Erc Worksheet 1 2020 The IRS has released the new 941 Payroll Tax Form for 2020 In the new form there is a new

New lines added for the 2nd quarter 2020 Worksheet 1 is available on page 20 of the instructions for Form 941 We ve put together a spreadsheet to help you Worksheet 1 included in the instructions to Form 941 is used to calculate the Nonrefundable Portion and Refundable Portion of the ERC b The

Erc Worksheet 1 2020

Erc Worksheet 1 2020

Erc Worksheet 1 2020

https://blog.taxbandits.com/wp-content/uploads/2020/10/Screen-Shot-2020-10-13-at-1.17.45-PM-1024x518.png

No entry is allowed on this line for the 2020 third and fourth quarter Report on line 25 the amount shown on Worksheet 1 Step 3 line 3d

Templates are pre-designed files or files that can be used for different functions. They can conserve time and effort by supplying a ready-made format and layout for creating various sort of content. Templates can be utilized for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Erc Worksheet 1 2020

.jpg)

Updated Form 941 Worksheet 1, 2, 3 and 5 for 2023 | Revised 941

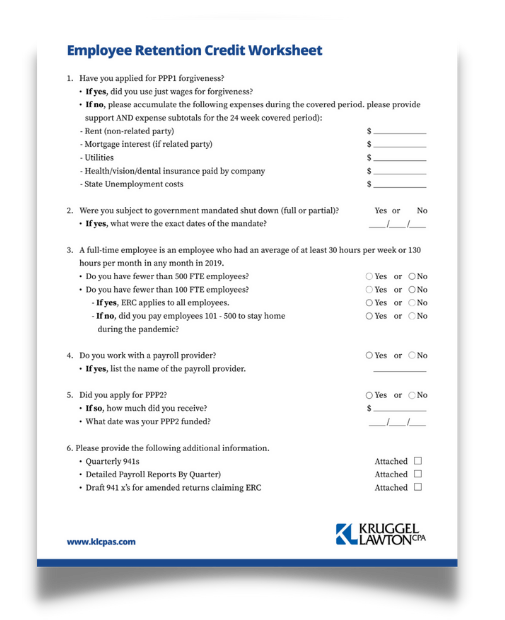

How to Unlock the Employer Retention Credit (ERC) for Your Business or Nonprofit | Kruggel Lawton CPAs

Employee Retention Credit (ERC) Calculator | Gusto

Employee Retention Tax Credit on 941

A No-Worries Guide to Complete Form 941 Worksheet 1 for 2020 | by TaxBandits - Payroll & Employment Tax Filings | Modern Payroll | Medium

![How To Fill Out 941-X For Employee Retention Credit [Stepwise Guide] | StenTam how-to-fill-out-941-x-for-employee-retention-credit-stepwise-guide-stentam](https://images.surferseo.art/bfce0c6e-3848-46ee-8e10-d8ca5813ab5d.png)

How To Fill Out 941-X For Employee Retention Credit [Stepwise Guide] | StenTam

https://www.payroll.org/docs/default-source/2020-forms-and-pubs/20k01-i941-093020.pdf?sfvrsn=b68d4540_4

Between January 1 2020 and April 1 2020 or send a Enter the nonrefundable portion of the employee retention credit from Worksheet 1 Step 3 line 3h

https://www.irs.gov/pub/irs-pdf/i941x.pdf

December 27 2020 therefore Worksheet 1 in those Instructions for 2020 enter the total corrected amount for all employees in column 1

.jpg?w=186)

https://www.taxbandits.com/payroll-forms/features/form-941-worksheet-1/

You should potentially use Worksheet 1 when claiming credits under the CARES Act and Employee Retention Credit for the second quarter of 2020 and beyond

https://erctoday.com/ertc-irs-form-941/

A business must have had at least one employee in 2020 or 2021 to qualify Step 1 in Worksheet 1 is where you report Social Security tax

https://medium.com/modern-payroll/new-form-941-worksheet-1-for-2020-with-irs-covid-19-changes-44b1d2b04189

A complete guide for 941 filers to fill out Form 941 Worksheet 1 Nowadays changes are happening in the blink of an eye A few months ago

employee retention credit reported on lines 11c and 13d are figured on Worksheet 1 Information about the credits on the Q2 941 can be found with the Here is a downloadable Worksheets 1 to 5 for preparing or amending your 941 X forms to claim ERC Employee Retention Credit and FFCRA

You must use this worksheet if you claimed the employee retention credit for wages paid after March 12 2020 and before July 1 2021 on