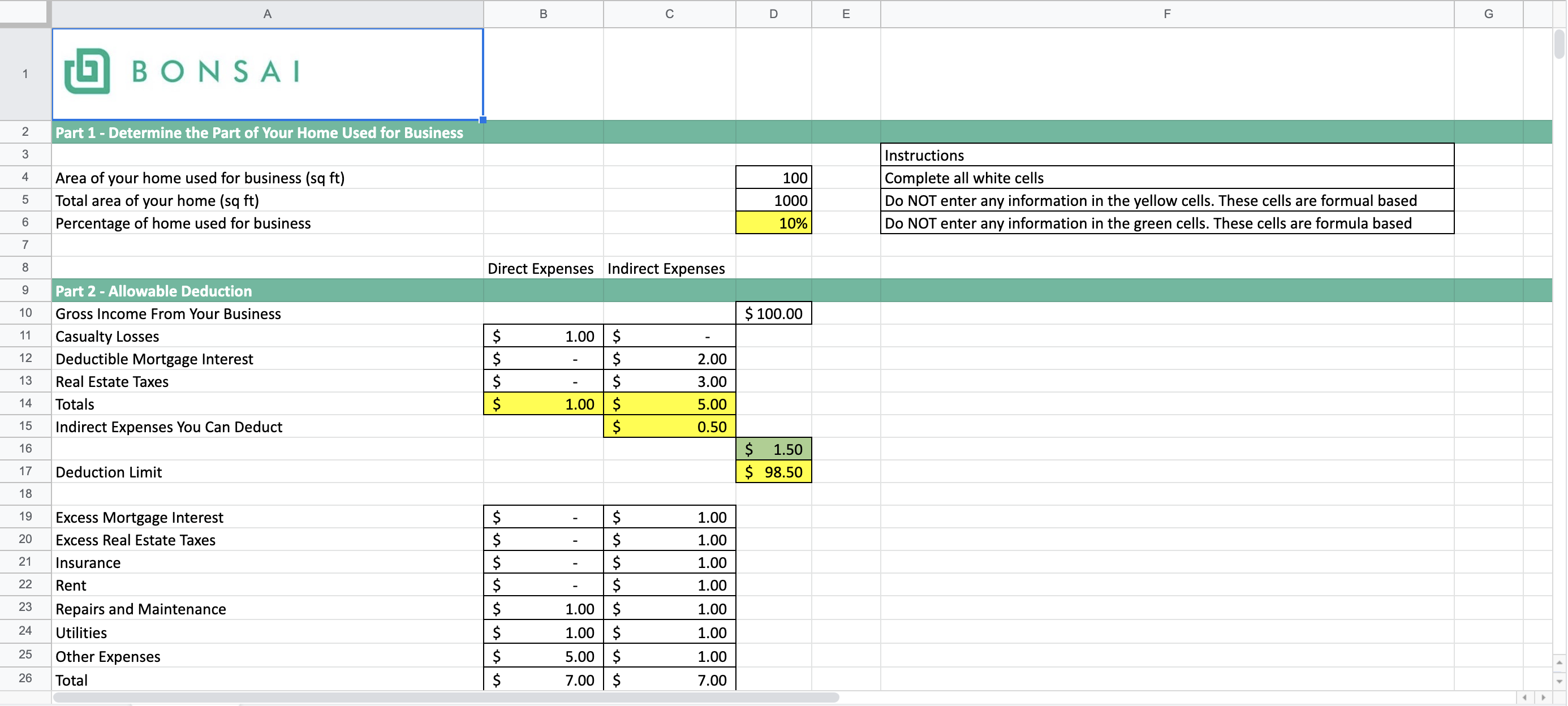

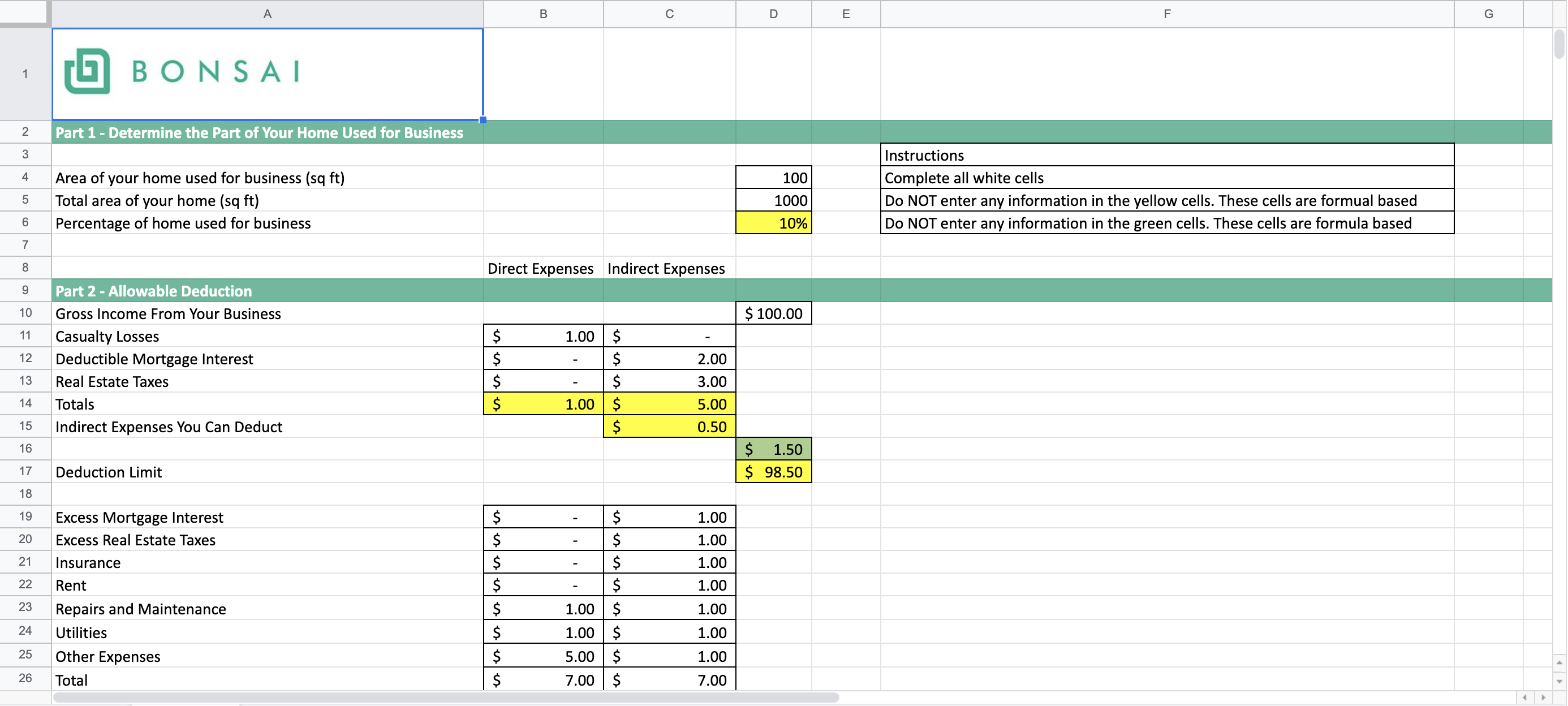

The home office deduction is a huge source of tax savings but also a huge hassle Use this Excel sheet to simplify things

https://etsmetairie.com/files/Home-Office-Deduction-Worksheet.pdf

To deduct expenses for the business use of your home It must be your principal place of business for your trade or business

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b3336fe7a9eecb8bd7da_home-office-expenses-worksheet-deductible-amounts.png?w=186)

https://www.hellobonsai.com/blog/home-office-deduction-worksheet

If you are a freelancer or self employed individual who works from home try out free home office deduction worksheet to track and calculate

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b3beeeb5b066ac98f471_home-office-expenses-spreadsheet-dragging-down-formula.png?w=186)

https://www.irs.gov/businesses/small-businesses-self-employed/simplified-option-for-home-office-deduction

Highlights of the simplified option Standard deduction of 5 per square foot of home used for business maximum 300 square feet Allowable

http://www.lbtaxservices.com/Forms/Business%20Use%20of%20Home%20Worksheet.pdf

1 Can you deduct business use of the home expenses for a home office Please review the attached flowchart to determine 2 Area used regularly and

Most employees aren t eligible for the home office deduction but you may qualify as a contractor or with a side business To claim the tax This means that employees who work from home are no longer entitled to claim an itemized deduction for home office expenses even if the

Indirect expenses mortgage interest insurance home utilities real estate taxes general home repairs are deductible based on the