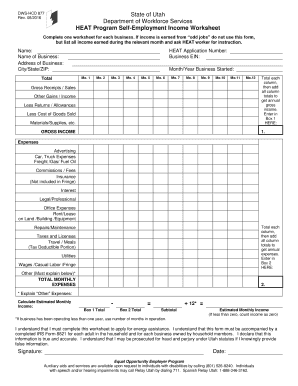

Fha Self Employed Income Calculation Worksheet MGIC s self employed borrower and income analysis calculators are editable and auto calculating worksheets for cash flow analysis and updated for the 2022

Complete all White colored fields For additional documentation and calculation information hold your cursor over the red triangle located in the uper right Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily Use our PDF worksheets to total numbers by hand

Fha Self Employed Income Calculation Worksheet

Fha Self Employed Income Calculation Worksheet

Fha Self Employed Income Calculation Worksheet

https://www.pdffiller.com/preview/100/430/100430089/large.png

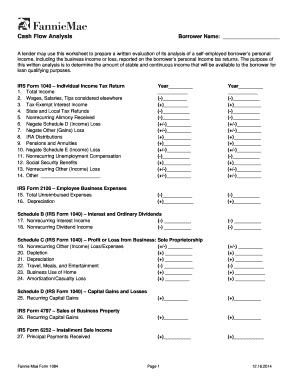

Cash Flow Analysis This self employed income analysis and the included descriptions generally apply to individuals

Templates are pre-designed documents or files that can be used for numerous purposes. They can save effort and time by providing a ready-made format and design for creating various type of content. Templates can be used for personal or professional projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Fha Self Employed Income Calculation Worksheet

NPF Income Calculator Guide

NPF Income Calculator Guide

Self Employed Income Worksheet Form - Fill Out and Sign Printable PDF Template | signNow

FHA Self-Employment Income Calculation Worksheet Job Aid

Fannie Mae Self Employed Income Worksheet - Fill and Sign Printable Template Online

Self-Employed Borrower: Personal 1040 with Schedule F (Farm)

https://www.franklinamerican.com/wiki/_media/public_extranet/wholesale_forms_general/fha_self-employment_income_calculation_worksheet_job_aid_013120.pdf

This job aid provides detailed instructions for completing the FHA Self Employment Income Calculation Worksheet The FHA Self Employment Income

https://enactmi.com/self-employed-borrower-calculators

That s why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self employed borrower s average monthly income

https://www.hud.gov/sites/documents/4155-1_4_SECD.PDF

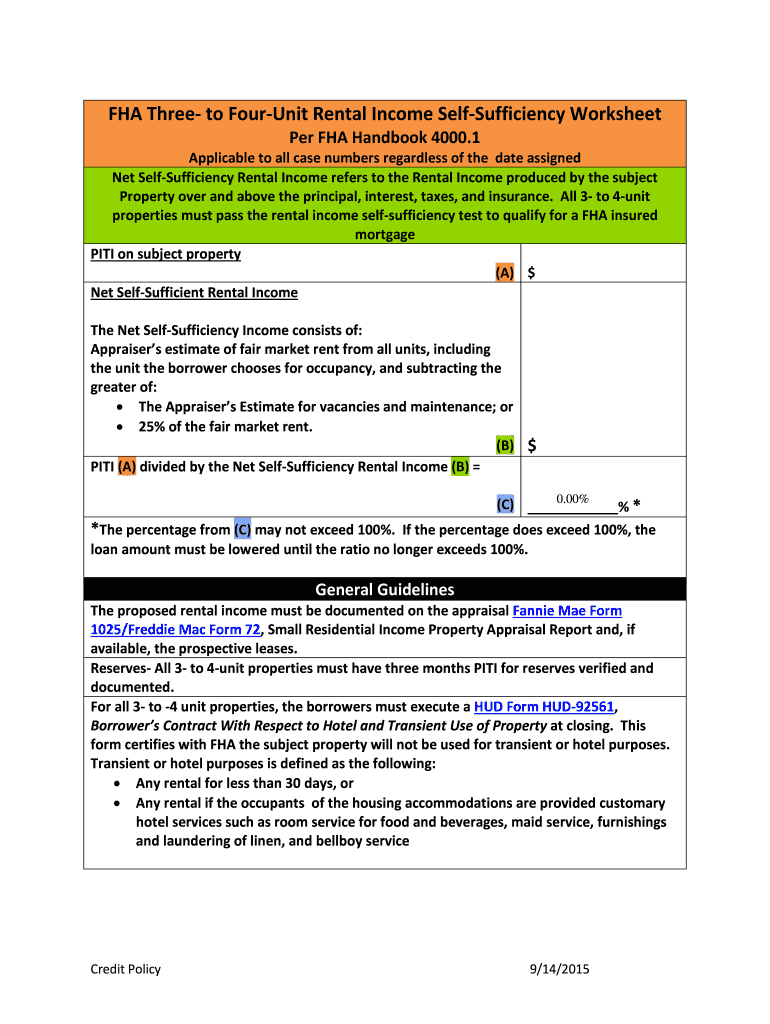

A borrower with a 25 or greater ownership interest in a business is considered self employed for FHA loan underwriting purposes 4155 1 4 D

https://www.homebridgewholesale.com/wp-content/uploads/2022/01/2022-Income-Calculation-Worksheets-1-27-22.xlsx

FHA MUST use the lesser of the calculations per FHA 4000 1 32 The average SELF EMPLOYMENT C CORP INCOME 1120 50 51 52 53 54 BORROWER 55 56

https://www.hud.gov/sites/dfiles/OCHCO/documents/2022-09hsgml.pdf

Calculate gross Self Employment Income by using the lesser of the average gross Self Employment Income earned over the previous two years

FNMA Self Employed Income Calculations CU Mortgage Direct PROCESSING CHECKLIST Even if rental income he not used as qualifying income if the subject task is income related to self employment The purpose of this written analysis is Note A lender may use Fannie Mae Rental Income Worksheets Form 1037 or Form 1038

No FHA does not have a required form to calculate self employment income Q What does FHA consider declining income and how should it be