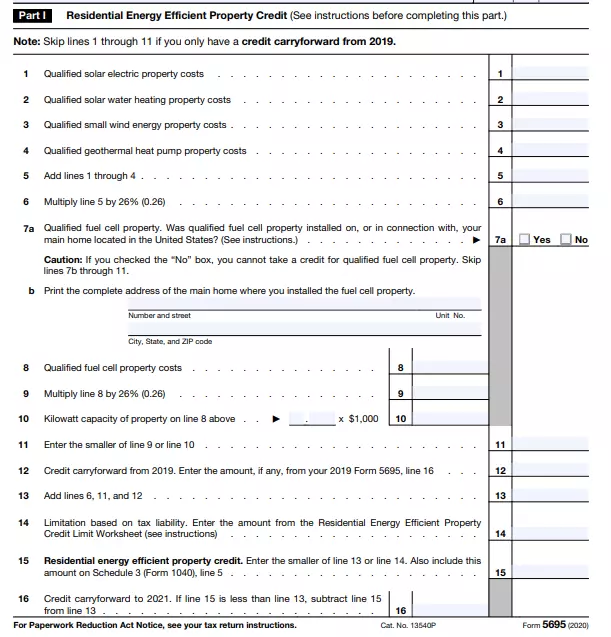

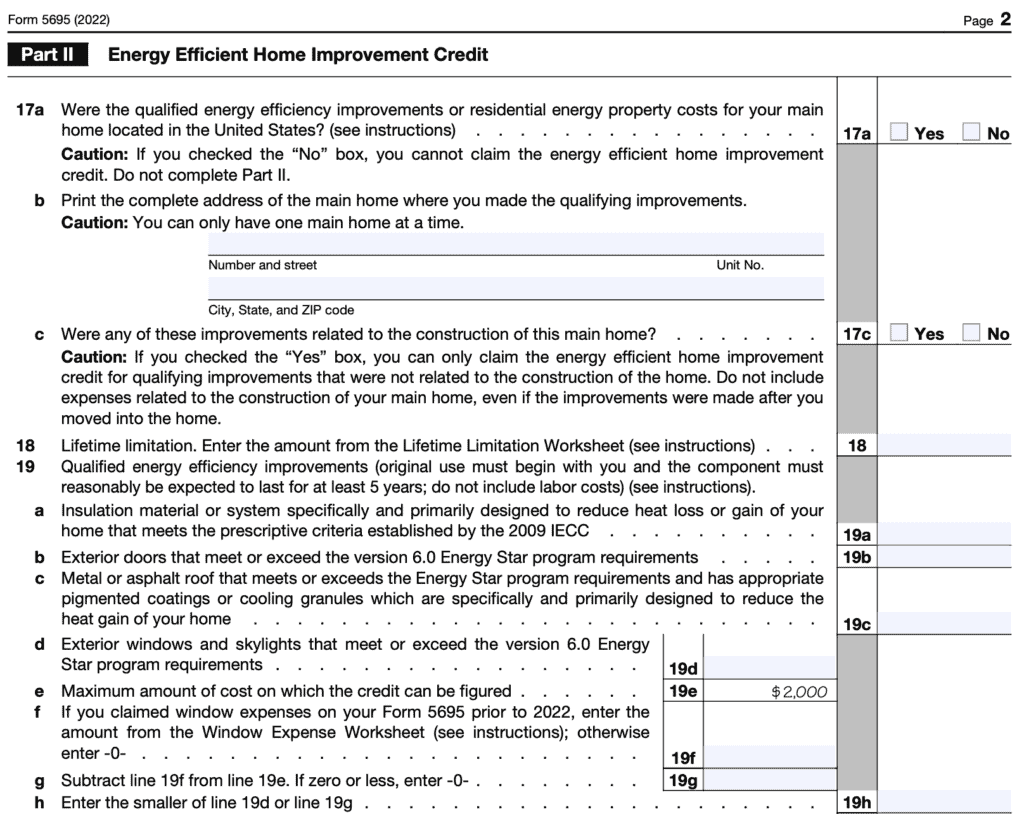

Energy Efficient Home Improvement Credit Limit Worksheet Taxpayers who believe they are entitled to a residential energy tax credit must complete and file Internal Revenue Service IRS Form 5695

Step 1 Calculate The Total Cost Of Your Solar Power System Step 2 Add Additional Energy Efficient Improvements Step 3 Calculate The Tax Credit Value This credit available through 2022 can reduce your tax bill for some of the costs you incur to make energy efficient improvements to your home

Energy Efficient Home Improvement Credit Limit Worksheet

Energy Efficient Home Improvement Credit Limit Worksheet

Energy Efficient Home Improvement Credit Limit Worksheet

https://www.pdffiller.com/preview/100/9/100009198/large.png

Energy Efficient Home Improvement Tax Credits Larry Pon CPA 6 6K Unrecaptured Section

Templates are pre-designed documents or files that can be used for various functions. They can conserve effort and time by providing a ready-made format and design for producing various sort of content. Templates can be used for individual or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Energy Efficient Home Improvement Credit Limit Worksheet

IRS Form 5695 Instructions - Residential Energy Credits

IRS Form 5695 walkthrough (Residential Energy Upgrades) - YouTube

IRS Form 5695 Instructions - Residential Energy Credits

How To Fill Out IRS Form 5695 to Claim the Solar Tax Credit

Steps to Complete IRS Form 5695 | LoveToKnow

How to Claim the Solar Panel Tax Credit (ITC)

https://www.irs.gov/pub/irs-pdf/f5695.pdf

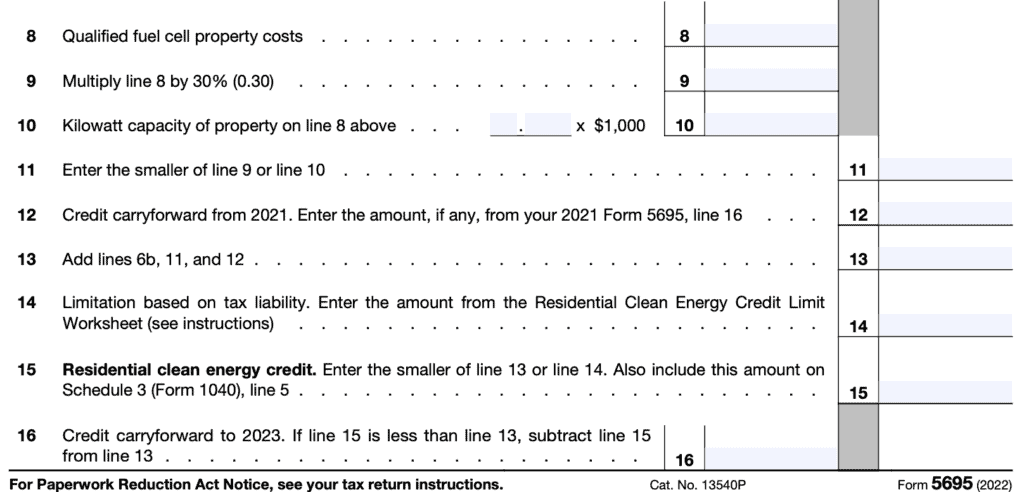

Enter the amount from the Residential Clean Energy Credit Limit Worksheet 30 Energy efficient home improvement credit Enter the smaller of line 28 or

https://www.energy.gov/sites/default/files/2023-02/Tax%20Credit%20Table.pdf

Credits have an annual limit See the table A More information on the energy efficient home improvement credit and residential clean energy property credit

https://everlightsolar.com/instructions-for-filling-out-irs-form-5695/

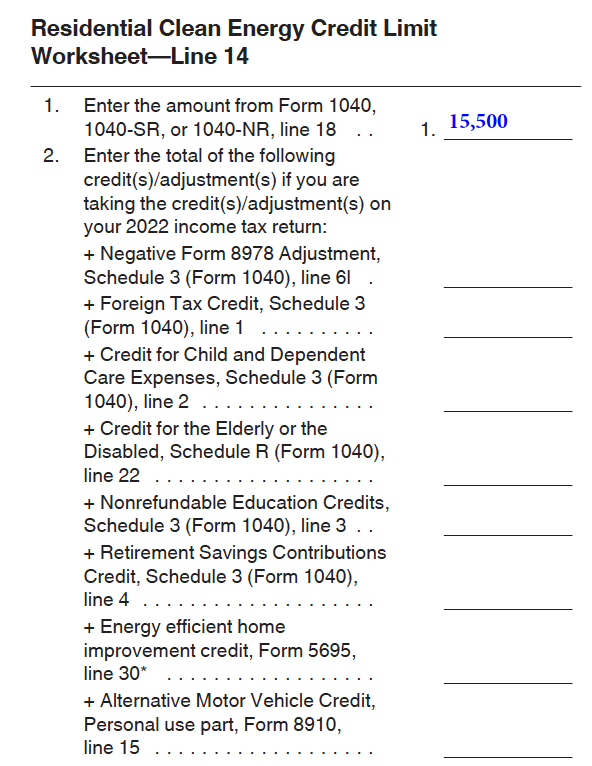

Complete the worksheet on page 4 of the instructions for Form 5695 to calculate the limit on tax credits you can claim If you are claiming tax credits for

https://www.taxact.com/support/797/2022/form-5695-residential-energy-credits

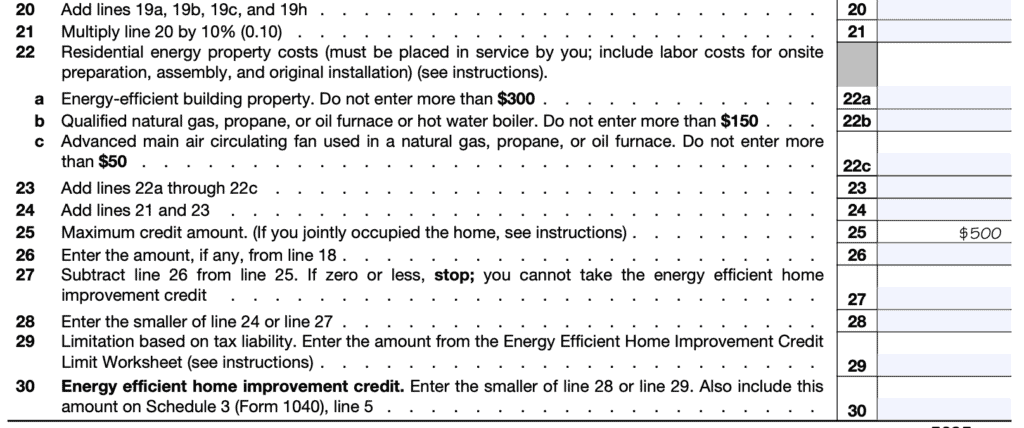

Energy Efficient Home Improvement Credit Part II A total combined credit limit of 500 for all tax years after 2005 A combined credit limit of 200 for

https://www.communitytax.com/tax-form/form-5695/

Use the information on page six of the Form 5695 instruction worksheet to calculate your credit limit then follow the directions on line 30 to transfer your

The IRS offers two different tax incentives for making energy efficient home improvements and major infrastructure overhauls to your home The federal tax credits for energy efficiency were again extended in 2021 If you made qualifying home improvements since 2017 you can claim them on your

Thus the maximum total yearly energy efficient home improvement credit amount may be up to 3 200 See Q 21 at the end of these FAQs for a