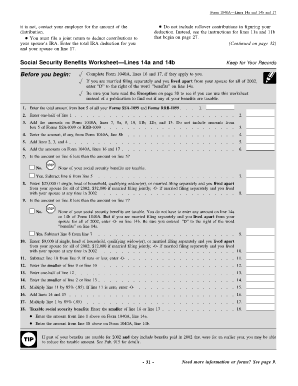

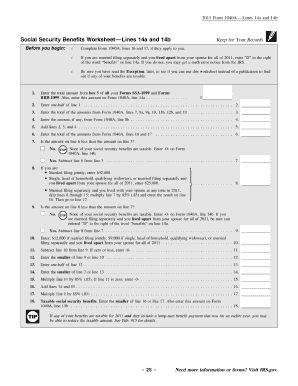

Form 1040 Social Security Worksheet 2022 Amount of social security benefits from Federal Form 1040 or 1040 SR line MODIFICATION FOR TAXABLE SOCIAL SECURITY INCOME WORKSHEET STEP 1 Eligibility

The reportable Social Security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040 SOCIAL SECURITY WORKSHEET 1 Enter the Use this step by step guide to fill out the 1040 social security worksheet 2014 2018 form swiftly and with ideal accuracy Find out other 1040 social security

Form 1040 Social Security Worksheet 2022

Form 1040 Social Security Worksheet 2022

Form 1040 Social Security Worksheet 2022

https://www.pdffiller.com/preview/6/963/6963800/large.png

The worksheet Wks SSB 1 WK SSB in Drake15 and prior is generated in a return when you have Social Security benefits entered on screen SSA that are

Templates are pre-designed documents or files that can be utilized for various purposes. They can save effort and time by providing a ready-made format and layout for producing different type of material. Templates can be utilized for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Form 1040 Social Security Worksheet 2022

Fillable Social Security Benefits Worksheet - Fill and Sign Printable Template Online

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

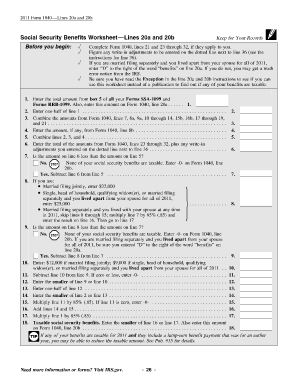

Social Security Benefits Worksheet - Lines 20a and 20b

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Irs Form 703 - Fill Out and Sign Printable PDF Template | signNow

1040 (2022) | Internal Revenue Service

https://www.irs.gov/instructions/i1040gi

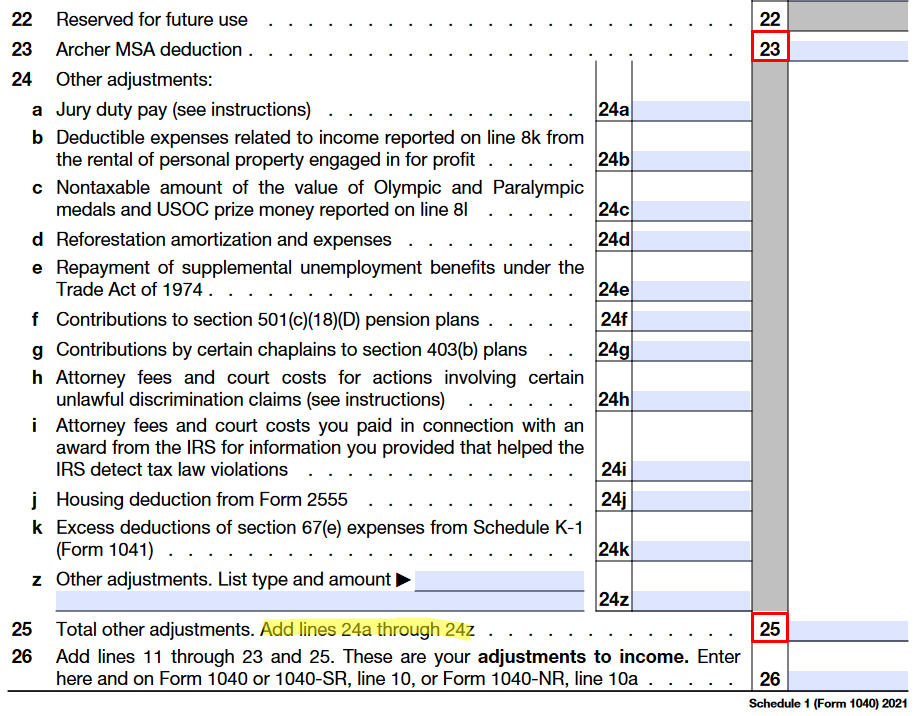

Accrued leave payment Social Security Benefits Worksheet Lines 6a and 6b Form 4137 Line 6 Unreported Social Security and Medicare Tax From Form 8919

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The worksheet provided can be used to determine the exact amount Social Security worksheet for Form 1040 Social Security worksheet for Form 1040A The file

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

Scroll down and click Form 1040 Taxable Social Security Social Security This worksheet is based on the worksheet in IRS Publication 915 Social Security and

https://pdfliner.com/social_security_benefits_worksheet_lines_20a_and_20b

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-12/Social%20Security%20Worksheet_w.pdf

2022 Modification Worksheet Taxable Social Security Income Worksheet Enter Taxable amount of social security from Federal Form 1040 or 1040 SR line 6b

form online 01 Edit your social security benefits worksheet for 2018 taxes online What percentage of Social Security is taxable in 2022 The OASDI tax rate The purpose of a taxable social security worksheet is to calculate the amount of Social Security benefits that may be subject to federal income tax The

If you are filing separately enter your spouse s Social Security number in You do not file a 2022 Form NJ 1040 and Your New Jersey gross income for