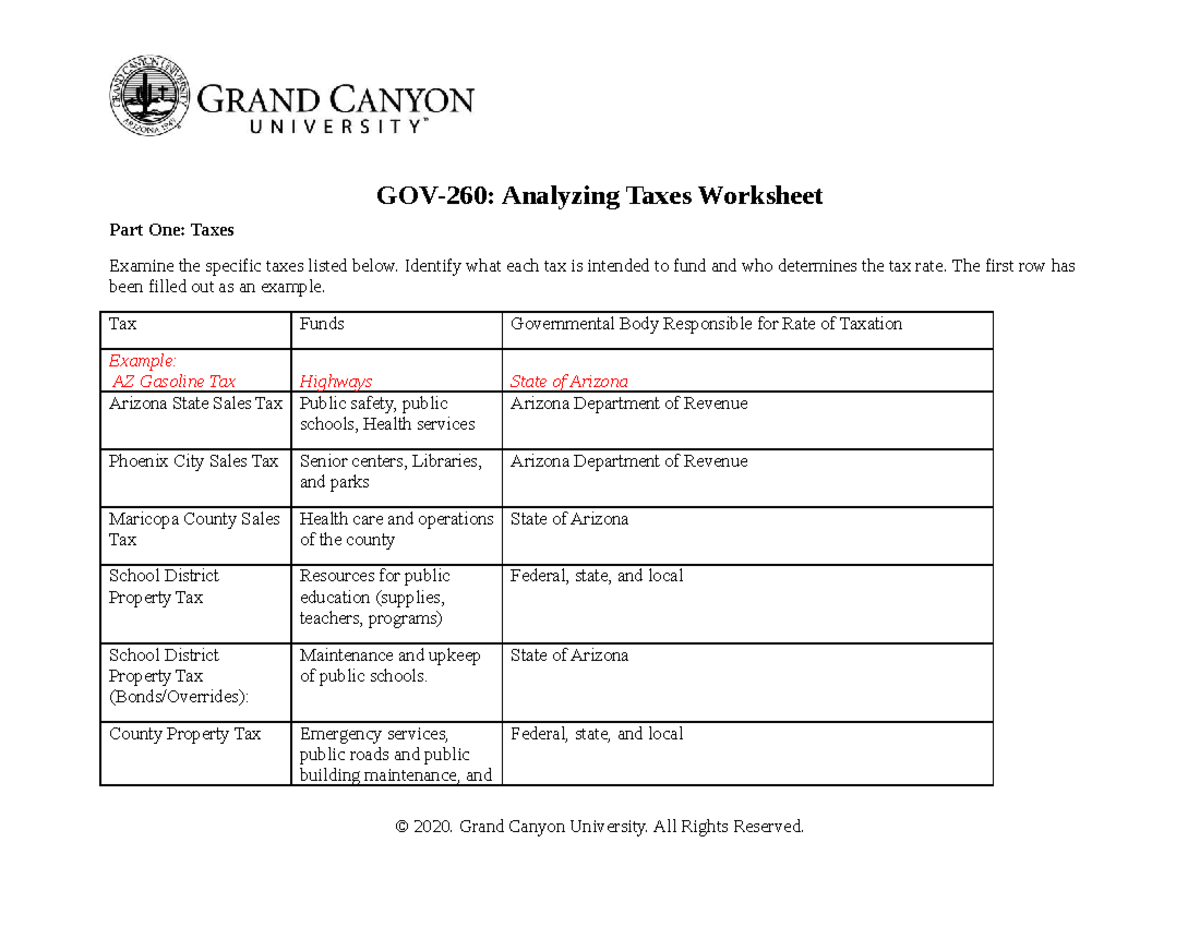

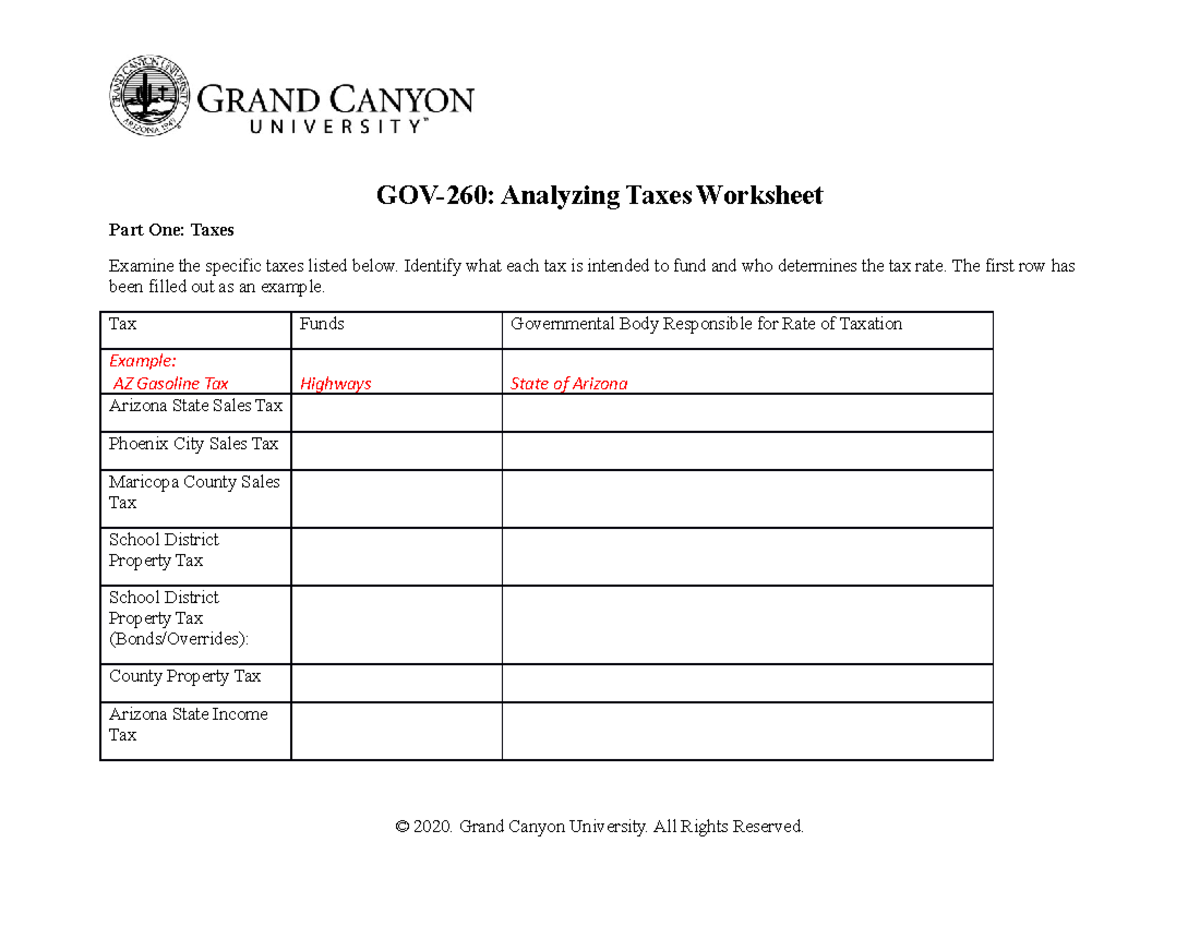

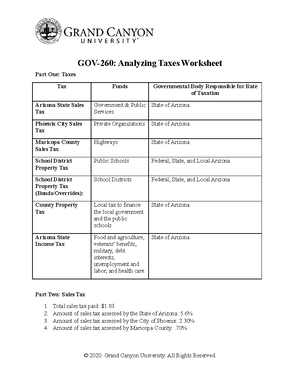

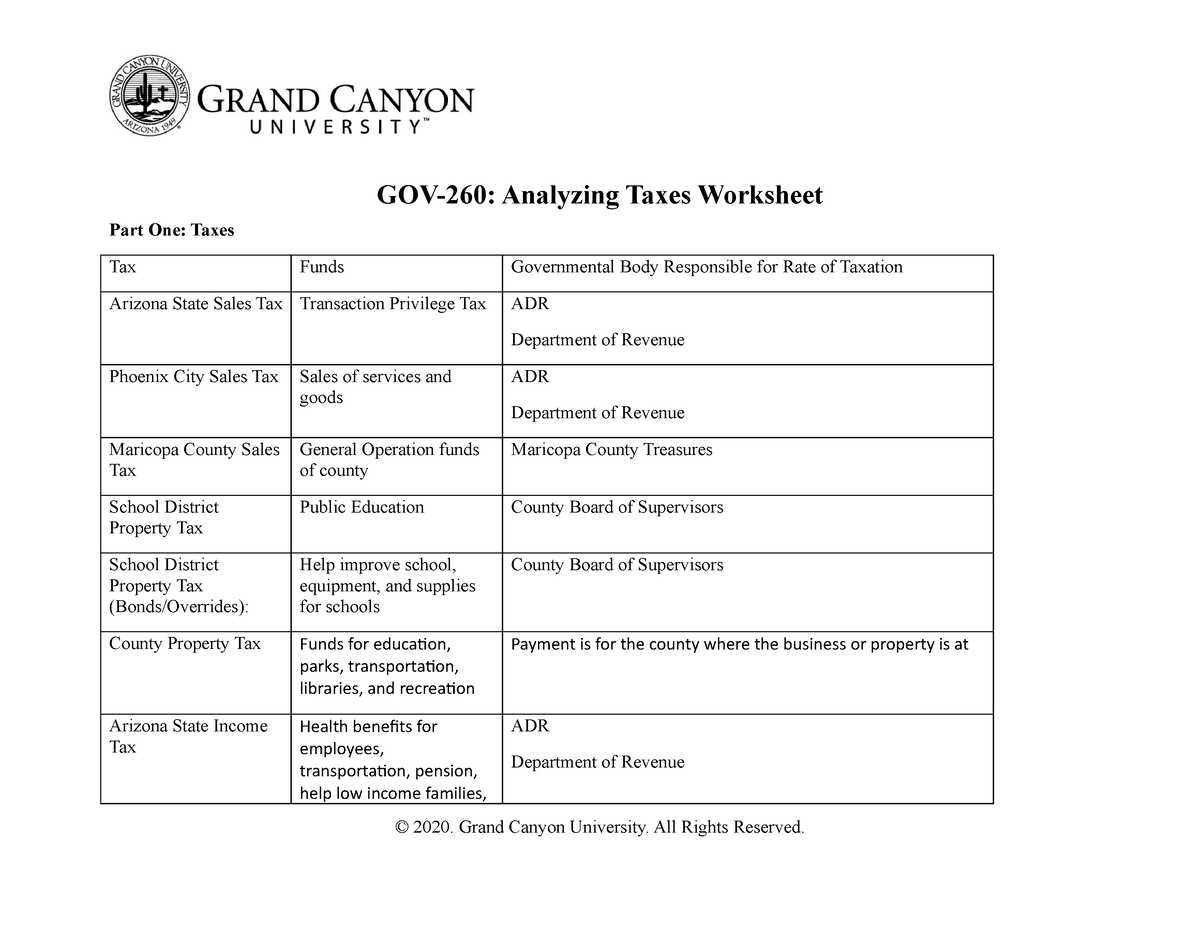

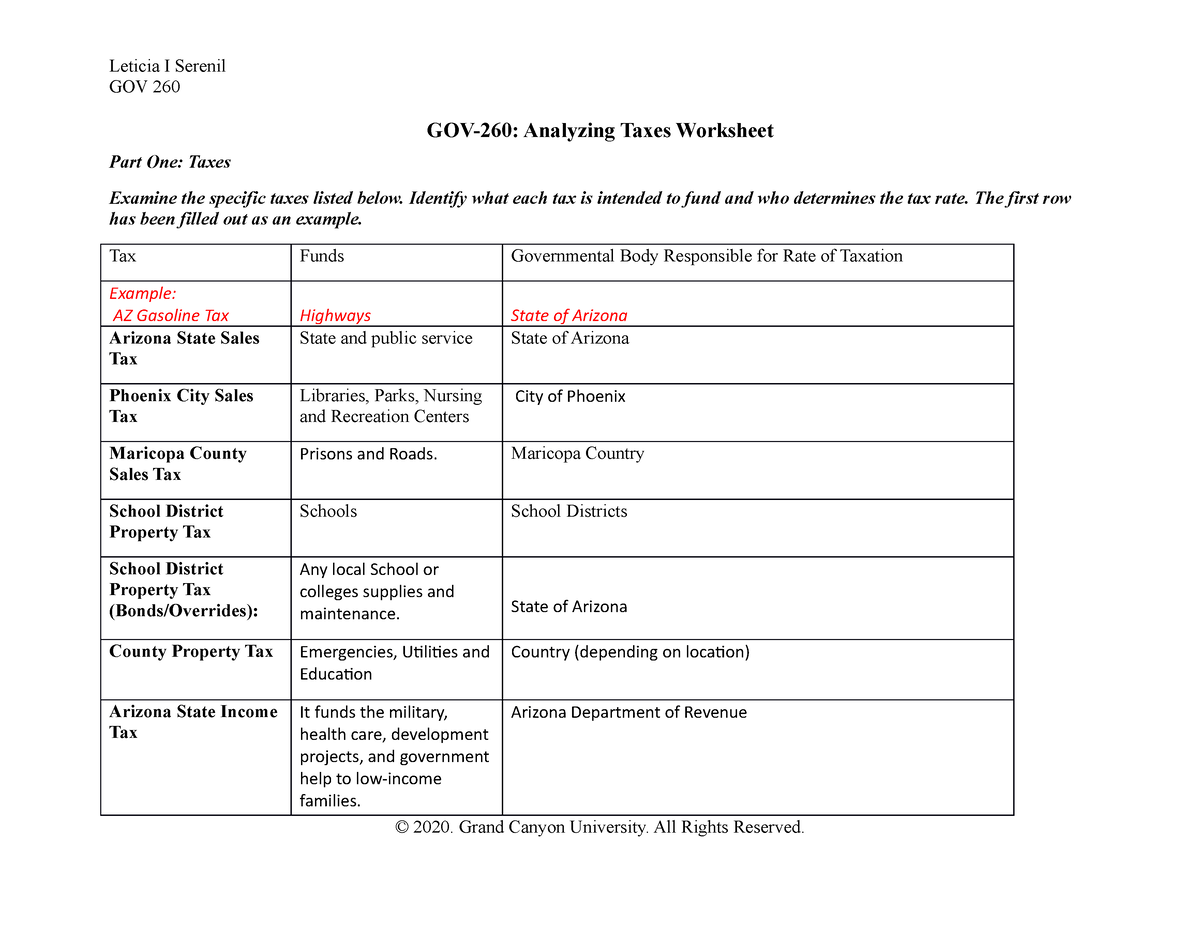

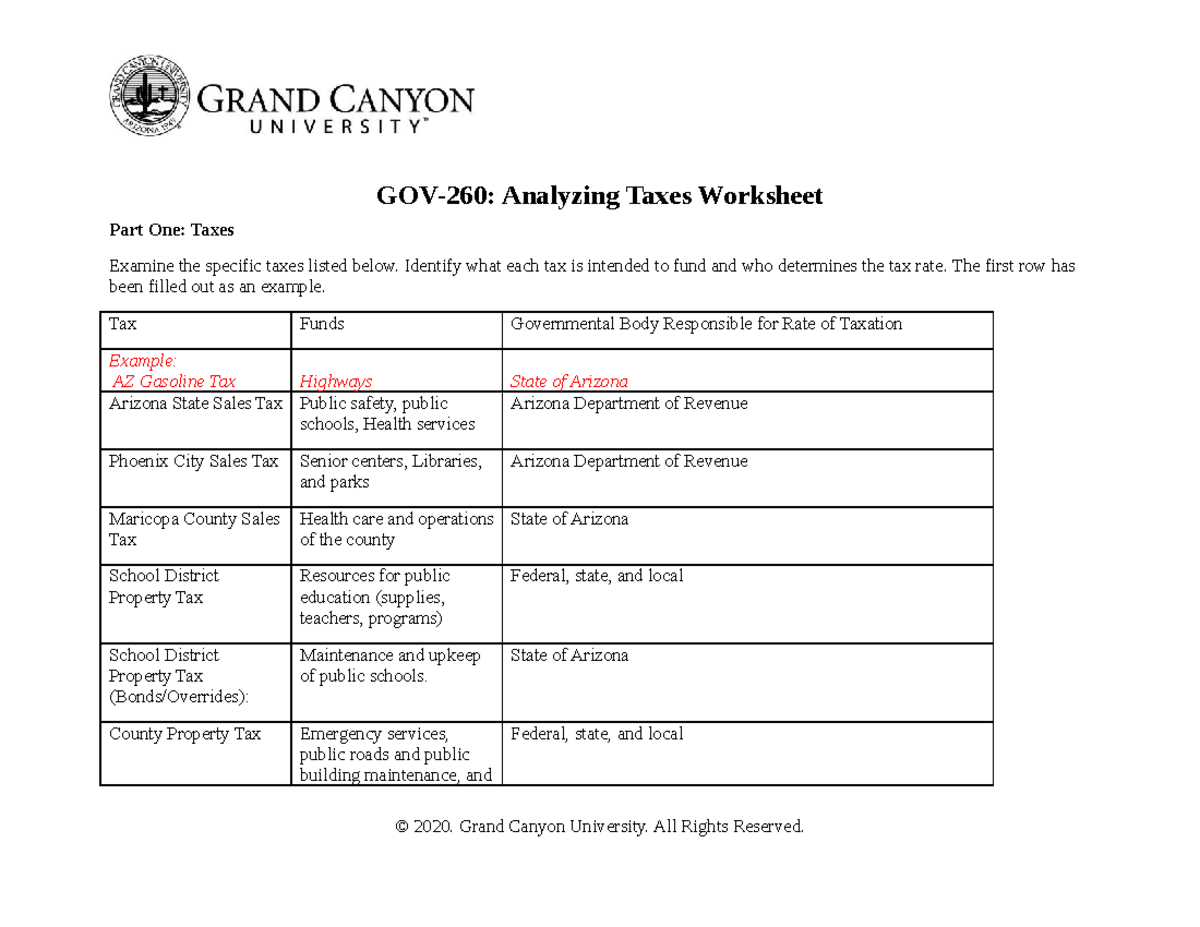

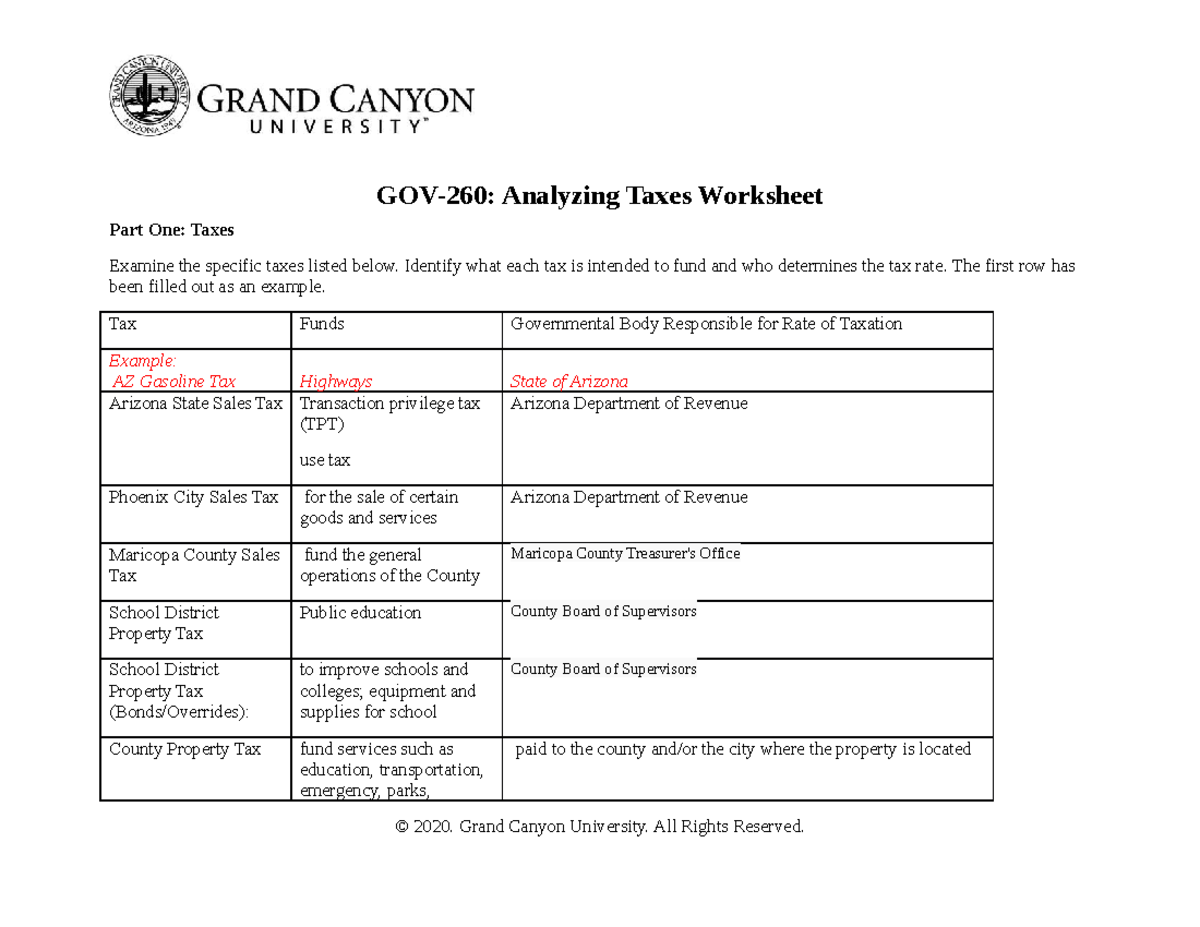

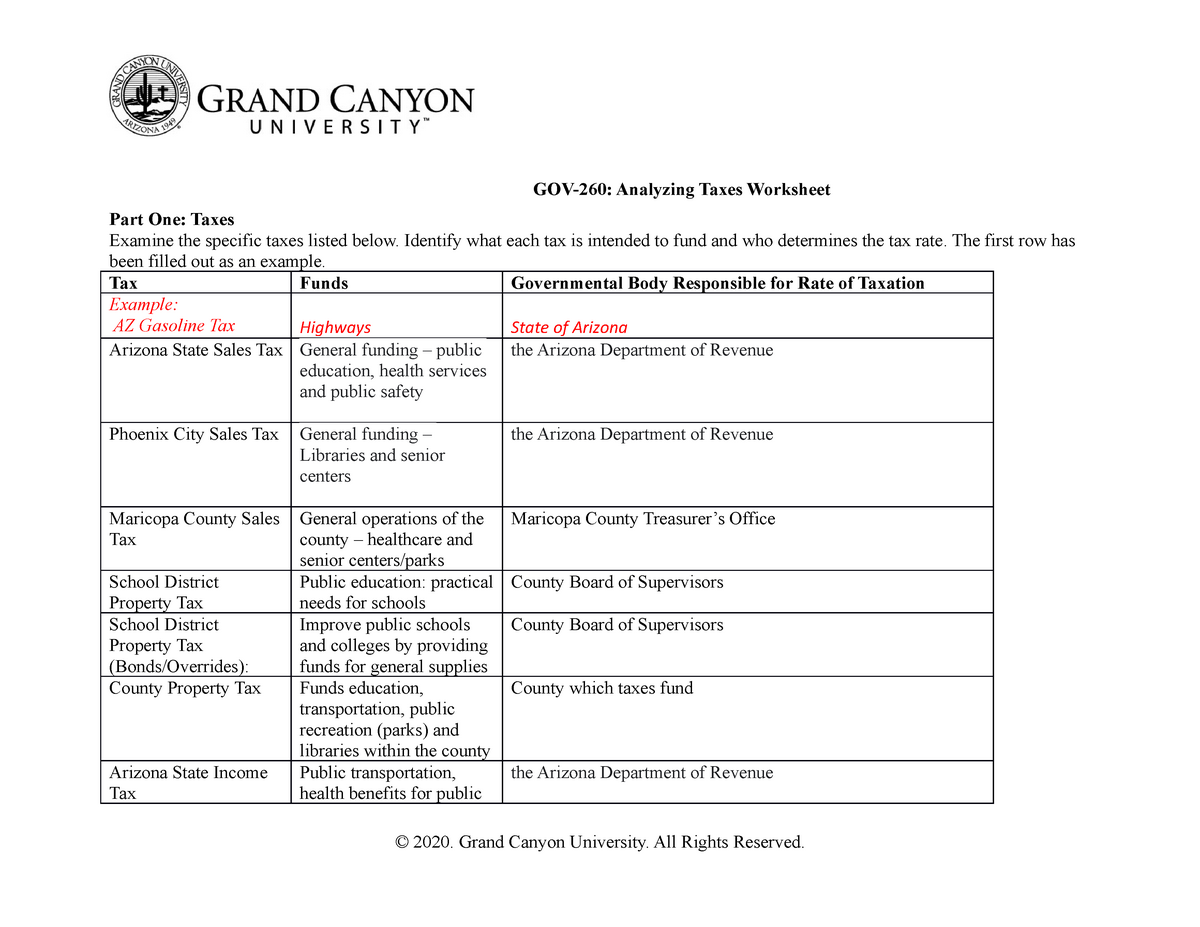

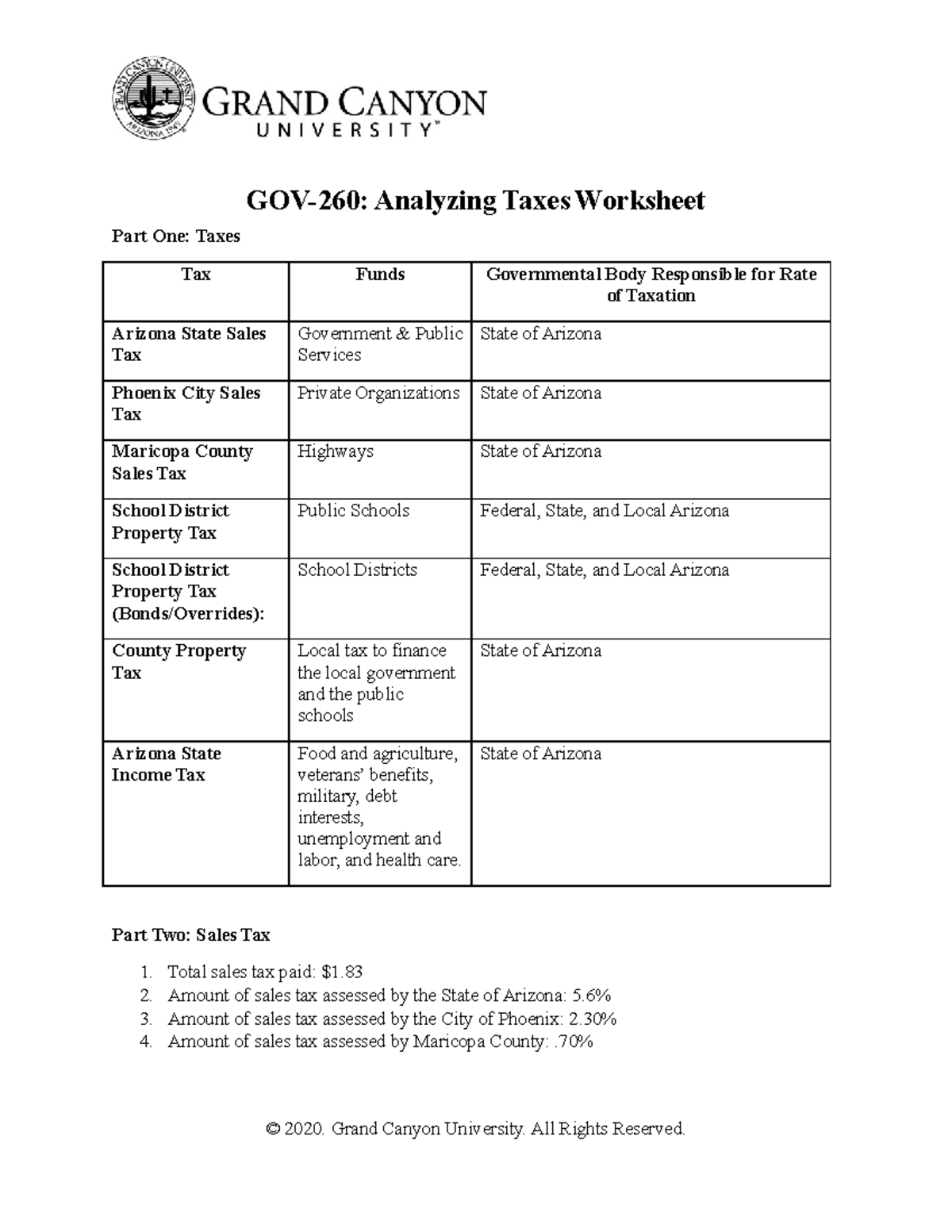

Gov 260 Analyzing Tax Worksheet Part One Taxes Examine the specific taxes listed below Identify what each tax is intended to fund and who determines the tax rate

GOV 260 Analyzing Taxes Worksheet Part One Taxes Examine the specific Describe the difference between Arizona State Income tax and Arizona State Sales tax Which tax bracket you fall into is determined by your total amount oThe back taxes owed on a home are found in listings of homes scheduled for tax

Gov 260 Analyzing Tax Worksheet

Gov 260 Analyzing Tax Worksheet

Gov 260 Analyzing Tax Worksheet

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7c24baf07194fa0b2ecdca9dbd38f9ef/thumb_1200_927.png

Therapy Worksheets For Self Esteem Gov 260 Analyzing Tax Worksheet

Templates are pre-designed files or files that can be used for different purposes. They can conserve time and effort by offering a ready-made format and design for creating various type of content. Templates can be used for personal or expert tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Gov 260 Analyzing Tax Worksheet

1 GOV 260 Analyzing Tax Worksheet - GOV-260: Analyzing Taxes Worksheet Part One: Taxes Examine the - Studocu

The Analyzing Tax Worksheet for Gov 260 - GOV-260: Analyzing Taxes Worksheet Part One: Taxes Tax - Studocu

Analyzing Taxes: Understanding Tax Funding And Rates For - PHIL2100 | Course Hero

GOV-260-Analyzing Tax Worksheet assignments and information - GOV-260: Analyzing Taxes Worksheet - Studocu

tax worksheet.edited.docx - GOV-260: Analyzing Taxes Worksheet Part One: Taxes Examine the specific taxes listed below. Identify what each tax is | Course Hero

GOV-260-Analyzing Tax Worksheet LIS - Leticia I Serenil GOV 260 GOV-260: Analyzing Taxes Worksheet - Studocu

https://www.studocu.com/en-us/document/grand-canyon-university/arizona-constitution-and-government/gov-260-analyzing-tax-worksheet/10572358

Examine the specific taxes listed below Identify what each tax is intended to fund and who determines the tax rate The first row has

https://www.coursehero.com/file/91201814/GOV-260-Analyzing-Taxes-Worksheet-3docx/

Stephanie Hernandez Professor Koening GOV 260 4 25 21 GOV 260 Analyzing Taxes Worksheet Part One Taxes Examine the specific taxes listed below

https://www.scribd.com/document/522259007/GOV-260-ScoringGuide-AnalyzingTaxWorksheet

GOV 260 Analyzing Taxes Worksheet Scoring Guide Grading Category Points Comments Part One Taxes 0 150 Examine the specific taxes listed below

https://www.studypool.com/documents/1682137/gov-260-grand-canyon-university-analyzing-taxes-worksheet

GOV 260 Analyzing Taxes Worksheet Part One Taxes Examine the specific taxes listed below Identify what each tax is intended to fund and who determines

https://www1.goramblers.org/textbooks/files?trackid=koK:6427&Academia=Gov-260-Analyzing-Tax-Worksheet.pdf

Federal Information System Controls Audit Page 2 Gov 260 Analyzing Tax Worksheet gov 260 analyzing tax worksheet 2 Downloaded from www1 goramblers on

The state use tax rate is the same as the state transaction privilege tax TPT rate sometimes referred to as sales tax currently at 5 6 percent In addition 0898522862 UUS75 Downloaded from chaoticmoon demos nagios by guest BLACK NATHANIAL Related with 0898522862 UUS75 Gov 260 Analyzing Tax Worksheet

taxes and allows more options for income and deductions to be entered mathematical functions Functions that manipulate quantitative data in a worksheet