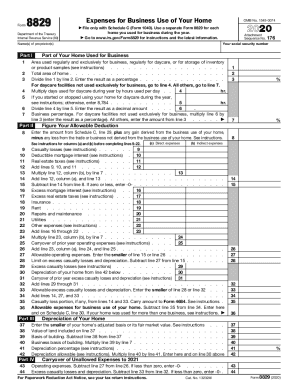

Form 8829 Asset Entry Worksheet Form 8829 Worksheet Check out how easy it is to complete and eSign documents form 8829 asset entry worksheet business use of home simplified method form

Instead complete the worksheet in Pub 587 All of the expenses for business use of your home are properly allocable to inventory costs Instead figure these Have questions on form 8829 Asset Entry Worksheet Working on depreciation for use for business using our home

Form 8829 Asset Entry Worksheet

Form 8829 Asset Entry Worksheet

Form 8829 Asset Entry Worksheet

https://kb.drakesoftware.com/Site/Uploads/Images/12513%20image%203.jpg

This is an important part of Form 8829 where you can calculate the total home business expense deduction Firstly you need to enter operating expenses as

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can conserve time and effort by supplying a ready-made format and layout for producing different type of content. Templates can be used for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Form 8829 Asset Entry Worksheet

Instructions Form 8829 2016 - Fill Out and Sign Printable PDF Template | signNow

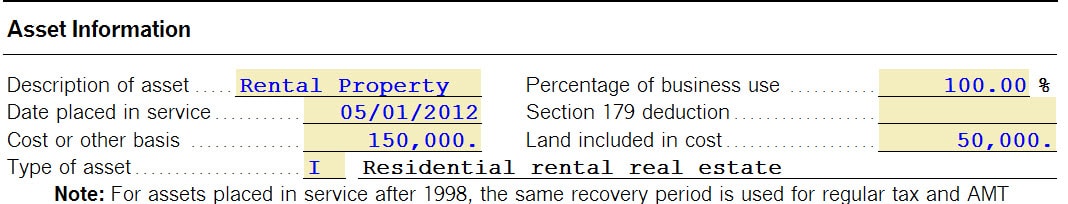

Common questions on the Asset Entry Worksheet in ProSeries

How to Claim the Home Office Deduction with Form 8829 | Ask Gusto

IRS Form 8829 Instructions - Figuring Home Business Expenses

Solved: Trying to fix incorrect entry - Form 8829

How to Complete IRS Form 8829

https://ttlc.intuit.com/community/business-taxes/discussion/help-me-understand-form-8829-asset-entry-worksheet-cost-must-be-entered-what-cost/00/243046

Solved Help me understand Form 8829 Asset Entry Worksheet cost must be entered what cost

https://www.irs.gov/forms-pubs/about-form-8829

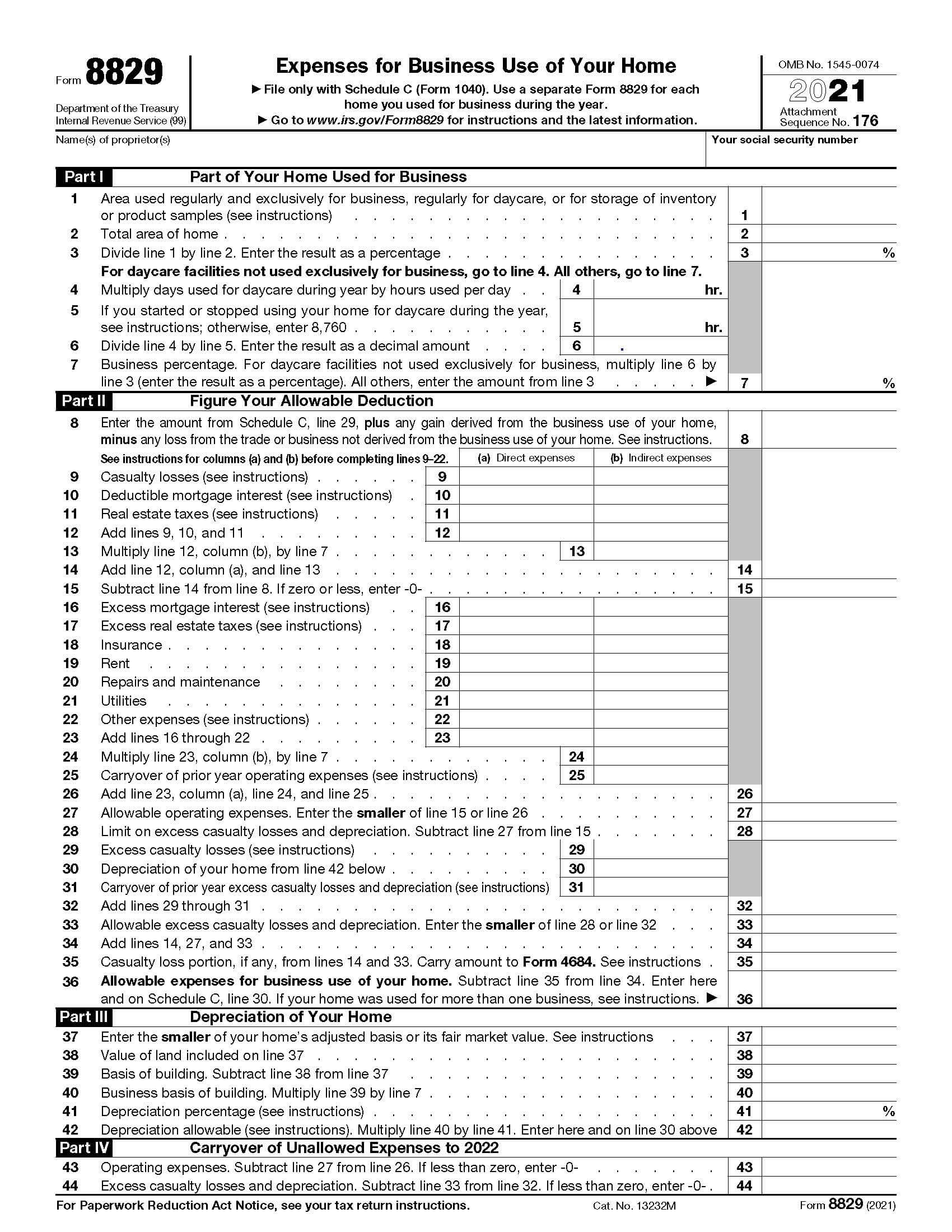

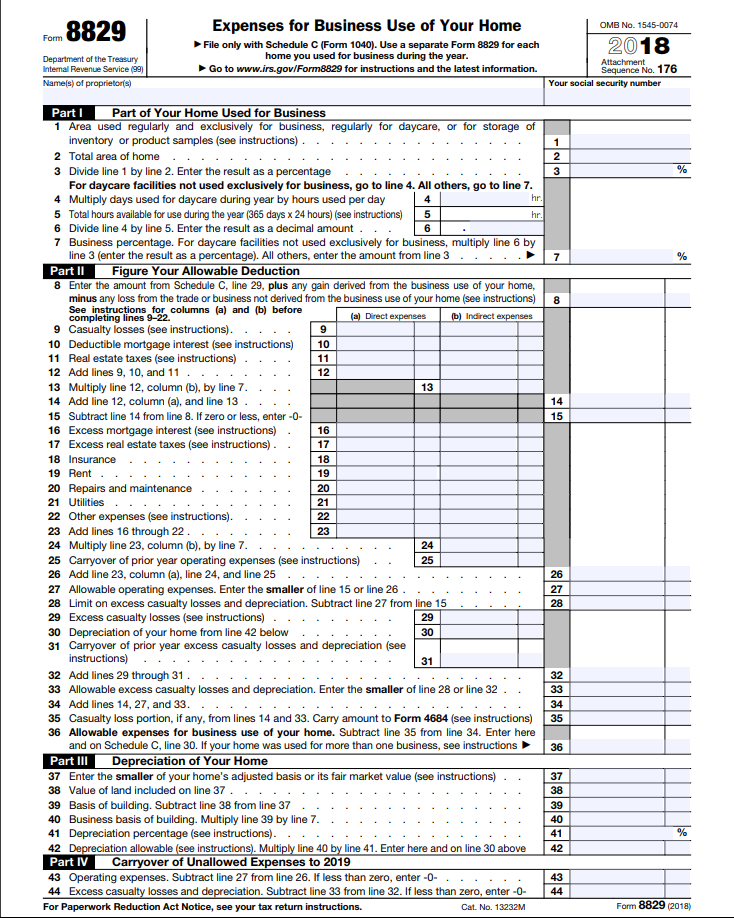

Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to next year of

https://www.fool.com/the-ascent/small-business/articles/how-to-deduct-home-office-expenses-with-form-8829/

You can deduct home office expenses by attaching Form 8829 to your annual tax filing Follow our step by step guide to calculating home office expenses and

https://support.taxslayerpro.com/hc/en-us/articles/360026281013-Desktop-Form-8829-Business-Use-of-Home

This worksheet is included in the Schedule K 1 Form 1065 entry window under Line 14A Net Earnings Loss from Self Employment and in Schedule

https://zipbooks.com/blog/8829-instructions-8829-form-guide-for-expensing-business-use-of-home/

Form 8829 also called the Expense for Business Use of Your Home is the IRS form you use to calculate and deduct your home office expenses 1099 contractors

Do not make an entry on line 20 in column B for any part of your electric bill Form 8829 Your situation may be different and we encourage you to read the Add all applicable asset detail Calculate the return To view the Business Use of Home Worksheet when the business use of home is linked to anything other

Schedule C or F if you haven t created the form open screen C or F select T or S from the TS drop list and complete any additional entries needed K1P