Form 1065 Line 20 Other Deductions Worksheet Line 20 Other Deductions Description ACH FEES ADVERTISING ALLOCATED WAGES Statement 3 Form 1065 Schedule M 2 Line 4 Other Increases

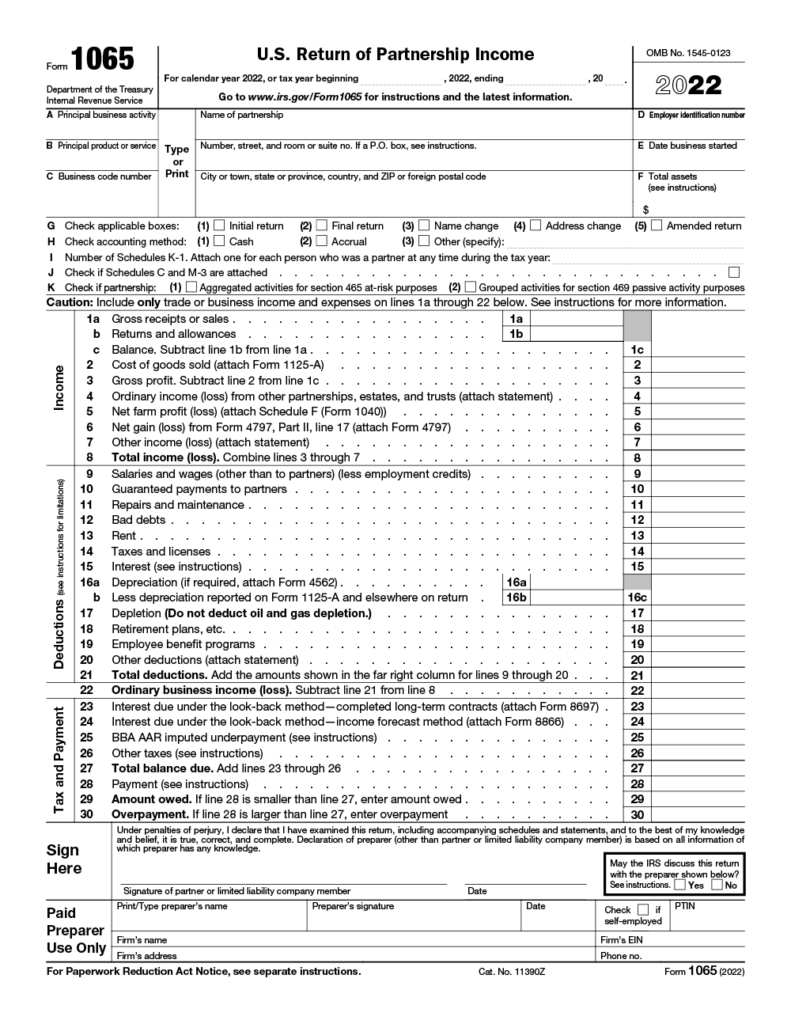

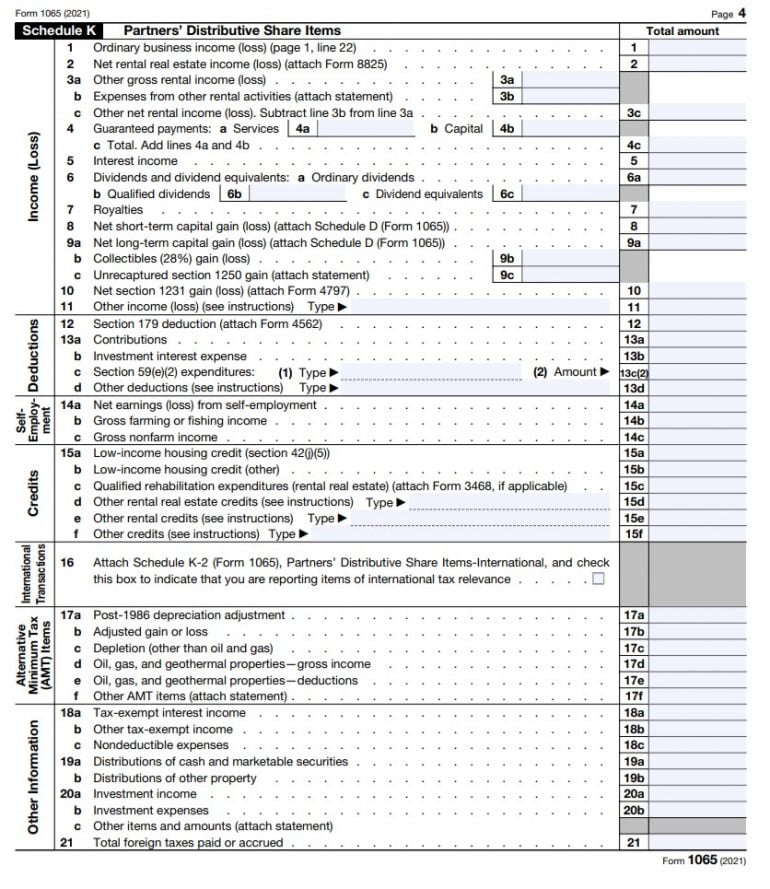

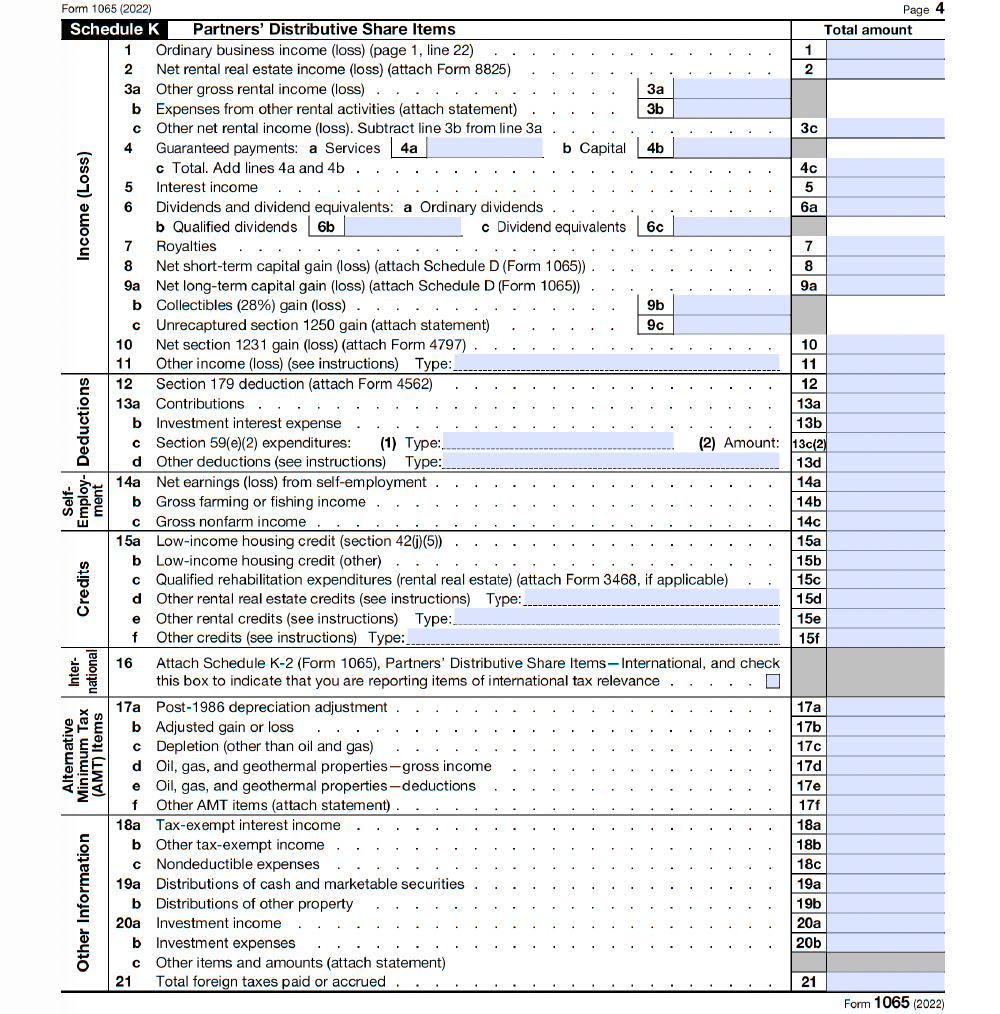

All items providing information used to figure credits at the partner level on Form 3468 and credit recapture items were moved to line 20c Other Information 20 20 Other deductions attach statement 21 22 Total deductions Add the amounts shown in the far right column for lines 9 through 20 Ordinary business

Form 1065 Line 20 Other Deductions Worksheet

Form 1065 Line 20 Other Deductions Worksheet

Form 1065 Line 20 Other Deductions Worksheet

https://lili.co/wp-content/uploads/2023/02/Form_1065_Page_1_1000x1294-791x1024.png

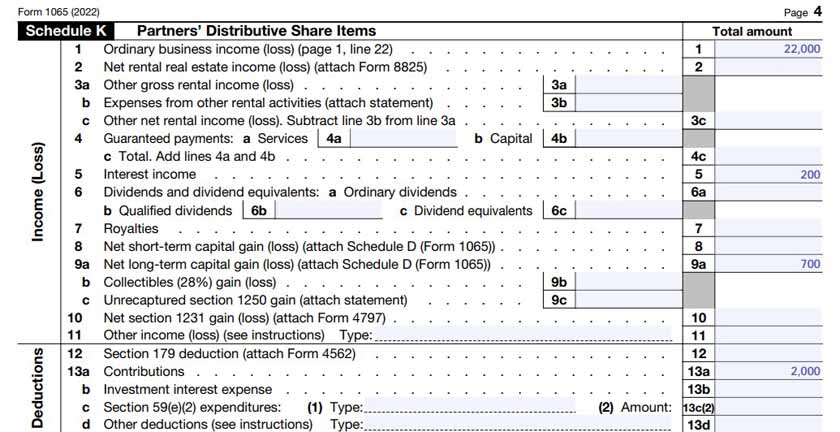

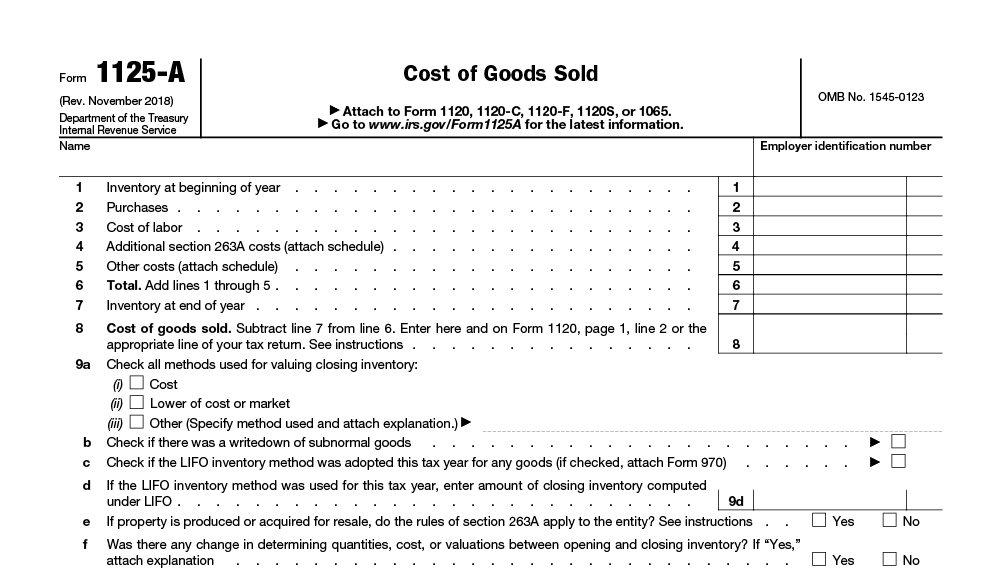

For Form 4797 line 27 and other items to which section 1252 applies See the Schedule 1 Form 1040 instructions for line 20 to figure your IRA deduction

Pre-crafted templates offer a time-saving solution for producing a diverse series of documents and files. These pre-designed formats and layouts can be utilized for various personal and expert jobs, including resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the content development procedure.

Form 1065 Line 20 Other Deductions Worksheet

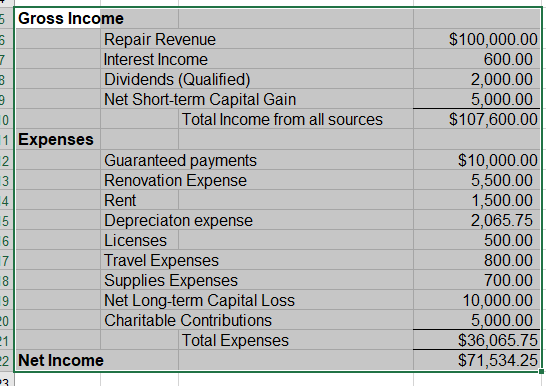

Please use the following information to complete the | Chegg.com

How to fill out an LLC 1065 IRS Tax form

Form 1065 Step-by-Step Instructions (+Free Checklist)

Form 1065 Instructions: U.S. Return of Partnership Income

IRS Form 1065 Instructions: Step-by-Step Guide - NerdWallet

Form 1065 Step-by-Step Instructions (+Free Checklist)

https://www.irs.gov/pub/irs-pdf/f1065.pdf

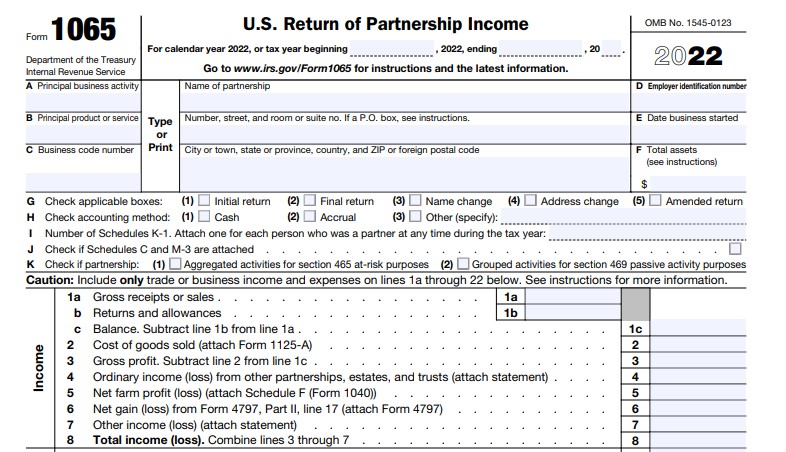

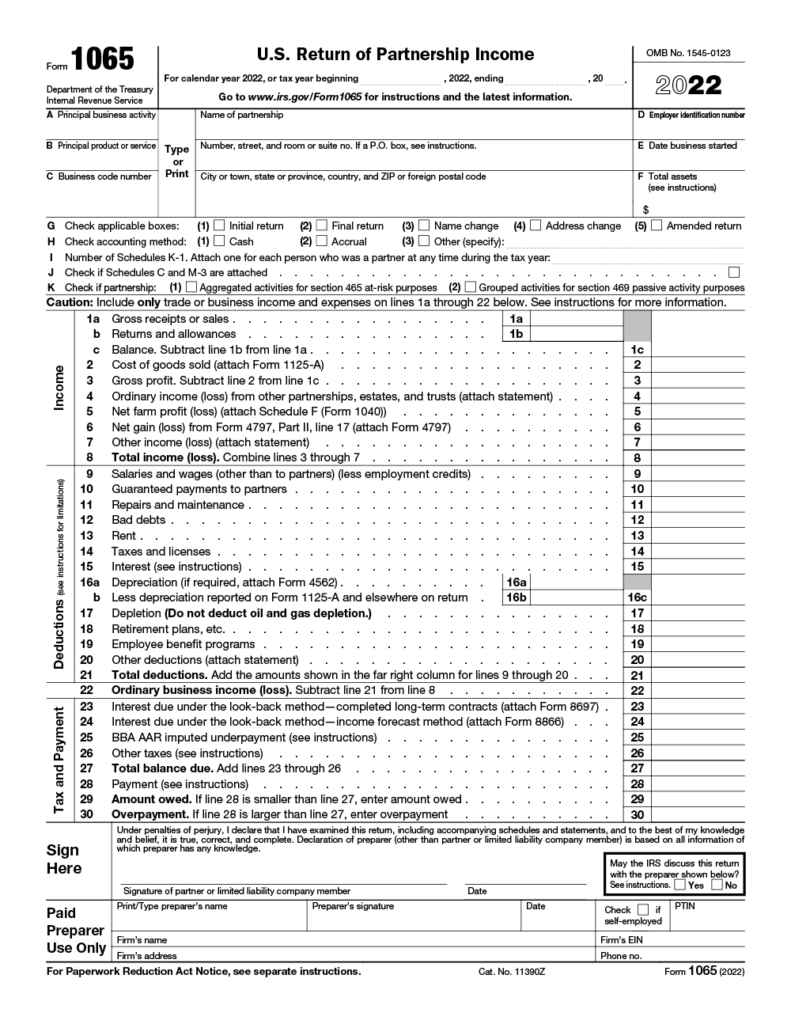

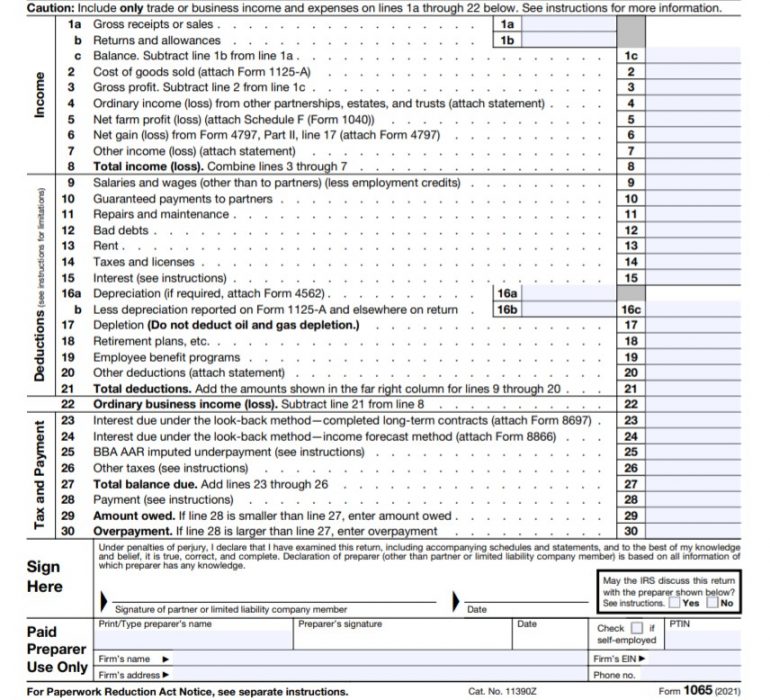

Caution Include only trade or business income and expenses on lines 1a through 22 below See instructions for more information Income 1a Gross receipts or

https://www.taxact.com/support/1403/2022/form-1065-other-deductions-or-expenses

Other deductions or expenses that do not conform to the separate lines for deductions on Form 1065 U S Return of Partnership Income are reported on Line 20

https://lili.co/taxes/form-1065

This is where line 20 Other deductions comes in If you need to include If you need to include expenses on line 20 attach an itemized statement of the

https://support.taxslayerpro.com/hc/en-us/articles/360009172974-Schedule-K-1-Form-1065-Tax-Exempt-Income-Non-Deductible-Expenses-Distributions-and-Other-Items-including-Section-199A-entries-

Line 20AF Excess business interest Amounts reported in Box 20 Code AF represent the business interest that was subject to a business

https://www.nerdwallet.com/article/small-business/form-1065

Form 1065 is an informational tax form used to report the income gains losses deductions and credits of a partnership or LLC but no taxes

If the partner s Federal Schedule K 1 Form 1065 includes capital gain loss complete line 19 and line 20 If the partner s Federal Schedule K 1 Form 1065 1 Enter the amount from federal Form 1065 line 1c of summing your gains and losses from sales of other asset backed securities not reported on line 20

Do not enter them on federal Form 8582 Include the amount on line 12 in the Itemized Deduction Worksheet Worksheet A 4 Gifts to Charity in the Form