Georgia Retirement Income Exclusion Worksheet The Georgia retirement income exclusion is calculated from the taxpayer and spouse date of birth entries on the federal basic data inputs

Georgia allows taxpayers age 62 64 to exclude up to 35 000 or retirement income on their tax return Taxpayers under age 62 and permanently disabled also This exclusion is generous in 2010 a Georgia taxpayer could claim up to 35 000 for the Retirement Income Exclusion worksheet on page 13 of the Georgia

Georgia Retirement Income Exclusion Worksheet

Georgia Retirement Income Exclusion Worksheet

Georgia Retirement Income Exclusion Worksheet

https://www.pdffiller.com/preview/100/593/100593292/large.png

Georgia s retirement income exclusion allows qualified taxpayers to exclude certain forms of income from state taxation These forms of income

Templates are pre-designed documents or files that can be used for different functions. They can conserve effort and time by supplying a ready-made format and layout for developing different sort of content. Templates can be used for individual or expert tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Georgia Retirement Income Exclusion Worksheet

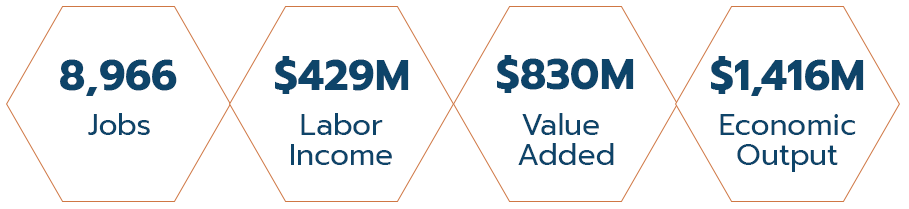

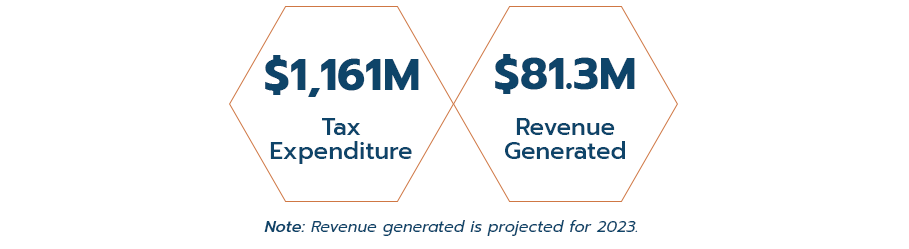

Tax Incentive Evaluation: Retirement Income Exclusion - DOAA

Untitled

Tax Incentive Evaluation: Retirement Income Exclusion - DOAA

G-4_rev7.14 - Georgia income tax-Line-Form | PubHTML5

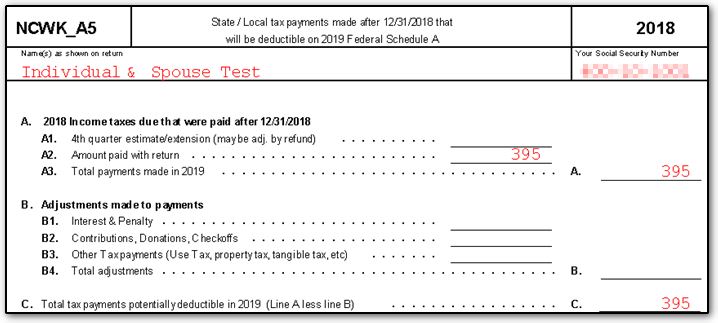

1040 - State Taxes on Wks CARRY (ScheduleA)

Corporation Income Tax General Instructions

https://dor.georgia.gov/document/document/2022-500-individual-income-tax-return-blank-form-printing/download

You qualify for Military Retirement Income Exclusion Complete this page If your Georgia earned income is less than 17 501 STOP HERE and enter line 3 on

https://www.audits2.ga.gov/reports/summaries/retirement-income-exclusion/

Currently taxpayers aged 65 and over may exclude up to 65 000 while those 62 to 64 as well as those permanently and totally disabled may

https://www.taxact.com/support/1574/2013/georgia-retirement-income-exclusion-rie

For taxpayers 65 or older the retirement exclusion is 65 000 This exclusion is available for both the taxpayer and spouse however each must qualify on a

https://cs.thomsonreuters.com/ua/ut/cs_us_en/states/iga/faq/1040-ga-retirement-income-exclusion-worksheet.htm

You can designate resident spouse retirement income as taxable to Georgia for married taxpayers filing a nonresident Georgia return

https://support.cch.com/kb/solution.aspx/sw4526

Go to the Georgia Income Deductions worksheet Select section 2 Subtractions Enter lines 1 4 Exclusion amounts are allowed for part year

Georgia does not tax Social Security retirement benefits and provides a deduction of 65 000 per person on all types of retirement income for Yes but there is a significant tax exclusion available to seniors on all retirement income For anyone age 62 to 64 the exclusion is 35 000 per person For

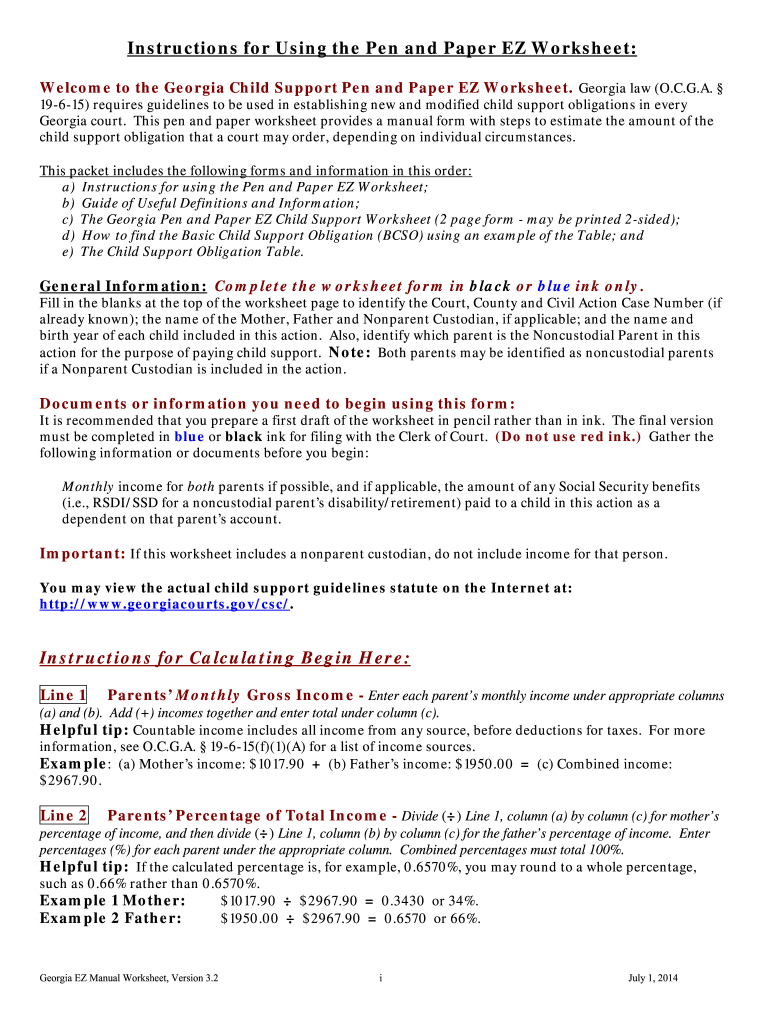

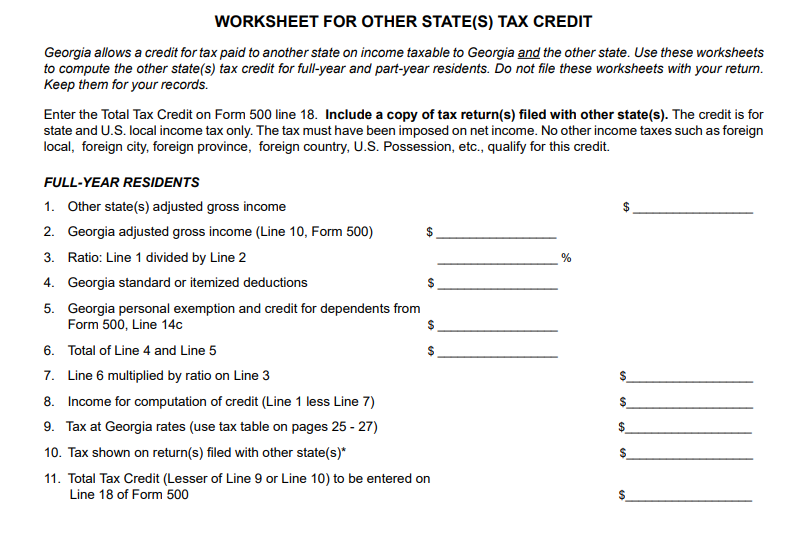

Worksheet for calculating additional allowances Enter the information as requested by each line For Line 2D enter items such as Retirement Income Exclusion