Illinois Withholding Allowance Worksheet Example Browse for the illinois withholding allowance worksheet example Customize and eSign regular withholding allowances Send out signed il w 4 example or print it

Therefore your employer will withhold Illinois Income Tax based on your compensation minus the exemptions to which you are entitled What is an allowance The W 4 Form includes a series of worksheets for calculating the number of allowances to claim One must provide some personal information and report Learn

Illinois Withholding Allowance Worksheet Example

Illinois Withholding Allowance Worksheet Example

Illinois Withholding Allowance Worksheet Example

https://www.pdffiller.com/preview/5/600/5600745.png

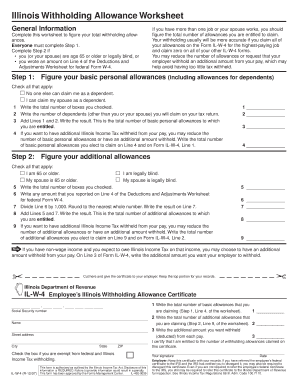

Illinois Form IL W4 must be completed to know how much state income tax to withhold from your new employee s wages

Templates are pre-designed documents or files that can be used for different purposes. They can save time and effort by supplying a ready-made format and design for developing different sort of content. Templates can be used for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Illinois Withholding Allowance Worksheet Example

How to Fill Out Your W-4 Form to Keep More of Your Paycheck (2019)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

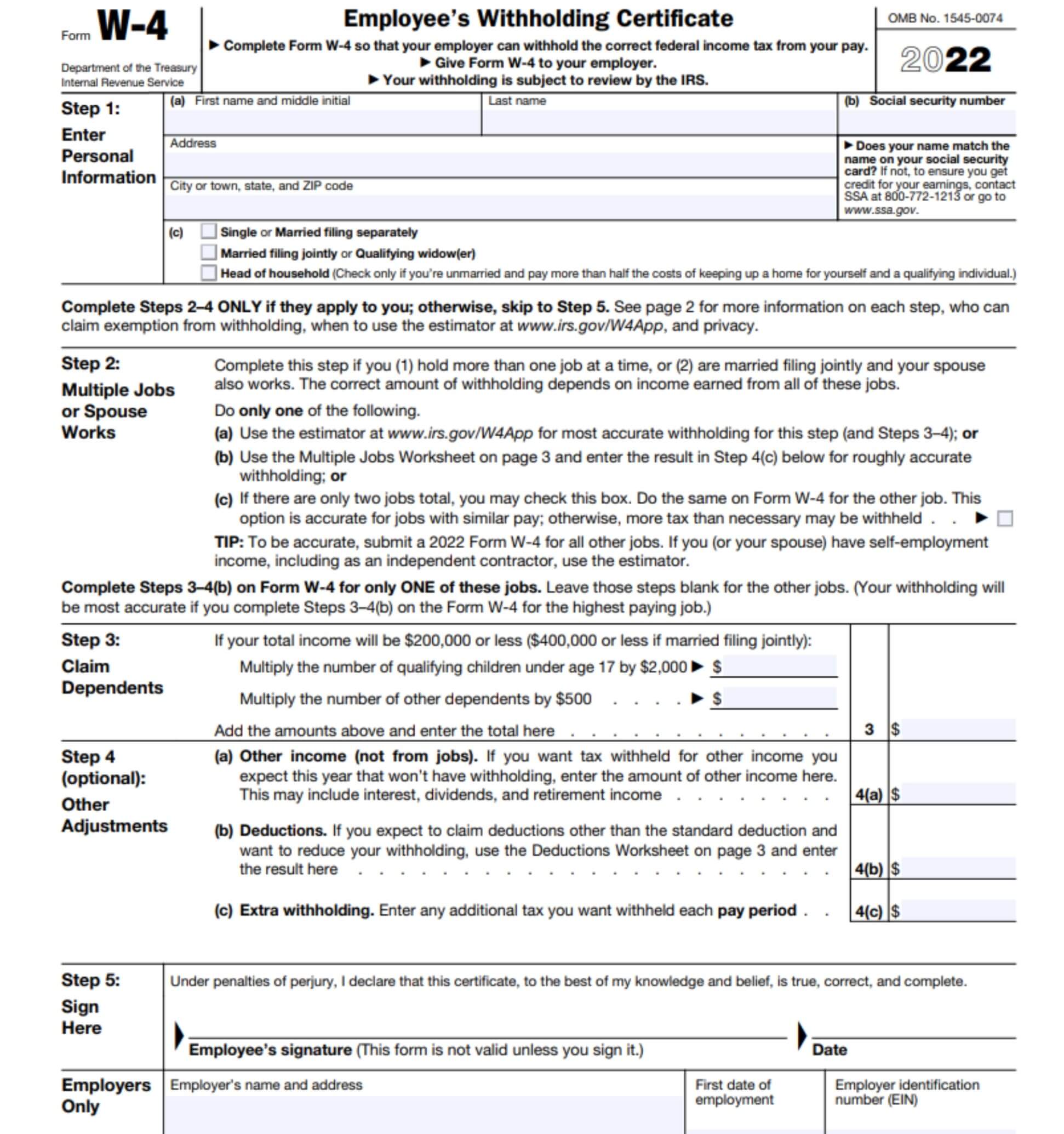

W-4 Form: How to Fill It Out in 2023

How to Fill Out Your W4 Tax Form - YouTube

How to Fill Out Your W-4 Form to Keep More of Your Paycheck (2019)

Who Should Complete IRS Form W-4?

Navigating the New 2020 W-4 | ASAP Payroll

https://www.obfs.uillinois.edu/common/pages/DisplayFile.aspx?itemId=94629

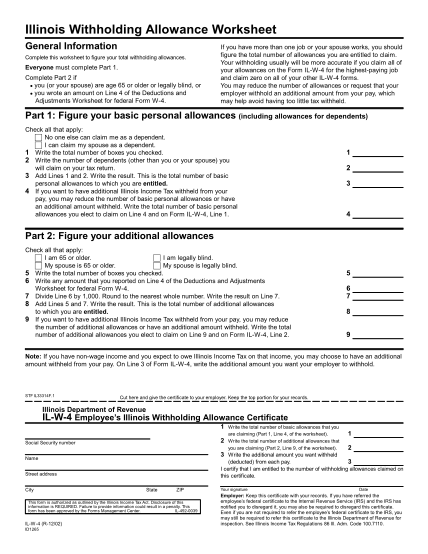

Cut here and give the certificate to your employer Keep the top portion for your records Complete this worksheet to figure your total withholding allowances

https://www.iwu.edu/financial-aid/il-w-4.pdf

Complete the worksheet on the back of this page to figure the correct number of allowances you are entitled to claim Give your completed Form IL W 4 to your

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg?w=186)

https://www.hrblock.com/tax-center/irs/forms/personal-allowances-worksheet/

Use W 4 line 7 to claim exemption from withholding for 2019 In this line you must also certify that you meet both of the following conditions for exemption

https://www.snc.edu/studentemployment/docs/studentemploymentblankforms_illinois.pdf

IL W 4 R 12 19 Page 12 Illinois Withholding Allowance Worksheet General Information Use this worksheet as a guide to figure your total withholding

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png?w=186)

https://taxsharkinc.com/fill-out-il-w-4/

Enter the total number of basic allowances you intend to claim on this line The number to enter is equal to the value at Step 1 Line 4 of your worksheet

Example interest and dividends Exceptions An employee may be able to claim Illinois Withholding Allowance Worksheet General Information Complete this If you expect to claim deductions other than the standard deduction and want to reduce your withholding use the Deductions Worksheet on page 3 and enter

Illinois Withholding Allowance Worksheet General Information If you have more than one job or your spouse works your Complete this worksheet to figure your