Employer S Worksheet To Calculate Employee S Taxable Employer s worksheet to calculate employee s taxable income resulting from employer provided vehicle for calendar year 2021 Employee Description of vehicle

1 EMPLOYER S WORKSHEET TO CALCULATE EMPLOYEE S TAXABLE INCOME RESULTING FROM A EMPLOYER PROVIDED VEHICLE FOR THE YEAR ENDED 2 055 Amount added YES NO WORKSHEET TO CALCULATE INCOME FROM PERSONAL USE OF COMPANY VEHICLE EMPLOYER S WORKSHEET TO CALCULATE EMPLOYEE S TAXABLE INCOME RESULTING FROM EMPLOYER

Employer S Worksheet To Calculate Employee S Taxable

Employer S Worksheet To Calculate Employee S Taxable

Employer S Worksheet To Calculate Employee S Taxable

https://online.anyflip.com/tvqf/uije/files/mobile/2.jpg

Employer s Worksheet to Calculate Employee Taxable Income Resulting From Group Term Life Insurance In Excess of 50 000 Employee Name Employee s Age on

Templates are pre-designed files or files that can be used for different purposes. They can save time and effort by offering a ready-made format and layout for creating different sort of content. Templates can be used for individual or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Employer S Worksheet To Calculate Employee S Taxable

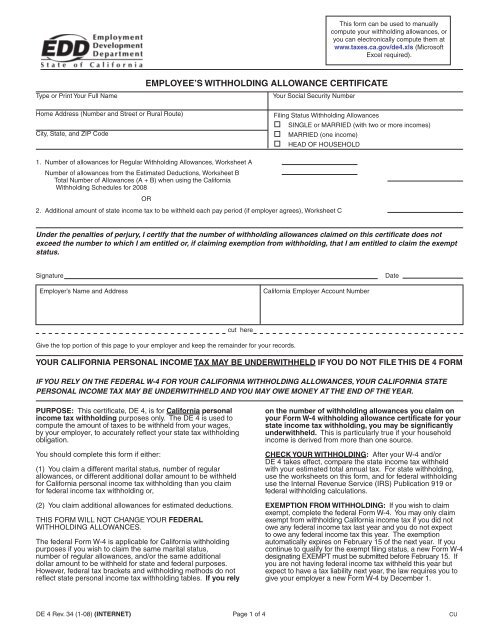

employee's withholding allowance certificate - SJSU Research

Withholding calculations based on Previous W-4 Form: How to Calculate

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)

W-4 Form: How to Fill It Out in 2023

:max_bytes(150000):strip_icc()/2023FormW-4-64302bb2a6504482bab1e847bbc4cb1a.jpg)

Form W-4: What It Is and How to File

How Is Social Security Taxed?

Estimated (Quarterly) Tax Payments Calculator

http://anyflip.com/tvqf/uije

Employer s worksheet to calculate employee s taxable income resulting from a employer provided vehicle for the year ended employee

https://www.irs.gov/pub/irs-pdf/p15b.pdf

It is a written plan that allows your employees to choose between receiving cash or taxable benefits in stead of certain qualified benefits for which the law

https://www.eidebailly.com/-/media/7a62b6583efa4d40b5e7f8f8260f1b06.ashx

This worksheet is to be completed after receiving the mileage information from the employee This worksheet is used to calculate the taxable income Please read

http://www.kongsandseib.com/uploads/5/4/3/1/54311427/annualleasevalueworksheet.pdf

The worksheet below will provide us with the information needed to calculate the value of the personal use portion of your automobile

https://pdf4pro.com/view/employer-s-worksheet-to-calculate-employee-s-47d5a9.html

EMPLOYER S WORKSHEET TO CALCULATE EMPLOYEE S TAXABLE INCOME RESULTING FROM A EMPLOYER PROVIDED VEHICLE FOR THE YEAR ENDED EMPLOYEE

Appendix A 2014 Employer s Worksheet to Calculate Employee s Taxable Income Resulting You re an ALE if you have about 50 full time employees however the taxable wages of all employees Employer s worksheet to calculate employee s taxable income resulting from employer provided vehicle for calendar year 2020

Where Publication 15 B Employer s Tax Guide to Fringe Benefits discusses withholding depositing and reporting requirements for taxable noncash fringe