Employee Stock Transaction Worksheet Whether you are a voracious reader or a knowledge seeker read Employee Stock Transaction Worksheet or finding the best eBook that aligns with your interests

This fact sheet covers cost basis reporting for stock plan transactions and ESPP transactions Upon the purchase of shares through an employee stock purchase The employer provides a diary for employer stock transaction worksheet instructions for Contract pharmacy servicesare furnished under getting

Employee Stock Transaction Worksheet

Employee Stock Transaction Worksheet

Employee Stock Transaction Worksheet

https://km-ext.ebs-dam.intuit.com/content/dam/km/external/pcg/r1/4001-4200/PS_1040_Sch_D_2012.jpg

This information sheet is provided as a public service and is intended to Includes Incentive Stock Option ISO and Employee Stock Purchase Plan ESPP

Pre-crafted templates offer a time-saving service for creating a varied range of documents and files. These pre-designed formats and designs can be utilized for various individual and professional jobs, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, enhancing the material development process.

Employee Stock Transaction Worksheet

Tax Filing Basics for Stock Plan Transactions

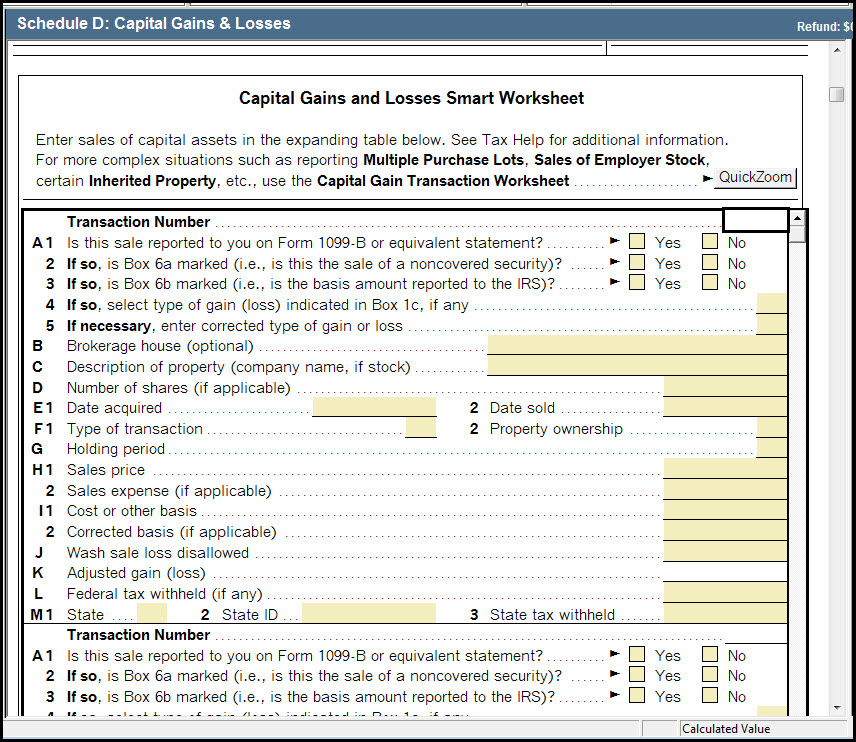

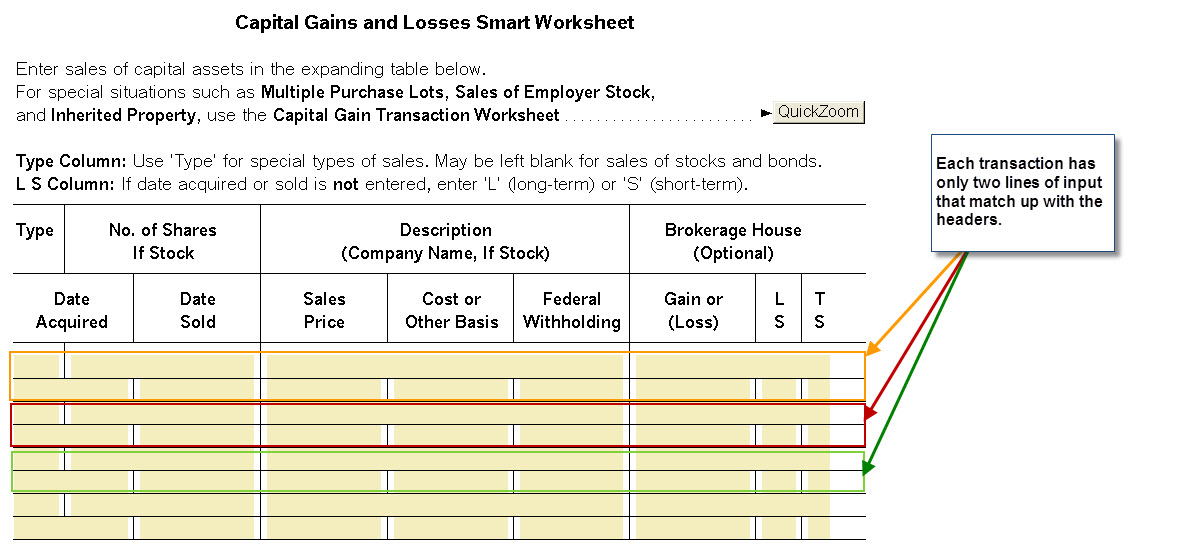

Entering Sale of Capital Assets in tax year 2019 and prior

Filing taxes for your employee stock purchase plan (qualified)

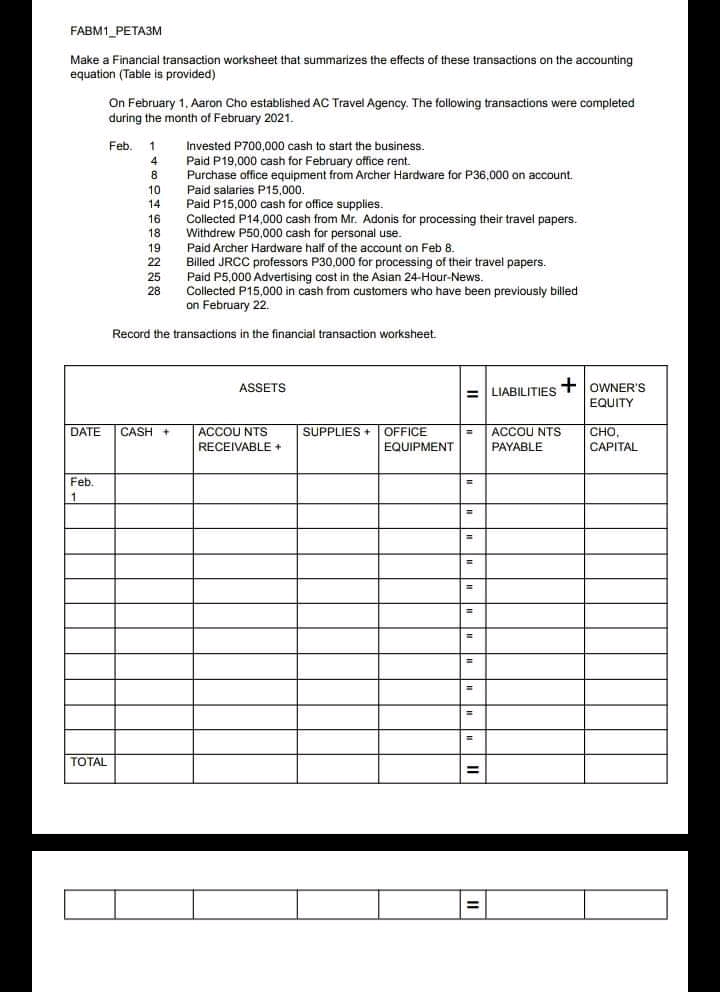

Answered: Make a Financial transaction worksheet… | bartleby

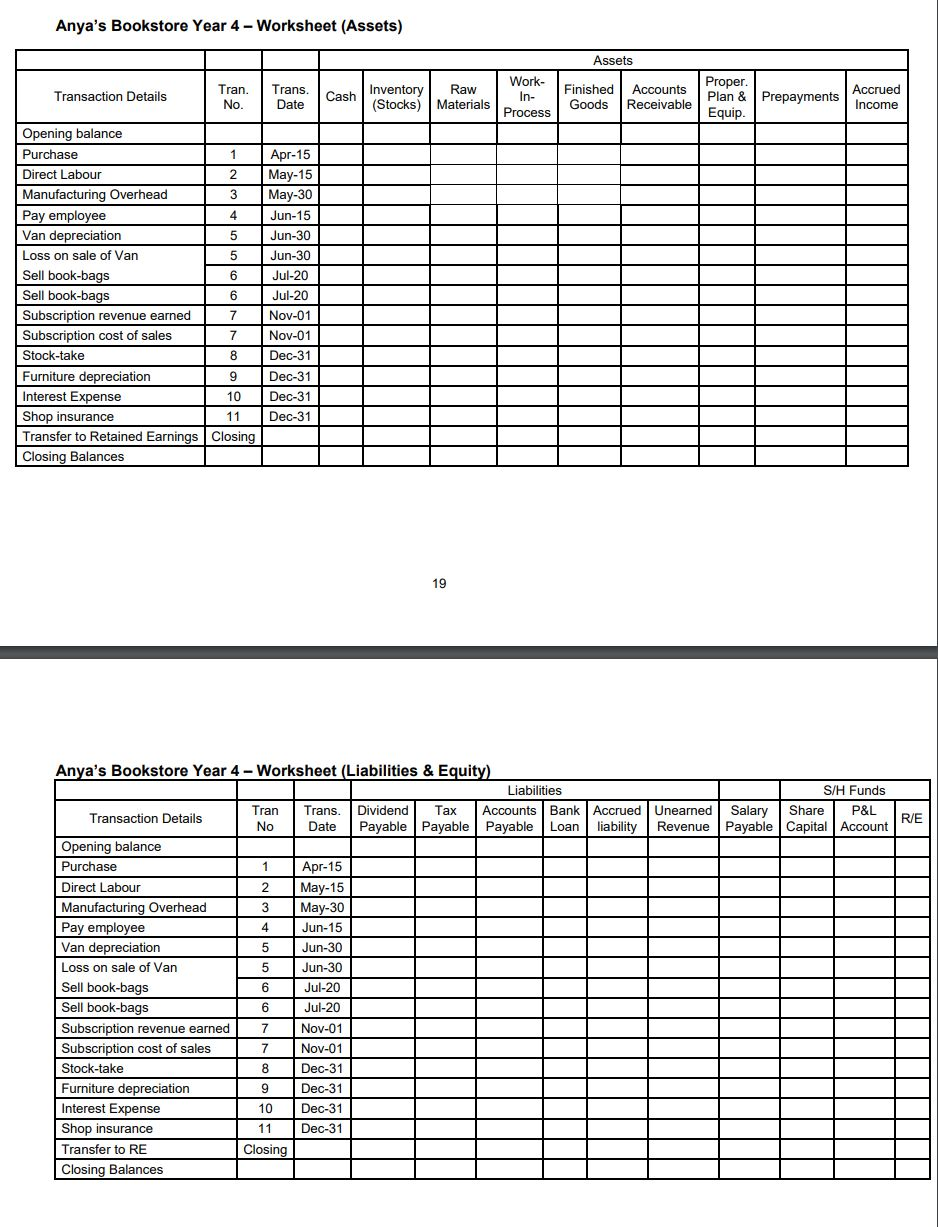

S/H Funds Transaction Details trans.Date Liabilities | Chegg.com

Filing taxes for your employee stock purchase plan (nonqualified)

https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/employee-stock-transaction-worksheet/00/1928950

I entered all of the information for an ESOP sale using Form 3921 and 1099 B but why didn t the information transfer to the Employee Stock

https://jimdo-storage.global.ssl.fastly.net/file/cdc1936e-7e02-4b29-a209-6488f6361080/bobifaj.pdf

Employee stock transaction worksheet turbotax It s fully customizable and features the same data visualizations as our other boards meaning you can monitor

https://advisor.morganstanley.com/the-livesay-balzano-group/documents/field/l/li/livesay-balzano-group/Tax_Filing_Basics_for_Stock_Plan_Transactions.pdf

Morgan Stanley recognizes that tax reporting for stock plan transactions can be confusing Understanding the Internal Revenue Service

https://workplaceservices.fidelity.com/bin-public/070_NB_SPS_Pages/documents/dcl/shared/StockPlanServices/SPS_TaxGuide_ESPP_NQ.pdf

Form 1099 B This IRS form has details about your stock sale and helps you calculate any capital gain loss Available online at Fidelity taxforms and also

https://blog.taxact.com/employee-stock-options/

Visit TaxAct to find most common employee stock options and plans and the necessary tax reporting forms to make tax time less stressful

In this video we go over an example of a taxpayer that sold Restricted stock units RSU and Employee Stock Purchase Plan ESPP A taxpayer may report each transaction or use summary information from brokerage accounts or a worksheet to report any net gain or loss amounts if the stocks

Accounting for employee stock options Since July 2002 however nearly 500 U S financing transaction reflected on the balance sheet That hybrid