In Home Daycare Tax Deduction Worksheet Below are forms and worksheets to help you keep track of your expenses Daycare Expense Worksheet xls Daycare Expense Wor

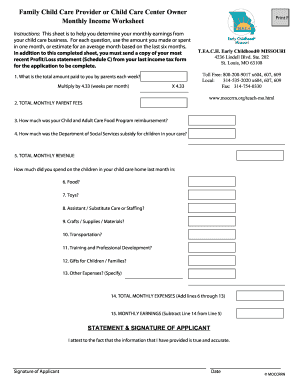

Quickfinder Supplemental Tax Organizers Family Daycare Provider Standard Meal and Snack Rate Log Annual Recap Worksheet Name of Provider TIN SSN Tax Year The best way to keep track of your deductions or expenses is to make a spreadsheet and take each receipt you have and record that expense in a category I use

In Home Daycare Tax Deduction Worksheet

In Home Daycare Tax Deduction Worksheet

In Home Daycare Tax Deduction Worksheet

https://www.pdffiller.com/preview/60/756/60756770.png

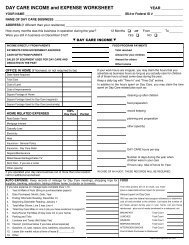

The worksheet uses the expense categories for a Schedule C that are most relevant to home based child care providers but they can also be used for any

Templates are pre-designed files or files that can be used for different purposes. They can save effort and time by offering a ready-made format and layout for developing different kinds of material. Templates can be utilized for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

In Home Daycare Tax Deduction Worksheet

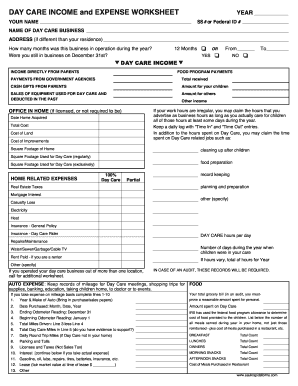

DAY CARE INCOME and EXPENSE WORKSHEET - MER Tax

DAY CARE INCOME and EXPENSE WORKSHEET - MER Tax

Mileage Logs, Forms & Checklists for Child Care Providers

Daycare Profit and Loss Template Form - Fill Out and Sign Printable PDF Template | signNow

The BIG List of Common Tax Deductions for Home Daycare | Home daycare, Starting a daycare, Family day care

Taxes for In Home Daycare-Little Sprouts Learning

https://lstax.com/documents/daycare-worksheets.pdf

Worksheet for you to record wages and payroll taxes you paid We DO NOT have these records as we DO NOT know what you paid and when TAX ALERT Be sure to bring

https://knelltax.com/files/In-home-Daycare-Worksheet.pdf

Real estate tax Percent used for business IN HOME CHILDCARE PROVIDER INFORMATION SHEET HOME EXPENSES

https://suncresttaxservice.com/wp-content/uploads/2017/12/daycare-income-and-expense-worksheet.pdf

Keep a calendar for documentation of the number of hours that you are doing business items for the daycare The more specific and accurate your records

https://www.irs.gov/pub/irs-pdf/p587.pdf

Worksheet To Figure the Deduction for Business Use of Your Home Keep for Your Records Use this worksheet if you file Schedule F Form 1040

https://www.pinterest.com/pin/82612974398871817/

Common home daycare tax deductions for child care providers A checklist of write Daycare Business Income and Expense sheet to file your daycare business

Using the simplified method you will measure your home area used for daycare in ft2 The IRS will let you deduct a set amount per square foot Daily Round Trip Miles if Day Care not in your home 8 Parking and Tolls 9 Licenses and Taxes not sales tax 10 Interest continue below if you take

Home based daycare providers can get a tax deduction for using their home These providers are spared from exclusive use the space is used