Form 8829 Line 11 Worksheet Form 8829 Line 11 Worksheet If you qualify for a home office deduction you ll file form 8829 along with your personal tax return It s a pain in the neck

File only with Schedule C Form 1040 Use a separate Form chopping board set kmart WebForm 8829 line 11 worksheet instructions for irs form 8829 Total Home Office 8829 worksheet Total area of the house square feet Area multiple line 11 b by line 6 pro rata statutory deduction for business

Form 8829 Line 11 Worksheet

Form 8829 Line 11 Worksheet

Form 8829 Line 11 Worksheet

https://kb.drakesoftware.com/Site/Uploads/Images/12513%20image%203.jpg

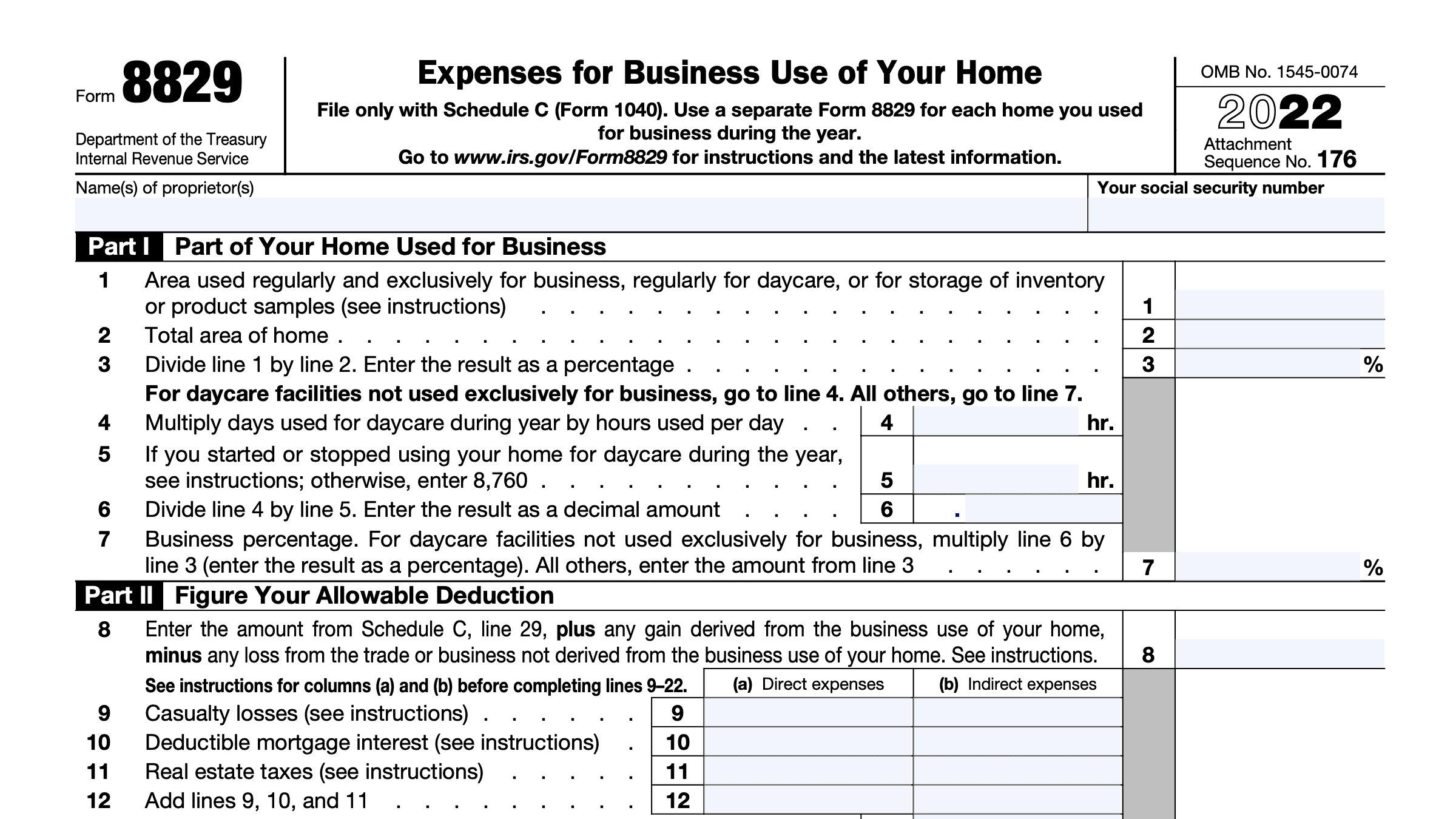

In this article we ll walk through the basics of this tax form and the home business deduction to include Background information on Form 8829 Recognized

Pre-crafted templates offer a time-saving service for developing a diverse variety of files and files. These pre-designed formats and designs can be utilized for numerous individual and expert tasks, including resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the material production process.

Form 8829 Line 11 Worksheet

Employee Business Expenses/ Home Office Deduction

How to Claim the Home Office Deduction with Form 8829 | Ask Gusto

Form 8829 line 11 worksheet

Solved: Trying to fix incorrect entry - Form 8829

IRS Form 8829 Instructions - Figuring Home Business Expenses

Smith extended return by Maritza Miranda - Issuu

https://www.irs.gov/pub/irs-dft/i8829--dft.pdf

Line 11 Worksheet 1 Enter your state and local income taxes or if Enter the smaller of line 6 or line 8 here and in column a of Form

https://zipbooks.com/blog/8829-instructions-8829-form-guide-for-expensing-business-use-of-home/

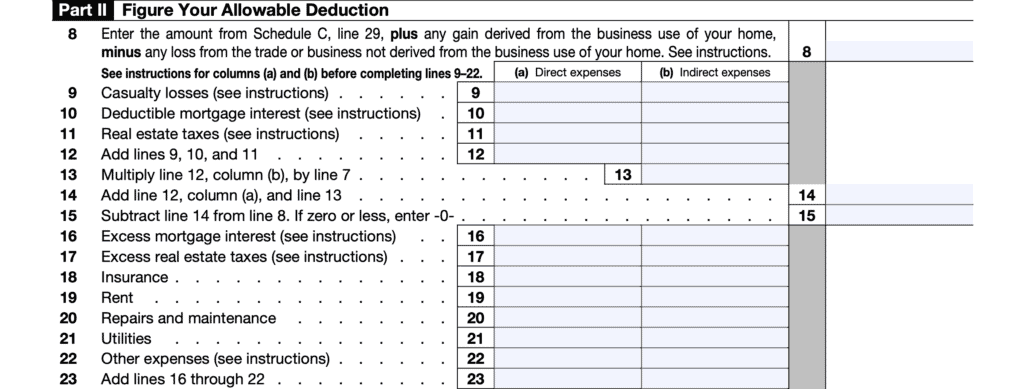

Line 11 Enter any real estate tax you paid during the tax year This is also considered an indirect expense unless you run your business from a separate

https://www.fool.com/the-ascent/small-business/articles/how-to-deduct-home-office-expenses-with-form-8829/

To qualify for a home office tax deduction the IRS says you must dedicate a portion of your home to be used exclusively and regularly for your business

https://www.esmarttax.com/tax-forms/federal-form-8829-instructions/

Do not make an entry on line 20 in column b for any part of your electric bill Lines 9 10 and 11 Worksheet or line 43 of your 2012 Form 8829 Line 34

http://kb.drakesoftware.com/Site/Browse/Form-8829-Office-in-Home

On lines 9 10 and 11 enter only expenses that would otherwise be deductible That part allocated to personal use will flow to Schedule A unless you check

Defining your home office location First the area you use for work in your home must be your principal place of business Next you can only If you view the worksheet supporting Line If you file Schedule C Form 1040 enter all your deductible real estate taxes on Form 8829 line 11 without

Form 1040 Instead complete the Worksheet To Figure the Deduction for Business Use of