Erp Phase 2 Worksheet Discussion on completing the ERP2 application form and guidance on where advanced tax and

Tool can be found in the ERP Phase 2 Handbook 243 B Form FSA 521 A ERP Phase 2 Allowable Gross Revenue Worksheet Depending on the farmer s 2021 ERP payments Phase 1 and Phase 2 combined This includes the application allowable gross revenue worksheet and an ERP Phase 2 Tool

Erp Phase 2 Worksheet

Erp Phase 2 Worksheet

x-raw-image:///4f935b47c91d5d16d8323fef3f72f2d18e4d7eae0dd2086e70f9261ea4b072d3

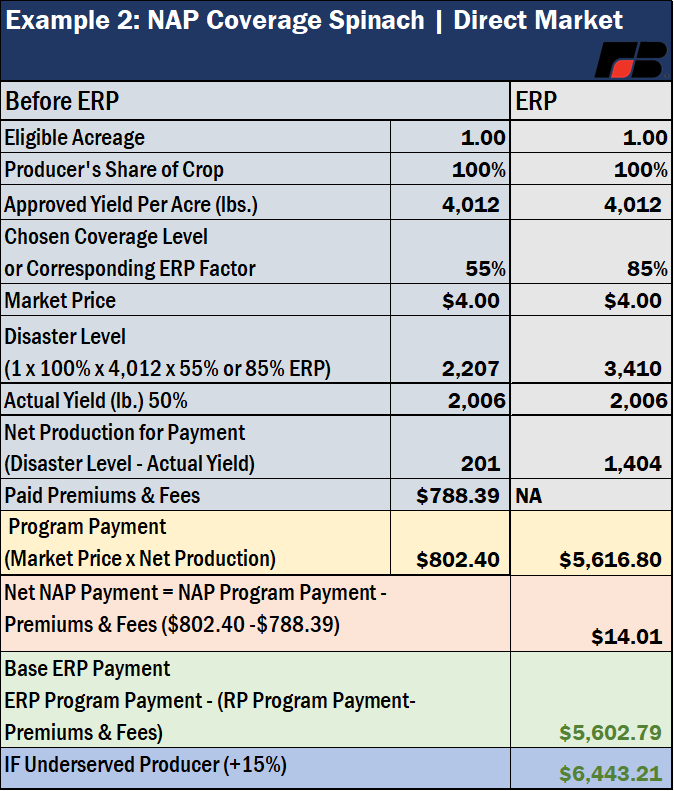

The Emergency Relief Program ERP Phase 2 is a revenue based program that relies on tax and financial records to calculate the losses a farmer

Pre-crafted templates use a time-saving option for producing a diverse series of documents and files. These pre-designed formats and layouts can be utilized for numerous individual and expert tasks, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, enhancing the content development process.

Erp Phase 2 Worksheet

Tax Issues & Applying for ERP Phase 2 Benefits

Tax Issues & Applying for ERP Phase 2 Benefits

Emergency Relief Program (ERP) Phase 2 Update 1/13/23 - ProAg Service & Insurance

USDA Farm Service Agency:

Disaster Assistance Resources - National Sorghum Producers

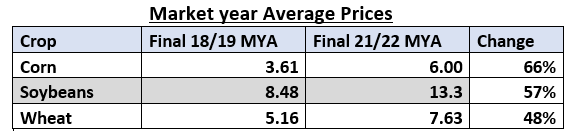

From WHIP+ to ERP: A New Name for 2020-2021 Ad Hoc Disaster Assistance | Market Intel | American Farm Bureau Federation

https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/emergency-relief-program/docs/erp_tool_version_4.xlsm

EMERGENCY RELIEF PROGRAM ERP PHASE 2 ALLOWABLE GROSS REVENUE WORKSHEET 1 1 Applicant Name 2 Application Number Go to Gross Rev Worksheet 3 4 3

https://www.farmers.gov/sites/default/files/2023-05/erp2-application-050123.pdf

If Gov t payments 125 000 this form is used to request waiver The income values must be certified by either a CPA or Attorney this is by

https://www.farmers.gov/sites/default/files/documents/farmersgov-parp-erp2-guide-for-new-customers.pdf

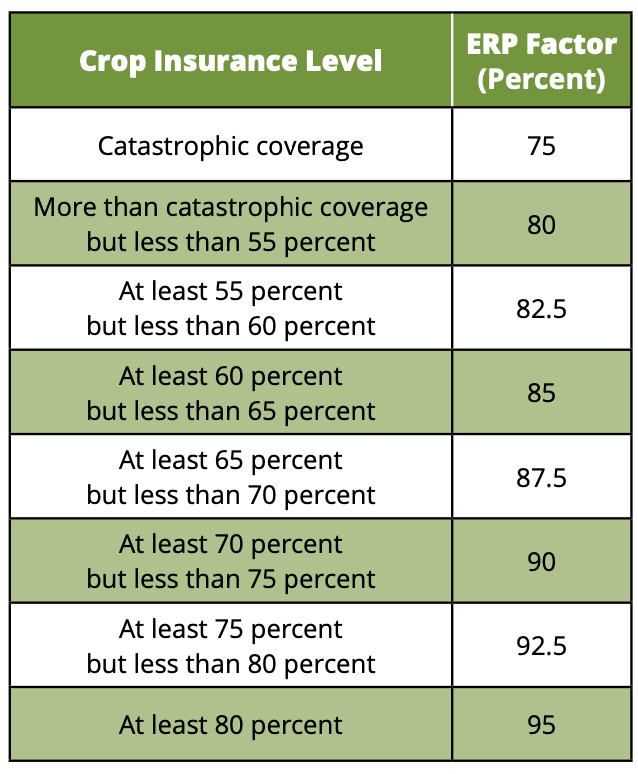

ERP Phase Two provides payments if you suffered eligible revenue losses due to qualifying disaster events such as a wildfire hurricane flood

https://cap.unl.edu/webinars/2023-erp-parp-webinar.pdf

The ERP Phase 2 Tool is an Excel spreadsheet that can also help Emergency Relief Program ERP 2 Page 17 The application FSA 521 Emergency Relief Program

https://www.agweb.com/opinion/we-have-fact-sheet-phase-2-erp

We finally found the Fact Sheet for Phase 2 of the Emergency Relief Program This post reviews the details

Application means the ERP Phase 2 application form Aquaculture means any 1 Form AD 2047 Customer Data Worksheet for new customers or existing Form AD 2047 Customer Data Worksheet Form CCC 902 Farm Operating Plan ERP for Phase 1 and Phase 2 combined for a program year if their average

The ERP is a program administered by the U S Department of Agriculture USDA which provides relief payments to commodity and specialty crop