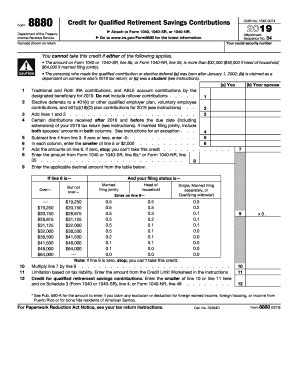

Form 8880 Credit Limit Worksheet There is a separate Credit Limit Worksheet in the form instructions that you use for line 11 6 Include Form 8880 With Your Tax Return Make sure to include

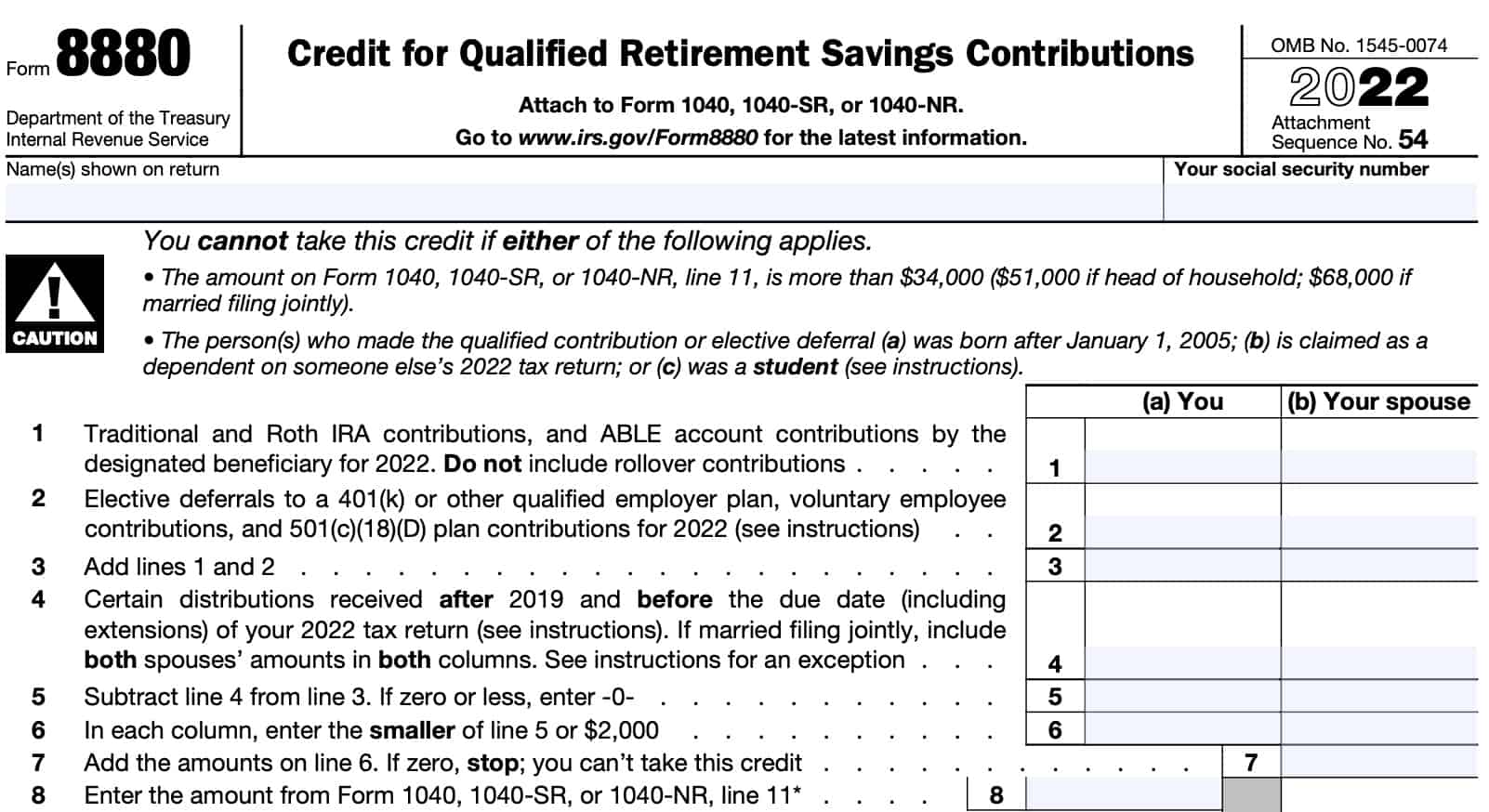

What are the income limits for the Saver s Credit Single married filing separately and qualifying surviving spouse up to 32 500 Head of The credit is equal to 50 20 or 10 of your retirement plan contributions The amount is dependent on your Adjusted Gross Income The maximum credit amount

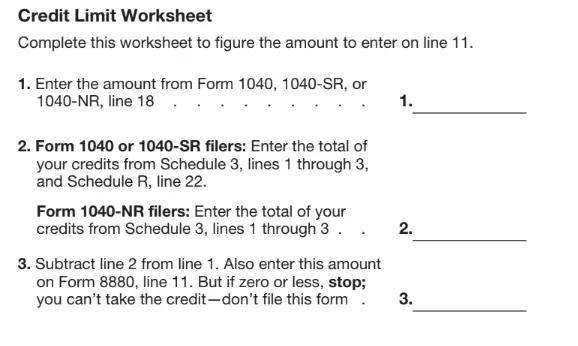

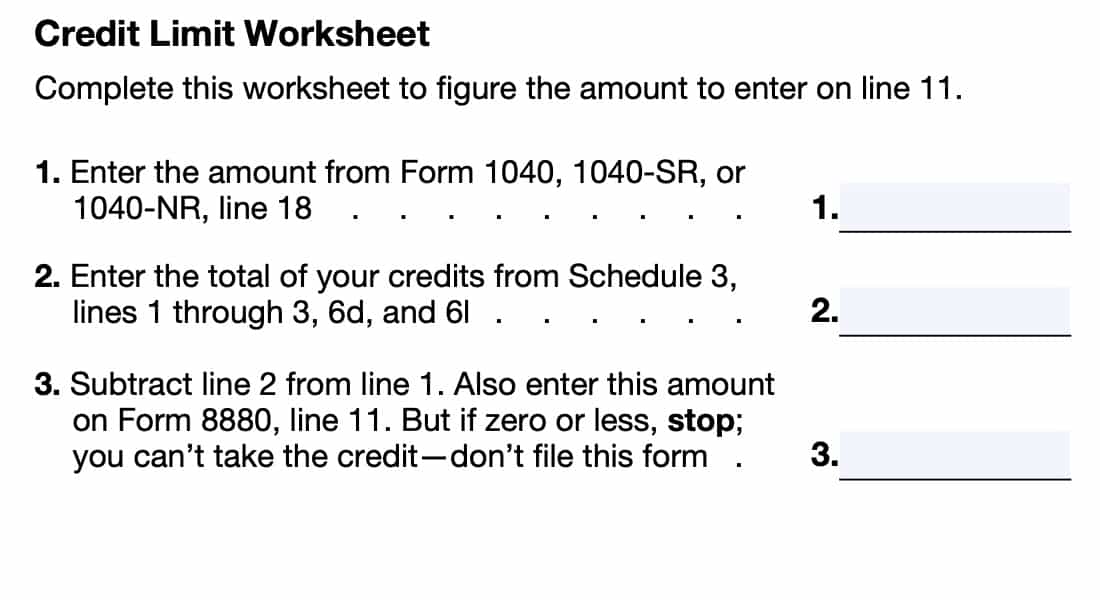

Form 8880 Credit Limit Worksheet

Form 8880 Credit Limit Worksheet

Form 8880 Credit Limit Worksheet

https://www.signnow.com/preview/100/9/100009198.png

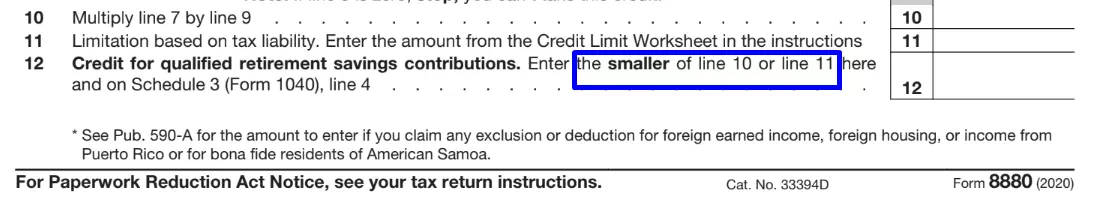

Enter the amount from the Credit Limit Worksheet in the instructions 11 12 Credit for qualified retirement savings contributions Enter the smaller of line

Pre-crafted templates use a time-saving option for creating a diverse range of documents and files. These pre-designed formats and designs can be used for numerous individual and professional tasks, including resumes, invitations, flyers, newsletters, reports, presentations, and more, improving the material development process.

Form 8880 Credit Limit Worksheet

IRS Form 8880 ≡ Fill Out Printable PDF Forms Online

IRS Form 8880 - Credit for Qualified Retirement Savings Contributions - Form 8880 Department of the Treasury Internal Revenue Service Credit for | Course Hero

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

IRS Form 8880 Instructions - Retirement Savings Tax Credit

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

Child Credit - Fill Out and Sign Printable PDF Template | signNow

https://www.irs.gov/forms-pubs/about-form-8880

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit Current Revision

https://www.esmarttax.com/tax-forms/federal-form-8880-instructions/

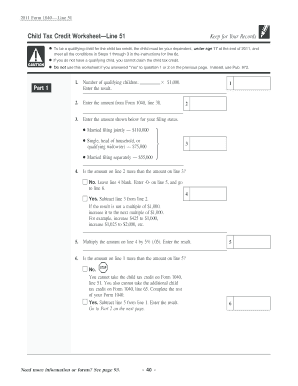

See Schedule R Form 1040A or 1040 to figure the credit Credit Limit Worksheet Complete this worksheet to figure the amount to enter on line 11 1 Enter

https://www.reginfo.gov/public/do/DownloadDocument?objectID=85804501

Information about Form 8880 and its instructions is at www irs gov form8880 OMB Enter the amount from the Credit Limit Worksheet in the instructions

https://turbotax.intuit.com/tax-tips/investments-and-taxes/what-is-the-irs-form-8880/L0mePsZju

Your Form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim The size of your tax

https://www.investopedia.com/irs-form-8880-credit-for-qualified-retirement-savings-contributions-5114767

IRS Form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan Eligible plans to which you can

lines of Form 8880 Line 1 You and your spouse s contributions to a Line 11 Use this Credit Limit Worksheet to figure the amount to enter on Are lines 18 and 19 both zero or blank and are you not filing Form 4952 XYes Complete the Qualified Dividends and Capital Gain Tax Worksheet

FORM 5695 LINE 30 ENTER THE TOTAL 3 SUBTRACT LINE 2 FROM LINE 1 600 COMPLETE THE CREDIT LIMIT WORKSHEET B ONLY IF YOU MEET ALL OF THE FOLLOWING 1 YOU