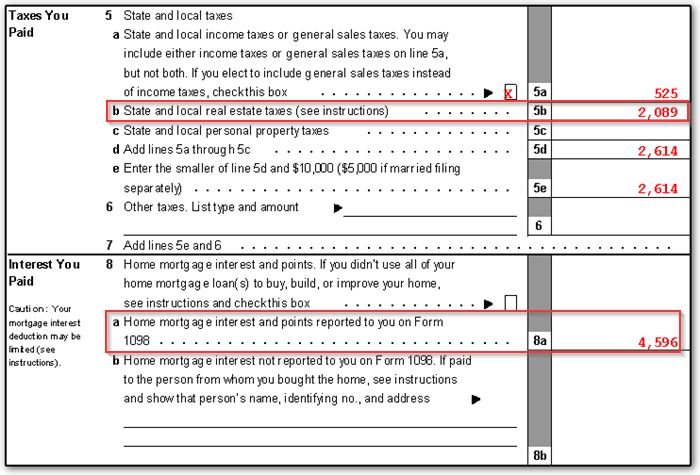

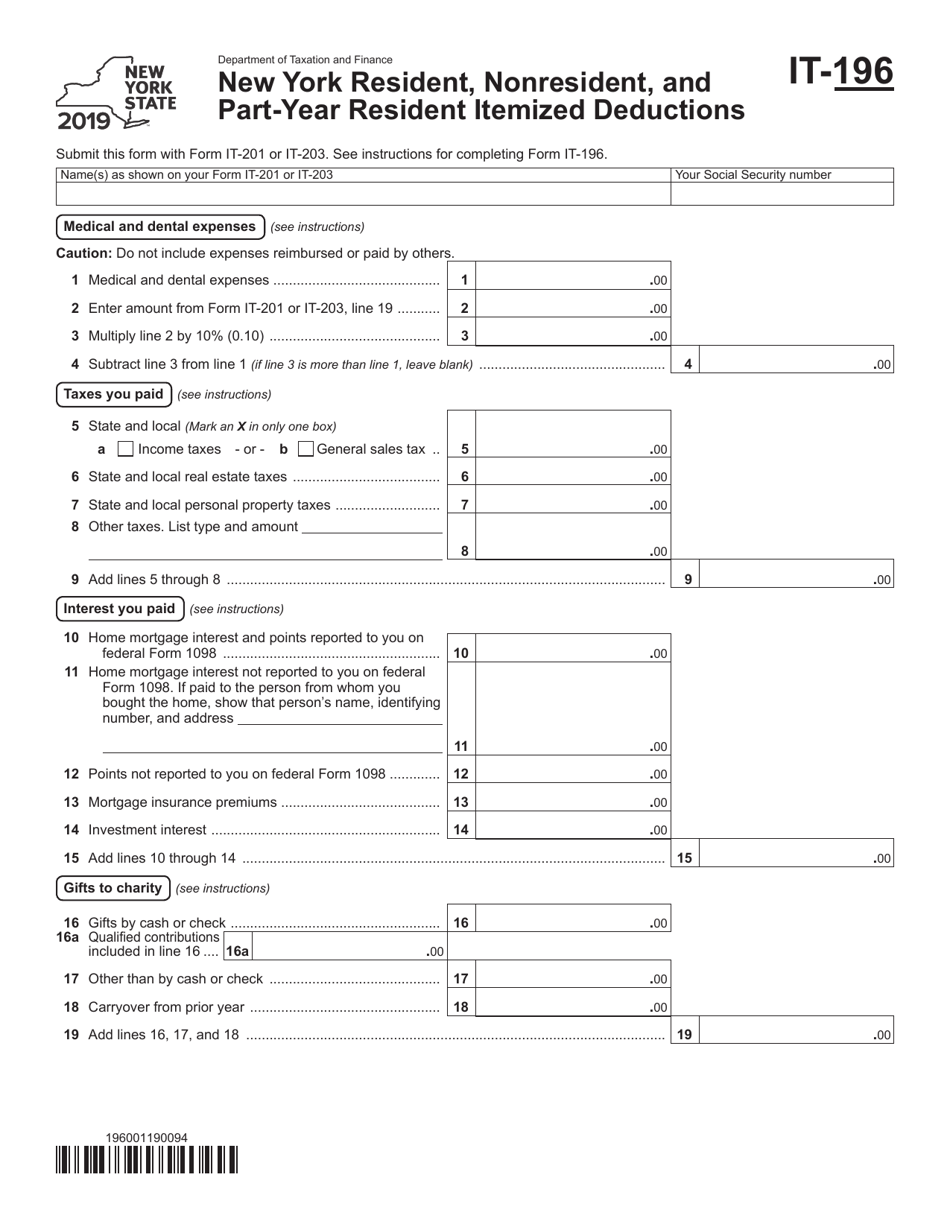

Home Mortgage Interest Deduction Worksheet An individual may claim an itemized deduction for qualified residence interest or home mortgage interest Schedule A Form 1040 Qualified residence interest is

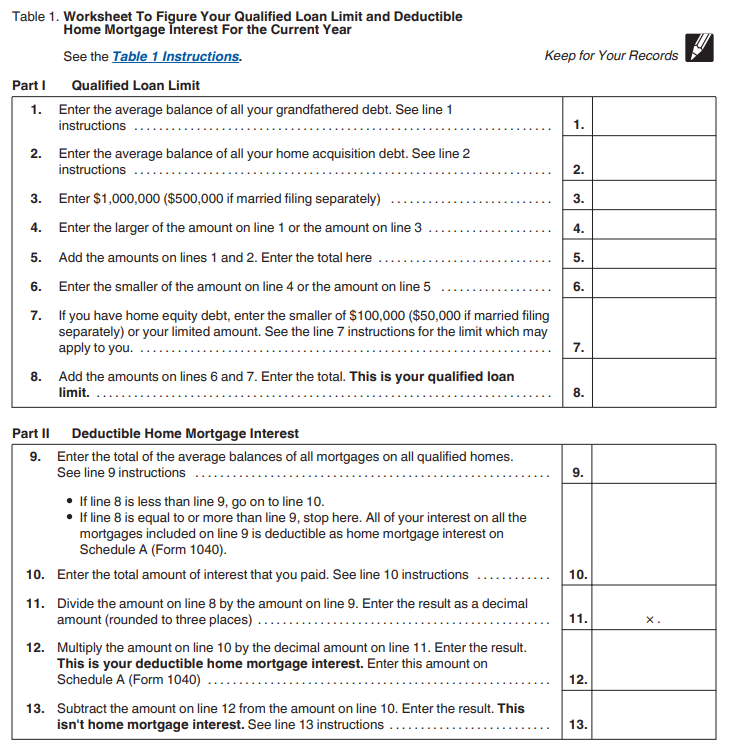

You will need to complete this IRS Qualified Loan Limit Worksheet before reporting the mortgage interest deduction in the 1098 program entry What if I own more You can only deduct interest on the first 375 000 of your mortgage if you bought your home after December 15 2017 Per IRS Publication 587 Business Use of

Home Mortgage Interest Deduction Worksheet

Home Mortgage Interest Deduction Worksheet

Home Mortgage Interest Deduction Worksheet

https://www.irs.gov/pub/xml_bc/10426g05.gif

deductible home mortgage interest Table 5 IRS Worksheet to Figure Home Mortgage Interest Part I Qualified loan limit Number 1 Computation action

Pre-crafted templates offer a time-saving option for producing a diverse series of documents and files. These pre-designed formats and layouts can be used for different personal and expert jobs, including resumes, invites, leaflets, newsletters, reports, discussions, and more, simplifying the material development procedure.

Home Mortgage Interest Deduction Worksheet

1040 - Schedule E - Tax Court Method Election

Mortgage Interest Deduction | escapeauthority.com

I don't believe my mortgage interest deduction is calculating correctly. My calculation is significantly different than that of TT. Any advice?

Student loan interest deduction worksheet: Fill out & sign online | DocHub

Publication 936 (2022), Home Mortgage Interest Deduction | Internal Revenue Service

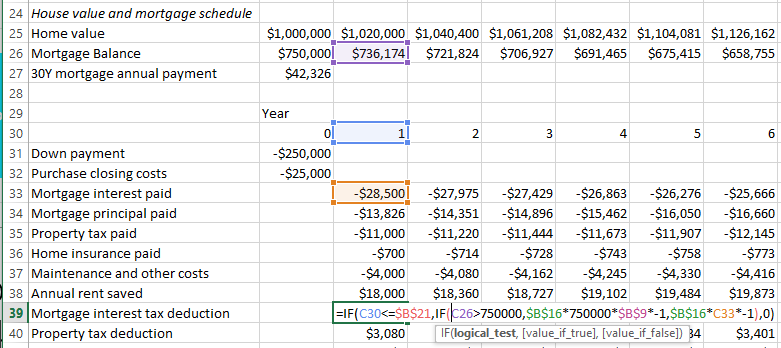

Decision-Making – SpreadsheetSolving

https://www.irs.gov/publications/p936

It contains Table 1 which is a worksheet you can use to figure the limit on your deduction Comments and suggestions We welcome your comments about this

https://proconnect.intuit.com/support/en-us/help-article/form-1098/understanding-deductible-home-mortgage-interest/L18S60lyN_US_en_US

How do I go to the Deductible Home Mortgage Interest Worksheet in ProSeries Open your client s Form 1040 return Tap the F6 key to go to the

https://www.adftaxes.com/files/Mortgage_Deduction_Limit_Worksheet.pdf

Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1 Enter the average is deductible as home mortgage interest on Schedule A Form 1040

https://cotaxaide.org/tools/Mortgage%20Interest%20Worksheet.html

Instructions Complete a worksheet tab for all home secured mortgages to determine the amount of interest paid that is deductible on Schedule A

https://cs.thomsonreuters.com/ua/toolbox/cs_us_en/Calculator_screen_overviews/cshw_deductible_home_mortgage_interest_screen.htm

This tax worksheet computes the taxpayer s qualified mortgage loan limit and the deductible home mortgage interest Example

Tax and interest deduction worksheet limited interest What is this tax and interest deduction worksheet Intuit Understanding the Deductible Home Mortgage Mortgage Interest Deduction Worksheet Please fill out this form if you have any kind of mortgage or home equity loan and you think you might qualify to

Such may be the essence of the book Home Mortgage Interest Deduction Worksheet a literary masterpiece that delves deep into the significance of words and