Like Kind Exchange Worksheet IA 8824 Like Kind Exchange Worksheet 45 017 Breadcrumb Home Forms Form IA8824 45017 pdf Tax Type Corporation Income Tax Fiduciary Tax

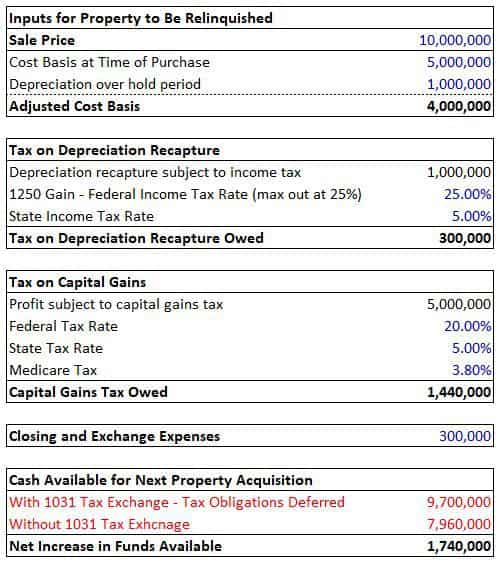

These regulations which apply to like kind exchanges beginning after December 2 2020 provide a definition of real property under section 1031 This calculator is designed to calculate and the recognized loss gain and the basis for a Like Kind Exchange

Like Kind Exchange Worksheet

Like Kind Exchange Worksheet

x-raw-image:///a838b845ac9c31a2b0f1e15045c37288f44c6f39815d82c6826fa49fc9f543dc

Complete 1031 Exchange Worksheet 2019 2020 2023 online with US Legal Forms Easily fill out PDF blank edit and sign them Save or instantly send your

Pre-crafted templates use a time-saving solution for creating a diverse range of documents and files. These pre-designed formats and designs can be used for various personal and professional jobs, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the content creation process.

Like Kind Exchange Worksheet

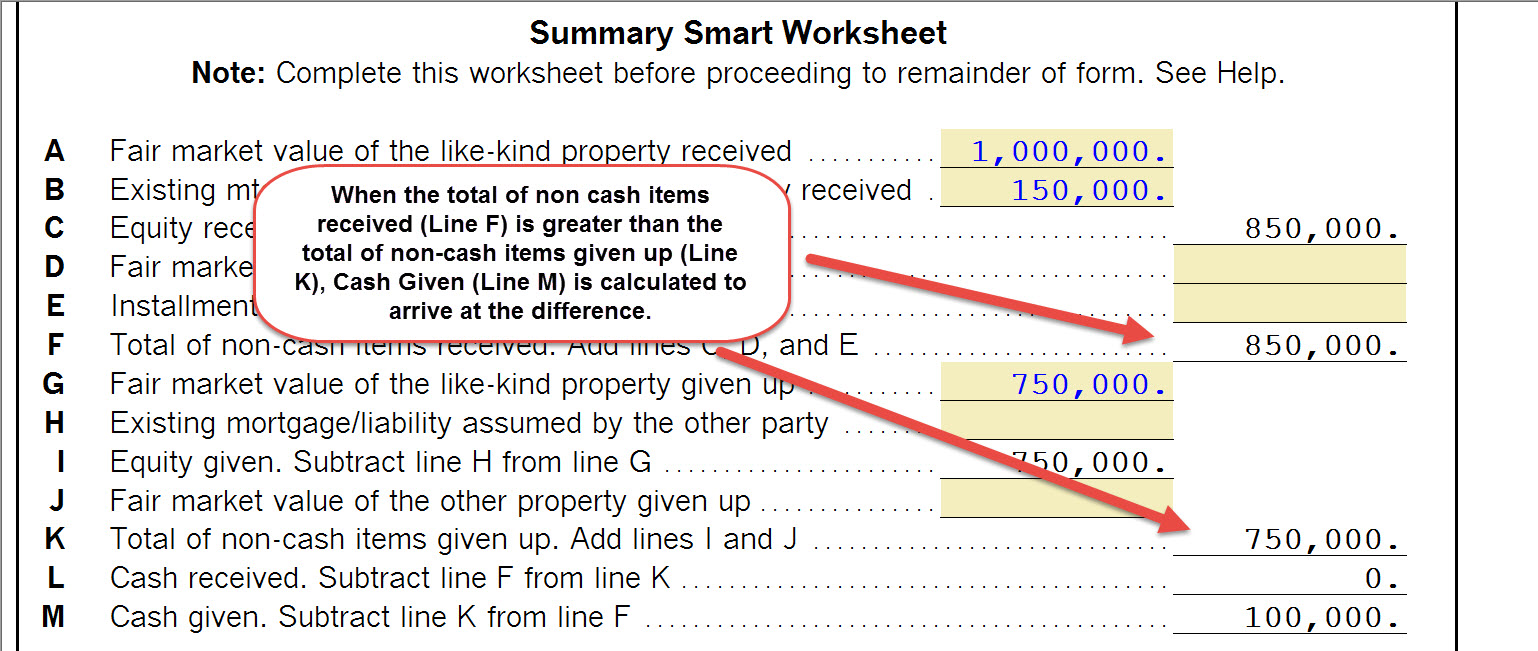

Completing a like-kind exchange in the 1040 return

Realty Exchange Corporation Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824

TAXPAK™ GuideBook 2017 Reporting Your 1031 Exchange

Like-kind exchanges of real property - Journal of Accountancy

Depreciation: Like-Kind exchange examples

TAXPAK™ Buying-DOWN! GuideBook 2020 Reporting Your 1031 Exchange

https://www.efirstbank1031.com/documents/Form8824Worksheet.xls

We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824 We hope that this worksheet will

http://www.1031.us/PDF/Form8824Instructions2005.pdf

The Worksheet is broken down into four steps as follows STEP 1 IT IS IMPORTANT TO READ EACH NOTE Gain Realized from Property Relinquished The first step is

https://www.expert1031.com/sites/default/files/worksheets2017.pdf

Download fresh worksheets from 1031TaxPak Page 3 WorkSheet 2 Calculation of Exchange Expenses HUD 1 Line A Exchange expenses from sale of Old

https://www.irs.gov/pub/irs-pdf/f8824.pdf

Information on the Like Kind Exchange Note Only real property should be described on lines 1 and 2 If the property described on line 1 or line 2 is real

https://cs.thomsonreuters.com/ua/toolbox/cs_us_en/Calculator_screen_overviews/cshw_like_kind_exchange_screen.htm

This tax worksheet examines the disposal of an asset and the acquisition of a replacement like kind asset while postponing or deferring the gain from the

Form 8824 worksheet is used to report the details of like kind exchanges of property under Internal Revenue Service IRS tax regulations This worksheet helps Additionally we have developed a Microsoft Excel spreadsheet to help you with the preparation of IRS Form 8824 Like Kind Exchanges If you would like a copy

In no way should the completion of this worksheet be construed as tax advice or used in place of competent tax advice Always consult a tax advisor to